I feel a bit like the proverbial guy that asks, “Besides that, Mrs. Lincoln, how did you like the play?” in trying to discuss the week ahead without knowing the results of the UK Parliament’s decision on the new deal negotiated between Prime Minister Johnson and the EU. I will write a separate note about Brexit before the Asian open. However, there are several other developments next week that will help shape the investment climate.

Europe is front and center. Three issues outside of Brexit stand out. First, the US tariffs went into effect on $7.5 bln of European imports that were sanctioned by the WTO for the damage caused by improper subsidies to Airbus. Europe has threatened to retaliate, and if it does so, the US is likely to respond in a tit-for-tat fashion.

Europe may be better advised to wait for the WTO to make a formal finding about US subsidies to Boeing. If these are also judged to be illegal, the EU has cover to retaliate but also a chit with which to negotiate. European exports to the US in 2018 were worth $487 bln. For individual companies, it can be devastating (European exporters as well as American importers, for the former it means loss of market share, and for the latter, loss of competitiveness and they are innocent victims), but it is more of an irritant than a body blow, like the one the US aims at China, where most of its exports to the US have been given an additional levy on top of what had previously prevailed. The tariffs then cover a small percentage of trade, .and the damage that the WTO recognizes is much less than the US claimed.

Moreover, and, arguably, more importantly, retaliation by Europe now would likely incur the mercurial American President’s wrath and increase the risk that the threatened auto tariffs (on claimed national security grounds) materialize. As investors and traders now, a small known loss is often preferable to an unknown and possibly larger one. A decision is expected by the middle of next month, six months after the Commerce Department’s findings were delivered.

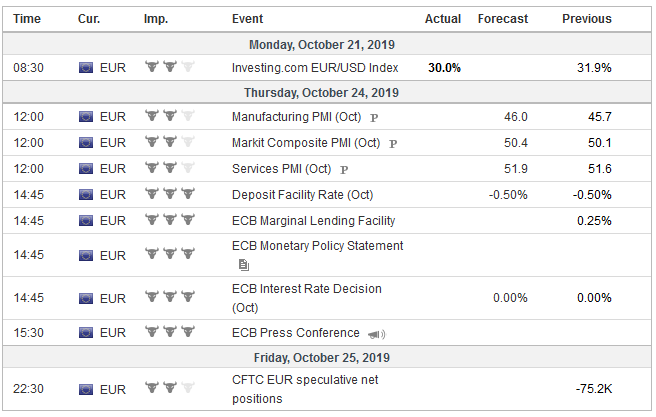

EurozoneThe other two issues are events on October 24. The preliminary October PMI for the eurozone will be reported, and Draghi holds his last ECB council meeting. We suspect that the eurozone economy is stabilizing, and that means that data should begin getting better sequentially. Indeed, there is a reasonable chance that both the manufacturing and service PMIs improve. The focus is on German manufacturing PMI. It rose only once last year, and in the past seven months, it has been alternating between gains and falls (the latter have been larger than the former). Germany’s manufacturing PMI fell to a new cyclical low of 41.7 last month. It is expected to recover slightly to 42. The services PMI finished last year at 51.8, and it was above that all this year until September when it fell to 51.4. The median forecast in the Bloomberg survey is for a 52 reading. The composite for the region stood barely abov3e the 50.1 boom/bust level in September. It likely firming a little this month. It is likely to be too modest to get excited about, but the business adjustment, robust lending figures, a reasonably strong labor market, and negative interest rates should help limit the regional economy’s downside. After announcing a multidimensional easing policy last month, it is unreasonable to expect any change from the ECB meeting. It is Draghi’s last meeting, and the event lends itself to a retrospective. Investors may be more interested in forward-looking insight. One of the key issues that are left outstanding is the self-imposed limits on asset purchases. Draghi will be asked about it during the press conference, but there is no answer, and there need not be now. In fact, it may not be until toward the end of next year that the caps become relevant. Changing the caps coupled with the open nature of the purchases would likely spur legal challenges, perhaps by some of the same critics that have contested other innovations by Draghi, such as the Outright Monetary Transactions. The courts have given the ECB wide berth. The ECB has already demonstrated the capital key (shareholding of the ECB based on population size and GDP) is flexible. Despite claims by some Italian politicians that the ECB discriminates against Italy, the central bank’s holdings of Italian debt is nearly 8.5% more than the capital key implies. The ECB’s Spanish holdings are around 7.5% above its share in the capital key, and French bond holdings are almost 4% more. The ECB’s investment is German bonds is about 1.3% less than the capital key. If the path to buying more sovereign bonds is blocked, it could leave the ECB will little choice but to purchase more private-sector bonds, though there seems to be little appetite for that now. Draghi is the third ECB President, and at the helm during the crisis, he was compelled to innovate and develop new tools. The tools were controversial, but the fissure at the central bank pre-existing the crisis. The very shape of monetary union and its fundamental incompleteness is a function of the division between creditor and debtor nations. That divide was evident in the European Exchange Rate Mechanism (ERM) and even before it, with the “snake” (the previous currency regimes). Without exaggeration, the split between creditor and debtor nations characterize modern Europe, and few issues can ignore it. |

Economic Events: Eurozone, Week October 21 |

As the monetary union grew, a rotating voting system was introduced. Yet, our understanding is that decisions have not required a vote. By that, it is meant that the majority was sufficiently large that the formal procedure was not necessary. The controversial decision to resume asset purchases plan was true to form, Draghi indicated last time. The dissenters were in a clear minority and have been vocal in defeat, but the point is they were a minority and have taken their case public.

Of course, this is the situation as Largarde takes the reins, but is not impossible, and contrary to the hyperbole, the institution is not at risk. It has not lost credibility. Dissents are not uncommon other major central banks like the Federal Reserve, the Bank of Japan, and the Bank of England, especially around turning points in the cycle. The danger is not dissent but groupthink. Still, those that dissents need a platform, and among the first things Lagarde ought to do is change the record (not minutes) of the ECB meetings, allowing members to dissent on the record and provide some rationale. At the same time, the seeming habit of German members of the ECB’s Executive Board to resign when they lose a vote is neither helpful nor effective.

II

On October 21, Canada holds its national election. The polls show a neck-to-neck race between the two largest parties, the Liberals, led by Trudeau and the Conservatives, led by Scheer. However, the main takeaway is neither seems to be drawing the support of more than a third of the voters. That means that a coalition will likely be necessary, and that would seem to give the edge to the Liberals who would have a potential ally in the New Democrats that is polling almost 20%. Pulling the Greens in too, who has about 9% support, would arguably make for a stronger government. Bloc Quebecois, which says it is not looking to join a government, is drawing about 6%.

The Canadian dollar is the strongest major currency this year, rising about 3.9% against the greenback. The central bank has resisted international pressures and hoed a steady and neutral path. Canada has become the highest yielder. The US 2-year premium over Canada reached a 12-year high of 85 bp this past March. It steadily fell and has completely vanished. Last week, the US was at a seven basis point discount, the biggest in two years.

Reports indicate that China has yet to formally invite the US to Beijing to resume negotiations to finalize an agreement that can be signed on the sidelines of the APEC meeting next month (November 16-17). It may be related to the bill that the House approved, and the Senate will take up shortly that requires Hong Kong’s autonomy to be reaffirmed annually to maintain its special trade status with the US. Beijing continues that it is an internal affair, but granting part of China access to US markets on different terms may have been the original sin.

The US is not letting the handshake deal deter it from challenging China on other fronts. To anticipate what China will do, one needs to consider how it can resist US tactics. One clear way to do this is to do the opposite. Link progress in one area to behavior in another. It could lead to the end of the third tariff truce.

We have long been mistrustful of what the conventional wisdom thought was the internationalization of the yuan was mostly the Sino-ification of Hong Kong. It seemed that it was more foreign observers than Chinese officials who talked about the yuan replacing the dollar. Its role in the world economy, even after joining the SDR is minor at best. The monthly SWIFT market share numbers will be reported next week. It stood at 2.22% in August, which was the highest since January 2016.

China will announce the setting of its new loan prime rate facility. A small rate cut is anticipated from 4.20% to 4.15%. The demand curve may not be that sensitive, so the main transmission channel maybe through expectations.

US data for September has generally disappointed, and some banks have cut their Q3 GDP forecasts (October 30). The median forecast in the Bloomberg survey is for 1.5% growth. The Atlanta Fed and the NY Fed’s GDP trackers are estimating growth at 1.8% and 1.9%, respectively, in the July-September period. However, the risk is that the weak momentum carries into Q4, which is what the early Fed manufacturing surveys have suggested. Next week, the flash PMI for October will be reported. The University of Michigan’s preliminary report showed 5-10 year inflation fell to a record low of 2.2%. It releases the final estimate at the end of next week.

Full story here Are you the author? Previous post See more for Next post

Tags: Canada,China,ECB,EMU,newsletter,US