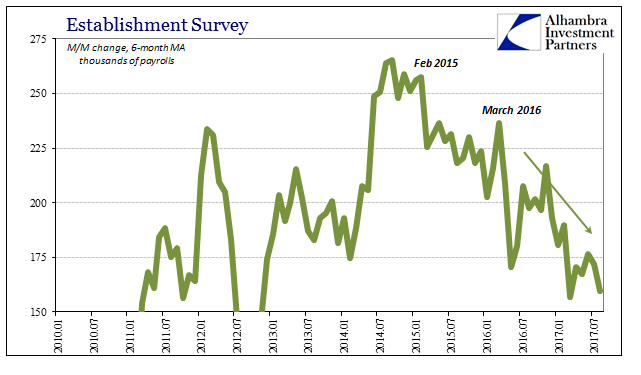

| The payroll report for August 2017 thoroughly disappointed. The monthly change for the headline Establishment Survey was just +156k. The BLS also revised lower the headline estimate in each of the previous two months, estimating for July a gain of only +189k. The 6-month average, which matters more given the noisiness of the statistic, is just +160k or about the same as when the Federal Reserve contemplated starting a third round of QE back in 2012. |

Establishment Survey, Jan 2010 - Jul 2017(see more posts on establishment survey, ) |

| Even I had expected that there would be some improvement in the labor market trend by now. The near-recession of 2015-16 finished nearly a year and a half ago, and though labor conditions typically lag the overall economic direction, more than enough time has passed to have been afforded the opportunity. |

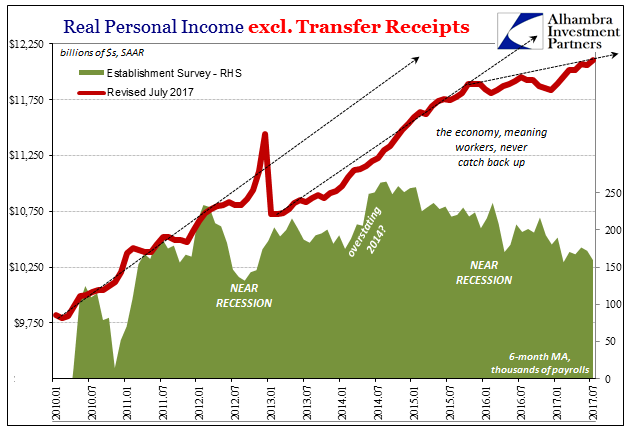

US Real Personal Income, Jan 2010 - Jul 2017(see more posts on U.S. Personal Income, ) |

| Instead, the trend of the BLS’s payroll reports since the “rising dollar” matches pretty well other economic accounts including, importantly, the BEA’s estimates for national income. |

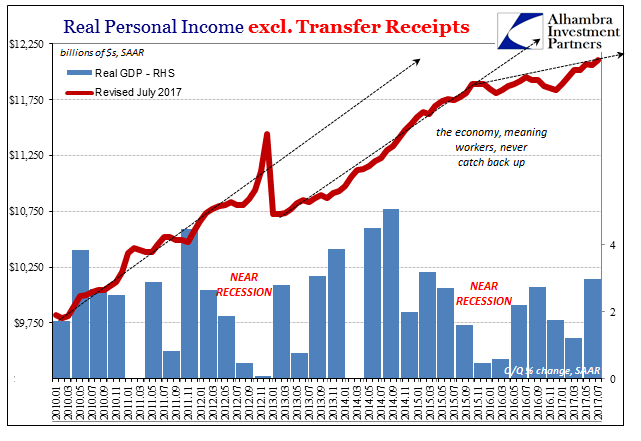

US Real Personal Income, Jan 2010 - Jul 2017(see more posts on U.S. Personal Income, ) |

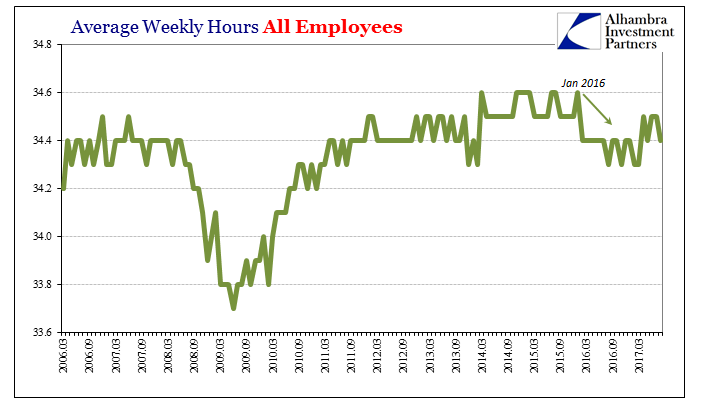

| The only improvement in the labor statistics, apart from the otherworldly unemployment rate, has been found in the figures for average weekly hours worked. |

US Average Weekly Hours, March 2006 - 2017(see more posts on U.S. Average Earnings, ) |

| It, however, hasn’t amounted to much more than a minor shift, more like everywhere else the absence of further deterioration than meaningful acceleration. |

US Average Weekly Hours, Aug 2007 - 2017(see more posts on U.S. Average Earnings, ) |

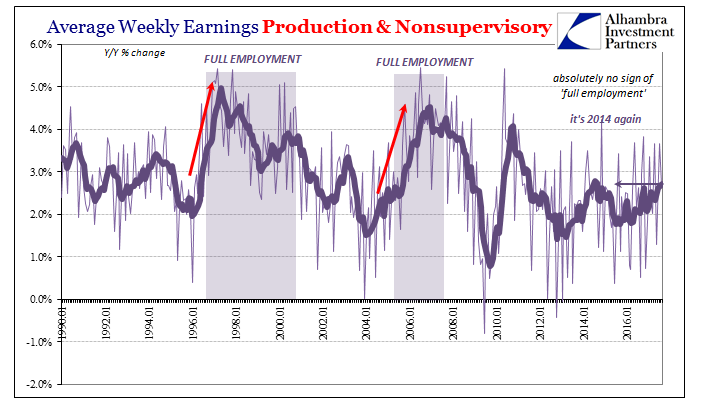

| Unfortunately for Federal Reserve officials, the small change in hours accounts for the small acceleration in weekly earnings. Wage rates continue to refute the unemployment rate, and incomes overall are nowhere near what would be consistent with “full employment.” At only 2.7% (6-month average, year-over-year), growth in earned income has merely matched the 2014 upturn, remaining far less than is required for an end to this stagnation. |

US Average Weekly Earnings, Jan 1990 - 2016(see more posts on U.S. Average Earnings, ) |

| The reason for that is very simple. The media has become filled with anecdotes and stories about a labor shortage, but as is common sense it can only be one related to regular turnover rather than of expansion (rapid or otherwise). Companies are always seeking new employees if for no other reason than existing workers leave all the time. There is no shortage that cannot be cured by rising wages and pay. |

Corporate Cash Flow/Monetary Noose, Jan 1985 - 2017, Two Labor Stories, Jan 1985 - 2017, US Retail Sales Stagnation, Jan 1992 - 2017(see more posts on U.S. Retail Sales, ) |

| Businesses in general and in the aggregate aren’t willing to pay, however. That much is clear from the earnings data if not also the slowdown in the headline Establishment Survey. That is because there is no economic growth and there has been none since 2007. For companies, that has meant little expansion in revenue and therefore cash flow. Because the economy doesn’t actually improve, they cannot afford to pay more for labor; both as wages as well as more employees. |

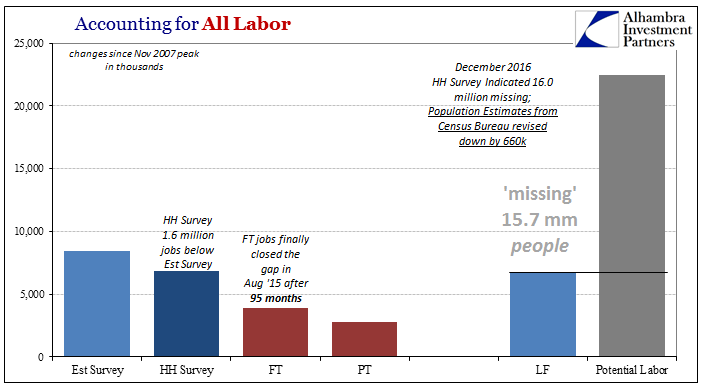

US Accounting for All Labor |

| The economic collapse as a result of the monetary (eurodollar) panic in 2008 meant a massive reduction in labor utilization both as the regular cyclical forces of recession but also greatly augmented by the sudden intrusion of liquidity preferences as a result of the panic (bank credit lines disappeared, commercial paper markets stopped functioning, and only the best credits could for a time source any liquidity funding needs at all). The growth in labor, as economy, never returned afterward because of the aftereffects of eurodollar irregularity – continuing intermittent monetary crisis that only sharpened liquidity preferences.

At some point in between it all became self-reinforcing such that it appears to be a chicken and egg kind of problem; little or no revenue growth has meant businesses over-manage their cost structure, especially labor, leaving a huge gap for consumers who now in the aggregate buy less goods and services, meaning little or no revenue growth, etc. The further slowdown in the global economy in 2015-16 seems to have tightened this monetary noose that much further. Business are expanding their use of additional labor (Establishment Survey) that much less, meaning that much less income growth (Real Personal Income less Transfer Receipts), and then of course that much less consumer spending (retail sales). The economy falls further behind for each of these monetary episodes because there is as yet no break in that cycle. |

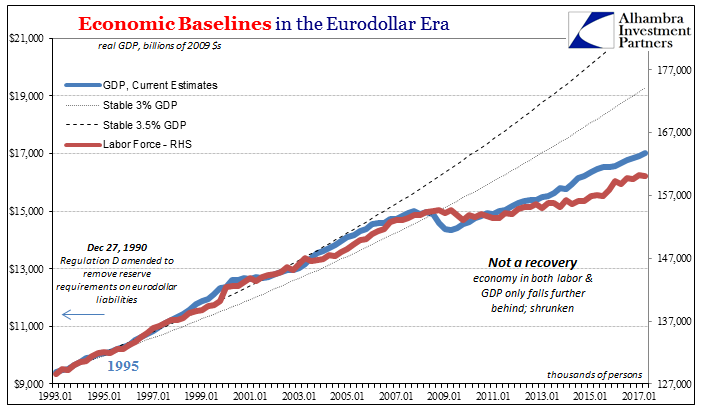

US Economic Baselines, Jan 1993 - 2017 |

| Monthly payroll reports are going to disappoint with some regularity, even in the best of times. The frequency of these letdowns has increased over the past few years, continuing, apparently, well into 2017 (already two-thirds of the way through). It’s still more evidence that “reflation” was hugely misplaced, more an outpouring of desperate hope than of rational analysis. I think that is why in comparison to past “reflations” it never once attained nearly the same proportions and enthusiasm. It was always a long shot.

|

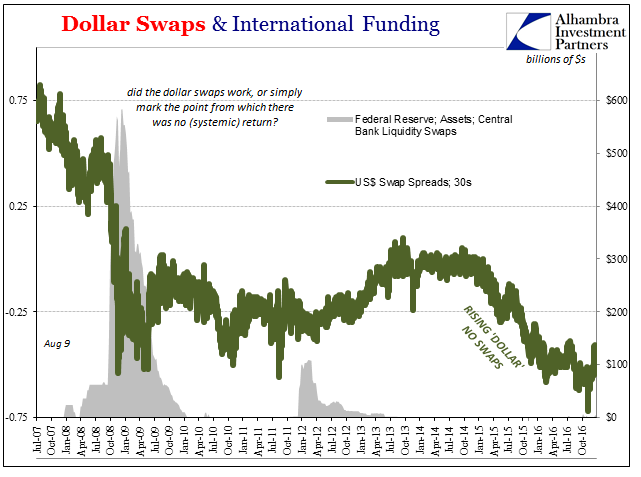

US Dollar Swaps, Jul 2007 - Oct 2016 |

| Some of those long shot bets were placed on the idea that the Fed (or whatever other central bank) might get something right. In the US that meant the crazy idea the FOMC was voting to raise the federal funds corridor because their economic models saw something really positive ahead. These econometric creations have a very poor track record especially over the past few years, but the thought was that maybe if the Fed was willing to actually go ahead with “rate hikes” they had to have been comfortable and assured enough to do them.

|

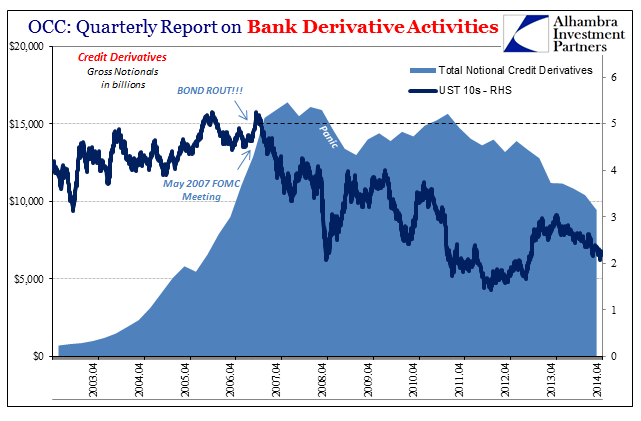

US Bank Derivative Activities, Apr 2003 - 2014 |

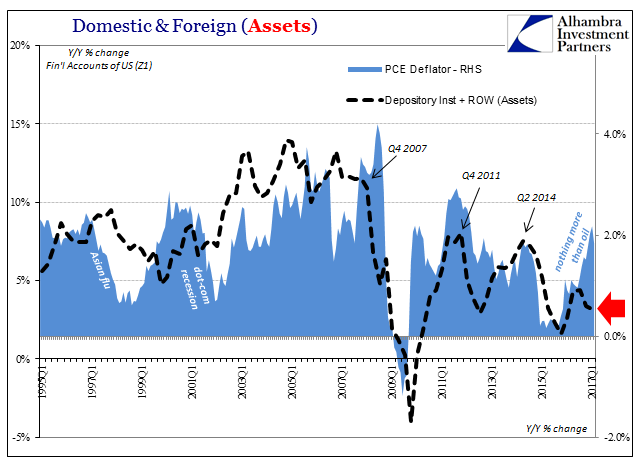

| What we are finding out instead, quite predictably, is that the committee is proceeding with “rate hikes” (not actual rate hikes) because they don’t know what else to do. The economy has never stopped disappointing, and even has become worse during this period where they thought it really would get much better, an actual recovery chance, but all their standards of orthodox policy belief tell them there is nothing left for them to do. This is as good as it gets, so they are getting out of the “stimulus” business even though nothing has been stimulated from the very start ten years ago.

It’s not really dissonance so much as a false assumption. There is no money at the Fed, therefore no stimulus, at least not anything that is truly usable in the modern eurodollar system, anyway. |

Domestic & Foreign(Assets), Q1 1995 - 2017 |

Tags: average weekly earnings,average weekly hours,consumer spending,consumers,corporate cash flow,currencies,economy,establishment survey,EuroDollar,eurodollar standard,Federal Reserve/Monetary Policy,FOMC,jobs,Labor,labor force,Labor Market,Markets,Monetary Policy,newslettersent,participation rate,payrolls,Reflation,U.S. Average Earnings,U.S. Personal Income,U.S. Retail Sales,unemployment rate