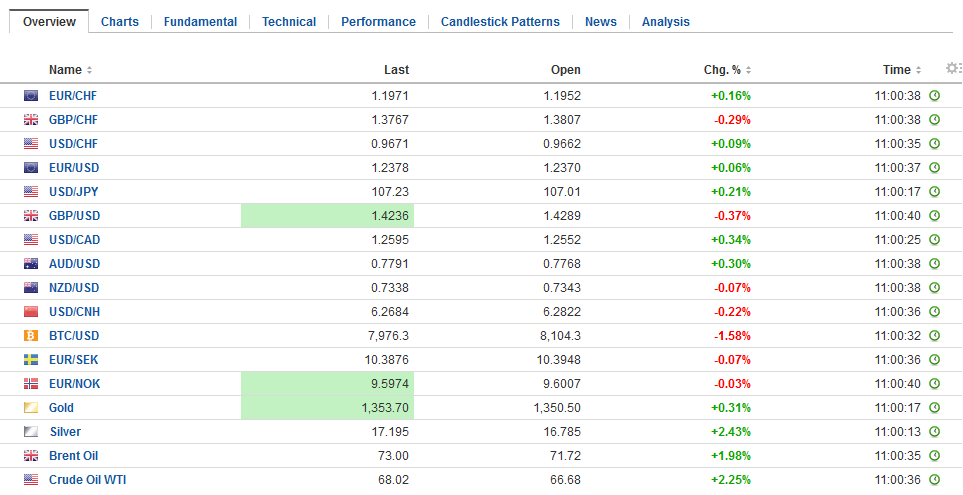

Swiss FrancThe Euro has risen by 0.11% to 1.1962 CHF. |

EUR/CHF and USD/CHF, April 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

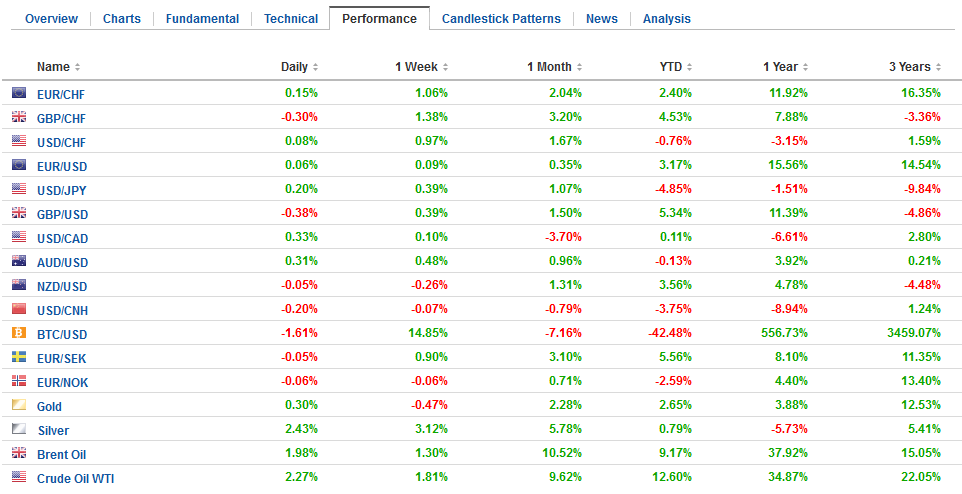

FX RatesThe US dollar is enjoying a firmer tone against major and most emerging market currencies. Sterling, which has become a market darling, hit an air pocket after softer than expected CPI. Sterling had reached its highest level since the 2016 referendum yesterday as it approached $1.44. It had traded $1.50 on the day of the referendum. On the back of today’s news, sterling, which had already been trading off in the face of the broadly firmer US dollar, traded to $1.4175, where bids were found. These losses brought sterling to near the 50% retracement (~$1.4170) of the last leg up, which began after sterling dipped below $1.40 on April 5. The 20-day moving average is found near $1.4140, and the 61.8% retracement is just below $1.4125. |

FX Daily Rates, April 18 |

| The euro was trading near GBP0.7800 before the referendum. The recent slide in the cross saw the euro trade near one-year lows against sterling (~GBP0.8620) yesterday before recovering smartly today through GBP0.8700. The euro had put in a bullish hammer candlestick at the end of last week, suggesting that a bottom was at hand, but it took today’s CPI report to solidify it. It tested the 20-day moving average (~GBP0.8720) and has not closed above it in a month.

Sterling’s advance against the dollar is largely, but not solely a function of the dollar’s pullback since the start of last year. The weaker dollar environment is probably also playing a role in the Swiss franc’s depreciation against the euro Recall in January 2015, the Swiss National Bank removed the cap it had on the franc. The floor for the euro was CHF1.20. Today the euro reached CHF1.1980. The euro is a more significant alternative to the dollar than the franc, and Swiss officials have clearly signaled their intention to lag behind other central banks in normalizing monetary policy. |

FX Performance, April 18 |

United KingdomUK headline CPI rose 0.1% in March, while the market expected a 0.3% increase. The recently introduced preferred measure, CPIH slipped to 2.3% from 2.5%, the weakest in a year. |

U.K. Consumer Price Index (CPI) YoY, May 2013 - Apr 2018(see more posts on U.K. Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| The core rate unexpectedly eased to 2.3% from 2.4%, while the market anticipated a 2.5% increase. Input and output prices for producers were softer. With earnings growth above the inflation, a BOE rate hike next month is still the most likely scenario. That said the high earnings and lower inflation are not expected to boost March retail sales, which will be reported tomorrow. The median forecast calls for a decline in retail sales, according to the Bloomberg survey. |

U.K. Core Consumer Price Index (CPI) YoY, May 2013 - Apr 2018 Source: Investing.com - Click to enlarge |

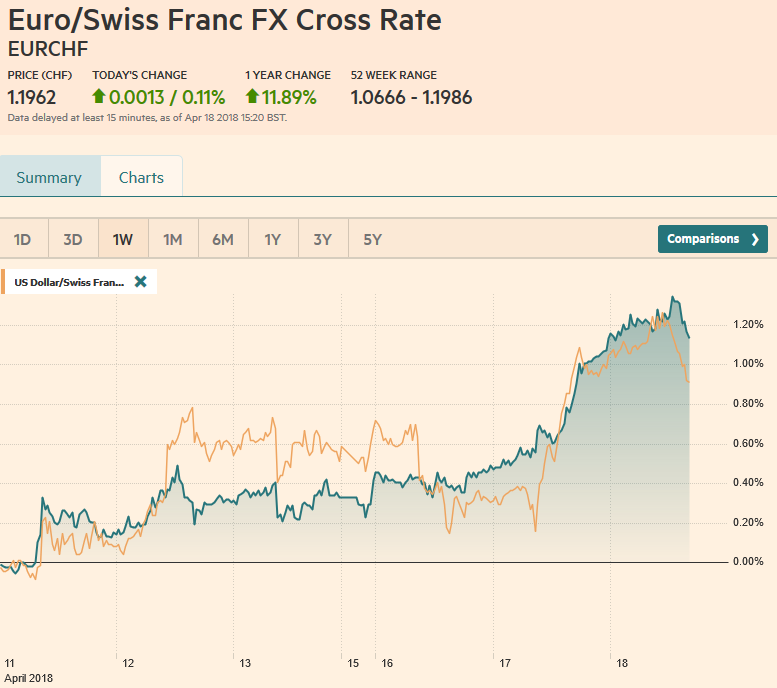

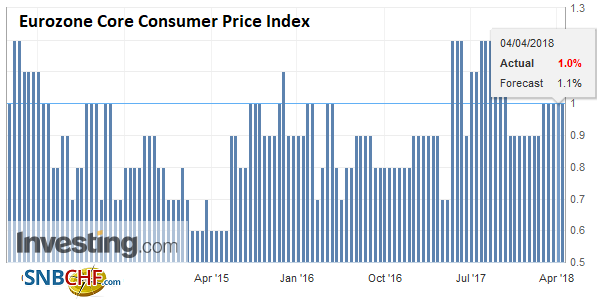

EurozoneThe ECB meets next week, and today’s downward revision to March CPI can only complicate its communication strategy. Headline inflation stood at 1.3% in the final reading, down from 1.4% in the preliminary report, but up from 1.1% in February. |

Eurozone Consumer Price Index (CPI) YoY, Apr 2013 - 2018(see more posts on Eurozone Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| The core rate was flat at 1.0%, where it was throughout Q1 after being steady at 0.9% in Q4 17. |

Eurozone Core Consumer Price Index (CPI) YoY, May 2013 - Apr 2018(see more posts on Eurozone Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

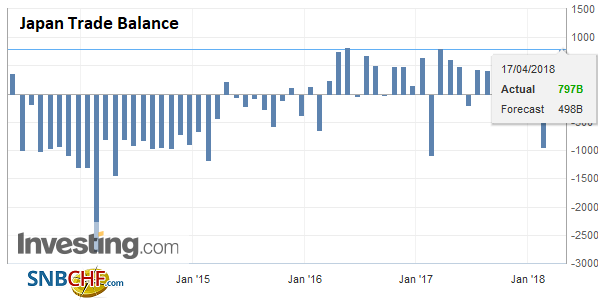

JapanJapanese trade figures (larger than expected surplus on the back of firm exports and soft imports) were not much of a factor, and news from the Trump-Abe meeting was sparse. There had been some thoughts that Abe would try to convince Trump to rejoin TPP, which there had seemed to be an opening last week. However, Trump’s new economic adviser (Kudlow) and the president himself seemed to play down this possibility. With little tangible from the meeting, it is not clear whether Abe’s standing in public opinion will get a boost from the lowest levels since taking office in 2012 that are the result of several scandals. |

Japan Trade Balance, May 2013 - Apr 2018(see more posts on Japan Trade Balance, ) Source: Investing.com - Click to enlarge |

Meanwhile, the UK faces another challenge. The House of Lords will take up the “Withdrawal Bill” today. There is a risk that it insists on staying the customs union. The bill was delayed in the House of Commons when it appeared that the government’s intention to withdraw from the customs union faced a likely defeat.

The Bank of Canada is the only major central bank meeting this week and today is the day. Bloomberg calculates about a 20% chance of a hike today is implied by the OIS. We suspect this exaggerates the risks of a hike, and if a hike were delivered, the Canadian dollar would rally.

The uncertainty emanating from the US remains palpable, and the recent string of Canadian economic data was mostly disappointing. Still, capacity constraints are evident and in the latest Business Outlook Survey found over half the companies expect inflation above 2% compared with about a third in the previous survey. With a rate hike still expected for Q3, we suspect a US dollar bounce toward CAD1.2640 may be sold in anticipation of the completion of the technical topping pattern that projects toward CAD1.2475.

The euro briefly poked above $1.24 yesterday to record the high for April, but the gains were not sustained, and the euro returned to $1.2340 today. The 20-day moving average is seen near $1.2330. There are several large option expires today that may also serve to keep the euro range-bound. Consider that there a roughly 525 mln euro strike at $1.23 that may protect the lower end of the range, while a 504 mln euro strike at $1.24 may cap the upside. Note that there is almost 560 mln euros struck at $1.2340 that also will be cut today.

The dollar remains in a narrow range against the yen. A shelf has been built near JPY106.65, and a cap is evident around JPY107.65-JPY107.75, in front of the JPY108 area thought to be more formidable resistance. Option expires today (~$523 mln at JPY107 and ~$420 mln at JPY107.40) is marking today’s range in Asia and Europe.

The PBOC unexpectedly cut required reserves by one percentage point yesterday, freeing up about CNY1.3 trillion. The effect of this was to boost stocks and bond prices. China’s 10-year yield fell 16 bp to 3.47%. The performance of Chinese bonds will increasingly matter as the government bonds are included in global benchmarks. About three-quarters of the funds freed up by the cut in reserves are expected to be used to repay government loans, while the remainder will be used to help small and medium business (extend loans, reduce rates). The yuan was little changed.

With China’s help, the MSCI Asia Pacific Index snapped a two-day fall and rose 0.75%,, which puts it up for the week. European shares are struggling to match suit, and the Dow Jones Stoxx 600 is nursing a small loss in later morning turnover in Europe. US shares are trading with a modestly firmer bias after yesterday’s earnings-driven gains.

Core bonds are little changed. UK Gilts are a notable exception, as soft inflation figures spur a rally that lowered 10-year yields by four basis points. Today is the eighth consecutive session that the US two-year premium over Germany is widening. It is approaching 300 bp, which is about 50 bp more than at the end of last year.

The Fed’s Beige Book is the main US economic event, outside of the continued stream of corporate earnings. After a softish start to the year, we expect a fairly upbeat anecdotal report. Bloomberg’s calculation still shows a li.ttle more than a 25% chance of a hike at next month’s meeting. This still strikes as far too high. Whatever gradual means for the Federal Reserve is does not mean back-to-back hikes yet, and in this cycle beginning at the end of 2015, the Fed has only hiked rates at meetings with pre-scheduled press conferences. While Powell may change this at some point, that point is not his second meeting.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$CAD,$CHF,$CNY,$EUR,$JPY,EUR/CHF,Eurozone Consumer Price Index,Eurozone Core Consumer Price Index,Japan Trade Balance,newslettersent,SPY,U.K. Consumer Price Index,U.K. Core Consumer Price Index,USD/CHF