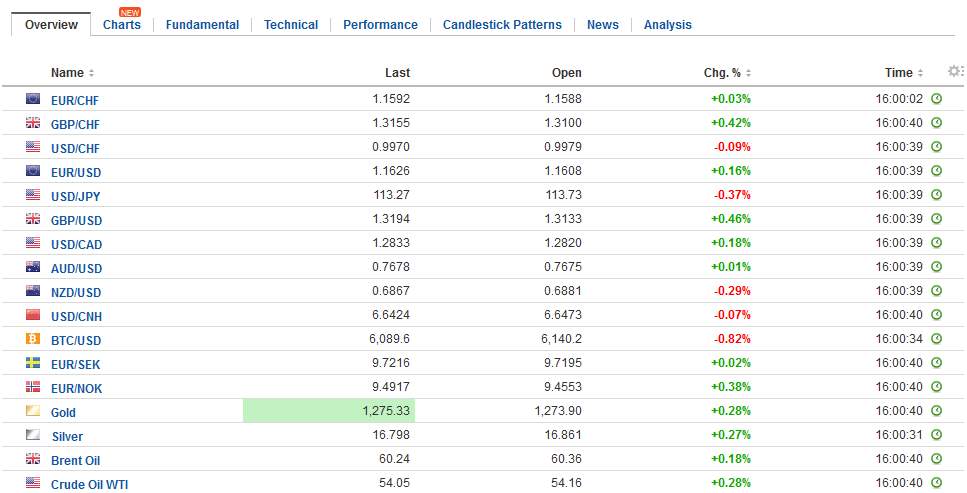

Swiss FrancThe Euro has risen by 0.29% to 1.606 CHF. |

EUR/CHF and USD/CHF, October 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe markets are mixed, mostly responding to idiosyncratic developments, as the week’s large events loom ahead. These BOJ, BOE, and FOMC meetings, eurozone flash CPI and US jobs reports. In addition, US President Trump is expected to announce his nomination of the next Fed chair, and the initial House tax bill will be unveiled. Technically, the dollar was overextended and the mostly heavier tone today ought not be surprising. The New Zealand dollar remains under pressure. Although it bounced into the end of last week, comments by Finance Minister Roberson that the changes in the central bank’s mandate would potentially lead to lower rates, are weighing today. Of course, this was the implication that the market responded to on news that the RBNZ’s mandate was going to be changed to include a full employment charge, like the Federal Reserve. Before the weekend, the Kiwi had approached the year’s low set in May near $0.6820. It has not made a new low, and it is beginning to look as if the selling has been exhausted. A move above $0.6915 would help confirm a low is in place. |

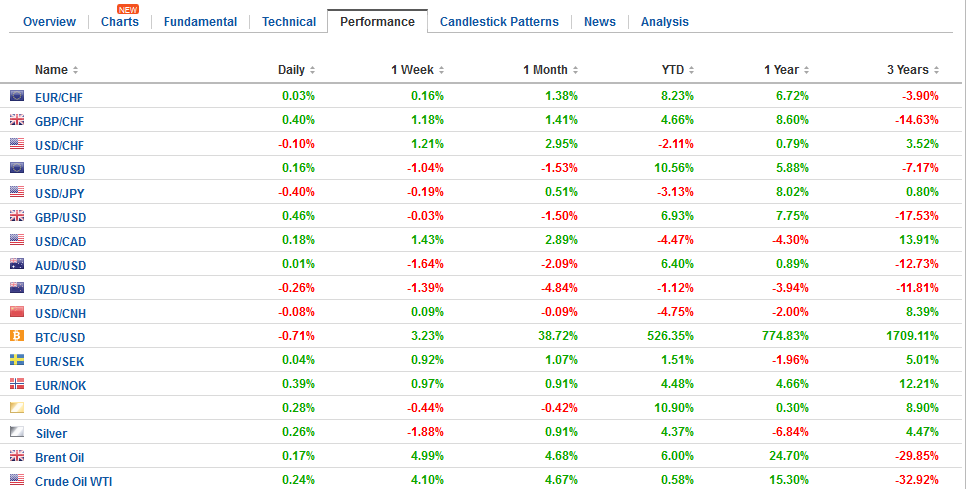

FX Daily Rates, October 30 |

| The euro is correcting higher. It was oversold at the end of last week when it hit $1.1575. After a slow start in Asia, it rose through initial resistance in Europe near $1.1625 and looks poised to challenge the $1.1660 area. The news stream is light, but the economic reports will help shade views ahead of this week’s first estimate of Q3 GDP and October flash CPI.

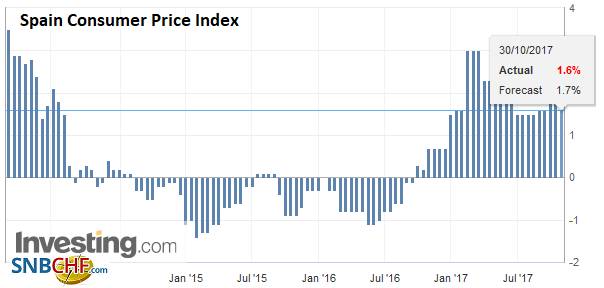

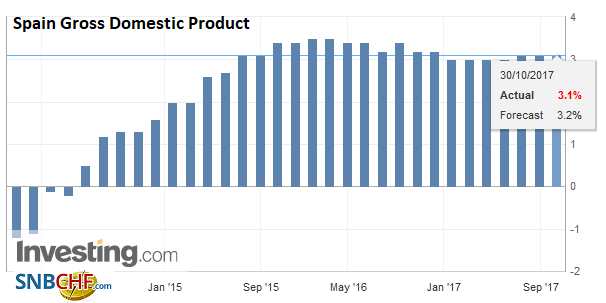

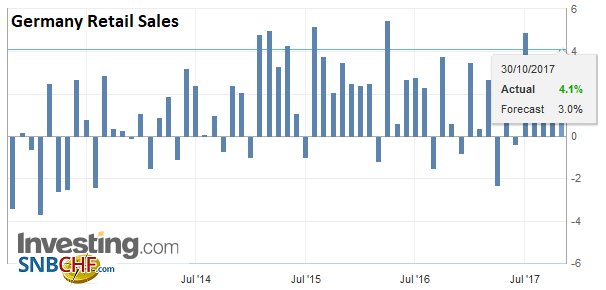

Spain was the first EMU country to report Q3 GDP. It was an impressive 0.8% quarter-over-quarter, in line with expectations and slightly slower than the 0.9% pace reported for Q2. The year-over-year pace was steady at 3.1%. For its part, Germany reported a 0.5% rise in September retail sales, while the August series was revised to a 0.2% contraction rather than a 0.4% fall. The 4.1% year-over-year increase compares with a 1.1% last September. The market expects that the eurozone economy expanded at around 0.5% in Q3, down from 0.6% in Q2. It is above trend, which means the output gap continues to close. Lastly, there are a few large options strikes that expiring today that may be in place. There is an option struck at $1.1650 for 508 mln euros, and an option struck at JPY113.80 for $530 mln. |

FX Performance, October 30 |

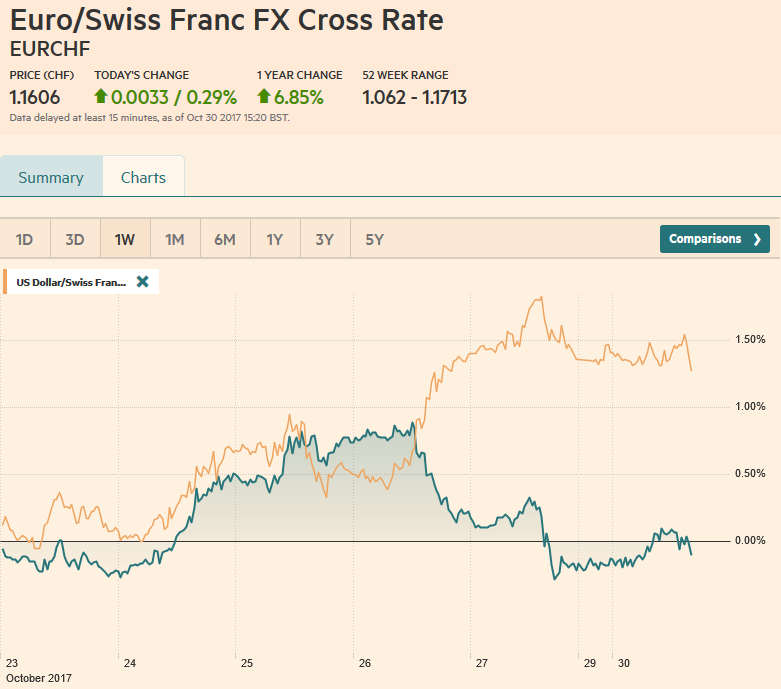

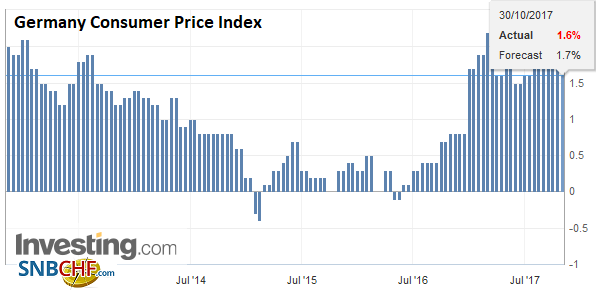

SpainSeparately, Spain reported EU harmonized CPI rose 0.6% in October, the same as September, but a bit faster than expected. Still, the year-over-year rate eased to 1.7% from 1.8%. Meanwhile, German states are showing softer inflation figures. A slightly lower EU harmonized measure from the 1.8% it reported in September would not be surprising. Draghi warned that due to energy prices, the pace of inflation might temporarily slow in the period ahead. There seems to be downside risk to the Bloomberg median forecast that October eurozone CPI was unchanged at 1.5% and 1.1% core rate. Both the GDP and CPI for the region will be reported tomorrow. |

Spain Consumer Price Index (CPI) YoY, Oct 2017(see more posts on Spain Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| There is no sign that Catalonia’s secessionist movement and the attempt by Madrid to invoke Article 155 to suspend the local autonomy is scaring investors. From the market’s point of view, the crisis is over except for the precise details. Spain’s 10-year is off six basis points, and at 1.50%, it is the lowest since a couple of weeks before the Catalan referendum was held. At 115 bp, Spain’s premium is two basis points above the eve of the referendum. Spanish stocks are leading the European bourses higher today with a 1.4% rally near midday compared with a flat performance by the Dow Jones Stoxx 600. In Spain, financials, real estate, and telecommunications are the leading sectors.

Of note, a poll conducted for El Mundo found a close Catalonia election, scheduled for December 21. Those opposed to independence are polling 43.4%, while the secessionists are drawing 42.5%. |

Spain Gross Domestic Product (GDP) YoY, Q3 2017(see more posts on Spain Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

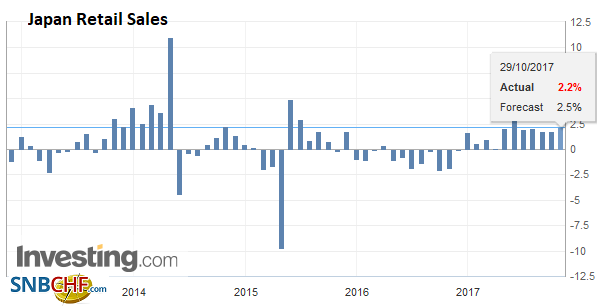

JapanJapan reported a 0.8% rise in September retail sales. That translates into a 2.2% year-over-year rise, which reflects a strong base effect. Japan’s private consumption (nominal) is growing about 1% a year. On Tuesday, Japan reports September employment and industrial output figures. The BOJ’s meeting is not expected to lead to a change in policy, but there is some thought the BOJ will accept the inevitable and lower its inflation forecast for this year, which currently stands at 1.1%. The core rate (excludes fresh food) matched the headline rate of 0.7% in September and was reported before the weekend. |

Japan Retail Sales YoY, Sep 2017(see more posts on Japan Retail Sales, ) Source: Investing.com - Click to enlarge |

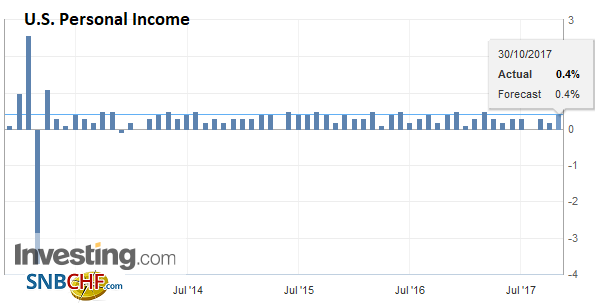

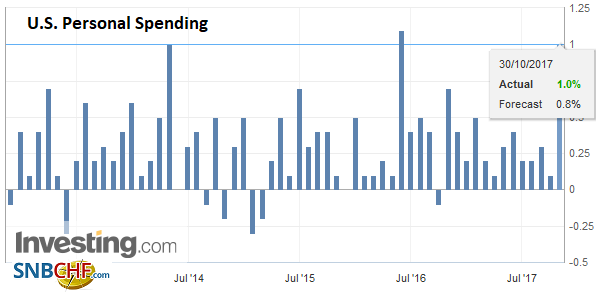

United StatesThe US reports September personal income and consumption data, but it has already been incorporated into Q3 GDP that was also reported before the weekend. There will be little new in the report, but that might not prevent the market from having a quick reaction to the headlines. |

U.S. Personal Income, Sep 2017(see more posts on U.S. Personal Income, ) Source: Investing.com - Click to enlarge |

| The interest today is in the first charges that the Special Prosecutor Mueller is expected to bring in the investigation into Russia’s attempt to influence last year’s US election. An announcement on the next Fed chair is thought to come any day this week. Investors seem comfortable that it will likely go to Powell. |

U.S. Personal Spending, Sep 2017 Source: Investing.com - Click to enlarge |

| Many understand this to be close to the continuity of the Bernanke-Yellen period. While some media reports highlight that President Trump’s approval rating has slumped to new lows, we suspect the limited market impact is partly a function of the fact that the President is still supported by more than 80% of Republicans. |

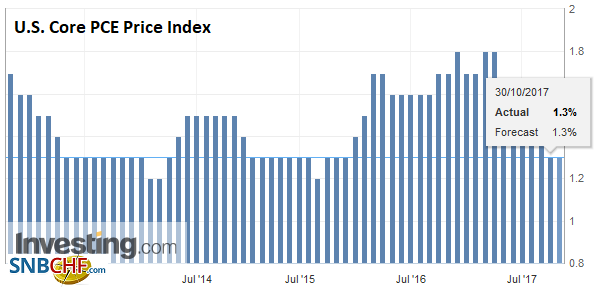

U.S. Core PCE Price Index YoY, Sep 2017 Source: Investing.com - Click to enlarge |

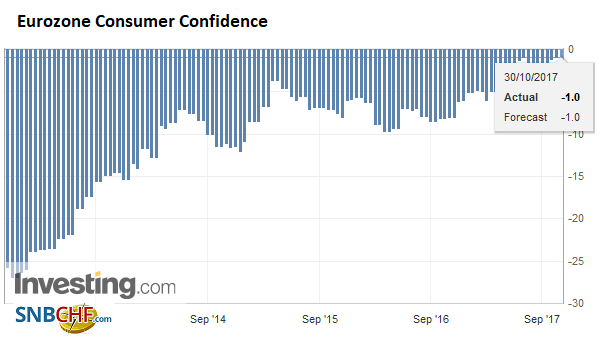

Eurozone |

Eurozone Consumer Confidence, Oct 2017(see more posts on Eurozone Consumer Confidence, ) Source: Investing.com - Click to enlarge |

Germany |

Germany Consumer Price Index (CPI) YoY, Oct 2017(see more posts on Germany Consumer Price Index, ) Source: Investing.com - Click to enlarge |

Germany Retail Sales YoY, Sep 2017(see more posts on Germany Retail Sales, ) Source: Investing.com - Click to enlarge |

The markets seem less impressed with the positive developments in Italy. S&P unexpectedly upgraded Italian credit rating to BBB. It is the first time S&P has upgraded Italy in 30 years. The rating now matches the other main agencies. S&P cited better growth and stronger banking system. Italian 10-year bond yields are off three basis points. The premium over Germany has narrowed nearly 20 bp this month to approach 1.50%, which is the lowest this year. Before the weekend, it was also announced that Bank of Italy Governor Visco was indeed going to get another term after political posturing and scapegoating had seen an effort to squeeze him out.

The MSCI Asia Pacific Index advanced 0.3%. The Nikkei managed to eke out the smallest of gains, but the focus was on Chinese shares. The Shanghai Composite fell almost 0.8%, which is the largest decline in two months. The drag was linked to fears that post-19th Party Congress, there would be a new deleveraging campaign. The 10-year government bond yield jumped nine basis points to 3.93%, a three-year high. Last Monday, it was nearly 20 bp lower. Separately, we note that China’s large banks reported strong Q3 earnings, though the price-to-book ratios are near the highest level in two years.

Graphs and additional information on Swiss Franc by the snbchf team.

Are you the author? Previous post See more for Next postTags: #USD,$EUR,$JPY,EUR/CHF,Eurozone Consumer Confidence,Germany Consumer Price Index,Germany Retail Sales,Japan Retail Sales,newslettersent,NZD,Spain Consumer Price Index,Spain Gross Domestic Product,U.S. Core PCE Price Index (PCE Deflator),U.S. Personal Income,USD/CHF,yuan