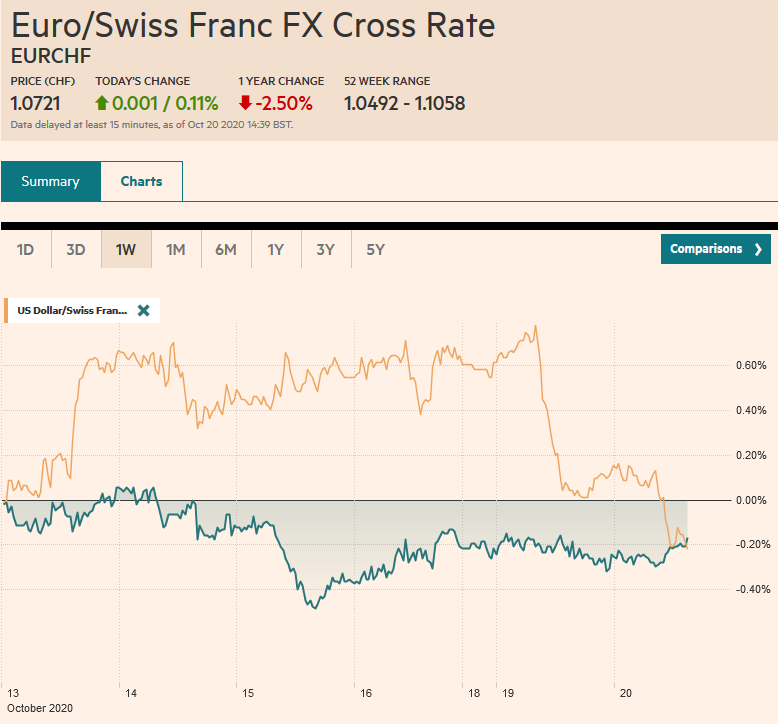

Swiss FrancThe Euro has risen by 0.11% to 1.0721 |

EUR/CHF and USD/CHF, October 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The capital markets lack a clear direction today. This is reflected in narrowly mixed equities, bonds, and currencies. The spreading contagion is giving rise to new economic concerns, among other things, and the UK-EU talks are struggling to resume, while Pelosi-Mnuchin talks in the US continue to drag. In the Asia Pacific region, Japan, Taiwan, and Australian bourses led declines, while China, Honk Kong, South Korea, and India advanced. Europe’s Dow Jones Stoxx 600 is straddling little changed levels, while US shares recoup part of the losses suffered late yesterday. US and European yields have firmed, and the core-periphery spreads are widening. However, the widening is not weighing on the euro, as it often does, and the single currency is above $1.18 for the first time in a week. The euro and the Scandis are leading most of the major currencies higher. The Antipodean currencies are the big movers to the downside as the central banks appear to be preparing the markets for more easing. Emerging market currencies are narrowly mixed, leaving the JP Morgan Emerging Market Currency little changed on the day. Gold had been in a $5 range on either side of $1900 in Asia but caught a bid in the European morning. December WTI continues to straddle the $41-area. |

Asia Pacific

The deputy governor of the Reserve Bank of Australia seemed to fan market expectations for lower rates by noting that bill rates can fall below zero ostensibly before the cash rate does. This seems like part of a campaign by the RBA to prepare the market for additional measures. Recently, it also suggested it is considering buying longer-dated bonds. The minutes from the last month’s meeting sees further easing will likely “gain more traction” as the economy opens up. It also anticipated shifting from targeting inflation expectations to targeting actual inflation. For its part, the RBNZ continues to prepare the market for additional easing. The RBA meets on November 5 and the RBNZ on November 10.

As widely expected, China’s loan prime rate was unchanged at 3.85% and 4.65% for the one and five-year benchmark, respectively. Meanwhile, economists continue to analyze yesterday’s Q3 GDP and September data. The import surge last month means that net exports added about 0.6 percentage points to Q3 GDP. Trade is a focus by the US and many commentators, but it is also important to recognize that many foreign consumer producers are made locally. Starbuck, McDonald,s Domino Pizza, Nike, General Motors, LVMH sales may not show up in trade figures, and tax arbitrage often makes the profits hard to trace.

The Bank of Japan meets next week (October 29). Reuters reports that the BOJ may reduce its growth and inflation forecasts. Government efforts to encourage travel with discounts of as much as 35% (PM Suga’s initiative “Go To Travel” campaign) has seen hotel prices, for example, fall by nearly a third from a year ago. The BOJ currently forecast core inflation, which excludes fresh food, to fall by 0.5% this year. It may be adjusted lower and is likely to fall in in the coming months as last year’s controversial sales tax increase drops out of the year-over-year comparisons.

The dollar firmed to six-day highs against the yen just above JPY105.60, where an $885 mln option expires today. While there have been a few exceptions, the greenback has mostly been on a JPY105-handle of nearly a month. It is the middle of a three yen range (JPY104-JPY107) that has largely confined prices since the end of Q2. The Australian dollar was probing $0.7200 at the start of last week, and the RBA has talked it down, and it now looks poised to challenge last month’s low near $0.7000. Below there, the next chart point of note is near $0.6965. The New Zealand dollar has lost a cent over the past week to around $0.6560. Last month’s low was a little above $0.6510 and offers the next target. The PBOC reference rate for the dollar was set at CNY6.6930, which was in line with expectations. It was the first time below CNY6.7 since April 2019. The offshore yuan reached its best level since July 2018 (~CNH6.6675)

EuropePrecious time is being chewed up by the UK-EU stand-off. EU negotiator Barnier seemed to offer intensification of talks and to begin the drafting of the legal text. This was not seen as sufficient for the UK’s negotiator Frost. Many reluctant to outright state that the talks have failed, and some expect them to resume by the end of the week. Meanwhile, another challenge is brewing. The latest Ipsos MORI poll found 58% of Scotland favors independence. The issue is far from reaching a head. The Scottish election is not until May 2021. After, and partly because of Brexit, this may be the next challenge for the Johnson government. |

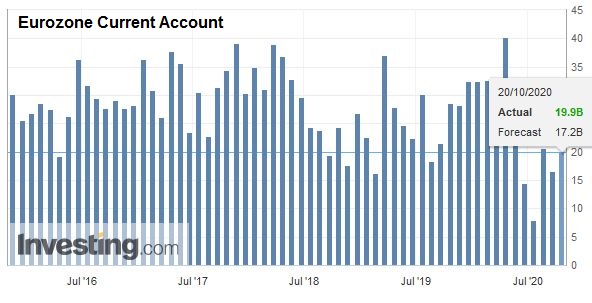

Eurozone Current Account, August 2020(see more posts on Eurozone Current Account, ) Source: investing.com - Click to enlarge |

The ECB meets next week, but expectations for fresh action are low. It is simply a question of time, however. The central bank has shown a clear preference for moving with updated staff forecasts. These will be delivered in December. Although many observers have emphasized the likelihood that the emergency bond-buying program is extended, we would not rule out a rate cut. The introduction of a lower loan rate (TLTRO) gives the ECB more scope to go deeper into negative territory (deposit rate at minus 50 bp) without being particularly disruptive.

For the first time in five sessions, the euro has traded above $1.18. A flurry of activity was seen in the European morning after the euro rose above $1.1790, where an option for 720 mln euros is set to expire today. The euro’s recent highs were near $1.1830. The intraday technicals are stretched, warning that follow-through buying in North America may be limited. Support is seen near $1.1760. Sterling is firm, but it has not been able to resurface above $1.30 after reaching $1.3020 yesterday. It is trading within yesterday’s ranges as the market awaits fresh developments. The euro is firm against sterling and is probing GBP0.9100 as its recovery off yesterday’s GBP0.9020 low continues. Last week’s high was near GBP0.9120.

AmericaWhile Pelosi-Mnuchin talks reportedly are closing the gap, it may still not provide sufficient to get a pre-election deal. The ultimate problem is not between Pelosi and Mnuchin. The White House seems almost desperate for a deal. The challenge is the Senate, and with Trump trailing in the polls, his ability to deliver the votes is in doubt. Moreover, the Senate is moving forward. Today it will take up a stand-alone bill to shift unused funds from the CARES Act to re-fund Payroll Protection Plan. Tomorrow the Senate will likely vote on a $500 bln stimulus package, which is less than a third of what Pelosi and Mnuchin are discussing. |

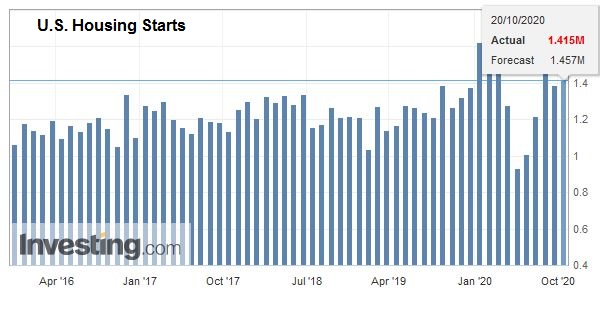

U.S. Housing Starts, September 2020(see more posts on U.S. Housing Starts, ) Source: investing.com - Click to enlarge |

On tap, today are five Fed officials speaking. The most interesting maybe Governor Brainard’s speech. It is not so much the topic, which is important (Community Reinvestment Act) even if it does not capture the imagination of the participants in the global capital markets. She is seen as a likely candidate for Treasury Secretary in a Biden administration. The US also reports September housing starts, which are expected to rebound (~3.5%) after the 5.1% decline in August. Permits are also expected to grow after edging lower. Housing remains a bright spot for the US economy, and data later this week are expected to show further gains in existing home sales. Both Canada and Mexico’s economic calendars are light but will pick up starting tomorrow. Canada will report retail sales and CPI tomorrow. Mexico reports September employment figures tomorrow and August retail sales ahead of the weekend.

The US dollar poked above CAD1.32 briefly in early European turnover and met determined sellers, perhaps related to a $515 mln option there that expires today. The greenback eased to session lows near CAD1.3170. Yesterday’s low near CAD1.3150 offers initial support. Last week’s low near CAD1.3100 may be a bit too far to look for today. The greenback remains in its recent trough against the Mexican peso. It dipped below MXN21.05 yesterday for the first time in a month. It may find support initially today above MXN21.15, and the upper end of the range is around MXN21.30.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$CNY,Bank of Japan,Brexit,China,Currency Movement,Featured,newsletter