Swiss FrancThe Euro has fallen by 0.13% to 1.1631 CHF. |

EUR/CHF and USD/CHF, November 03(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

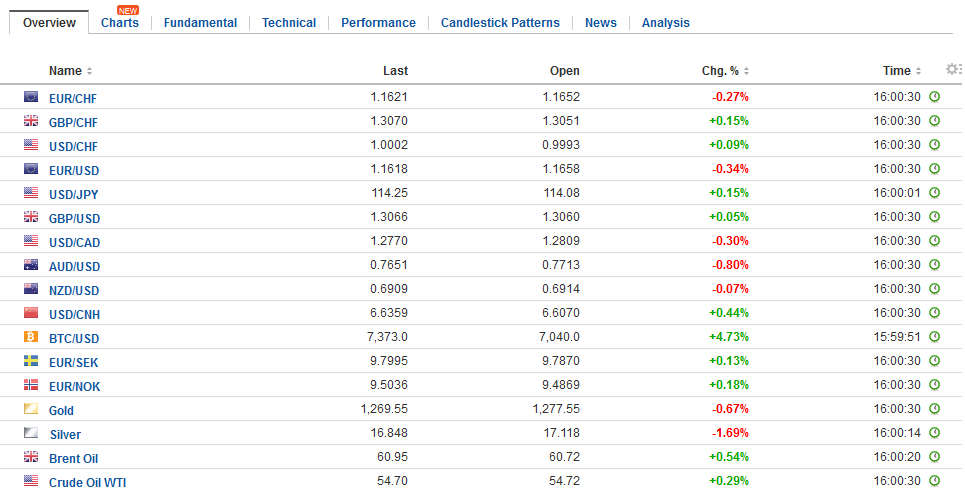

FX RatesThe US dollar is firm but is not going anywhere quickly. The lack of fresh interest rate support and uncertainty over the US tax proposals, which the Brady, the Chair of the House Ways and Means Committee hopes to have a revised version out after the weekend so the committee work can begin on Monday. The popular press seems to focus on some objections by Democrats, but this misses the point. The Republicans hope to pass tax reform without relying on Democrats. It is the same strategy employed for health care reform, and the problem then and the challenge now is within the Republican Party and its constituencies. A wing of the GOP wants no increase in the deficit, and another wing wants lower taxes. Immediately upon the release of the proposals, the National Federal of Independent Business objected that the bill would not help most small businesses. The National Association of Realtor objected and homebuilder shares sold-off yesterday. |

FX Daily Rates, November 03 |

| Tokyo markets were closed, which contributed to a subdued Asian session. The Nikkei closed the week with a 2.4% gain after a 2.6% gain the prior week. The Nikkei is sitting on 20-year highs and is on an eight-week run. Foreign investors are re-weighting toward Japanese shares after having cut exposure earlier in the year. There is some chunky option expires today. There is $2.2 bln struck at JPY114.00 and another $1.1 bln at JPY114.50. On the downside, there is an option at JPY113.80 for $400 mln that expire today.

The euro reached almost $1.1690 yesterday, its best level since the ECB meeting, but was unable to close above the $1.1660 important technical level. The single currency has been confined to less than a cent range this week. The over-extended condition we warned of is being alleviated by the sideways trading this week. Between $1.1595 and $1.1600, there are options with a notional value of 1.8 bln euros set to expire today. There are roughly another 1.8 bln euros struck between $1.1670 and $1.1700. The US dollar found support in front of CAD1.28, where a $512 mln option is struck that is set to expire today. A break sees additional US dollar support near CAD1.2750-CAD1.2780. The CAD1.2900-CAD1.2930 marks the nearby cap. |

FX Performance, November 03 |

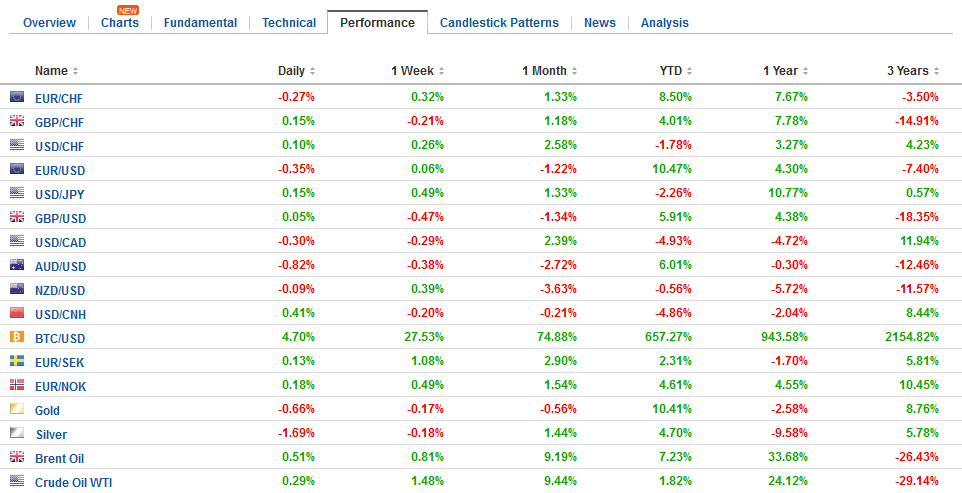

ChinaMany observers think that the Chinese government may flatter its economic data, and they give private data more credence. However, the situation is more complicated, and this is born out with the PMI. The official measure showed weakness in the non-manufacturing sector (54.3 from 55.4), but the Caixin measure reported earlier today showed a modest increase to 51.2 from 50.6. The more important development in China was the PBOC’s large injection via one-year money that helped calm the government bond market. The 10-year yield had risen nearly 20 bp in recent days and the official action this week which injected nearly CNY1 trillion this week, which essentially replaced the maturing loans. The US dollar closed higher against the yuan for the second consecutive session, but all this did was pare its weekly loss to about 0.3%. |

China Caixin Services PMI, Oct 2017(see more posts on China Caixin Services PMI, ) Source: Investing.com - Click to enlarge |

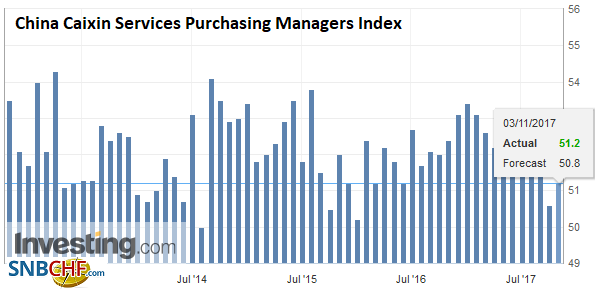

United KingdomSterling continues to trade heavily and has marginally extended yesterday’s losses. It has approached $1.30, where today there is a GBP694 mln option struck there that expires in NY. Last month’s low was just below $1.3030. Sterling has not traded below there in two months. The somewhat stronger than expected service sector PMI (55.6 vs. 53.6 in September). It is the strongest since April. The composite reading rose to 55.8 from 54.1. It is also a six-month high. A move above $1.2120 would help lift the technical tone. |

U.K. Services PMI, Oct 2017(see more posts on U.K. Services PMI, ) Source: Investing.com - Click to enlarge |

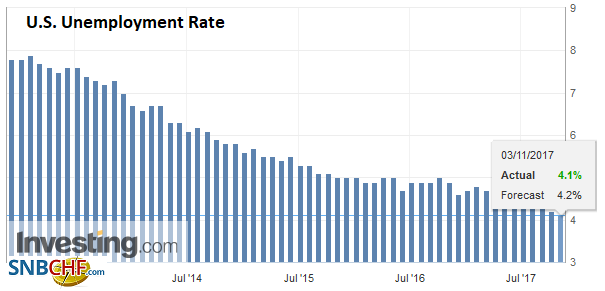

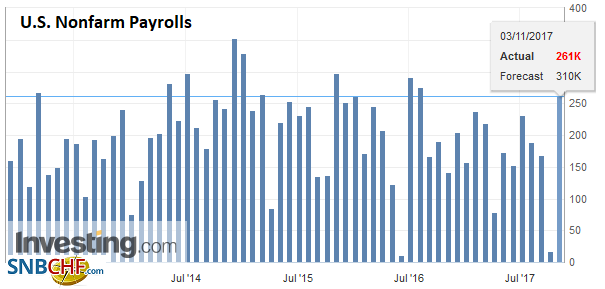

United StatesThe focus in the US is in the monthly employment data. The consensus calls for around a 300k increase. We suspect the risk is on the upside. That said, it probably requires more than 370k to excite the market, which realizes that the data is a payback from the loss of jobs due to weather in September. |

U.S. Unemployment Rate, Oct 2017(see more posts on U.S. Unemployment Rate, ) Source: Investing.com - Click to enlarge |

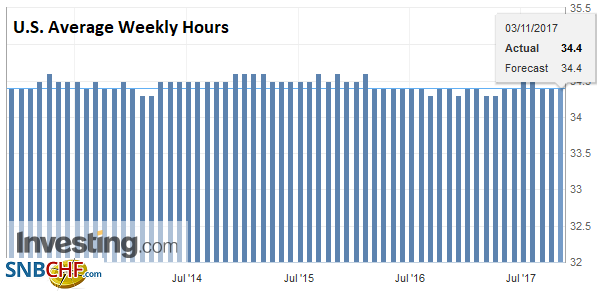

| Hourly earnings may have also been skewed from the storm. A 0.2% rise, given the base effect, would see the year-over-year rate slow to 2.7% from 2.9%. The average this year through August was 2.6%. Other measures of labor compensation, like the recent Q3 Employment Cost Index, shows a modest acceleration. |

U.S. Average Weekly Hours, Oct 2017(see more posts on U.S. Average Earnings, ) Source: Investing.com - Click to enlarge |

U.S. Nonfarm Payrolls, Oct 2017(see more posts on U.S. Nonfarm Payrolls, ) Source: Investing.com - Click to enlarge |

|

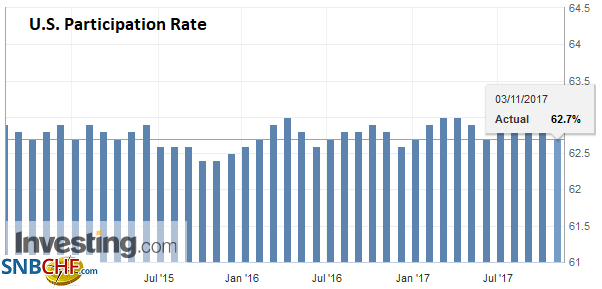

U.S. Participation Rate, Oct 2017(see more posts on U.S. Participation Rate, ) Source: Investing.com - Click to enlarge |

|

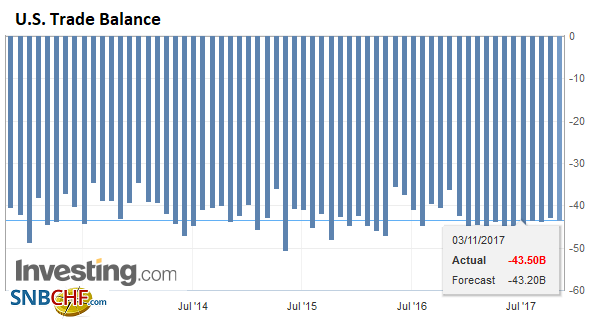

U.S. Trade Balance, Sep 2017(see more posts on U.S. Trade Balance, ) Source: Investing.com - Click to enlarge |

|

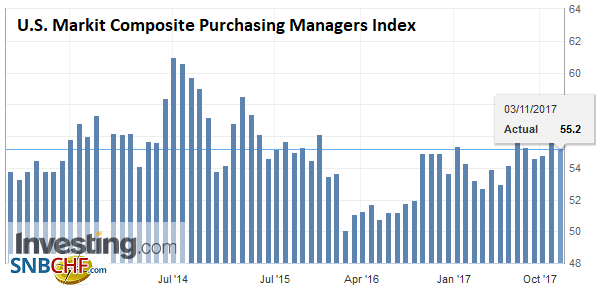

U.S. Markit Composite PMI, Oct 2017(see more posts on U.S. Markit Composite PMI, ) Source: Investing.com - Click to enlarge |

|

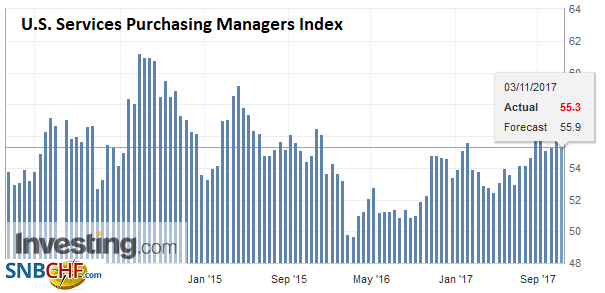

U.S. Services PMI, Oct 2017(see more posts on U.S. Services PMI, ) Source: Investing.com - Click to enlarge |

|

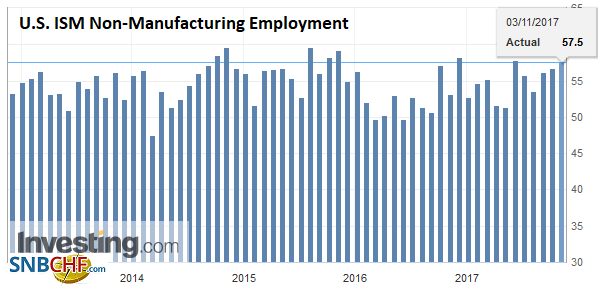

U.S. ISM Non-Manufacturing Employment, Oct 2017 Source: Investing.com - Click to enlarge |

|

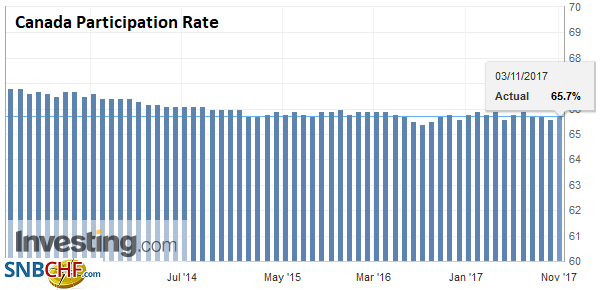

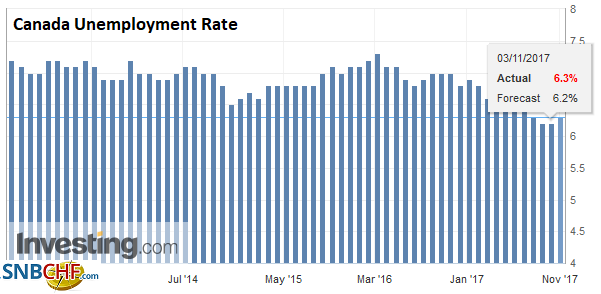

CanadaWe note that Canada reports its jobs figures as well. With the Bank of Canada warning that the economy may slow after a strong H1 and has turned decidedly cautious after two hikes in Q3, the market has reacted strongly to disappointing data. That could be the case with today’s jobs report. In September, Canada created 112k full-time jobs. Proportionately, this is as if the US created over a million jobs in a single month. |

Canada Participation Rate, Oct 2017(see more posts on Canada Participation Rate, ) Source: Investing.com - Click to enlarge |

Canada Unemployment Rate, Oct 2017(see more posts on Canada Unemployment Rate, ) Source: Investing.com - Click to enlarge |

|

Canada Employment Change, Oct 2017(see more posts on Canada Employment Change, ) Source: Investing.com - Click to enlarge |

The Australian dollar is the weakest currency on the day, thus far, and is off nearly 0.5%. It was sold in response to the disappointing retail sales. Rather than recover from August’s 0.5% decline as the market expected, they were unchanged. The central bank meets next week but is on a decidedly steady course with a 1.5% cash rate. The Aussie is nearing support near $0.7665, and a break of it would signal a test on the recent low from late October near $0.7625 initially.

While our “one-and-done” view was widely shared, it was by no means universal, but the BOE seemed even more dovish than many expected. It no longer is threatening to raise rates more than the market expects, and looking at the short-sterling futures strip, the bias is toward two hikes by the end the end of 2019.

Graphs and additional information on Swiss Franc by the snbchf team.

Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$CAD,$CNY,$EUR,$JPY,$TLT,Canada Employment Change,Canada Participation Rate,Canada Unemployment Rate,China Caixin Manufacturing PMI,China Caixin Services PMI,EUR/CHF,newslettersent,U.K. Services PMI,U.S. Average Earnings,U.S. Markit Composite PMI,U.S. Nonfarm Payrolls,U.S. Participation Rate,U.S. Services PMI,U.S. Trade Balance,U.S. Unemployment Rate,USD/CHF