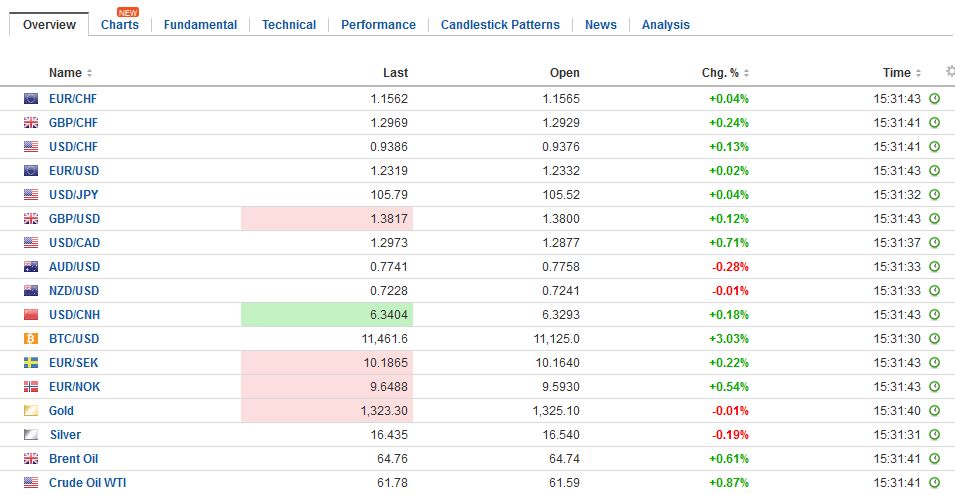

Swiss FrancThe Euro has fallen by 0.08% to 1.1549 CHF. |

EUR/CHF and USD/CHF, March 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

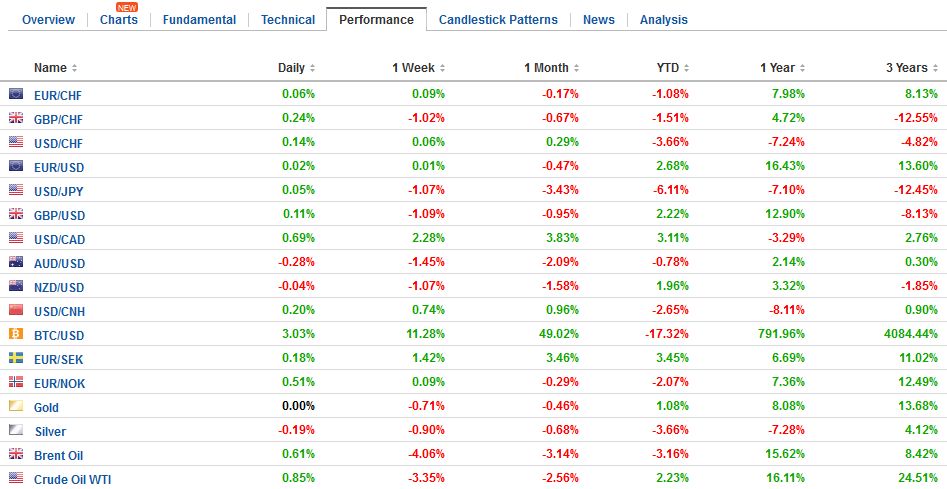

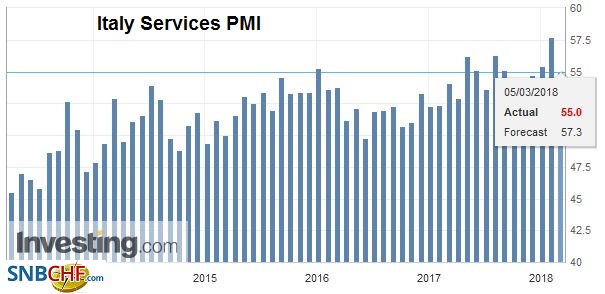

FX RatesThe US dollar is narrowly mixed. The Japanese yen remains firm. The dollar appears stuck in a narrow range. Near JPY105.20 the seems to be some short-covering pressure in front of JPY105. On the top side, the greenback is encountering offers in front of JPY105.80. Sterling is firm against the dollar as it recovers against the euro. Before the weekend, the euro reached GBP0.8950, its best levels since last November. The euro is testing GBP0.8900 that was previously resistance. The dollar-bloc currencies continue to trade heavily. Australia reported a dramatic jump in apartment building approvals (42%+) that sparked a 17.1% jump in overall approvals. While the Canadian dollar is inside last Friday’s range, the Aussie has traded on both sides of its pre-weekend range. A close above $0.7775 or below $0.7740 could potentially be important. The Italian election results look a bit more euro-skeptic, but the not far from what the polls showed. Coalitions matter under the new electoral rules, and the center-right coalition appears to have the most votes, followed by the 5-Star Movement, and then the center-left in third. There were two surprises. First, the center-left did poorer, with the PD receiving only about half as many votes as they did in the last European Parliament election. Second, Berlusconi’s political party also did worse than expected. It trailed the Northern League. |

FX Daily Rates, March 05 |

| After the final count, the next step is for Italy’s President Mattarella to let one group try to put together a government. The issue here appears to be whether it should go to the party with the most votes, or the coalition with the most votes. The former would imply the 5-Star Movement, though it has eschewed coalitions and other party leaders has indicated the sentiment was reciprocal. The latter would imply the center-right.

It is not clear the strength of the center-right coalition. Operas often have double-dealing and back-stabbing (defections in game theory), and the drama of Italian politics often seem have an operatic quality. It will take some time to sort this out, but Italy is in fine company. It took Belgium over a year to get a government after the last election. It took Germany four-months. Is it unreasonable to suspect that Italy will come in between those two markers? |

FX Performance, March 05 |

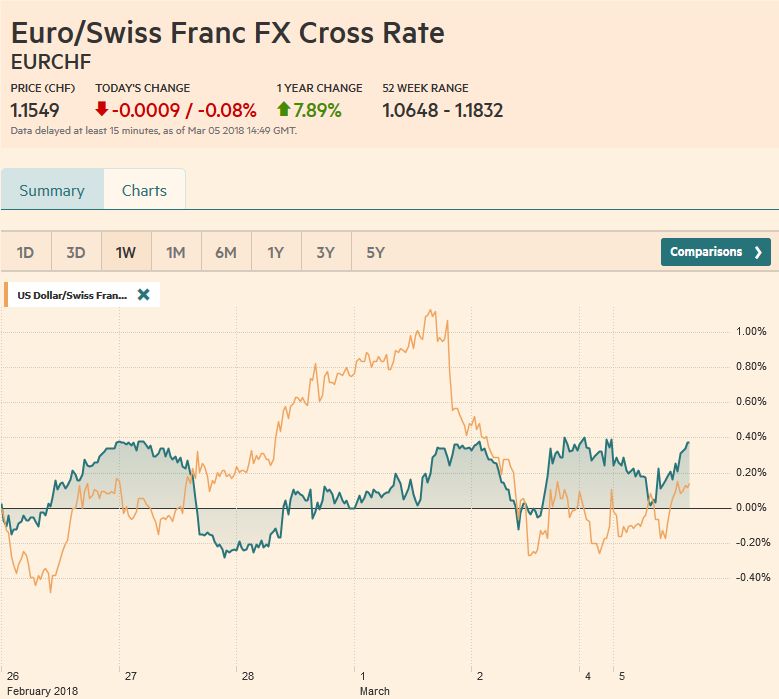

ItalySeparately, and only underscoring the challenges that lie ahead, Italy’s economy did not seem to have the same momentum as other large economies in the euro area, but its loss is even greater. The February service PMI fell to 55.0 from 57.7, and coupled with the disappointing manufacturing survey, the composite fell to 56.0 from 59.0. The pullback brings the composite back to levels seen in November, and it is still above last year’s average. Italian assets have been sold, after holding their own or outperforming in the run-up. The stock market is off 1.1%. Today’s loss puts the FTSE Milan Index lower on the year (-0.8%), but it is the best performing of the major European markets this year. Within the G7, only the S&P 500 is up on the year (~0.65%). Italy’s benchmark 10-year yield is up four basis points to 2.0%. It is virtually flat on the year. The two-year yield is up two basis point to minus 19, which is an increase of about nine basis points this year. It compares to the eight basis point increase in Germany and 19 in Spain for a comparable tenor. The 10-year Gilt and 10-year Bund yield are near five-week lows of 1.45% and 62 bp respectively. |

Italy Services Purchasing Managers Index (PMI), Apr 2013 - Mar 2018(see more posts on Italy Services PMI, ) Source: investing.com - Click to enlarge |

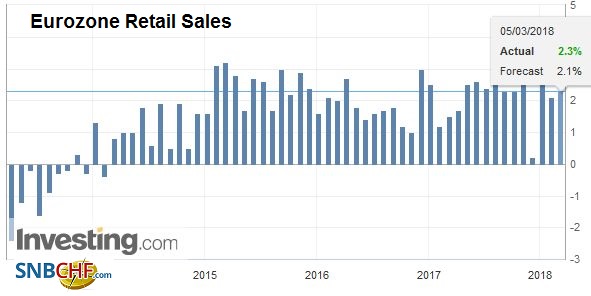

EurozoneOther European equities are higher today, with the Dow Jones Stoxx 600 up 0.6%, snapping the four-day decline. All the major sectors are higher except financials with are slipping into negative territory in late European morning turnover. European 10-year yields are mostly lower. The euro has been in a cent range between $1.2270 and $1.2370. In European activity, the single currency has enjoyed straddled the pre-weekend close that was a little below $1.2320. There is a 519 mln euro option struck at $1.23 that expire today. |

Eurozone Retail Sales YoY, Apr 2013 - Mar 2018(see more posts on Eurozone Retail Sales, ) Source: investing.com - Click to enlarge |

| The eurozone service and composite PMI readings were a bit softer than the flash readings. The service survey slipped to 56.2 from a flash reading of 56.7 and 58 in January. |

Eurozone Services Purchasing Managers Index (PMI), Mar 2013 - Mar 2018(see more posts on Eurozone Services PMI, ) Source: investing.com - Click to enlarge |

| The composite reading eased to 57.1 from the 57.5 flash. It stood at 58.8 in January and averaged 57.2 in Q4. |

Eurozone Markit Composite Purchasing Managers Index (PMI), Mar 2013 - Mar 2018(see more posts on Eurozone Markit Composite PMI, ) Source: investing.com - Click to enlarge |

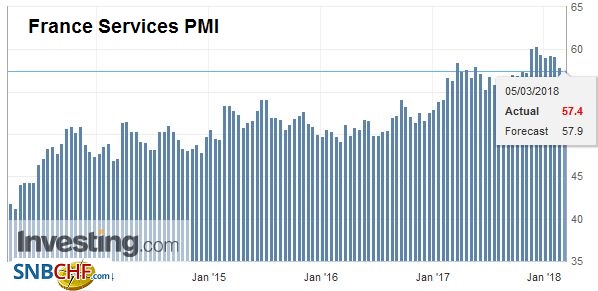

| The revisions seem to reflect the soft Italian reading and disappointing final readings in France. The flash readings in France also told of some loss of momentum and the final report showed even more. |

France Services Purchasing Managers Index (PMI), Mar 2013 - Mar 2018(see more posts on France Services PMI, ) Source: investing.com - Click to enlarge |

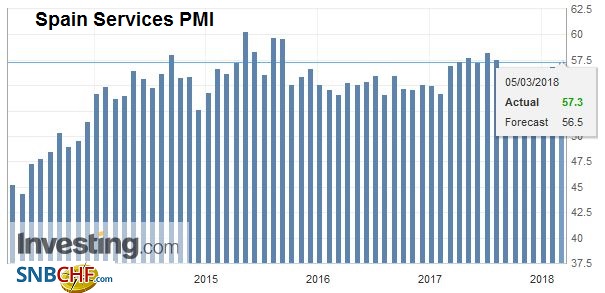

GermanyIn contrast, Germany’s services PMI was in line with expectations while the composite was revised higher (57.6 vs. 57.4 flash). To round out the large EMU members, note that Spain bucked the regional loss of momentum and both the service and composite extended January’s gains. |

Germany Services Purchasing Managers Index (PMI), Mar 2013 - Mar 2018(see more posts on Germany Services PMI, ) Source: investing.com - Click to enlarge |

Spain |

Spain Services Purchasing Managers Index (PMI), Apr 2013 - Mar 2018(see more posts on Spain Services PMI, ) Source: investing.com - Click to enlarge |

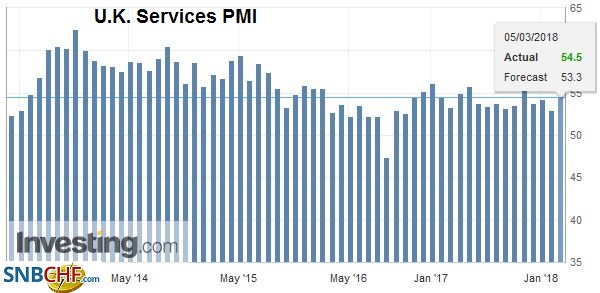

United Kingdom |

U.K. Services Purchasing Managers Index (PMI), Apr 2013 - Mar 2018(see more posts on U.K. Services PMI, ) Source: investing.com - Click to enlarge |

ChinaAsian shares fell, with the MSCI Asia Pacific Index off 1% for the fifth consecutive loss. China’s markets resisted the regional pull and managed to eke out minor gains. The Caixin PMI for services and composite were softer but difficult to put much stock in given the distortions of the Lunar New Year. Separately, the government announced plans to the National People’s Congress that the growth target this year is around 6.5%. It also announced cuts in mobile phone service (30%?) and in many tariff schedules. |

China Caixin Services Purchasing Managers Index (PMI), Apr 2013 - Mar 2018(see more posts on China Caixin Services PMI, ) Source: investing.com - Click to enlarge |

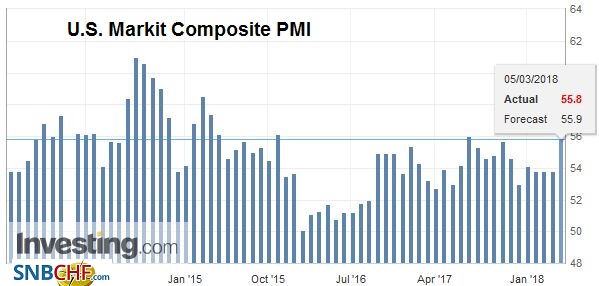

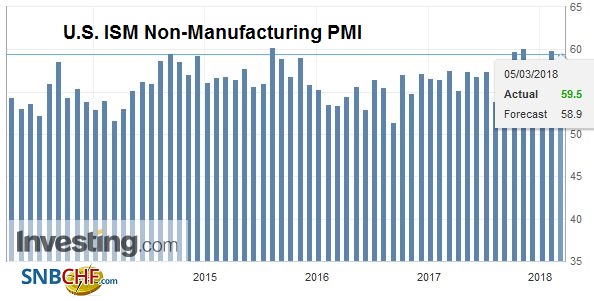

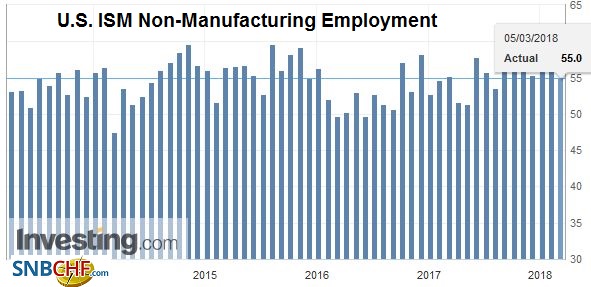

United StatesIn the US session features the Markit services and composite PMI, while the ISM reports the results of its non-manufacturing survey. |

U.S. Services Purchasing Managers Index (PMI), Apr 2013 - Mar 2018(see more posts on U.S. Services PMI, ) Source: investing.com - Click to enlarge |

| The main report of the week is the jobs data at the end of the week and another robust report is expected. We note that the weekly initial jobless claims, and its four-week moving average are at new cyclical lows. Several Fed officials speak this week ahead of the quiet period ahead of the March 21 FOMC meeting. Quarles speaks today, but Dudley and Brainard speeches tomorrow may be the most important. |

U.S. Markit Composite Purchasing Managers Index (PMI), Apr 2013 - Mar 2018(see more posts on U.S. Markit Composite PMI, ) Source: investing.com - Click to enlarge |

U.S. ISM Non-Manufacturing Purchasing Managers Index (PMI), Apr 2013 - Mar 2018(see more posts on U.S. ISM Non-Manufacturing PMI, ) Source: investing.com - Click to enlarge |

|

U.S. ISM Non-Manufacturing Employment, Apr 2013 - Mar 2018 Source: investing.com - Click to enlarge |

Full story here Are you the author? Previous post See more for Next post

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,China Caixin Services PMI,EUR/CHF,Eurozone Composite PMI,Eurozone Markit Composite PMI,Eurozone Retail Sales,Eurozone Services PMI,France Services PMI,FX Daily,Germany Services PMI,Italy,Italy Services PMI,newslettersent,Politics,Spain Services PMI,U.K. Services PMI,U.S. ISM Non-Manufacturing PMI,U.S. Markit Composite PMI,U.S. Services PMI,USD/CHF