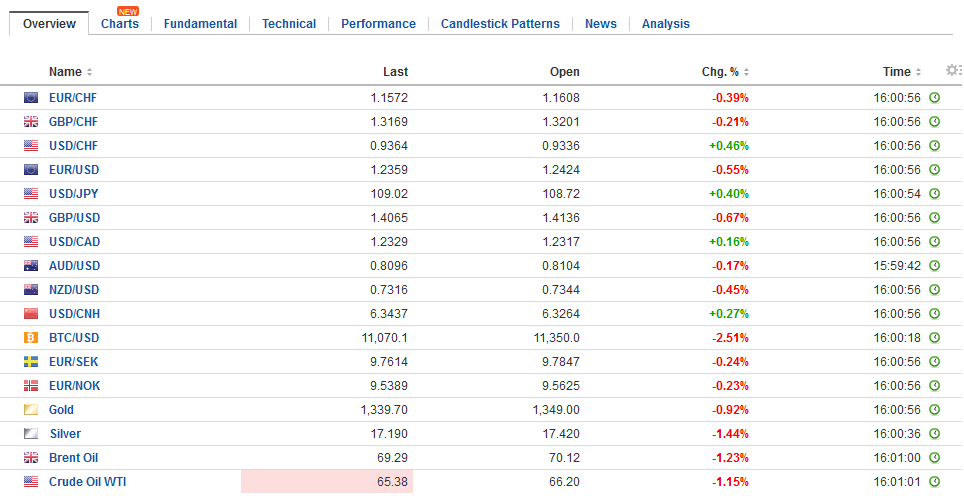

Swiss FrancThe Euro has fallen by 0.33% to 1.1559 CHF. |

EUR/CHF and USD/CHF, January 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

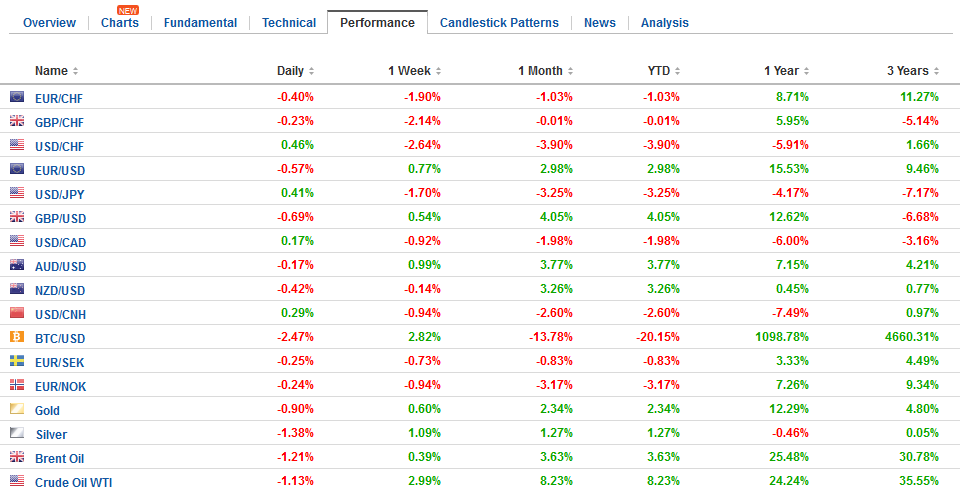

FX RatesThe US dollar is modestly firmer, but nothing to suggest a outright correction rather than consolidation. However, have a dramatic drop over the past month, much more than we think is justified by macroeconomic developments and interest rates, we think the dollar may have overshot. That said there does seem to be a change in the market’s reaction function. Consider that commments by ECB’s Knot urging asset purchases to end as soon as possible, allowing a rate hike in 2019. This may be the first time that a rate hike and 2019 were explicitly linked by an ECB official. At any other time in the past month, this would have sent the euro higher: not today. The fact of the matter is that the ECB just met and rejected Knot and other hawks arguement to give a date certain to end the purchases. It is strategically folly to pre-commit to stop the purchases when the said purchases have been linked to the central bank’s legal mandate to achieve the inflation target. It would make it more difficult to dip into the same tool kit again if necessary because the purhcases would be unanchored to the ECB’s mandate. This is a Trojan Horse. |

FX Daily Rates, January 29 |

| It is tactically naive to signal a precommitment to end the purchases in September. The anticipatory nature of investors and the discounting mechanism of the market would spur a sharp appreciation of the euro and higher interest rates, jeoparidizing the very conditions that facilitated the action in the first place.

There is talk that the Swiss National Bank intervened to weaken the franc. It may have, but the impact has been marginal at best. The franc is off about 0.55% at pixel time (~CHF0.9375), the most among the majors, but sterling, the second weakest is off 0.4% (~$1.4095). The US 10-year yield traded up to nearly 2.72%. It is the highest level since 2014. The US Treasury will anounce its quarterly refunding this week. The market appears to be building a concession ahead of what promises to be a large increase in coupon supply this year. The net supply of Treasuries will double this year to over $1 trillion. About a third or so will be bills, but this is not possible untile a resolution of the debt ceiling. At the same time, market-based measures inflation expectations are rising, and the Federal Reserve will be buying $420 bln few bonds this year than 2017. |

FX Performance, January 29 |

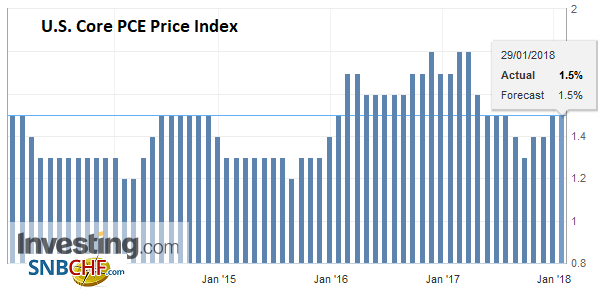

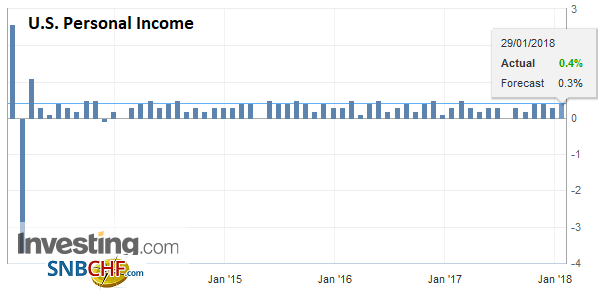

United StatesWhat promises to be an eventful week begins off slowly. The only economic data of note today is the US December personal income and consumption data. And even this is old news following the pre-weekend release of the first estimate of Q4 GDP. |

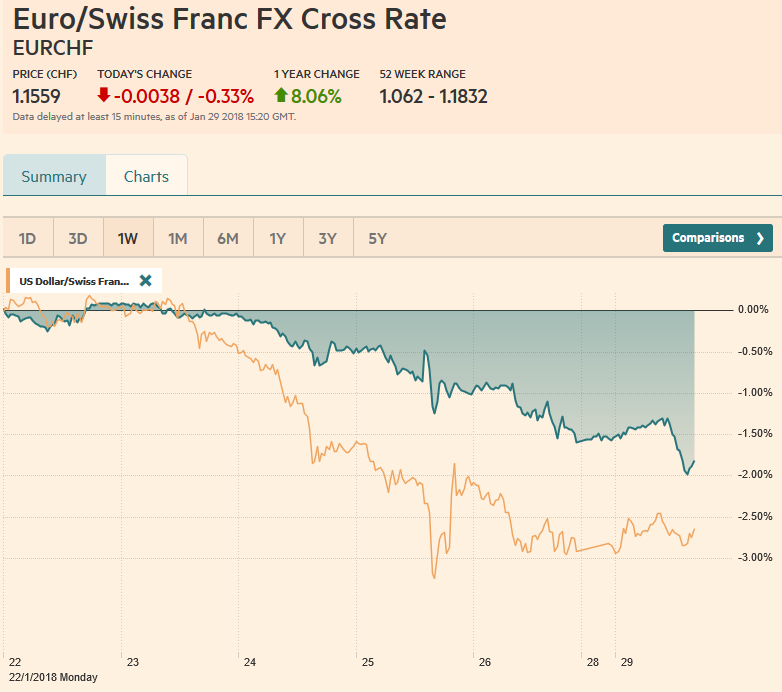

U.S. Core PCE Price Index YoY, Dec 2017 Source: Investing.com - Click to enlarge |

| The disappointing headline number concealed strong details, including the 4.3% rise in final domestic sales (which excludes net exports and inventories). The PCE deflator used for GDP calculations rose to 2.0%, but the monthly figure may stay at 1.5%. |

U.S. Personal Income, Dec 2017(see more posts on U.S. Personal Income, ) Source: Investing.com - Click to enlarge |

In the other US highlights this week, we expect a hawkish hold from the FOMC, where it will upgrade its economic and inflation assessments, may shift the balance of risks, while leaving rates steady at Yellen’s last meeting. Trump’s first State of the Union Address will naturally draw a great deal of attention, but the main new initiative that may be announced is the infrastruture program. We expect a largely self-congratulatory speech. US auto sales were slowing before the storms hit and destroyed more than 500k vehicles. The replacement masked the pullback from cyclical highs, which is likely to continue. The January employment report is at the end of the week and a recovery from the soft December headline is likely, while a 0.3% rise in hourly earnings would lift the year-over-year rate to 2.6% (from 2.5%).

The US tariffs levied on washing machines and solar panels have spurred much handwringing and chin wagging over the protectionism. There is a tendency to exaggerate. Bush put tariffs on steel that were later ruled illegal. Obama slapped duties on vehichle tires. Neither defected from trade. It is premature to conclude that Trump has done so. He may, but it should not be a foregone conclusion. Yes, he pulled out of TPP talks, but Clinton and Sanders were also opposed. His threat to pullout of NAFTA annd the free-trade agreement with Korea have thus far been negotiating tactics. Before the weekend, the US-based International Trade Commission found against Boeing in charges brought against Canada’s Bombardier.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$CHF,$EUR,$TLT,EUR/CHF,newslettersent,U.S. Core PCE Price Index (PCE Deflator),U.S. Personal Income,USD/CHF