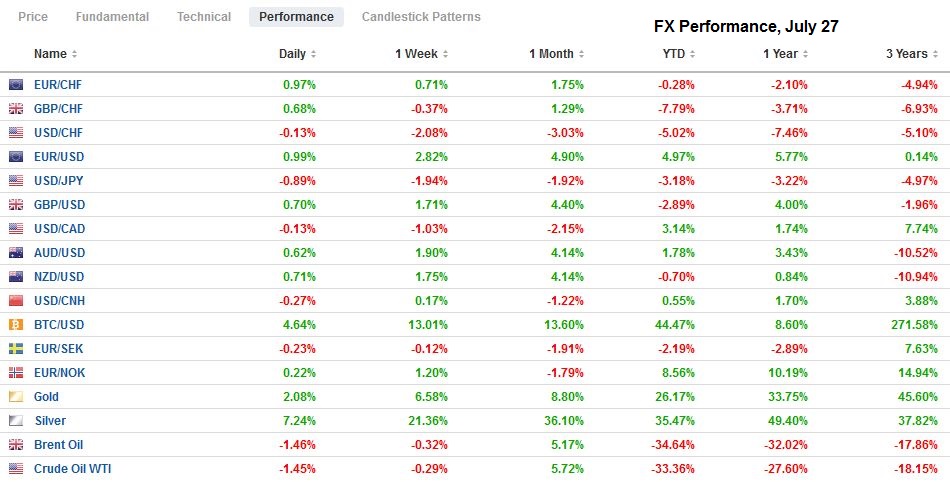

Swiss FrancThe Euro has risen by 0.91% to 1.0817 |

EUR/CHF and USD/CHF, July 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The US dollar’s dramatic sell-off continues. It is off against nearly all currencies. Among the majors, the Swedish krona and Japanese yen are leading the money, and the euro surged through $1.17. Emerging market currencies are fully participating, with the JP Morgan Emerging Market Currency Index posting its fifth gain in six sessions. The greenback’s retreat appears to have become decoupled with the equity market. The yen’s strength, for example, had a limited impact on Japanese shares, which were narrowly mixed, with the Topix rising and the Nikkei falling. Asia Pacific bourses were mixed, though most of the large ones, including China, South Korea, Australia, and Taiwan advanced. Note that the shake-up in the chip space that saw Intel shares crushed at the end of last week lifted Taiwan Semiconductor Manufacturing Company up 10% and helped the Taiex rise 2.2%. European stocks were struggling, but the better than expected German IFO helped equities recover. US equities are trading higher after the S&P 500 posted back-to-back losses at the end of last week for the first time this month. Bond markets are also mixed. The European core is doing better than the periphery, but yields are +/- 2 bp. The US 10-year is near 57 bp. Gold is rallying for the seventh consecutive session at around $1944 is at new record levels. Its 2% gain is the most in three months. Oil, on the other hand, is little changed with the September WTI contract trading quietly around $41 a barrel, inside the pre-weekend range. |

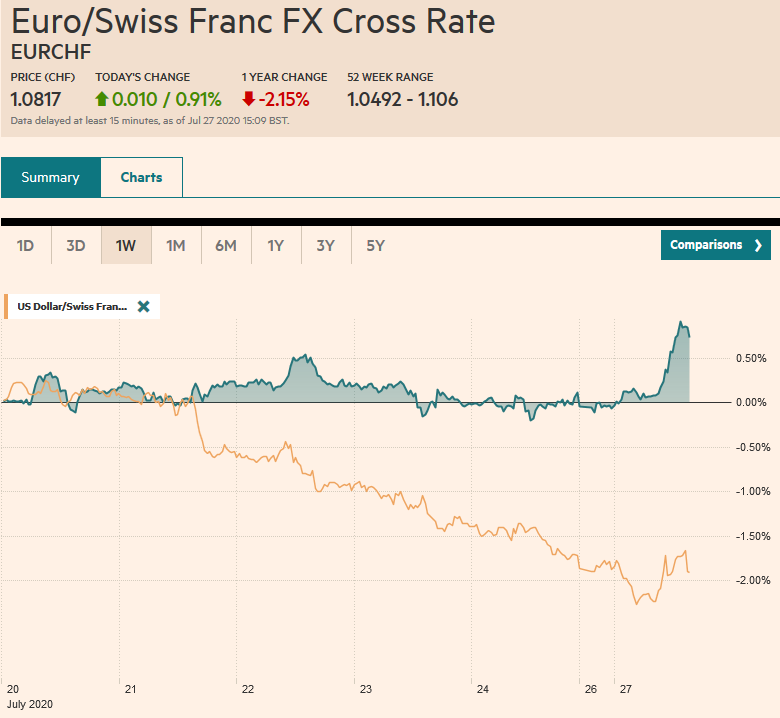

FX Performance, July 27 |

Asia Pacific

Japan reported it May All Industries Activity Index fell 3.5% in May after the April reading was revised to -7.6% from -6.4%. This is like a proxy for GDP. While the US and EMU report Q2 GDP this week, Japan’s first estimate is not due until the middle of next month. Separately, the May Leading Index was revised lower (to 78.4 from 79.3) but still held on to a small gain from April’s 77.7.

Hong Kong’s imports and exports recovered in June, but not by as much as had been hoped. Exports fell 1.3% from a year ago, a 7.4% slide in May. Economists had project outright growth. Imports fell 7.1% from a year ago. Economists had expected that May’s 12.3% slump would have been halved. The net result was an HKD33.3 bln deficit. Of note, Hong Kong’s exports to China rose 8.8% from a year ago, while its exports to the US were 21.4% below a year ago (-14.4% in May). Exports to Taiwan were also stronger. Exports to Europe were weaker.

Helped by the economic recovery and government infrastructure spending, China reported June industrial profits rose 11.5% year-over-year, following May’s 6% improvement. Still, profits were off 12.8% in H1 from a year ago. Private sector and foreign businesses trailed in the profit-recovery, underscoring the role of state-owned enterprises. Although the manufacturing sector led the rebound in the PMI to be released at the end of the week, it is the service sector that appears to be recovering quicker.

The dollar was sold through JPY106 before the weekend while Tokyo was on holiday. The market was cautious and took it back to JPY106 at the close. Japanese traders sold the dollar back off to around JPY105.45 before Europe entered the fray and has kept it in a narrow range near its trough, awaiting the US market leadership. Initial resistance is seen near JPY105.70. The Australian dollar is firm near $0.7120. It reached a high last week, closer to $0.7180. The intraday technicals suggest it is poised to move higher in North America today. The PBOC set the dollar’s reference rate at CNY7.0029, which was stronger than expected, and the yuan snapped a three-day decline. The greenback finished the mainland session near its reference rate.

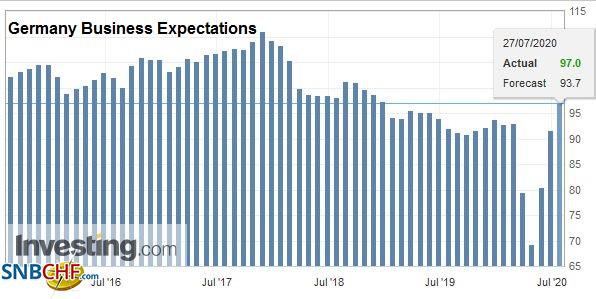

EuropeThe German IFO survey lent credence to the improvement seen in the preliminary PMI before the weekend. The current assessment rose to 84.5 from 81.3. It is the best since March. |

Germany Ifo Business Climate Index, July 2020(see more posts on Germany IFO Business Climate Index, ) Source: investing.com - Click to enlarge |

| The expectations component improved to 97.0 from 91.6, its best since November 2018. This lifted the assessment of the overall business climate to 90.5 from 86.3. It has not been this high since January. |

Germany Business Expectations, July 2020(see more posts on Germany Business Expectations, ) Source: investing.com - Click to enlarge |

The idea that Europe is outperforming the US is so far limited to some recent PMI surveys and may be vulnerable to the new flare-up in Covid-19 in several countries, including Spain and France. The divergence is unlikely to be reflected in this week’s first estimate of Q2 GDP. The eurozone contracted by 3.6% quarter-over-quarter in Q1 and is expected to have shrunk by another 12% in Q2. The US contracted by 5% at an annualized pace in Q1, which is about 1.2% quarterly. The median forecast for Q2 GDP in the Bloomberg survey is for a 35% annualized decline, which is about 7.8% on a quarterly basis.

The EU debt issuance under the Recovery Plan is embraced by some as the Hamiltonian moment. We recognize its potential but are reluctant to extrapolate to a fiscal union from what could be one-off emergency measures. We have suggested it could be scaffolding but that the building of the greater union is still in the distant future. Bundesbank President Weidmann cautioned that while he endorsed the action, it should not serve as “a springboard for large scale EU debt for regular household financing.” He emphasized the temporary nature of it, and urged a control mechanism to ensure the funds are spent “wisely and efficiently.”

The euro’s run higher is being extended for the 10th session of the past 11. It has fallen once since July 9. Today’s push in the Asia Pacific timezone saw $1.1725 before consolidating and easing to almost $1.1680 in the European morning. This pullback may provide a better buying opportunity for North American dealers who have been consistent dollar sellers in the run. Sterling is bid as well and has moved above last month’s high (~$1.2815) to rise to its best level since March (~$1.2860). Support now is seen near $1.2800. Meanwhile, the euro, which had tested the GBP0.9000 area last week, tested the upper end of this month’s range near GBP0.9140.

America

The US reports June durable goods orders today and the Dallas Fed’s manufacturing survey. The manufacturing and housing market seems to be leading the US recovery, and this is expected to be evident in today’s reports. Headline durable goods orders are expected to have risen by around 7% after the 15.7% gain in May. However, the May report was bolstered by defense and aircraft orders. Excluding these, June orders will likely be stronger than May’s 1.6% increase. The report may help economists fine-tune their forecasts for Q2 GDP, which is released later this week. Of course, the FOMC’s two-day meeting, which concludes Wednesday, is the other main highlight of the week.

The moratorium on evictions from federally-backed rental properties enshrined in the CARES Act came to an end over the weekend. The landlords can give tenants a 30-day notice to vacate the premises. Prior to the passage of the moratorium, federally-backed apartment buildings accounted for a third of eviction cases. The $600 a week extra unemployment insurance is set to expire at the end of the week. Some Republicans are pushing for an employment bill to be passed this week, which would tie the extra compensation to the previous pay, capping it at around 70%, according to press accounts. Part of the problem, and why this approach was previously rejected, is the logistical challenge that may prove to be beyond the capacity of many states to properly implement.

At just below 59 bp, the 10-year posted its lowest weekly close in history. The 10-year real yield closed at a record low of minus 92 bp. A dovish FOMC statement is expected amid the mounting virus cases and the escalation of US-China tensions, as officials prepare for additional measures as early as September. Unlike a year ago, the US-China tensions are not being spurred by rounds of tariffs but geopolitics. In fact, it appears that China has stepped up its purchases of US agricultural products in recent weeks.

The US dollar bears have their sights set on last month’s low near CAD1.3315. The greenback was sold through CAD1.34 last week but straddled the area in the previous two sessions. The Canadian dollar often lags behind the other major currencies in moves against the US dollar. The CAD1.3400 area should offer initial resistance, and a move above CAD1.3450 would likely squeeze the greenback shorts. Mexico reports its June trade balance today. It is expected to return to surplus after two months of large deficits (~$3.5 bln). The dollar is trading a little above this month’s lows (~MXN22.1550). A break could see MXN21.90-MXN22.00. The peso’s strength is not so much a reflection of its domestic economic situation as much as it is about the broader risk appetites and its high real and nominal rates.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$CNY,EMU,Featured,federal-reserve,Gold,newsletter