Swiss FrancThe Euro has fallen by 0.06% to 1.0821 |

EUR/CHF and USD/CHF, January 4(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The first day of the New Year, but it feels a lot like last year. The dollar is under pressure, and equities are higher. Outside of Japan and Malaysia, The MSCI Asia Pacific Index extended last week’s 3.6% gain. It has not rallied for seven consecutive sessions. Led by mining and energy, Europe’s Dow Jones Stoxx 600 is up 1.5%, which would the largest gain in two months and puts the benchmark at its highest level since last February. US shares are also trading with an upside bias. Benchmark 10-year yields were a little higher in Asia but are off 2-3 bp in Europe. The US 10-year yield is slightly firmer, around 0.93%. The dollar is heavy, with European currencies leading the majors. Sterling is an exception, and it’s struggling around little changed levels. The JP Morgan Emerging Market Currency Index fell in the last two weeks of 2020 but has jumped 1% today to quickly recoup the year-end losses. Gold has rallied in the wake of the dollar’s slide (and crypto gains), and near $1935, it is at a two-month high. Oil prices are firm as OPEC+ meets to consider February output after increasing output by 500k barrels a day this month. WTI is near $50 a barrel. |

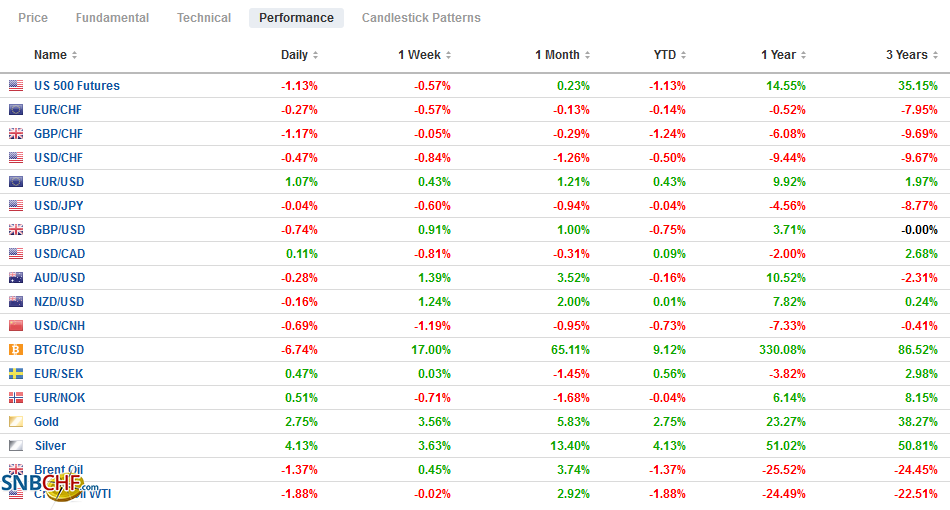

FX Performance, January 4 |

Asia Pacific

The official Chinese PMI and the Caixin version both saw manufacturing cool but still expanding. Of note, Japan’s manufacturing PMI rose to the 50.0 boom/bust level (49 in November) and its best reading since last April. Taiwan was also strong at 59.4 (from 56.9) and its best in a decade. South Korea was unchanged at 52.9. Australia slipped to 55.7 from 56.0.

Last week, the NYSE said that it would delist three of China’s largest telecom companies given the US sanctions. There is some thought that President Trump will expand the efforts, and there is some speculation that oil companies may be next.

Despite the Japanese government considering a new lockdown for Tokyo and the weakness in Japanese stocks, the yen is trading at its best level since last March. The dollar broke below JPY103 in late Asian turnover before finding a bid near JPY102.70 in early European activity. There is little meaningful support ahead of JPY102.00. The intraday momentum reading is stretched. Initial resistance may be offered by previous support in the JPY103.00-area. The Australian dollar is firm but holding just below the high made on New Year’s Eve (~$0.7742), which is the highest it has been since mid-2018. The next target is the $0.7800-area. The PBOC set the dollar’s reference rate at CNY6.5408, but the news today is that the dollar fell below CNY6.50 for the first time since 2018. The yuan’s 1% gain today is the most in nearly three months.

EuropeThe manufacturing PMI for the eurozone slipped to 55.2 in December from the flash reading of 55.5, but the takeaway is that it is at its highest level since May 2018. The recovery remains intact. Employment rose in Germany, France, and Italy. Spain’s employment fell for the second month. New orders were mixed. Germany was unchanged, while France and Spain fell, and new orders rose in Italy. |

Eurozone Manufacturing Purchasing Managers Index (PMI), December 2020(see more posts on Eurozone Manufacturing PMI, ) Source: investing.com - Click to enlarge |

The UK reports a mixed batch of data itself. In November, consumer credit was weaker than anticipated, but mortgage approvals (a 13-year high) and lending rose more than forecast. The December manufacturing PMI rose to 57.5, edging past the preliminary reading of 57.3 after 55.6 in November. It is the strongest reading since November 2017. New orders rose to 56.7 from 54.9, which is its highest reading since August 2020.

The euro traded above $1.23 at the end of last week. After finishing 2019 near $1.2215, the euro is again testing the $1.23 area. It appears to be stalling in the European morning, and the intraday momentum is stretched. The $1.2240-$1.2260 area may offer initial support. The PMI services and composite on Wednesday is followed by the December CPI figures on Thursday. The base effect warns that even a 0.4% gain on the month will not lift the headline CPI above zero, while the core rate is expected to be little changed at 0.2%. Sterling traded at $1.3685 last week, its best level since mid-2018. It traded a little through $1.37 earlier today but is consolidating above $1.3660. The euro fell to a one-month low on New Year’s Eve to almost GBP0.8930. It has come back bid today but encountered offers near GBP0.9000. Although the UK is rolling out the AstraZeneca/Oxford vaccine, Prime Minister Johnson is also considering a new national lockdown for England.

America

It is a busy week for US economic reports. Today starts with the December manufacturing PMI (maybe a slight downward revision from the preliminary 56.5 reading after 56.7 in November, which was the highest since 2017) and November construction spending (like the fifth month of the past six with a gain of 1% or more). The highlight of the week is the employment report on January 8. A sharp slowdown (some are warning of an outright decline) is expected. Canada reports its December manufacturing PMI today. It peaked at 56.0 in September and has slipped a little since. It also reports its December jobs data at the end of the week. After strong gains in recent months, Canada may have also lost jobs in December.

Mexico reports November worker remittances today. They are running about 10% above a year ago. Its PMI readings will also be released today and were below the 50 boom/bust level in November. AMLO has been reluctant to back large fiscal stimulus efforts for fear of a debt-trap. The burden has fallen on monetary policy, which makes this week’s December CPI reading important for policy outlook. Recall that consumer prices rose by more than 4% year-over-year in August-October, and this steadied the central bank’s hand after easing consistently for most of last year. There was some concern that the drop to 3.33% in November was due to one-off factors. A fall below 3% would likely excite rate cut speculation.

The greenback’s slump has carried it to a new 2 1/2-year lows against the Canadian dollar near CAD1.2665. It settled near CAD1.2725 on New Year’s Eve. The next area of technical support is not seen until CAD1.25. Initial resistance is pegged in the CAD1.2680-CAD1.2700 area. The US dollar is trading heavily against the Mexican peso. It is near MXN19.76 around midday in Europe. Last month’s lows were closer to MXN19.70, and that is where the greenback may be headed near-term.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,China,Currency Movement,EMU,Featured,Japan,newsletter,PMI