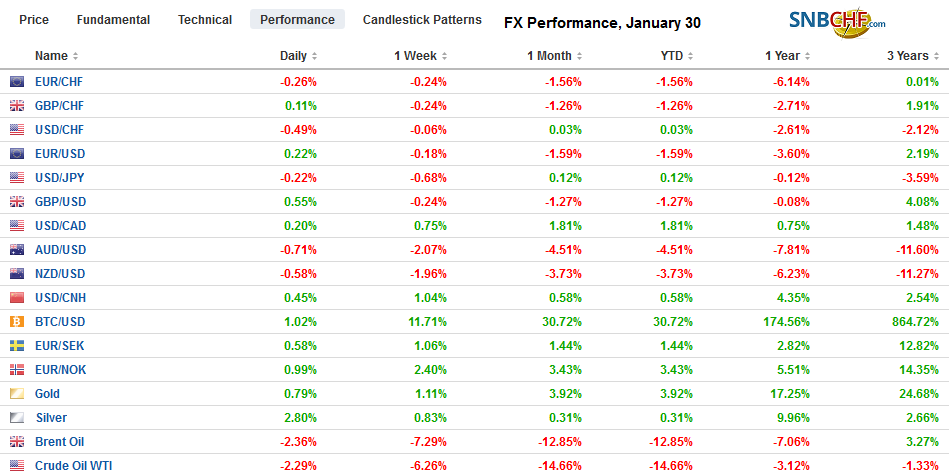

Swiss FrancThe Euro has fallen by 0.21% to 1.0689

|

EUR/CHF and USD/CHF, January 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The ongoing concerns about the geometric progression of the new coronavirus continues to swamp other considerations for investors. Risk continues to be unwound, as the World Health Organization meets to decide if this is indeed a global health emergency. Several large equity markets in Asia were hit particularly hard. Taiwan re-opened from the Lunar New Year holiday and plummeted 5.7%. Hong Kong fell a little more than 2.5%, while the Nikkei and Kospi fell about 1.7%. European bourses are faring better, but the Dow Jones Stoxx 600 is giving back half of the gain scored in the past two sessions, and US shares are trading heavily, with the S&P 500 trading off about 0.5% in electronic activity. Bonds attract a safe-haven bid, and benchmark 10-year yields are mostly 1-2 bp lower, putting the US 10-year yield near 1.57%. he US dollar is mixed, but the currencies often seen as sensitive to growth, like the dollar-bloc and Scandis are underperforming, while the yen and Swiss franc edge higher. The euro and sterling are treading water. Emerging market currencies are heavy, and the JP Morgan Emerging Market Currency Index is off for the seventh time in the past nine sessions and is at its lowest level since early December. Gold is returning to a safe haven from a risk asset and is rising for the eighth time in 10 sessions. It is gaining for the seventh week in the past eight. Oil is being weighed down by ideas that demand will slacken, but also from supply as US, inventories jumped by 3.5 mln barrels, well above expectations and the most in a couple of months. March WTI is testing the recent low near $52 a barrel. Recall that when the US-Iran confrontation escalated earlier this month, March WTI pushed above $65. |

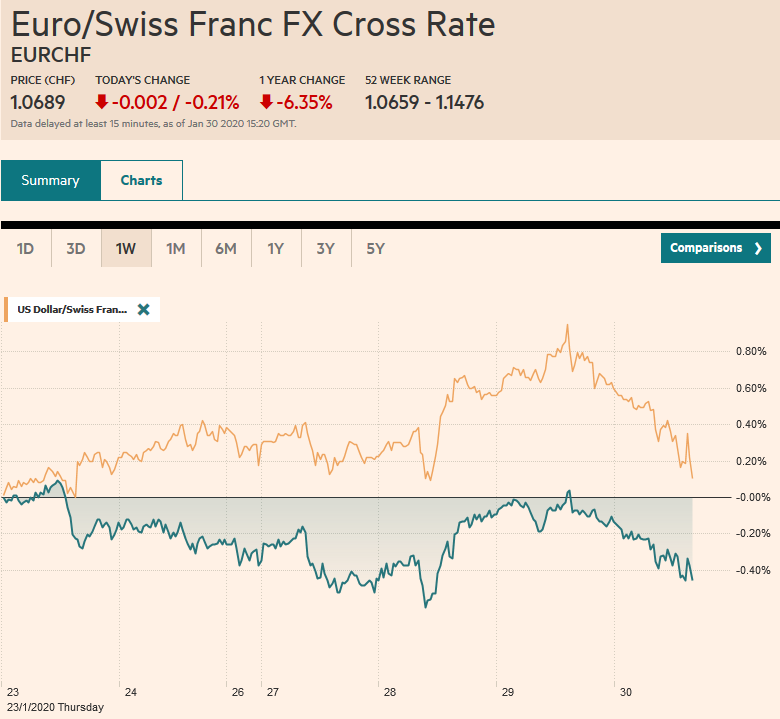

FX Performance, January 30 |

Asia Pacific

The coronavirus is impacted Asia markets the hardest. China, where the markets remain closed as the holiday is extended. Flights to and from China have been cut dramatically. China has begun earmarking subsidies to start controlling the virus. The virus also poses credit risk issues.

Economic news has been swamped by the virus. Of note, Samsung reported with its earnings, which disappointed, that memory chip prices are still falling. Separately, manufacturers’ confidence for February had ticked up (77 from 73), while non-manufacturing sentiment slipped (74 from 75). Rising exports and falling imports saw New Zeland report a larger than expected December goods trade surplus. The value of dairy exports reached a record, though volumes were little changed. China replaced the US as the largest destination for its beef. China took a record 28% of New Zealand exports in the fiscal year, up from 24%.

The dollar reached the high for the week yesterday just above JPY109.25. It has been down to about JPY108.80 today and continues to straddle the JPY109-level, where an option for almost $550 bln is struck that expires today. The risk still is on the downside, and the 200-day moving average near JPY108.45 may be the next target. The Australian dollar is taking another leg lower, and near $0.6720 is at its lowest level in more than three months. The large topping pattern we identified projects toward $0.6670, which is the 2019 low. The dollar rose above the 7.0 level against the offshore yuan (CNH) for the first time since Christmas. Recall that the dollar closed at roughly 6.9425 against the onshore yuan (CNY) on January 23 as the markets closed for the Lunar New Year.

EuropeThe market is near evenly divided about today’s Bank of England meeting. That means that no matter what the outcome, half the market will be ill-prepared for the results. Economists seem to lean against a move, while the derivatives market shows a split among participants. Recent data suggest that some of the uncertainty ahead of the election has been lifted, but the downside risks remain palpable. The fact that it is also the last meeting Carney will lead may also be influencing expectations. There have been two dissents at the last couple of meetings, and even if rates are not changed, a 6-3 vote will keep expectations for a move in the next couple of meetings elevated, with sentiment shaped by high-frequency data. |

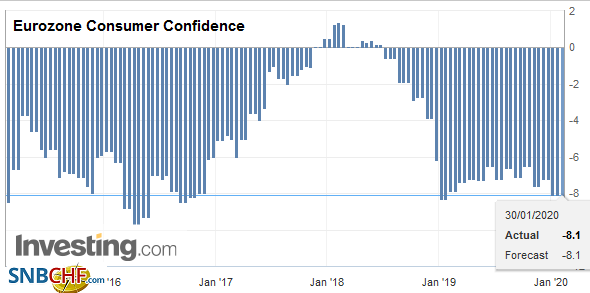

Eurozone Consumer Confidence, January 2020(see more posts on Eurozone Consumer Confidence, ) Source: investing.com - Click to enlarge |

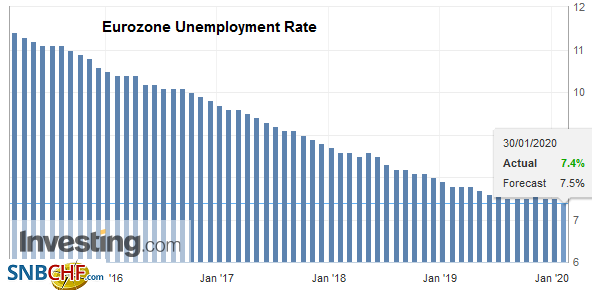

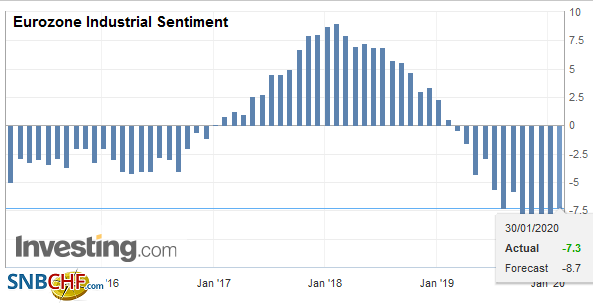

| The unemployment queues in Germany unexpectedly shrank by 2k in January, though the unemployment rate was unchanged at 5.0%. Unemployment in the eurozone fell to a new cyclical low of 7.4% at the end of last year. It was at 7.8% at the end of 2018. The data lends credence to the gradual improvement in sentiment and PMI readings. Separately, German states are reporting January inflation figures ahead of the national data due later today. Prices in Germany and the eurozone as a whole typically fall in January, but it does not prevent the year-over-year rate from ticking up. That is what most of the German states reported and what the national figures are expected to show. Eurozone’s preliminary January CPI figures (along with the first estimate of Q4 GDP) will be released tomorrow. Prices may have fallen 0.9% month-over-month but may have edged up to 1.4% from 1.3% year-over-year. |

Eurozone Unemployment Rate, December 2019(see more posts on Eurozone Unemployment Rate, ) Source: investing.com - Click to enlarge |

| The UK will leave the EU tomorrow. It is well known, and the UK enters into a standstill phase for the rest of the year. There is unlikely to be a significant market reaction. The key date now becomes the end of the year. The UK and EU will negotiate the new trade relationship. The UK wants a deal free-trade deal similar to the one struck between the EU and Canada, which also is not predicated on regulatory alignment. And it wants the agreement by the end of the year. The EU says that it is too shallow of a deal for such an important trading partner and that the end of the year is too soon. |

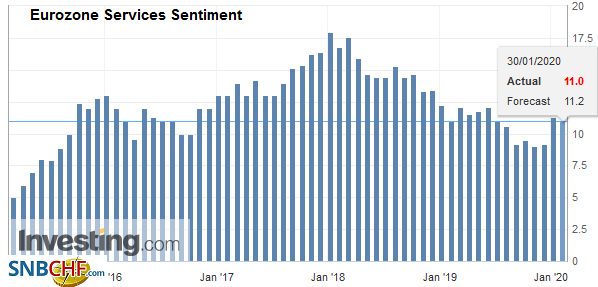

Eurozone Services Sentiment, January 2020 Source: investing.com - Click to enlarge |

| The euro has held above $1.10 today while trading within yesterday’s range (~$1.0990-$1.1030). Although the downside momentum has eased, it is not clear that a meaningful low is in place. The topping pattern warns of risk toward $1.0960 and possibly even last year’s low near $1.0880. A move above $1.1050 may help stabilize the tone. There are a couple of options expirations to note today. There is one for 1.3 bln euros at $1.0985 and another for 1.2 bln euros at $1.10. Sterling is little changed as it straddles the $1.30 level ahead of the central bank announcement. Tactically, we are more inclined to fade the initial reaction to the rate decision. Any relief rally on a standpat outcome may prove short-lived as rate cut expectations may continue to hand over the market, while a sell-off on a rate cut may prove a buying opportunity. There is a GBP350 mln option at $1.2975 that will be cut today and one for about GBP585 mln at $1.3100, which looks safe. |

Eurozone Industrial Sentiment, January 2020 Source: investing.com - Click to enlarge |

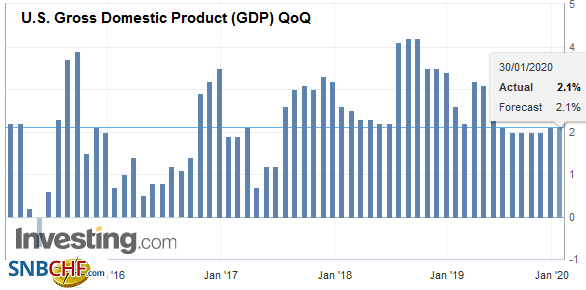

AmericaThe cautious optimism of Fed Chair Powell did not arrest the swing in the pendulum of market sentiment toward a rate cut. The implied yield of the December 2020 fed funds futures contract fell four basis points to 1.23%, the lower end a three-and-a-half-month trading range. It is now implies a yield of 1.205%. The 10-year yield slipped back below 1.60% to levels not seen since the first part of last October. The Fed offered minor tweaks in the economic assessment, which included the softening of the description of household consumption and a five basis point increase in the interest paid on reserves. The risks seemed still aligned to the downside. The take-away is simply that there has not been a material change in the Fed’s understanding of the economy and the gap between the standpat Fed policy to the market expectations. However, the Powell underscore the commitment to reach the 2% PCE deflator target, which gave a dovish cast to the meeting outcome. The market’s attention turns toward the first look at Q4 US GDP. The NY Fed’s GDP trackers put growth at 1.2% at an annualized pace as of January 24. The Atlanta Fed’s model sees it at 1.7%. The median forecast in the Bloomberg survey is for 2.0% growth. Q3 GDP was 2.1%. The issue seems to be how much did household consumption slows and where there offsets. Consumption, which is around 70% of the economy, grew by a heady 4.6% in Q2 and slowed to a still-strong 3.2%. In Q4, it may have slowed further toward 2.0%. Business investment likely fell for the third consecutive quarter. Trade contributed positively. The change in the change of inventories is always a wild card. The deflator draws some attention, and the headline GDP deflator is expected to be little changed at 1.8%. The core deflator, though, may slip back from 2.1% to 1.6%. |

U.S. Gross Domestic Product (GDP) QoQ, Q4 2019(see more posts on U.S. Gross Domestic Product, ) Source: investing.com - Click to enlarge |

The US dollar has been knocking on CAD1.32 in recent days but has pushed above it today to reach nearly CAD1.3225 in the European morning, and just shy of the 200-day moving average (~CAD1.3230). These levels have not been seen since early December. The next technical target is seen in the CAD1.3280-CAD1.3300 area. A note of caution over the speed of the move as the upper Bollinger Band (two standard deviations above the 20-day moving average) is near today’s session highs. The Mexican peso’s high yields continue to protect it. The dollar is little changed against the peso this week, and if anything, it is a touch softer. However, it may be challenged today. Mexico reports its Q4 GDP, and it is likely to have contracted. Although the economy eked out a little growth in Q3 (0.1%), it contracted in Q1 and Q2 and is forecast to have shrunk by 0.2% in Q4. A move above MXN18.85 would be notable and would suggest a retest on the MXN19.00 area.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$CNY,Bank of England,Brexit,coronavirus,Currency Movement,EUR/CHF,Eurozone Consumer Confidence,Eurozone Unemployment Rate,federal-reserve,Germany,newsletter,U.S. Gross Domestic Product,USD/CHF