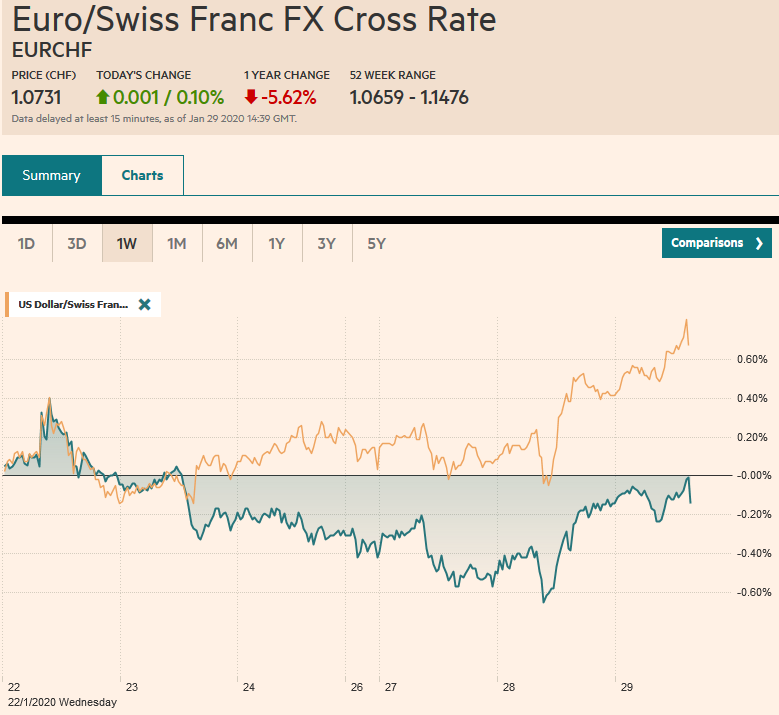

Swiss FrancThe Euro has risen by 0.10% to 1.0731 |

EUR/CHF and USD/CHF, January 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: This colorful Malay saying captures the spirit of the animal spirits. Narrowly escaping an escalation of a trade war between the world’s two largest economies, the outbreak of a deadly virus has spurred moves, especially the sell-off in stocks and rally in bonds, for which many investors seemed ill-prepared. Even though the virus contagion has not peaked, the recovery in US equities yesterday points to a break the fear and anxiety. Most Asia Pacific equity markets pared recent losses, though Hong Kong re-opening for the first time, played some catch-up, and the Hang Seng fell 2.8%. European bourses are also stabilizing, and the Dow Jones Stoxx 600 is up about 0.3% in late morning turnover, led by healthcare and materials. US stocks are firm in Europe after the S&P 500 held the support we identified near 3235, the (38.2%) retracement of the leg-up from the December 3 low. Bonds remain bid. The benchmark 10-year yields are mostly 2-4 bp lower today, which leaves the US yields hovering above 1.6%. Of note, Italy’s generic 10-year yield reached over 1.25% a couple weeks ago amid political worries, is now near 86 bp, the lowest since before Christmas. Meanwhile, the dollar remains firm against most major and emerging market currencies. The yen continues to outperform, suggesting that the risk-off fears continue to linger despite the equity market stabilization. The price of oil snapped a five-day drop yesterday and is extending the recovery today, helped perhaps by the unexpectedly large drop API’s estimate of US inventories (-4.27 mln barrels) and talk of OPEC+ extending curbs. Gold ended a four-day advance yesterday, shedding almost 1%, but has returned bid today. |

FX Performance, January 29 |

Asia Pacific

The confirmed cases of the new coronavirus have surpassed China’s official estimate of the SARS virus. Travel restrictions and output cuts continue to broaden. At first, it seems services were more vulnerable than production, but now it seems clearer than manufacturing will also be depressed, and supply chains remain vulnerable. It appears the disruption will last through at least next week and possibly the first week in February and extends to international companies operating in China. Starbucks, for example, has announced extended closures of more than half of its branches on the mainland. Japan’s Toyota also shuttered local production. China is to report the January PMI tomorrow before markets reopen.

Australia reported slightly firmer than expected Q4 19 CPI. The net impact was to reinforce that the Reserve Bank of Australia will not cut rates when it meets on February 3. The derivative markets showed a nearly 85% chance of no change in policy at the end of last week, and the odds have moved close to 90%. The year-over-year rate edged up to 1.8% from 1.7%. Economists expected no change.It is the highest since Q4 18 when it also stood at 1.8%. It rose 0.7% on the quarter, instead of the 0.5% expected. The underlying measures increased by 0.4% in Q4 19. The drought and fires pushed up food prices. Fruit prices, for example, for 6.8%. Tradeable goods prices rose by 0.2%, while non-tradable goods rose 1%.

The dollar reached a three-day high a little above JPY109.25 before selling pressure re-emerged. The dollar’s recent low was on Monday near JPY108.75. There are two option expires of note today. There is one for about $610 at JPY109.00 and one for $465 at JPY109.25. Although the daily technical readings favor additional dollar losses, the intraday technical readings warn that higher levels may be seen first. The Australian dollar bounced from a three-month low near $0.6735 yesterday to a little more than $0.6775 today before running out of steam. The reversal lower, though, is stretching the intraday technical readings. Recall that the dollar closed near CNY6.9425 last Thursday as the mainland markets shut. The offshore yuan has edged higher for the past two sessions, leaving the dollar near CNH6.9610 (vs. CNH6.9320 last Thursday).

Europe

EMU’s money supply growth and lending figures for December disappointed. M3 year-over-year growth slowed for the second consecutive month, and the 5% pace was the slowest since June. Loans to non-financial businesses slowed to 3.2% from 3.4%. The monthly extension of new loans slowed to a trickle of 0.7 bln, as trade and the manufacturing slump took a toll. On the other hand, lending to households accelerated to 3.7% (from 3.5%) is the strongest in 11 years. There is little doubt that the ECB is on hold. However, the money supply and lending figures suggest that the transmission of monetary policy may be stalling.

Attention turns to tomorrow’s Bank of England meeting. It remains a close call. The economic consequences of the new coronavirus may encourage a cut, but on balance, the sentiment leans against a move. The derivatives market suggest about a 55% chance that the BOE stands pat.This means that a significant number of participants will be surprised no matter the outcome tomorrow. It is also Carney’s last meeting as Governor. he next MPC meeting is not until March 26.

The euro has already traded on both sides of yesterday’s range. It traded up to almost $1.1030 and down to $1.0995.The intraday technicals are stretched, but the market may want to test last November’s lows in the $1.0980-$1.0990 area. There is a 1.2 bln euro option at $1.0985 that expires tomorrow. On an outside day, the close is particularly important from a technical perspective. Sterling is hovering just above $1.30, having been down to $1.2975 yesterday. There is an option for roughly GBP310 at $1.2965 that will be cut today and another option for GBP220 at $1.30 that expires too. The intraday technicals warn that sterling’s low may not be in place yet today.

America

The US reports December goods trade, retail inventories, and pending home sales. But the key event is the FOMC meeting followed by Chairman Powell’s press conference. We do not expect significant changes in the central bank’s economic assessment. It is no hurry to change its stance, which 14 of 17 Fed officials last month thought could persist for the entire year. The press is likely interested in how the Fed thinks about the risks the virus poses, but the focus may be on the Fed’s balance sheet and its plans to reduce T-bill buying in Q2. There may be some technical adjustment to the interest paid on reserves (yes, required reserves and excess reserves). With the effective Fed funds rate near the lower end of the band, a small increase in the interest paid on reserves is thought to help ensure that the funds’ rates remain in the target range. The December 2020 fed funds futures contract implies a yield of 1.25%. The current effective average is about 1.55%. This implies 30 bp of easing is anticipated, i.e., one cut and about a 20% chance of a second one.

Canada and Mexico’s economic calendars are light today. Canada reports November’s monthly GDP figures tomorrow. A flat performance is expected after a 0.1% contraction in October. Disappointment will likely weigh on the Canadian dollar. Mexico will report Q4 GDP figures tomorrow. After contracting for three consecutive quarters, growth was flat in Q3. However, it is expected to have contracted by 0.2% in Q4 19. It would be the third successive quarter that the year-over-year pace has been negative. Mexico’s central bank meets on February 13 and is expected to ease policy again.

The US dollar reversed lower after poking above CAD1.32 for the first time since mid-December. It found support near CAD1.3155 and has not seen follow-through selling today. While the greenback is poised to test yesterday’s highs, the intraday technicals suggest the upside will be limited. The US dollar neared MXN19.00 on Monday and fell back to MXN18.71 yesterday. The appetite for risk has not returned, and the dollar is firm against the peso, trading near MXN18.75 in Europe. There is scope to test the MXN18.80-MXN18.85 area.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Australia,Bank of England,China,EUR/CHF,federal-reserve,newsletter,SPX,USD/CHF