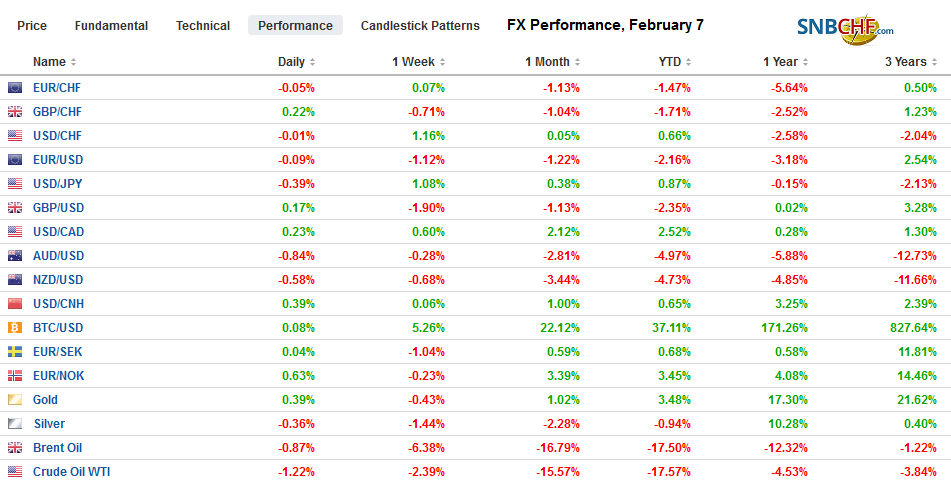

Swiss FrancThe Euro has fallen by 0.07% to 1.0692 |

EUR/CHF and USD/CHF, February 7(see more posts on EUR/CHF, USD/CHF, ) Source: makets.ft.com - Click to enlarge |

FX RatesOverview: A more cautious tone is evident today in the markets, which seem to have run well ahead of macro developments and evidence that the new coronavirus is not yet contained. After a roughly 3.5% advance in the past three sessions, the MSCI Asia Pacific index pulled back with nearly the markets in the region slipping. The Dow Jones Stoxx 600 may end its four-day advance as materials, energy, and consumer discretionary sectors drag down the index (~-0.4%), which were not helped by the disappointing industrial production figures US stocks are also trading with a heavier bias. Benchmark bond yields are slipped 1-2 bp in Europe after 2-4 bp in the Asia Pacific region. The US 10-year is hovering around 1.60%, about 10 bp higher than a week ago. The dollar remains strong and traded at new highs for the year against the euro, sterling and the dollar-bloc currencies. It is firm against all the majors but the yen, where the JPY110 area proved sticky. Emerging market currencies are also lower. The JP Morgan Emerging Market Currency Index is off about 0.3% after falling almost 0.5% yesterday to give back this week’s gains and threaten to extend the losing streak for the fourth consecutive week. Oil is steady as Russia contemplates the proposal to extend cuts to the end of the year and cut a bit more here in the first half. The March WTI contract is off about 1% this week coming into today. Gold is firm today but is off about 1.3% this week, its largest loss since last November. |

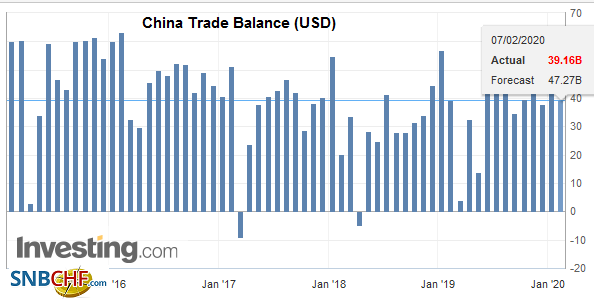

FX Performance, February 7 |

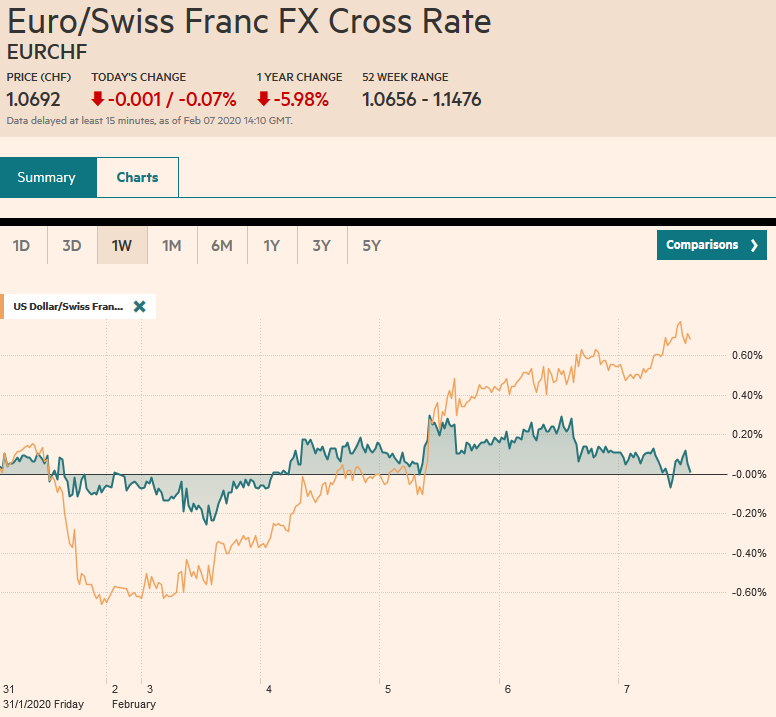

Asia PacificEven before the outbreak of the new coronavirus, Japan’s economy contracted under the weight of the sales tax increase and the typhoons. The government hoped that some measures would help offset the impact of the tax, but data earlier today raised fresh doubts. Household spending fell 4.8% year-over-year in December after a 2.0% drop in November. The Q4 drop was nearly 12%, only a little bit less than the roughly 15.5% decline in the three months after the previous sales tax increase (2014). Recent comments by BOJ officials suggest there is a growing concern of the virus impact on the Japanese economy in Q1, |

Japan Household Spending YoY, December 2019(see more posts on Japan Household Spending, ) Source: investing.com - Click to enlarge |

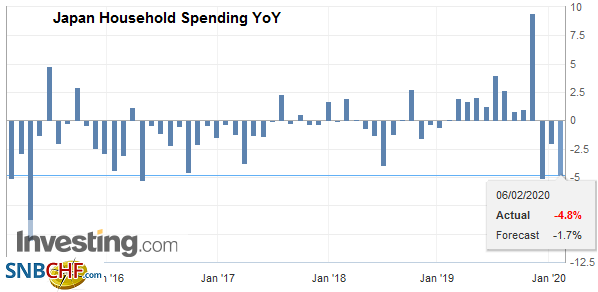

| S&P cut its forecast for China’s 2020 growth to 5% from 5.7% due to the coronavirus. It is predicated on the idea that the virus is contained by March. It also assumes a quick snapback with 2021 growth at 6.4%. It notes that China accounts for roughly a third of global growth, and its slowdown will be felt broadly. Consider today’s January trade figures that saw Taiwan’s exports to China fell 7.9% (year-over-year) after a 1.8% rise in December. Imports from China dropped 18.2% after a 16.5% increase. South Korea saw its exports China slump by 10.5%, and imports fell 9.6%. Some of this will be the normal distortions around the Lunar New Year, but some no doubt reflect the economic impact of the coronavirus. Separately, news that China’s reserves edged up to $3.115 trillion from $3.108 is of little material importance. This represents a net change of 0.25%, which is noise–i.e., reflecting no policy change or intervention, but just the normal fluctuation due mostly to valuation shifts including the euro’s 1% depreciation against the dollar in January and perhaps part of the rally in bonds. |

China Trade Balance (USD), December 2019(see more posts on China Trade Balance, ) Source: investing.com - Click to enlarge |

The dollar poked ever so slightly above JPY110 in the phantom zone after the US market closed yesterday and before Asian markets opened and reached almost JPY109.65 in the European morning. There is a $1.4 bln option at JPY110 that expires today and another one for about $625 mln at JPY109.50. The dollar finished last week near JPY108.35. The Australian dollar has wholly surrendered the week’s earlier gains and to approach last October’s low near $0.6670. There is little in terms of chart level between this area and the lows from 2008-2009 around $0.6000-$0.6250

Europe

The eurozone’s disappointing industrial production figures may have pushed on an open the door to take the euro to its lowest level since last October and calls into question the green shoots that had seemed to be signaled by sentiment data. Germany, France, and Spain each reported dismal figures. What was expected to be a 0.3% decline in France was actually a 2.8% decline in the month of December, and November was revised to flat from up 0.3%. Manufacturing output fell 2.6% in December. Spain’s industrial production was forecast to fall by 0.9%, and instead, it slowed by 1.4%, and the November increase was shaved to 0.8% from 1.0%. Germany’s was the most shocking even if the median forecast of a 0.2% decline did not capture the pessimism spurred by yesterday’s news that factory orders fell 2.1% (instead of tick up as economists expected). Germany’s industrial output slid by 3.5%. November’s upward revision to a gain of 1.2% from 1.1% offers little consolation.

The euro finished last year above $1.12 and was sold below $1.0950 today in the face of the broad-based dollar advance and the disappointing EMU data, which renews fears of a recession, despite negative interest rates. A break of $1.0940 targets the $1.0880 2019 low from last October. The euro has fallen every day this week. It closed last week a little below $1.11. While the euro is off about 1.3% against the dollar this week, sterling has shed a little more than 2% at $1.2930. The big reversal took place Monday as investors seemed to begin realizing that the UK-EU trade talks would be arduous, and the risk was high that no agreement may be struck. There is an option for about GBP325 mln at $1.2950 that expires today. Support is seen around $1.29, which is also the low since the election. Russia cut its key rate by 25 bp to 6.0% as widely expected, and the official statement made it clear that the easing cycle is not over after the fifth consecutive cut. With inflation near 2.5%, there is scope for additional rate cuts. The ruble weakened on the news.

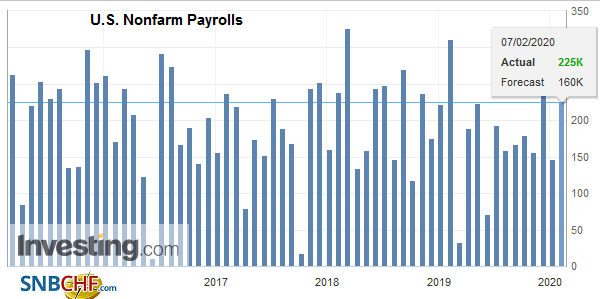

AmericaThe surge in the ADP private-sector job growth estimate (291k) did not get economists to revise up their estimates very much for today’s official report. |

U.S. Nonfarm Payrolls, January 2020(see more posts on U.S. Nonfarm Payrolls, ) Source: investing.com - Click to enlarge |

| In fact, the median forecast in the Bloomberg survey is for a 155k increase in private sector jobs and 165k, including the government sector. |

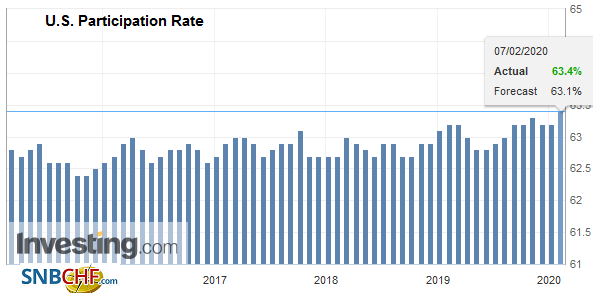

U.S. Participation Rate, January 2020(see more posts on U.S. Participation Rate, ) Source: investing.com - Click to enlarge |

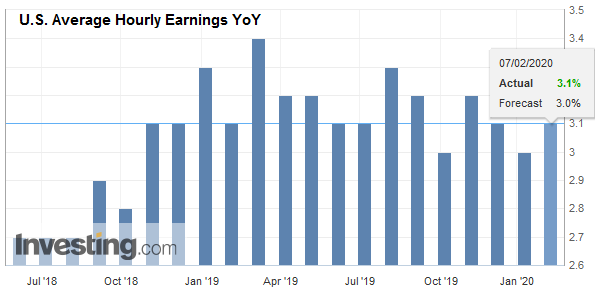

| Average hourly earnings are expected to have picked up, helped on the margins by the rise in minimum wage rates after a tepid 0.1% increase in December Included in today’s report will be the annual revisions. |

U.S. Average Hourly Earnings YoY, January 2020(see more posts on U.S. Average Hourly Earnings, ) Source: investing.com - Click to enlarge |

| Preliminary indications suggest the revisions will reduce the level of employment by around half a million as of March 2019 and maybe by around 100k for the April-December period. Last year’s average is likely to fall from the 175k currently to something closer to the current readings (~155k). |

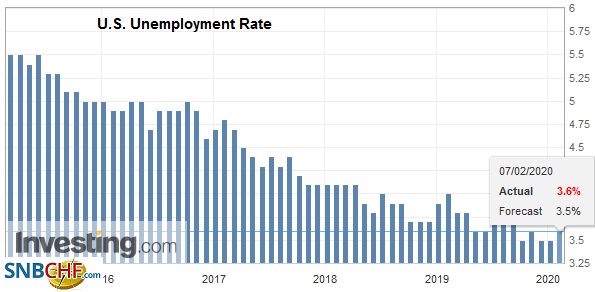

U.S. Unemployment Rate, January 2020 Source: investing.com - Click to enlarge |

Canada also reports its January jobs data. The market recognizes the Bank of Canada has shaded its neutrality dovishly. The implied yield of the December BA futures contract (three-month interest rate) has fallen by roughly 25 bp since the end of last year. The OIS curve has a cut discounted by early Q3. A disappointing report would likely see investors bring the cut forward. A strong report, especially if in contrast to soft US data, could reinforce the cap around CAD1.3300-CAD1.3330.

The US dollar is making a marginal new high for the year ahead of the employment data. It has spent a little time above CAD1.33 every day this week, but so far has not closed above it. There are two sets of expiring options to note. The first is near the money at CAD1.3290 for about $580 mln, and the second is at CAD1.3290 for almost the same amount. The Canadian dollar has depreciated by about 0.5% this week, and unless it recovers today, it will extend is losing streak to the fifth consecutive week. The US dollar fell to a new low for the year against the Mexican peso yesterday (~MXN18.56) before recovering to close a little below MXN18.66. It is now testing the 20-day moving average near MXN18.7450. In situations like this, where the US dollar has had a strong run-up ahead of an important event, one should take seriously the risk of a buy the rumor, sell the fact type of activity. The Dollar Index, which reached a new 2020 high above 98.60, would need to reverse and fall through 98.20 to be anything of note.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,China,China Trade Balance,coronavirus,Currency Movement,EMU,EUR/CHF,Japan Household Spending,jobs,newsletter,Trade,U.S. Average Hourly Earnings,U.S. Nonfarm Payrolls,U.S. Participation Rate,U.S. Unemployment Rate,USD/CHF