Swiss FrancThe Euro has risen by 0.20% to 1.0989 |

EUR/CHF and USD/CHF, October 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The UK’s departure from the EU remains up in the air as a new attempt to pass the necessary legislation through Parliament continues today. Many market participants seem to remain optimistic that Prime Minister Johnson’s plan will ultimately succeed. After slipping to $1.2875 initially, sterling briefly pushed through $1.30, which had held it back last week. Equities are firm. Nearly all the markets in Asia Pacific rose, and the Dow Jones Stoxx 600 is steady to higher. The US S&P 500 is poised to retest the 3000-mark. Benchmark 10-year bond yields continue last week’s march higher, with US and European yields 3-6 bp higher. The dollar is seeing last week’s losses extended, but we suspect the stage is being set for a “turnaround Tuesday.” |

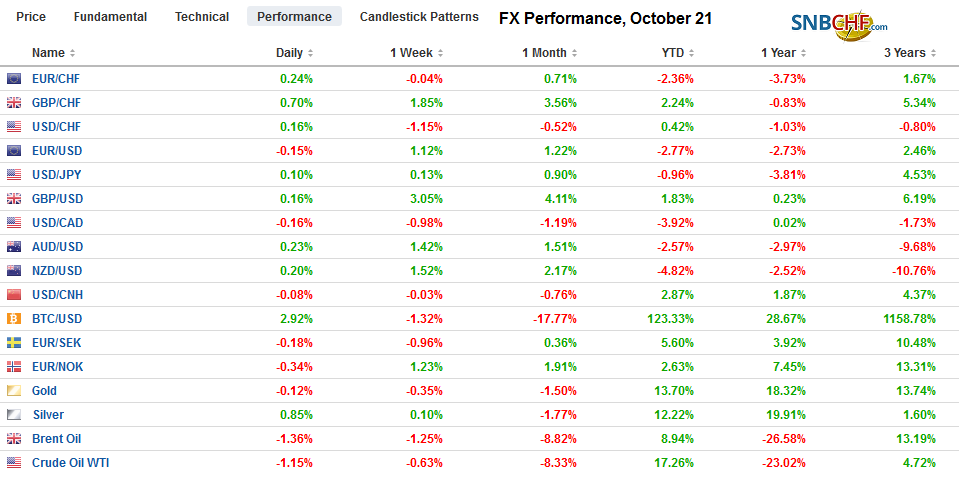

FX Performance, October 21 |

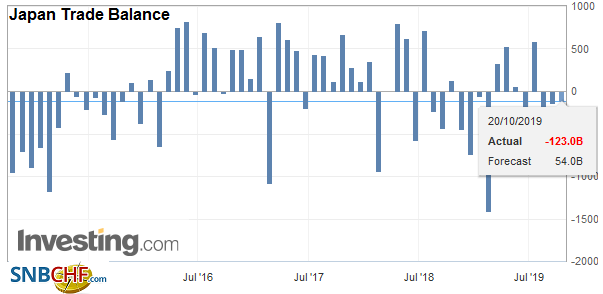

Asia PacificThe People’s Bank of China did not cut its new Prime Loan Rate as had been expected. It was set at 4.20% last month, and many expected a campaign of small monthly cuts. Economists are trying to digest signal that is being sent but do not seem to read much into it. Instead, it is seen to be a question of timing. Separately, China’s Vice Premier confirmed progress is being made on “phase 1” of trade talks with the US, though no date has been set to resume the work that is supposed to lead to a formal agreement between Trump and Xi next month. Separately, but related, US Vice President Pence is expected to make an important speech on China on October 24. The speech had been initially planned around mid-year but was postponed for fear of antagonizing China during sensitive trade talks. Japan’s September trade figures showed that the pace of export and import declines moderated to produce a large than expected trade deficit of JPY123 bln (~$1.1 bln). The median forecast in the Bloomberg survey called for a JPY54 bln surplus. Many observers do not seem to appreciate that what drives the Japanese current account surplus is not the trade account but the capital account. Earnings from overseas, i.e., mostly profits and return on portfolio investment, are the drivers, like Switzerland. Exports were off 5.2% year-over-year after an 82% decline in August. The Bloomberg survey median was for a 3.7.% contraction. Imports fell 1.5% after August’s 11.9% decline and expectations for a 2.8% drop. |

Japan Trade Balance, September 2019(see more posts on Japan Trade Balance, ) Source: investing.com - Click to enlarge |

South Korea’s trade figures for the first 20-day of October reflect not only the regional slowdown but also seem to pick-up its trade tensions with Japan. Exports overall fell 19.5% year-over-year after a 21.8% decline in the first 10-days of October. Semiconductor exports were off 29%. Exports to China were down 20% from a year ago, while exports to Japan fell 21%. Imports fell 20.1% from a year ago, nearly doubling the 11.1% decline picked up earlier. Imports from Japan were down 21% year-over-year.

The dollar fell to a four-day low near JPY108.30 in early Asia amid the uncertainty spurred by the UK over the weekend. However, it recovered to about JPY108.65 in early Europe, where it seemed to stall. There are $1.3 bln in expiring options struck between JPY108.30 and JPY108.45. The Australian dollar is extending its advance for the fourth session to its highest level in over a month (~$0.6880). September’s top was just shy of $0.6900. We see the technical indicators getting stretched and anticipate a pullback shortly. Despite the poor trade figures, the Korean won leads the emerging market currencies higher with around a 0.8% gain that has pushed the dollar to three-month lows below KRW1172.00.

Europe

Brexit remains center stage today. Johnson will try again today to push the bills through Parliament. There still seems to be much political maneuvering, and it is not clear whether much progress will be achieved today. That said, the debate and “fighting and talking” is likely to continue in the coming days. Many observers think that despite the loss on Saturday, Johnson’s agreement will eventually carry the day with an exit (to a near standstill transition phase ), still likely by the end of the month. Despite some pushback from French President Macron, the EU is seen likely to grant the UK some extension, though it need not be in a hurry to do so. It might wait for this week’s developments and hold an emergency summit next week. The case before the Scottish high court today claiming Johnson was in contempt of court for how it carried out the Benn Act seems moot.

Switzerland’s national election results have a little market impact. However, the results seem to be broadly in line with other European elections this year that has seen the anti-immigration parties lose momentum, while parties that put an emphasis on the environment gain support. In Switzerland’s case, this was the Greens and Green Liberal, which picked about 44 seats in the 200 seat chamber, while the Swiss People’s Party lost about 11 seats.

Sterling held below $1.30 at the end of last week but pushed through it briefly in early European turnover. If the high is not in place, we suspect it came pretty close until today’s Parliament developments are seen. Initial support now maybe near $1.2950, while the session low was set near $1.2875 in early Asian turnover. The pre-weekend low was around $1.2840. The euro edged to a new two-month high near $1.1180 at the start of the European session. An option for almost 750 mln euros at $1.1185 expires today. Another option for 1.1 bln euros is struck at $1.12 and also expires today. On the downside, options for 1.1 bln euros are also to be found in between $1.1125 and $1.1150. The Turkish lira is the weakest of the emerging market currencies, off about 0.8%. The central bank meets later this week, and many expect it to deliver a 100 bp rate. The dollar is near a one-month low against the Russian rouble. The central bank is expected to cut its key rate by 25 bp at the end of the week.

America

The Trump Administration initially proposed that the President’s Doral properties host next year’s G7 summit. The pushback was palpable and seemed to have met international disdain, with suggestions that officials would not stay there in protest. The appearance of impropriety proved too much. The President’s domestic critics see it as more evidence of the disregard of the “emoluments clause” that prohibits receiving payments or gifts from foreign governments. Over the weekend, the Administration rescinded its decision and will look for another location. Trump suggested Camp David as a possible alternative. It is difficult to assess the international reputational damage of even the suggestion given broader disregard for traditions and conventions. That said, it is Trump’s Syrian strategy that appears to have brought on the strongest criticisms from within the Republican Party.

Canada goes to the polls today. It is a very tight race. Prime Minister Trudeau’s disapproval rating near 58% is higher than Trump’s. However, his Conservative opponent has been mostly unable to capitalize on the incumbent’s woes. Both candidates are drawing support by around a third of the electorate. Given the stance of other parties, a coalition with Trudeau’s Liberals seems more likely that a Conservative-led government. The Canadian dollar is the strongest of the major currencies this year, rising a little more than 4% against the US dollar.

The Canadian dollar is edging higher today, though it is the weakest of the dollar-bloc currencies. The US dollar is trading a little above CAD1.31 to match its lowest level since July 31.Below there is the congestion range that it spent most of July in, which extends to CAD1.30. Initial resistance is seen around CAD1.3140. The dollar’s eight-day slide against the Mexican peso is stalling today in front of MXN19.10. Nearby resistance is pegged around MXN19.20, and the 200-day moving average is closer to MXN19.26. The Dollar Index finished last week below its 200-day moving average (~97.40) for the first time in three months. The lower Bollinger Band (two standard deviations below the 20-day moving average) is about 97.30, and it has closed the past two sessions below it. Important chart support is seen near 97.00.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Brexit,Canada,Currency Movement,EUR/CHF,Japan Trade Balance,newsletter,South Korea,Switzerland,USD/CHF