Tag Archive: U.S. Personal Income

FX Daily, June 26: Investors Wrestle with Notion that More Covid Cases mean More Stimulus

It may be that a new surge in virus cases will elicit more policy support from officials, but the immediate focus may be on the economic disruption. The number of US cases is reaching records, and at least a couple of states are stopping their re-opening efforts. Several other countries, including parts of Australia, Japan, and Germany, are wrestling with the same thing, And some emerging markets, like Brazil and Mexico, have not experienced a lull.

Read More »

Read More »

FX Daily, May 29: Month-End Profit-Taking Weighs on Equities as the Euro Pops Above $1.11

Overview: The announcement that President Trump will hold a press conference on China later today rattled investors yesterday after they had earlier shrugged off the escalation of tension between the US and China to take the S&P 500 up to its highest level in nearly three months. The S&P 500 reversed and settled on its lows, and this carried over into today's activity, which also may be reflecting month-end adjustments.

Read More »

Read More »

FX Daily, April 30: ECB Takes Center Stage

Overview: Equities continue to recover even as deep economic contractions are reported. Yesterday, the US said Q1 GDP contracted at an annualized pace of 4.8%, while the eurozone reported today that output fell 3.8% quarter-over-quarter in Q1. Hong Kong and South Korea were closed, but the rest of the Asia Pacific bourses rallied strongly with several, including Australia and India, rising more than 2%.

Read More »

Read More »

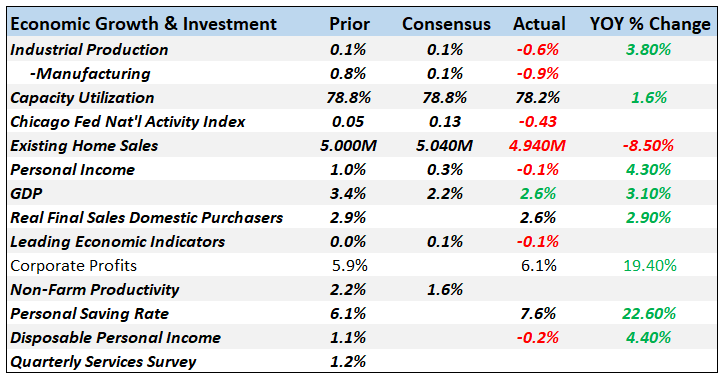

Monthly Macro Chart Review – March

We’re changing the format on our Macro updates, breaking the report into two parts. This is part one, a review of the data released the previous month with charts to highlight the ones we deem important. We’ll post another one next week that will be more commentary and the market based indicators we use to monitor recession risk.

Read More »

Read More »

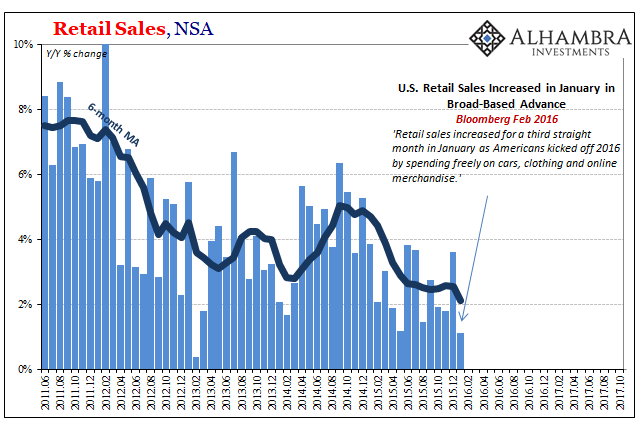

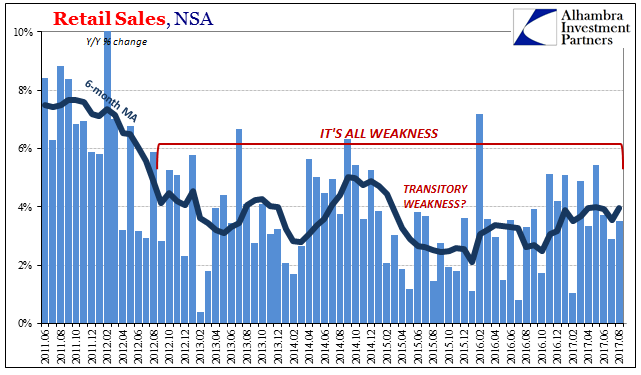

The Retail Sales Shortage

Retail sales rose (seasonally adjusted) in March 2018 for the first time in four months. Related to last year’s big hurricanes and the distortions they produced, retail sales had surged in the three months following their immediate aftermath and now appear to be mean reverting toward what looks like the same weak pre-storm baseline. Exactly how far (or fast) won’t be known until subsequent months.

Read More »

Read More »

FX Daily, March 29: Bonds and Stocks are Firm, While the Greenback Consolidates Upticks

The choppy US equity session yesterday, ultimately ending with modest losses as the tech sector remained under pressure, has been shrugged off in Asia and Europe, where modest gains have been seen. The dollar is little changed after yesterday's gains, and bonds are mostly firmer.

Read More »

Read More »

FX Daily, March 01: USD Snaps 3-Month Slide, Firm Ahead of Powell Part II

The US dollar rebounded last September and October before the downtrend resumed in November, and lasted through January. The dollar gained broadly last month, except against the yen, which rose almost 2.4% in February. This pattern is evident today, the first trading day of March. The dollar is extending its gains against most currencies but is only managing to consolidate in a narrow range against the yen.

Read More »

Read More »

FX Daily, January 29: A Brief Word

The US dollar is modestly firmer, but nothing to suggest a outright correction rather than consolidation. However, have a dramatic drop over the past month, much more than we think is justified by macroeconomic developments and interest rates, we think the dollar may have overshot.

Read More »

Read More »

Retail Sales, Consumer Sentiment, And The Aftermath Of Hurricanes

Consumer confidence has been sky-high for some time now, with the major indices tracking various definitions of it at or just near highs not seen since the dot-com era. Economists place a lot of emphasis on confidence in all its forms, including that of consumers, and there is good reason for them to do so; or there was in the past.

Read More »

Read More »

FX Daily, November 30: US Dollar Comes Back Bid, but Brexit Hopes Underpin Sterling

The US dollar is broadly firmer. The rise in US yields yesterday has seen the greenback extend its recovery against the yen. It briefly pushed through JPY112.40, after dipping below JPY111.00 at the start of the week, for the first time since mid-September. Since the end of last week, been capped at the 200-day moving average against the yen, found near JPY111.70, but yesterday it pushed past. There are nearly $1 bln of options struck between...

Read More »

Read More »

The (Economic) Difference Between Stocks and Bonds

Real Personal Consumption Expenditures (PCE) rose 0.6% in September 2017 above August. That was the largest monthly increase (SAAR) in almost three years. Given that Real PCE declined month-over-month in August, it is reasonable to assume hurricane effects for both. Across the two months, Real PCE rose by a far more modest 0.5% total, or an annual rate of just 3.4%, only slightly greater the prevailing average.

Read More »

Read More »

FX Daily, October 30: Dollar Slips in Consolidative Activity

The markets are mixed, mostly responding to idiosyncratic developments, as the week's large events loom ahead. These BOJ, BOE, and FOMC meetings, eurozone flash CPI and US jobs reports. In addition, US President Trump is expected to announce his nomination of the next Fed chair, and the initial House tax bill will be unveiled.

Read More »

Read More »

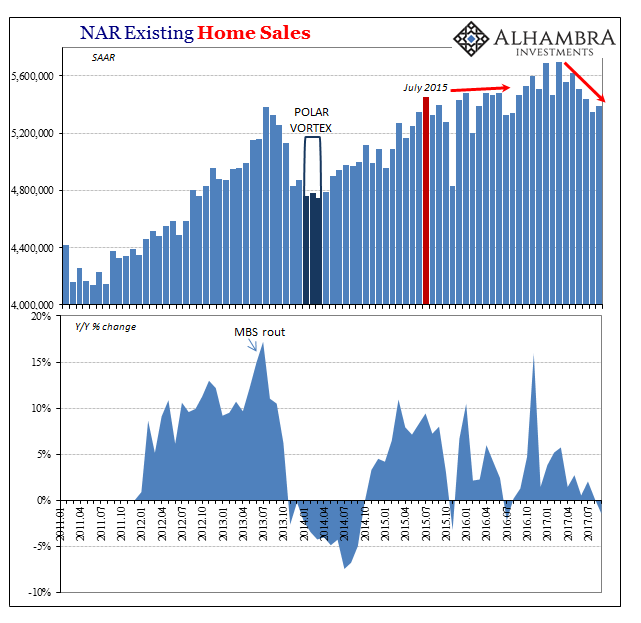

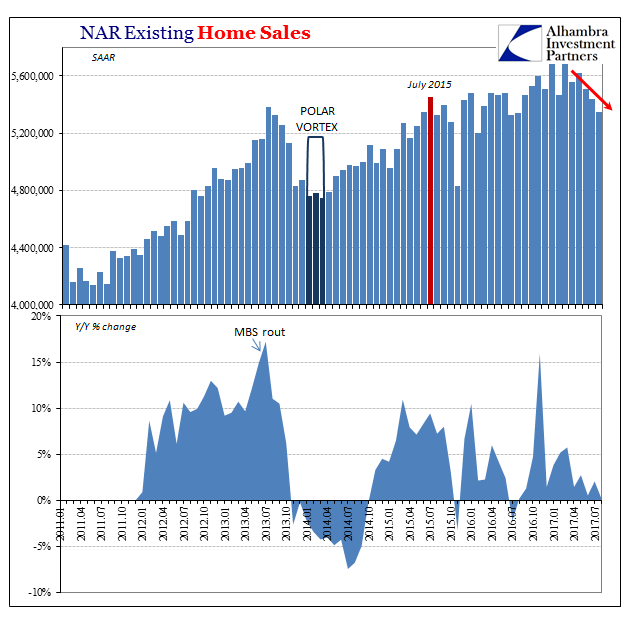

Housing Isn’t Just About Real Estate

The National Association of Realtors (NAR) reported today that sales of existing homes (resales) were up slightly in September 2017 on a monthly basis. At a seasonally-adjusted annual rate of 5.39 million last month, that was practically unchanged from the 5.35 million estimate for August that was the lowest in a year.

Read More »

Read More »

The Payroll Report To Focus On Is August’s, Not September’s

The hurricanes didn’t disappoint, causing major damage at least to the BLS. Precisely how much the statistics were affected by the disruptions in Texas and Florida really can’t be calculated, not that everyone won’t try. It makes this month’s payroll report a Rorschach test of sorts. You can pretty much make it out to be whatever you want.

Read More »

Read More »

Auto Sales Up Last Month, But Why?

Auto sales rebounded sharply in September, with most major car manufacturers reporting better numbers. Sales at Ford were up 8.9% last month from September 2016; +11.9% at GM; Toyota +14.9%; Nissan +9.5%; Honda +6.8%. The only negatives were reported by FCA (-9.7%) and Mercedes (-1.7%).

Read More »

Read More »

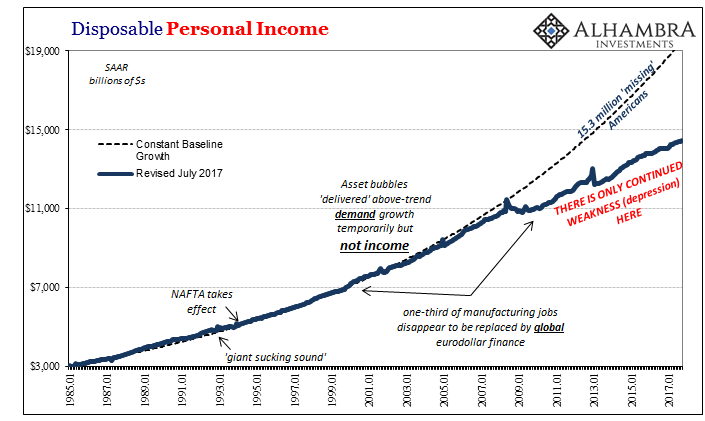

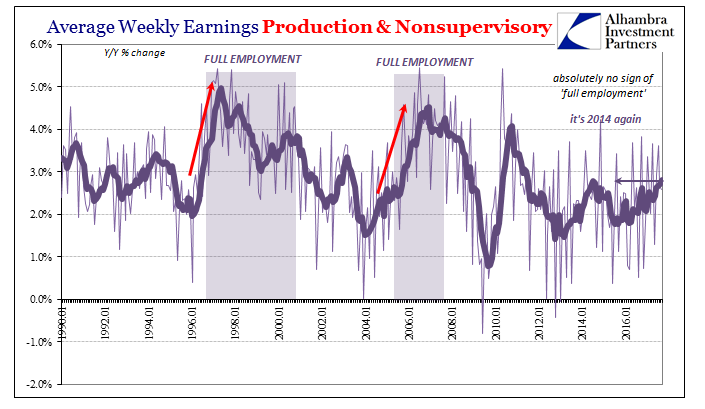

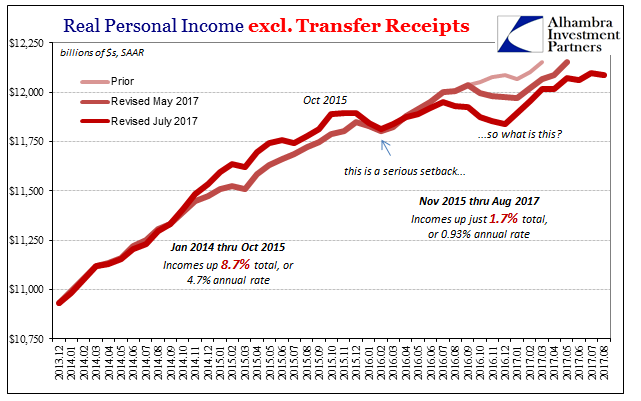

Incomes Are What Matters, So Bad Month, Bad Year, Bad Decade

Sometimes economics can be complicated, such as why the labor market has slowed in such lingering fashion since early 2015. Sometimes economics can be easy, such as why there is so much less to the economy this year than thought. The easy part relates to the hard part. The labor market slowed and so did national income. Though so much of official focus is on debt supplementation, it’s always, always about income.

Read More »

Read More »

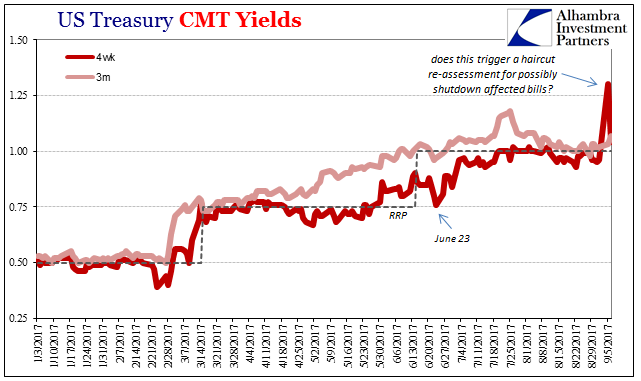

It Was Collateral, Not That We Needed Any More Proof

Eleven days ago, we asked a question about Treasury bills and haircuts. Specifically, we wanted to know if the spike in the 4-week bill’s equivalent yield was enough to trigger haircut adjustments, and therefore disrupt the collateral chain downstream. Within two days of that move in bills, the GC market for UST 10s had gone insane.To be honest, it was a rhetorical exercise.

Read More »

Read More »

The Real Estate View For A Second Lost Decade

The National Association of Realtor (NAR) reports today that sales of existing homes in the US were down 1.7% in August 2017 from July. At a seasonally-adjusted annual rate of 5.35 million, that’s the lowest pace for resales since July 2016. It is yet another data point reflecting the almost certain end of “reflation” in the economic sense.

Read More »

Read More »

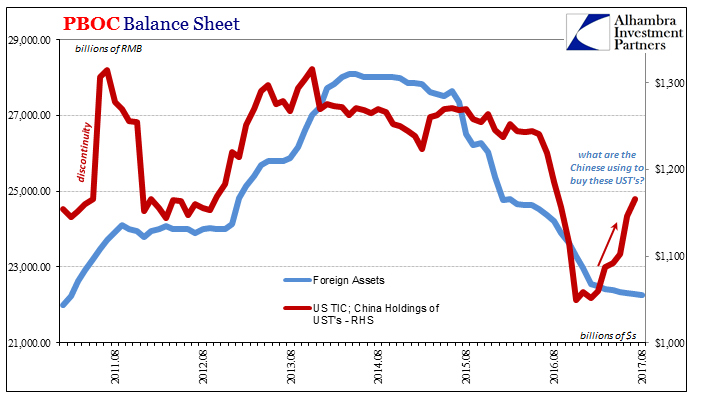

Swimming The ‘Dollar’ Current (And Getting Nowhere)

The People’s Bank of China reported this week that its holdings of foreign assets fell slightly again in August 2017. Down about RMB 21 billion, almost identical to the RMB 22 billion decline in July, the pace of forex withdrawals is clearly much preferable to what China’s central bank experienced (intentionally or not) late last year at ten and even twenty times the rate of July and August.

Read More »

Read More »

Retail Sales and the End of ‘Reflation’

There will be an irresistible urge to the make this about the weather, but more and more data shows it’s not any singular instance. Nor is it transitory. What does prove to be temporary time and again is the upside. The economy gets hit (by “dollar” events), bounces back a little, and then goes right back into the dumps. This, it seems, is the limited extent of cyclicality in these times.

Read More »

Read More »