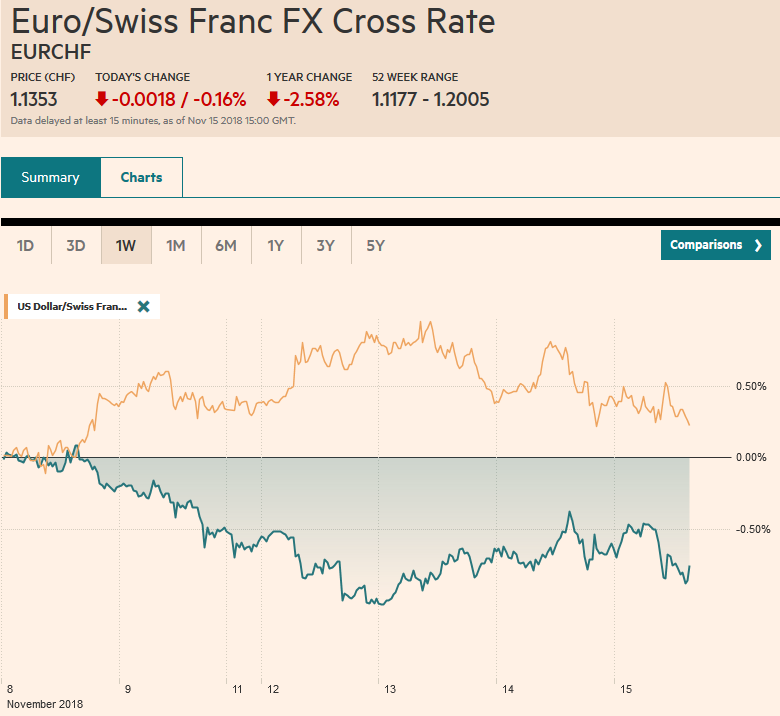

Swiss FrancThe Euro has fallen by 0.16% at 1.1353 |

EUR/CHF and USD/CHF, November 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The resignation of the UK’s Brexit negotiator after Prime Minister May had secured support from a majority of the cabinet sent sterling sharply lower. Raab’s resignation underscores the difficulty the Brexit agreement faces in the UK Parliament. Sterling was hammered nearly 2.5 cents on the news and trade below $1.28. British rates fell on the prospects of a separation without a divorce agreement. If the market hopes were dashed in the UK, there still is a “hope” trade around China. China’s formal response to the US trade demands spurred optimism that an escalation of trade tensions can be avoided. This still does not seem the most likely scenario and Chinese officials do not appear to have put anything new on the table. Asian equities were lifted by the optimism and the yuan gained on the dollar for the third consecutive session, the longest streak in three months. The US dollar is mixed. Sterling’s drop has dragged the European currencies lower. Strong Australian jobs data and the trade optimism puts the Aussie on the top of the boards, though holding just below last week’s high (~$0.7305). European equities are mostly lower, with the Dow Jones Stoxx 600 off 0.4%, with consumer discretionary, materials, and energy resisting the pressure. Core benchmark 10-year yields are off three-five basis points, with 10-year Gilt yields off 12 bp. Peripheral European yields are three-five basis points higher, with Italy not leading the move today. Rate hikes in the Philippines (mostly expected) and Indonesia (surprise) have sent their respective currencies higher, though the volatile and accessible EM currencies, like the South African rand and Turkish lira, are also higher. |

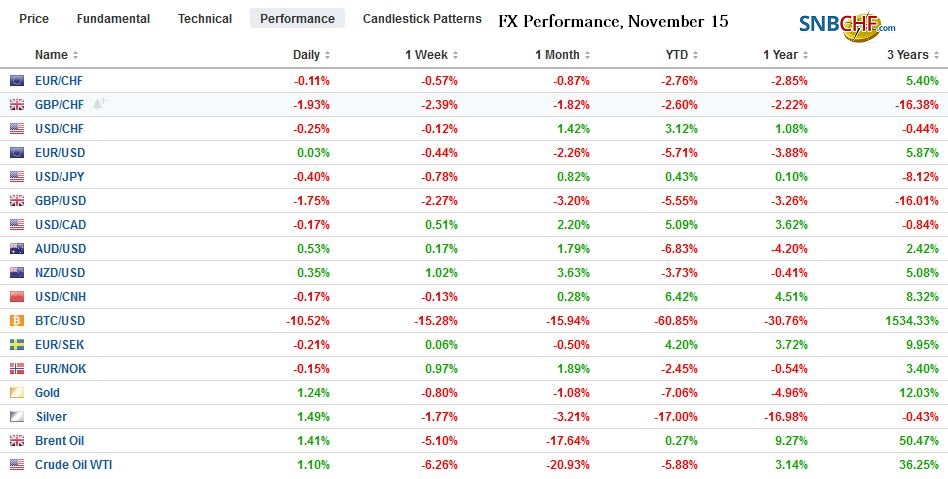

FX Performance, November 15 |

Europe

Brexit is the main story today. There was a three-stage process and progress had seemed apparent. First, the UK and EC negotiators worked out the wording of an agreement. Second, Prime Minister May pushed it through the cabinet after a grueling five-hour meeting and following several resignations of her original cabinet including both wings of the party. The third is key: Parliament’s approval. The resignation of the Raab, the UK’s negotiator, is seen a clear indication that it will not pass Parliament. The Conservative Party is split and cannot count on Labour and other opposition parties to come to its aid. It is not clear the next step. There has not yet been a formal leadership challenge. The Tories ostensibly could topple the government in a confidence vote, but new elections would only add to the chaos. There is a push for a second referendum, but both the Tories and Labour party officials are opposed.

After reaching a high near $1.3070 yesterday, sterling has traded below $1.2800 in the European morning. At the end of October, sterling found support near $1.27. The year’s low was set near $1.2660 in mid-August. If investors were to conclude that the UK was going to crash out of the EU with no agreement, sterling could retest the flash-crash low from October 2016, which Bloomberg puts near $1.1840. It is not as if such disorder is good for the euro. The single currency is under pressure too. It had traded around $1.1350 yesterday and early today before returning toward yesterday’s lows (~$1.1260). A no-deal Brexit, the drop in oil prices, the loss of economic momentum in the region complicates the ECB’s task. While it is committed to ending the asset purchase program next month, the new staff forecasts may shave inflation and growth projections, making for a dovish end to its QE. There are almost 1.6 bln euros in options in the $1.1250-60 area that expire today and another 2.65 bln euros in options struck between $1.1200 and $1.1225 that will but cut today.

Asia Pacific

Australia released solid jobs data, and while it lifted the Australian dollar, a rate hike still seems some time away. Australia created 32.8k jobs in October and the September series was revised higher. The jobs were all full-time (42.3k), while part-time positions were pared. The unemployment rate was steady at 5.0% even though the participation rate ticked up (65.6%). The news comes on the heels of yesterday’s news that wages rose 2.3% in Q3, the fastest in three years, though probably boosted by the minimum wage increase. Inflation is near the lower end of the central bank’s 2-3% target. The Aussie rallied on the news but stalled in front of $0.7300 and last week’s highs. It slipped back toward $0.7260, where an A$675 mln option expires today. A move below the $0.7230 area would help confirm a top may indeed be in place.

The Australian dollar may have been aided by the other big story and that apparently belated Chinese response to US trade demands. Many observers and investors continue to expect that despite the bravado and bellicose rhetoric, an agreement will be forged. We are less sanguine. China’s formal response may be sufficient to keep the Trump-Xi meeting on track on the sidelines of the G20 meeting at the end of the month. However, the talks that began last Friday were the first in months and it is still not obvious that in Trump Administration that the Treasury Department truly leads trade negotiations. This still seems more like political theater than substantive progress. In fact, the US decision not to proceed yet with the threatened 25% auto tariffs was reportedly based on the fear that it would prevent a united front against China. Rather than moving toward a compromise, we see both sides digging in and preparing for a protracted confrontation.

The US dollar is trading in the lower half of yesterday’s range against the yen. It is the first day in six that it may not trade above JPY114.00. Lower yields and equities sap the upside momentum. Initial support near JPY113.30 has held. There are options for $890 mln expiring today and struck in the JPY113.35-50 area. There is another batch of expiring options (~$1.37 bln) in the JPY112.80-JPY113.00 range.

North America

The US reports October retail sales and November Empire State and Philadelphia Fed surveys. These reports overshadow import/export prices, weekly initial jobless claims, and September inventory data. Headline retail sales are expected to have bounced back after a 0.1% rise in September. An expected 0.5% gain would be the best since July. We seem some downside risks here, but the components used for GDP calculations (excluding items like autos, gasoline, and building materials) are expected to be firm. US consumption is being fueled by more people working, getting paid slightly more, disinflation in goods (though not services), and credit. The Fed surveys should show continued above-trend growth.

Fed Chief Powell gave no reason for investors not to expect a hike next month. He offered a balanced view of the economy and identified three general risks: slowing growth from abroad, fading fiscal stimulus, the lagged effect of the past rate hikes on the economy (eight since late 2015). We think the Fed will likely deliver 2-3 more rate hikes before pausing.

API estimated that US oil inventories rose nearly 8.8 mln barrels last week. If confirmed by the EIA today, it would be the largest build in more than a year and a half. The 12-day slide in prices was snapped yesterday, but there has been little recovery.

Mexico is expected to hike rates 25 bp today (we mistakenly indicated it was going to happen yesterday). The US dollar has pushed above MXN20.50 in the last two sessions but has not closed above it Initial support is seen near MXN20.25 and then MXN20.00. Meanwhile, in the US, the Democrats, which will have a majority in the new House, have indicated they will demand changes in the new trade agreement struck by the Trump Administration. The heads of the three countries are expected to sign off on the draft at the G20 summit (Nov 30-Dec 1 and before AMLO is sworn in as the next Mexican President. The US dollar is trading in a CAD1.3200-65 range. While the upside does not appear exhausted, the $866 mln CAD1.33 option that expires today may help cap it.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$CAD,$CNY,$EUR,Brexit,EUR/CHF,MXN,newsletter,OIL,USD/CHF