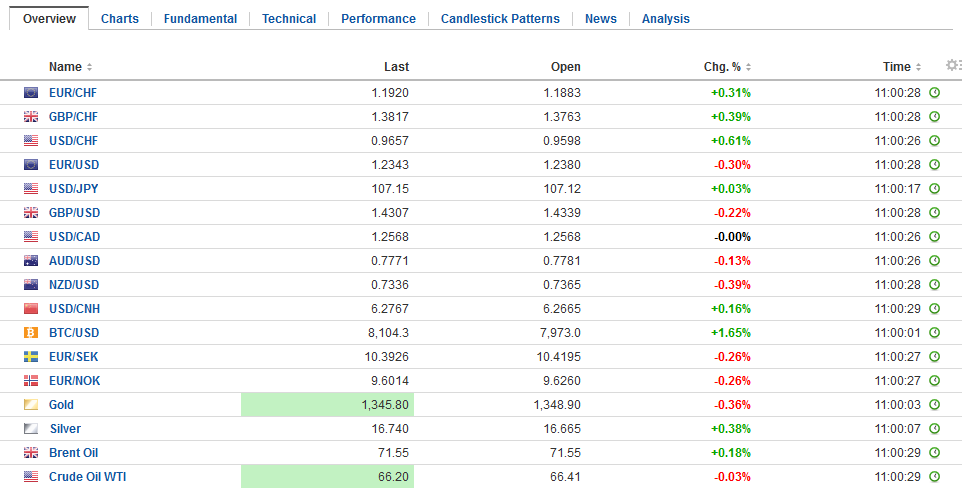

Swiss FrancThe Euro has risen by 0.29% to 1.1914 CHF. |

EUR/CHF and USD/CHF, April 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

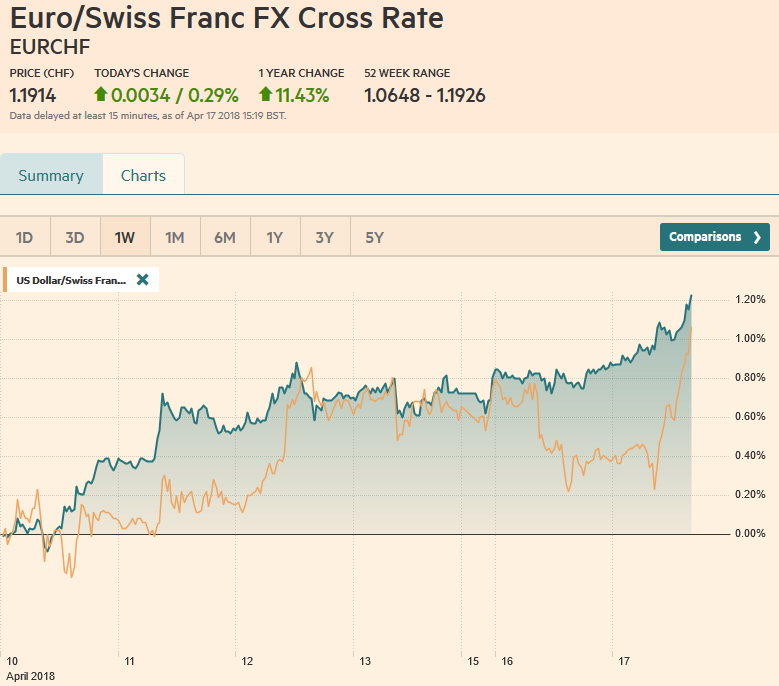

FX RatesAfter the retreating in the North American session yesterday, despite a rebound in retail sales after three-months of declines, the greenback has been sold further in Europe and Asia. The euro edged through last week’s high near $1.24, and sterling rose through the January high to reach its best level since the mid-2016 referendum. Sterling rose through $1.4375 before the easing after the employment report. Initial support is seen in the $1.4300-$1.4320 area. The claimant count rose 11.6k in March, and the February series was revised to 15.1k from 9.2k. The claimant count is rising. It averaged a little less than 3k in 2017 and less than 1k a month in 2016. The average in Q1 is 7.6k and minus 5k in Q1 17. |

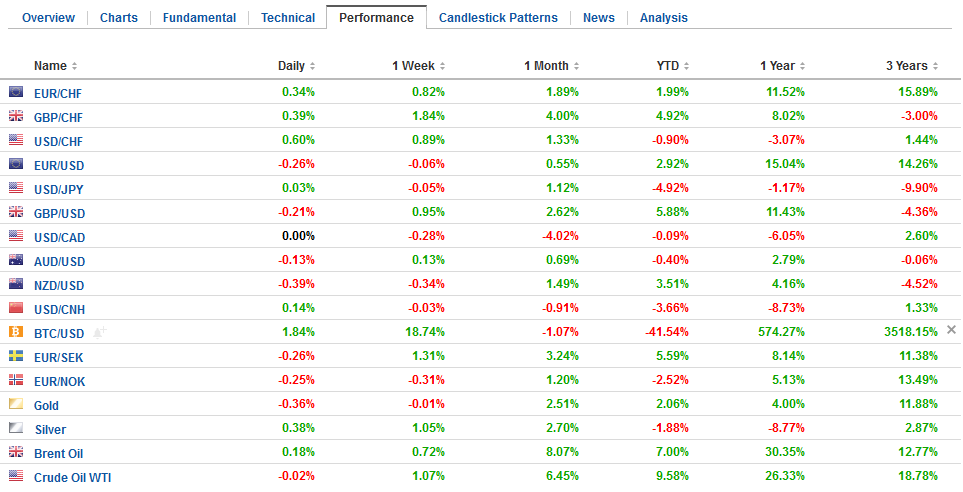

FX Daily Rates, April 17 |

| The euro was already encountering offers in the European morning before the survey. The euro eased further after the report. Support is seen in the $1.2340-$1.2360 area.

The dollar rose to nearly JPY107.80 before the weekend but has been unable to build on the momentum this week. It fell to JPY107 yesterday and a little further today. Bids were seen repeatedly near JPY106.65 last week. There is a large option expiry today ($1.2 bln) at JPY107.20, and that may cap the upside. |

FX Performance, April 17 |

United KingdomAverage weekly earnings growth rose to a 2.8% pace (three-months through February year-over-year) up from 2.6%. A worrisome sign is that fixed asset investment is still rising faster than GDP (7.5%) suggesting that the shift from investment-led (which to a large extent is debt-financed) to consumer-driven still has a ways to go. The yuan, both onshore and offshore is slightly weaker today. |

U.K. Unemployment Rate, May 2013 - Apr 2018(see more posts on U.K. Unemployment Rate, ) Source: Investing.com - Click to enlarge |

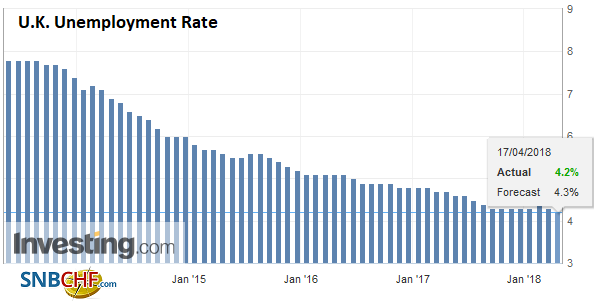

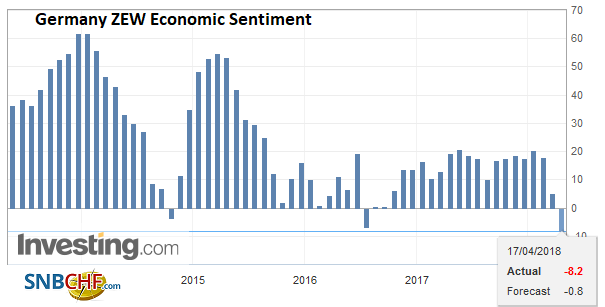

GermanyGerman economic data continues to surprise on the downside as economists have not yet caught up to the slowing that has occurred here in Q1. Today’s disappointment was the ZEW survey. Both the current assessments and expectations components fell more than expected. Of note, the latter fell into negative territory for the first time since July 2016 and is the lowest since late 2012. |

Germany ZEW Economic Sentiment, May 2013 - Apr 2018(see more posts on Germany ZEW Economic Sentiment, ) Source: Investing.com - Click to enlarge |

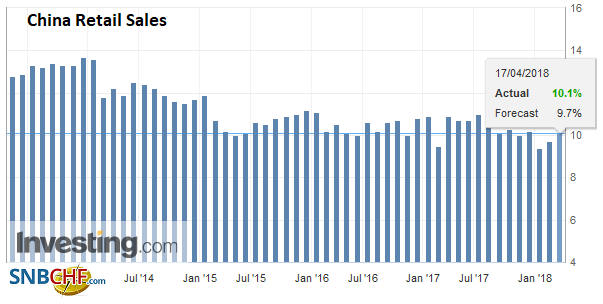

ChinaChina reported a series of data. The takeaway is that official figures show amazingly steady growth (6.8%) for a large economy and one ostensibly going through a transition. Retail sales rose more than expected (10.1%). |

China Retail Sales YoY, May 2013 - Apr 2018(see more posts on China Retail Sales, ) Source: Investing.com - Click to enlarge |

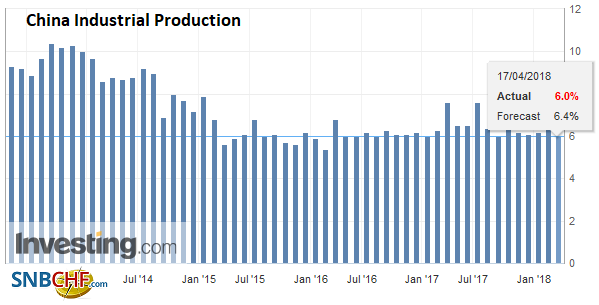

| While industrial output rose a little slower than expected (6.0%). |

China Industrial Production YoY, May 2013 - Apr 2018(see more posts on China Industrial Production, ) Source: Investing.com - Click to enlarge |

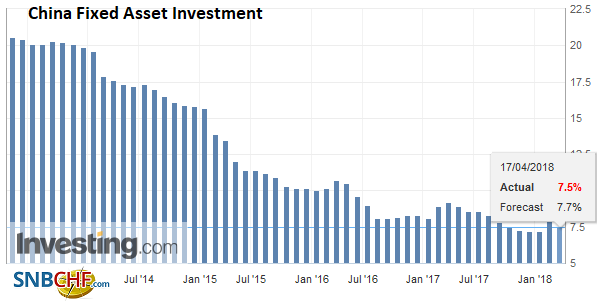

| A worrisome sign is that fixed asset investment is still rising faster than GDP (7.5%) suggesting that the shift from investment-led (which to a large extent is debt-financed) to consumer-driven still has a ways to go. The yuan, both onshore and offshore is slightly weaker today. |

China Fixed Asset Investment YoY, May 2013 - Apr 2018(see more posts on China Fixed Asset Investment, ) Source: Investing.com - Click to enlarge |

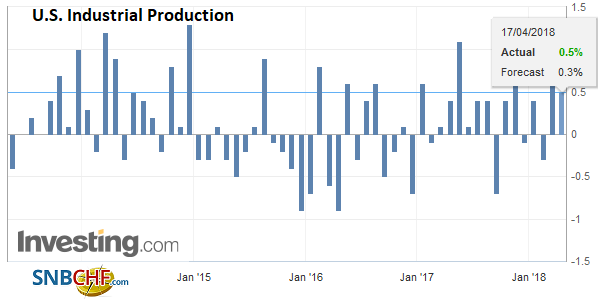

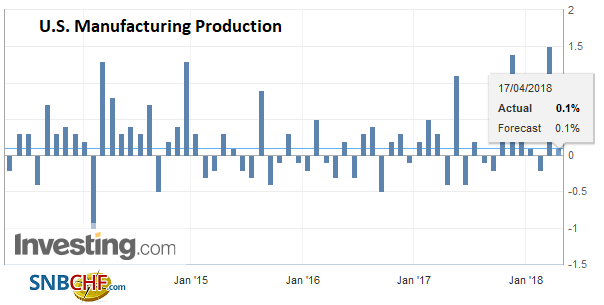

United StatesThe US reports industrial production and manufacturing output for March today. February’s strong gains (1.1% and 1.2% respectively) are unlikely to be duplicated. The risk is on the downside of the median forecasts for 0.3% and 0.1% respectively. Housing starts should bounce back from the 7.0% decline in February. Permits may stabilize after falling 5.7%. At least five Fed officials speak today. Most have spoken recently, and only one governor (Quarles) speaks today. Consequently, the market impact may be minor. |

U.S. Industrial Production, May 2013 - Apr 2018(see more posts on U.S. Industrial Production, ) Source: Investing.com - Click to enlarge |

U.S. Manufacturing Production, May 2013 - Apr 2018 Source: Investing.com - Click to enlarge |

Japan’s Abe visits Trump today. Abe is under pressure from allegations over several favoritism/cronyism allegations and has seen his support in recent polls fall below Trump’s. Abe’s trip to the US may not help very much. The issues on the agenda, trade and North Korea, are unlikely to produce tangible results. We have suggested that although Japan may not get a country exemption from the steel tariffs, about a third or so of its roughly two million steel tons of exports to the US could get product exemption, which may be determined later.

Meanwhile, the Hong Kong Monetary Authority continued to intervene to support the Hong Kong dollar. The intervention reached a cumulative $2.4 bln and does not appear over as HKD sits on the lower band. Although HIBOR is rising gradually, officials are reluctant to raise rates quicker for fear of drawing in speculative funds. However, former Chief Executive Yam suggested scope to issue Exchange Bills to absorb the excess liquidity.

Minutes from the recent meeting of the Reserve Bank of Australia reinforced expectations that policy is on hold for some time. The gradual pace of growth gives officials time, but the appreciation of the Australian dollar keeps price pressures in check. The Aussie remains mostly confined to the pre-weekend trading range of roughly $0.7750-$0.7810. The Aussie has edged higher against the New Zealand dollar after the NZD$1.05 support area (and three-year trendline) held last week. New Zealand reports Q1 CPI tomorrow, and expectations for a soft report is keeping the Kiwi on the defensive.

There are three US developments to note. First, yesterday the US announced sanctions on ZTE Corp for violating the terms of its sanctions settlement (selling shipments of telecom to Iran and North Korea and lying and deceiving the US government) and imposed a seven-year prohibition against it buying US equipment. This weighed on its shares and its suppliers, which weighed on the tech sector in Asia.

Second, Trump has made two Fed nominations. As rumored, Clarida, most recently from PIMCO, and formerly in Bush’s Treasury Dept, was nominated for the vice-chair. Clarida is regarded as a centrist and pragmatist. The “new neutral” slogan at PIMCO and some of his writing suggest Clarida recognizes that the equilibrium rate for Fed funds is lower than it has been in the past. Michelle Bowman, a Kansas banking commissioner, has been nominated to the Board of Governors, specifically to help represent the community banks mandated by Congress. The Goodfriend nomination has passed committee and is being stalled on the Senate floor.

Third, the US reported the Treasury’s International Capital report after the markets closed yesterday. The takeaway is that foreign demand for long-term US securities remained robust in February at $57.9 bln after $62.5 bln in January. It averaged $34.15 a month in 2017 and $4.8 bln in 2016. The $120.4 bln of long-term portfolio flows into the US likely financed the bulk of the Q1 current account deficit. We note that foreign investors were net buyers of Treasury bonds and notes for the first time in four months, though they have been consistent but small buyers of Agency bonds.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$CAD,$CNY,$EUR,China Fixed Asset Investment,China Industrial Production,China Retail Sales,EUR/CHF,Germany ZEW Economic Sentiment,newslettersent,NZD,U.K. Unemployment Rate,U.S. Industrial Production,USD/CHF