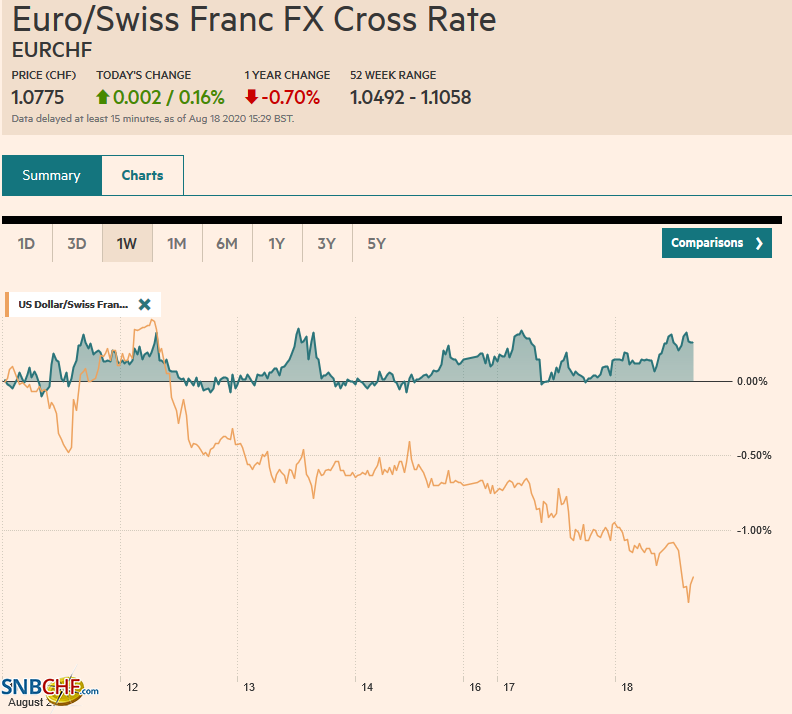

Swiss FrancThe Euro has risen by 0.16% to 1.0775 |

EUR/CHF and USD/CHF, August 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The NASDAQ rallied 1% yesterday to record highs as the Dow Industrials struggled, and the S&P 500 was able to eke out a small gain. The coattails were short, and the strength of the yen may have contributed to a 0.2% loss of the Nikkei. Still, its 6.2% advance this month is the best among the G10. Chinese equities posted small gains, but amid rising infections and anticipating new lockdown measures, South Korea’s Kospi took it on the chin, falling nearly 2.5%. New US actions against Huawei took a toll on Taiwanese chip makers and weighed on the broader index. India’s 1% gain led the region. European shares are flattish, and the Dow Jones Stoxx 600 remains within the range set before the weekend. US shares are also a little changed. Benchmark 10-year yields are mostly 1-2 bp softer, which puts the US 10-year yield near 67 bp. The dollar is under modest pressure, falling against nearly all the currencies today. Among the majors, sterling, the yen, and the Canadian dollar are up just shy of 0.5% to lead. Russia, Mexico, and South Africa lead the emerging market currencies higher. Turkey stands out as a notable exception. Gold has re-taken the $2000 level. The next technical target is near $2025. Oil is firm but flat within its recent ranges. The $43.50 capped the rally earlier this month in the September WTI contract. |

FX Performance, August 18 |

Asia Pacific

The US tightened its attempt to isolate Huawei. It extended its sanctions to cover 38 more affiliates in 21 countries. The goal is to cut its access to semiconductor chips. This hit Taiwanese chip producers. Separately, and contrary to the assessment of many private economists, US trade adviser Navarro said in an interview yesterday that China is “absolutely” keeping its word on purchases of US goods. President Trump has also praised Chinese agriculture purchases. Separately, reports suggest some 14 mln barrels of oil in seven super-class tankers are on their way to China now.

The minutes from the recent meeting of the Reserve Bank of Australia confirmed it did not see the need for additional measures. However, there were two mitigating factors. First, officials were concerned that cheap funding was not leading to new credit expansion, though it was not clear on whether it was a supply or demand challenge. Second, the latest outbreak and lockdown in Victoria will push up unemployment and weigh on economic activity.

The dollar stalled just above JPY107 last week and is retracing the gains scored in the first half of August. It has traded at an eight-day low near JPY105.40 today, just above the (61.8%) retracement of the bounce off the JPY104 level seen on July 31. Resistance is seen around JPY105.80, and there is an option for about $480 mln at JPY106 that expires today. The Australian dollar is firm and approached the month’s high set on August 8, near $0.7245. A move above $0.7255 targets $0.7300. Note that the Aussie continues to march higher against the New Zealand dollar. With today’s gains, the 11-day streak seems to match record moves of 1985 and 1991. The RBNZ seems more aggressive than the RBA, and this appears to be the main driver. The PBOC set the dollar’s reference rate at CNY6.9325, in line with bank model projections. The greenback traded down to almost CNY6.92, a fresh five-month low.

Europe

Rising new virus cases in Europe have begun to have an economic impact according to some high-frequency data. In the first two weeks of August, activity slowed in France, Italy, and Spain. Germany, which is reporting the most cases in four months, and Sweden and Norway are seeing more sluggish results. There is risk that these developments are picked up on the preliminary August PMI releases at the end of the week. If reflected, the service PMI appears more vulnerable than the manufacturing PMI.

The top UK and EU negotiators (Frost and Barnier) have dinner tonight to kick-off the week of staff negotiations. Frost and Barnier will meet again at the end of the week. To ensure that the treaty can be ratified, it is generally understood that it needs to be concluded by the end of September or early October at the latest. Often in such circumstances, officials bring in the goalposts, as it were, and reduce their ambitions and could settle for a smaller and narrower deal to secure an agreement.

In addition to UK trade talks, the EU is being challenged on two other fronts. The first is Belarus and the risk that Russia provides military/police support. The second is Turkey, which appears to be set to begin drilling for oil off the southwest coast of Cyprus and says it will continue to do so for the next month (September 15).

Nevertheless, euro has resurfaced the $1.1900 area and reached $1.1915 in early European turnover, just shy of the August 6 high, which is also a two-year high. Above there, the $1.20 area offers psychological resistance, and as we have pointed out previously, it is the euro’s average since its launch. Initial support is around $1.1880 and then $1.1860. Sterling is also firmer and knocking against this month’s high (~$1.3185). It has seen $1.3200 in March before collapsing, and the high for the year is closer to $1.3280. We have noted that 50 and 200-day moving averages (Golden Cross) for the major currencies have crossed. Sterling is the last, and it is happening today.

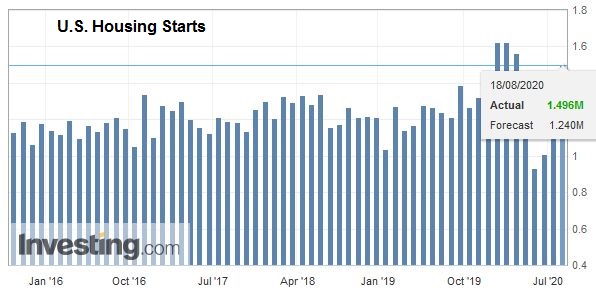

AmericaIn and of itself, the Empire State manufacturing survey means little. However, the disappointment was palpable. Economists had expected a decline, but the deterioration of sentiment was notable and worrisome if it is representative. Roughly a third saw conditions improving, and almost a third saw deterioration. New orders contracted, and the six-month outlook eased. The Philadelphia Fed survey will be released on Thursday at the same time was weekly jobless claims. The results will be compared. Ahead of it, though, the US reports July housing starts today (another month of solid gains are expected), and the FOMC minutes from the July meeting will be released (tomorrow). Those, like ourselves, who expect fresh policy move next month, would hope to seem some groundwork being laid in the minutes. There are also expectations that at the September FOMC meeting, a formal recognition that the inflation target is symmetrical, meaning that the undershoot will allow it to encourage an overshoot. |

U.S. Housing Starts, July 2020(see more posts on U.S. Housing Starts, ) Source: investing.com - Click to enlarge |

Canada’s Finance Minister Morneau resigned. There are a couple of flashpoints, including Prime Minister Trudeau’s fiscal response to the pandemic and desire to get more directly involved. Also, both Morneau and Trudeau have been caught up in a scandal involving a favoring a charity to which both had ties. Former Bank of Canada and Bank of England Governor Carney has been consulting with Trudeau, and some see him as a likely successor to Morneau. Deputy Prime Minister Freeland is also seen as a candidate.

The political developments in Canada have done no harm to the Canadian dollar, which has continued to march higher. The US dollar has slipped below CAD1.3160 in the European morning to trade at fresh seven-month lows. The intraday technicals are stretched. A bounce toward CAD1.3180-CAD1.3200 would likely be seen as a new opportunity to sell the greenback. The next chart support is seen a little above CAD1.3100. The US dollar low for the year was set in January near CAD1.2960. The greenback is also offered against the Mexican peso as it yields yesterday’s gains. Support is seen in the MXN21.85-MXN21.95 area, as the broad dollar weakness and Mexico’s attractive rates blunt concerns about its domestic economy. The Brazilian real will be in focus today. It was the weakest currency in the world yesterday, and the dollar settled above BRL5.50 for the first time since the end of June. Concerns about fiscal policy plans with low real rates provided a weak backdrop for concerns over the futures of the market-friendly finance minister (Guedes).

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Australia,Brazil,Canada,China,Currency Movement,EUR/CHF,Featured,newsletter,USD/CHF