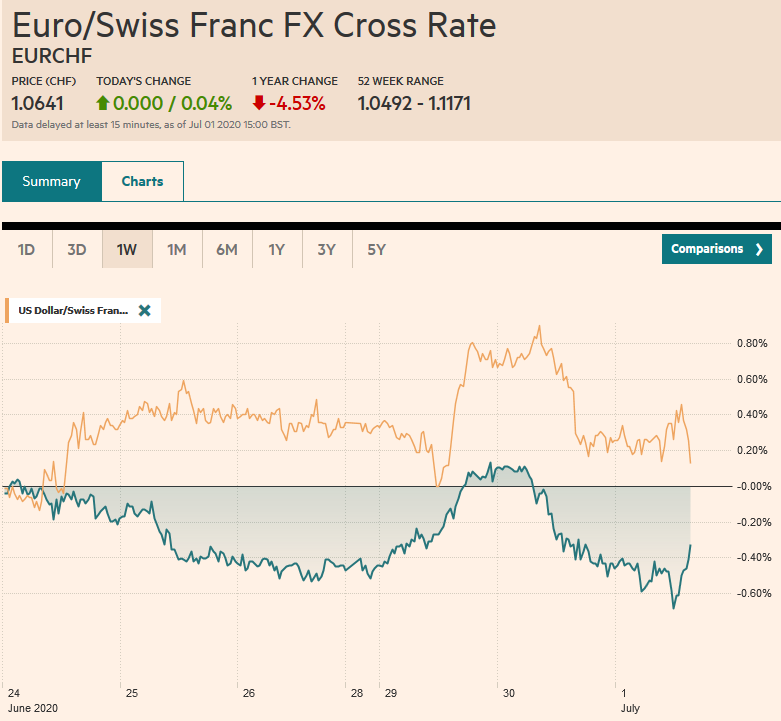

Swiss FrancThe Euro has risen by 0.04% to 1.0641 |

EUR/CHF and USD/CHF, July 1(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

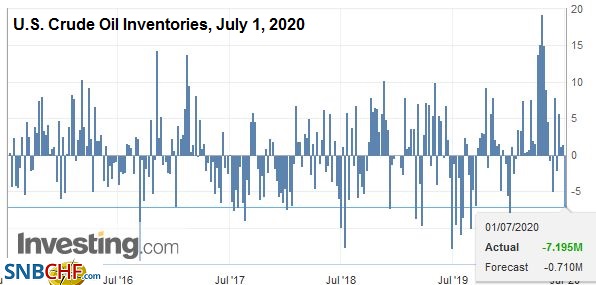

FX RatesOverview: The resurgence of the contagion in the US has stopped or reversed an estimated 40% of the re-openings, but the appetite for risk has begun the second half on a firm note, helped by manufacturing PMIs that were above preliminary estimates or better than expected. Except for Tokyo and Seoul, equities in the Asia Pacific region rose. The MSCI Asia Pacific Index rose almost 15.5% in Q2. European stocks are extending their advance for the third consecutive session. The Dow Jones Stoxx 600 rose a little more than 12.5% in Q2. The S&P 500 rose for the past two sessions to close the quarter with a 20% gain. Benchmark yields are firm with the US 10-year near 68 bp. European bond yields are 1-2 bp higher, and the Antipodeans saw a 4-6 bp increase. The dollar is mixed against the major currencies. While it is little changed against most, Norwegian krone and yen are the strongest, up about 0.8% and 0.4% respectively in late European morning turnover. Led by the Mexican peso, most emerging market currencies are firm, and the JP Morgan Emerging Market Currency Index is about 0.2% higher, which would be its biggest gain in a week. Gold made a new multiyear high near $1790, drawing near the $1800 target. Oil is bouncing back with the help of the firmer manufacturing PMIs and the large fall in API-estimated US inventories (-8.1 mln barrels). |

FX Performance July 1 |

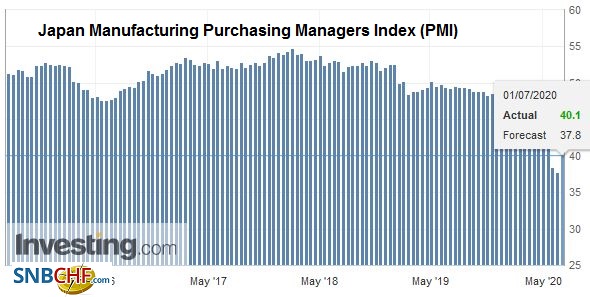

Asia PacificJapan’s Tankan showed a marked deterioration in sentiment in Q2 that was worse than expected. Large manufacturers’ sentiment fell to -34 from -8, and large non-manufacturers fell to -17 from 8. The bright spot was that capex plans rose 3.2% from 1.8% in Q1. Separately, Japan’s initial estimate for the June manufacturing PMI that showed a decline to 37.8 from 38.4 was revised up to 40.1. |

Japan Manufacturing Purchasing Managers Index (PMI), June 2020(see more posts on Japan Manufacturing PMI, ) Source: investing.com - Click to enlarge |

| China’s Caixin manufacturing PMI rose to 51.2 from 50.7 in May. Recall that the official estimate rose to 50.9 from 50.6. Separately, note that although Hong Kong is closed for the national holiday (handover July 1, 1997), China wasted no time making a couple of arrests under its controversial new security law. |

China Caixin Manufacturing Purchasing Managers Index (PMI), June 2020(see more posts on China Caixin Manufacturing PMI, ) Source: investing.com - Click to enlarge |

South Korea reported June trade figures. Exports and imports fell a little more than expected but still showed a marked improvement from May. Exports were off 10.9% from a year ago. In May, they had fallen by 23.6%. Imports fell 11.4% in June after 21% in May. The net result was a large trade surplus of $3.66 bln, the largest in Q2. It compares with an average of a $3.2 bln surplus in 2019. South Korea’s manufacturing PMI edged up to 43.4 from 41.3. Separately, Taiwan’s manufacturing PMI rose to 46.2 from 41.9, and India’s rose to 47.2 from 30.8.

The dollar is posting a potential key downside reversal against the Japanese yen. It initially rose above JPY108 for the first time since June 9 after a strong gain in the US, but it quickly reversed and fell below yesterday’s low (~JPY107.50). In this price action, the close is important. There is a $400 mln option at JPY107.30 that expires today. The bottom end of the range is JPY106.00, but the JPY107.00-JPY107.20 area may offer initial support. The Australian dollar recorded an outside up day yesterday, and follow-through buying today lifted it to about $0.6920, a five-day high. It is the third consecutive session the Aussie is higher. The next target is near $0.6975. There is a large option for A$1.8 bln that expires tomorrow at $0.6895.

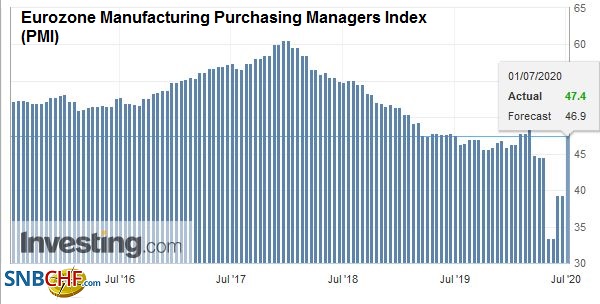

EuropeThe June manufacturing PMI for the eurozone was revised to 47.4 from the initial estimate of 46.9. It stood sat 39.4 in May and finished 2019 at 46.3. |

Eurozone Manufacturing Purchasing Managers Index (PMI), June 2020(see more posts on Eurozone Manufacturing PMI, ) Source: investing.com - Click to enlarge |

| Germany’s manufacturing PMI was raised to 45.2 from 44.6 and 36.6 in May. In December 2019, it stood at 43.7. The French PMI pushed further above 50, with the final reading of 52.3. It is a little higher than the flash reading of 52.1. In May, it was 40.6. Italy’s stood at 47.5 after May’s 45.5, and Spain’s rose to 49.0 from 38.3. |  |

| French and German consumption bounced back in May. Germany reported a 13.9% surge in May retail sales. The median forecast in the Bloomberg survey called for a 3.5% increase. In April, German retail sales had fallen a revised 6.5% (initially -5.3%). It was enough to lift the year-over-year rate to 3.8% from -6.4%. Yesterday, France reported the wider measure of consumer spending jumped 36.6% in May (month-over-month) after a 19.1% decline in April (initially reported as -20.2%). Separately, Germany reported its unemployment queues rose by 69k in June, about half as much as forecast. For the record, the UK’s manufacturing PMI was unrevised from the preliminary reading of 50.1. It stood at 40.7 in May. |

U.K. Manufacturing Purchasing Managers Index (PMI), June 2020(see more posts on U.K. Manufacturing PMI, ) Source: investing.com - Click to enlarge |

Sweden’s Riksbank increased in bond buying by SEK200 bln (~$21 bln) and extended the program until the middle of next year. Of the new buying, SEK10 bln will be for corporate bonds, and that program will start in September. It left the key interest rate at zero. The Riksbank raised its forecast for this year. The economy is expected to contract by about 4.5% rather than the 6.9%-9.7% previously. Separately, the June manufacturing PMI rose to 47.3 from 40 in May.

The euro has been confined to a narrow range of about 15 pips on either side of $1.1230 in subdued turnover. There is an option for 625 mln euro at $1.1220 that expires today. Tomorrow there is a 2.2 bln euro at $1.1250 that will be cut. It does not appear to be going anywhere quickly. Sterling recovered smartly yesterday from almost $1.2250 and managed to poke above $1.2400 in late dealings. Today there is an option there ($1.24) for about GBP500 mln that expires today. There may be near-term scope toward $1.2430, but the intraday technicals are getting stretched.

AmericaThe US economic calendar is chock full today, with the ADP private-sector jobs estimate (median forecast in the Bloomberg survey is for 2.85 mln after a 2.76 mln decline in May) ahead of tomorrow’s official estimate. Markit updates its manufacturing PMI. The preliminary estimate was 49.6, up from 39.8 in May. |

U.S. Manufacturing Purchasing Managers Index (PMI), June 2020(see more posts on U.S. Manufacturing PMI, ) Source: investing.com - Click to enlarge |

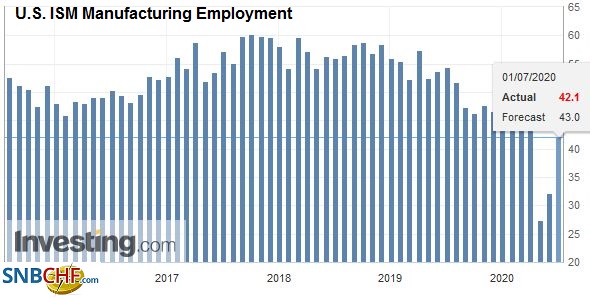

| However, the manufacturing ISM may steal its attention. It is expected to rise to almost 50 from 43.1. Watch the forward-looking new orders. A move above 50 could drive the response. June auto sales will be reported. A small increase from May’s 12.2 mln seasonally-adjusted annual rate is anticipated. |

U.S. ISM Manufacturing Employment, June 2020(see more posts on U.S. ISM Manufacturing Employment, ) Source: investing.com - Click to enlarge |

| Through May, the US averaged monthly sales of 13.2 mln. A year ago, the average was near 16.9 mln. Lastly, note that the Senate extended the Payroll Protection Plan to early August. The House will take up the bill today. The $669 bln program made an estimated 4.8 mln loans, disbursing about $520 bln. |

U.S. Crude Oil Inventories, July 1, 2020(see more posts on U.S. Crude Oil Inventories, ) Source: investing.com - Click to enlarge |

Canada does not have any major data releases today but reports May trade figures and June manufacturing PMI tomorrow. Today Mexico reports its worker remittances, which have surprised on the upside. Tourist and trade flows have dried up, but the worker remittances remain strong, helped perhaps by the peso’s depreciation this year (~17.3%). Markit reports its June manufacturing PMI. It was at 38.3 in May and is expected to have edged up slightly. The new USMCA comes into effect today, and Mexican President AMLO will visit the US next week. Brazil also reports its manufacturing PMI and the trade figures for June. The Brazilian real is the poorest performing currency in H1, falling 29.3%. Lastly, we note Colombia surprised the market, delivering only as 25 bp rate cut yesterday. It had delivered 50 bp cuts in the previous three meetings, and two of the seven board members wanted another move of that magnitude. It adjusted its repo facilities to provide more liquidity.

The US dollar was sold from around CAD1.3700 to CAD1.3570 yesterday. Follow-through selling saw almost CAD1.3545 in early Europe. Initial resistance is seen near CAD1.3580-CAD1.3600. Last week’s low was near CAD1.3485, and the 200-day moving average is just below CAD1.3500. The greenback set the June high against the Mexican peso yesterday near MXN23.23. It is bouncing off the MXN22.80 area seen in early European turnover. The MXN23.00 area should offer resistance. The dollar has risen for the past three weeks against the peso, its longest advance since March. A break of the MXN22.50 area could signal a near-term high is in place.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Brazil,China,Colombia,Currency Movement,EUR/CHF,Featured,FX Daily,newsletter,USD/CHF