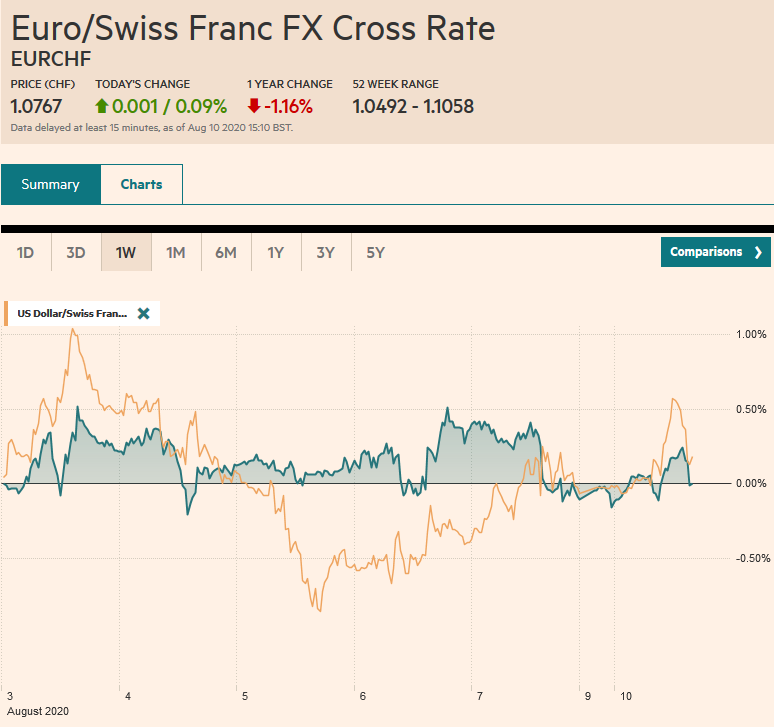

Swiss FrancThe Euro has risen by 0.09% to 1.0767 |

EUR/CHF and USD/CHF, August 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The new week has begun slowly with Singapore and Tokyo markets closed for national holidays. The MSCI Asia Pacific Index rose 2% last week and edged higher today, led by 1.5%-1.7% rallies in South Korea and Australia. Hong Kong was a notable exception and eased around 0.6%. Europe’s Dow Jones Stoxx 600 also advanced 2% last week and is straddling little changed levels. The same could be said for US shares. The S&P rose by nearly 2.5% last week. The bond market is quiet, and the US 10-year benchmark yield is about 56 bp. Meanwhile, the dollar is slightly firmer against most major and emerging market currencies, mostly within the pre-weekend ranges. A clearer weakening bias among emerging market currencies is evident, with the Turkish lira, South African rand, and Mexican peso, the heaviest. The JP Morgan Emerging Market Currency Index is lower for the third consecutive session, and it is off for the seventh time in eight sessions. Gold is consolidating above the pre-weekend low (~$2015.5). It has a nine-week advance in tow to start the week. Crude oil is firmer, and the September WTI contract has recouped most of the 1.7% pre-weekend decline. |

|

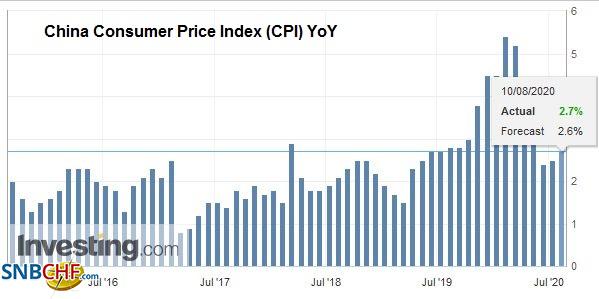

Asia PacificChina reported July consumer prices to 2.7% year-over-year, a little firmer than expected after the 2.5% gain in June. Floods in China have disrupted supplies, including food, and this looks largely responsible for the increase in headline CPI. Pork prices rose 10.3% on the month, for example, as the floods cut short the improvement seen recently, leaving prices up about 86% year-over-year. Core prices rose 0.5% year-over-year after a 0.9% rise in June. It is the lowest since 2010 and is seen signaling scope for easier monetary policy. Meanwhile, the deflation in producer prices eased to minus 2.4% from minus 3%. |

China Consumer Price Index (CPI) YoY, July 2020(see more posts on China Consumer Price Index, ) Source: investing.com - Click to enlarge |

China plays tit-for-tat sanctioning 11 US officials, including two sitting Senators (Rubio and Cruz) after the US sanctioned 11 Hong Kong officials at the end of last week, including Chief Executive Lam. The US Health and Human Services Secretary is the highest-ranking American to visit Taiwan for around three decades. Former Japanese Prime Minister Mori also visited Taiwan over the weekend. These visits can do nothing but provoke China. The US does not have a mutual defense treaty with Taiwan. If Beijing thinks that delicate balance with Taiwan is at risk in the medium or long-term, it could act. There can be little doubt it is a red-line for China. China has demonstrated an assertiveness in the past year or so in the South China Sea, Macau, Hong Kong, and India. Taiwan fits the general pattern.

The Reserve Bank of Australia stepped up its bond-buying today. Recall that at last week’s RBA meeting, the small rate cut we thought possible was not delivered. Instead, it signaled a resumption of its bond-buying program, which had been put on hold for the past three months as its yield-curve control efforts of targeting 25 bp yield on the 3-year note did not require new purchases. Last Wednesday and Thursday, the RBA bought A$500 mln and today bought A$1 bln (targeting the April 2023-April 2024 maturities. The data highlight of the week for Australia is the jobs report early on August 13 in Sydney. A more moderate gain after the almost 211k surge in June. The and deadly outbreak of the virus poses downside risks for macro data. Separately, the Reserve Bank of New Zealand meets (August 12) and most likely will keep rates on hold at 25 bp. There is some risk of new asset purchases. New Zealand reports no virus for the past 100 days.

The dollar is steady around JPY106. The 20-day moving average, which the dollar has not been able closed above for three weeks, is a little above JPY106.15. Initial support is seen near JPY105.70. Last week’s high was almost JPY106.50. The Australian dollar posted a key downside reversal ahead of the weekend, but there has been no follow-through selling today. The pre-weekend low near $0.7145 remains intact. The upside has been limited to a bit more than $0.7170, ahead of chart resistance near $0.7180. The dollar’s gains after the employment data at the end of last week had suggested a softer yuan today after it strengthened last week to five-month highs. The PBOC set the dollar’s reference rate at CNY6.9649, a little stronger than the bank models anticipated. The greenback remains pinned on its floor against the Hong Kong dollar, forcing the Hong Kong Monetary Authority to support it.

Europe

Italy has requested 28 bln euros in unemployment assistance from the EC. Rome has pressed forward with new tax breaks and wants to cut taxes, including personal taxes next year. Its funding costs may encourage a rare August bond sale. Prime Minister Conti appears to be trying to use the crisis to reset the Italian economy. However, it seems to be resting so far on fiscal stimulus rather than reform.

It is an important week for UK data. July jobs data tomorrow is followed by June industrial production (German, France, Spain, and Italy reported strong gains last week ahead of the aggregate figure this week) and trade figures. These lead up the Q2 GDP estimate on August 12. The median forecast in the Bloomberg survey calls for a 20.7% contraction (quarter-over-quarter), which would be among the worst in Europe. Separately, surveys suggest that one in three employers plan on cutting staff in the current quarter, and 40% of private companies plan to reduce headcount.

Turkey’s central bank has eased pressure on local banks to extend credit. The central bank is reluctant to raise rates, but Turkish banks reported have begun doing so for loans and deposits. It seems like small beer and the dollar traded at new record highs against the lira. Separately, though perhaps not wholly unrelated (see wag the dog), Turkey has taken provocative steps in the East Mediterranean. It has begun naval exercises and sent a drilling ship into waters that the EU recognizes as Greece’s. Note that tensions have been escalating in the region. Last week, Greece and Egypt signed an agreement on their maritime borders following a similar agreement between Turkey and Libya. Both Greece and Turkey reportedly mobilized their navies and airforces yesterday.

In the European morning, the euro slipped marginally below the $1.1755 low seen before the weekend. The 3 bln euro option that expires today at $1.18 reinforces the cap seen near there. The euro has not traded above the $1.18 level in Europe though did poke above it briefly in late Asian turnover. Last week’s low was a little below $1.17. Sterling is little changed, holding a roughly $1.3040-$1.3085 range, well inside the pre-weekend range. The euro dipped below GBP0.9000 but found support ahead of last week’s shelf forged around GBP0.8980. This week’s UK data, coupled with a dollar, which looks to benefit from short-covering, could provide an incentive to push sterling back below $1.30 in the coming days.

America

There is much confusion over President Trump’s executive order and memoranda issued over the weekend. He provided a deferral of the collection of payroll “taxes” that fund Social Security and Medicare for people who earn less than $100k a year from September 1 until the end of the year. He held out the possibility that if he is re-elected, the deferral will turn into a permanent cut. However, since it is only a deferral, many employers will likely choose to still collect it now rather than try to claw it back later. The immediate pushback is that is would weaken the finances of Social Security. That said, there has long been talk of means-testing Social Security rather than it being a right of citizenship.

Trump also granted a $300 a week federal unemployment insurance (to replace the $600 a week program that ended last month) if the states provide a $100 a week, which would seem to only exclude Puerto Rico. Yet, it is not clear whether the states would need to come up with another $100 a week for this program. Governors do not seem to have been consulted, and several have objected. Moreover, the federal funds come from re-directing disaster-relief funds for which there is around $44 bln. Given the demand, the funds would not be expected to last much more than a month. Lastly, Trump also extended the moratorium on servicing student loans and renewed the ban on some evictions and foreclosure. This seems the least controversial, but have been criticized for being too narrow.

The battle in the US over mail-in voting is taking another turn. First, the states were informed that they would have to pay 55 cents for postage to mail voters ballots instead of the usual 20 cent bulk rate. This plays into fears that the postal service is becoming politicized with slowdowns, as overtime availability is restricted, and other delays as new sorting and delivery policies are rolled-out. There appears growing concern that the mail-in voting could mean that the results are not known, and this may be one of the factors lifting three-month volatility and steepening the slope of the vol-curve.

The economic calendar for North America is light today, but it will be a busy week. Today features the US JOLTS report, and Canada’s housing starts. The headline July job growth for the US and Canada before the weekend was better than expected. Canada appears to have recovered about 52% of the jobs it lost, while the US has recovered about 44%. Mexico reports June industrial output figures tomorrow (forecast are for around a 17% increase on the month, helped by the auto sector), but the highlight of the week is the central bank meeting on Thursday where Banxico is expected to deliver a 50 bp rate cut that would bring the target to 4.5%.

The US dollar approached CAD1.32 in the middle of last week and was testing CAD1.34 at the end of the week. The greenback is in a tight range so far today, and while it has not been above CAD1.34, it has not been below CAD1.3375 either. The 20-day moving average, which the US dollar has not closed above in almost a month, is found near CAD1.3425. The US dollar carved out a little shelf near MXN22.30 last week. The nearby cap is around MXN22.60. The dollar has been mostly with on the MXN22-handle since the middle of June. Currency stability encourages carry-trades to take advantage of Mexico’s high real and nominal rates.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,China,Currency Movement,Featured,newsletter,Taiwan,Turkey