Many investors are confused, and the official communication only fanned the confusion. Before turning to next week’s key events and data, let’s first spend some time, working through some of the confusion.

There was no change in policy last week. The US did not suddenly become protectionist. It did put tariffs on solar panels and washing machines. At the end of last week, unexpectedly the US International Trade Commission ruled against Boeing’s claims against Canada’s Bombardier. All US presidents in the modern era have fought against what it argues are other countries taking unfair trade advantage, and have levied tariffs on some products, or like the great free-trade advocate, Ronald Reagan used “voluntary export restrictions” and “orderly market agreements” to protect the American producers. Note too that the US wins most of the cases it brings to the WTO.

The tarriffs on solar panels and washing machines were narrowly based. They will be challenged at the WTO, where its largest trading partner, Canada has also challenged the longstanding practice of the US. There will likely be additional measures announced over the coming few months on steel, aluminum, and intellectual property. The best course for US trading partners is not to enter into a tit-for-tat trade war, but to use the international conflict resolution mechanisms that the US helped create in the first place.

The US did not abandon the “strong dollar policy” or begin a currency war. Not only did Mnuchin clarify his comments, but President Trump gave as near a full-throated endorsement of the strong dollar policy as imaginable. While Mnuchin’s remarks fueled criticism from other G7 officials, they did not retaliate by trying to talk down their own currencies. The much talked about “currency war” has not begun.

It seems rather obtuse more than two decades after Rubin first enunciated the strong dollar policy that some economists still try to link the policy to a certain exchange rate. These economists go on then to debate which interest groups, industries, and social classes are helped by a stronger exchange rate and which are hurt. This reflects a profound and dangerous misunderstanding.

The strong dollar policy was not about exchange rates, as paradoxically as that may sound. It was about the de-weaponization of the foreign exchange market. Recall that prior to 1995, the foreign exchange market was indeed an arena of rivalry between leading capitalist countries. After the collapse of Bretton Woods in 1971, there was a reluctance to simply let the market determine exchange rates. The 1985-1987 period was the heyday of G7 coordination in the foreign exchange market. And, even as late as 1995, US policymakers from time-to-time, would threaten to depreciate the dollar.

Rubin represented a break from this tradition. The strong dollar policy was the beginning of the de-weaponization of the foreign exchange market. In that little phrase, the US signaled it would no longer use the dollar to elicit policy concessions or reduce its debt burden. Mnuchin did not suggest otherwise. Now the G7 and the G20 have endorsed this principle, which briefly stated is that foreign exchange rates ought to be set by the market.

However, many investors are indeed concerned that the US is defecting from the evolving international order that Trump’s predecessors were instrumental in building. The “America First” espoused by the President plays into precisely these fears, and its origin was shortly after the US Congress rejected Wilson’s League of Nations proposal. It is not clear how there fears will be alleivated before the next presidential election in 2020, but a shift in control of the legislative branch in November could help convince others of the resiliency we have identified. Trump’s so-called disruptions could be limited to tactical changes rather than a strategic reversal of the thrust of US policy since the end of WWII.

The ECB did not change its policy one iota. Asset purchases at the rate of 30 bln a month will continue at least through September, and the link to the development of price pressures was maintained. The hawks, who advocate setting a terminal date for the purchases, do not represent a majority. Growth is strong, and price pressures still need the extraordinary monetary support, which extends beyond the asset purchases.

Draghi sounded as optimistic as ever about the economy. Given the euro’s appreciation since the December ECB meeting and the questions from the reporters, there was no doubt that Draghi would address it. He did not push as hard as some would have expected about the euro’s strength, which he attributed to the strength of the regional economy and to Mnuchin’s comments (without citing Mnuchin by name). Given the magnitude of the euro’s rise before Mnuchin’s comments, it would seem Draghi was putting more weight on the former (macroeconomic considerations) than the latter (comments that appeared to violate the rules of engagement).

Likewise, at Davos, BOJ Governor Kuroda did not announce a shift in Japan’s monetary policy. What drew a sharp market reaction was Kuroda’s comment that it was finally getting close to its inflation target and that wages were beginning to rise. The BOJ targets core CPI, which excludes fresh food, at 2%. Several hours before Kuroda spoke, Japan reported that the December core CPI rose 0.9%, the same as in November. In December 2016, it stood at minus 0.2%.

Kuroda suggested wages might have begun rising in Japan. This could be true, but the aggregate data on labor cash earnings does not show it. The 2017 year’s average year-over-year rate is 0.4%. The 2016 average was 0.5%. In 2015, the average was 0.2%. There does seem to be something happening though. Hourly cash earnings of non-regular workers have accelerated while regular workers continue to experience weaker earnings growth.

Kuroda was explaining to an international audience that its Qualitative and Quantitative Easing and Yield Curve Control strategies were yielding desirable results. He indicated a few days earlier in favor of patience and perseverance. Just as it is showing results is not the time to abandon the course. Nothing Kuroda said suggests that investors should change their views on the trajectory of BOJ policy.

Thus far, Japanese bond yields have withstood the rise in other G7 countries yields. For example, over the past three months, as US and German 10-year yields have risen by roughly 25 bp, the yield on the 10-year JGB has risen 0.3 bp. At the short-end of the coupon curve, Japan’s yields even more resilient. The US two-year yield has risen 53 bp over the past three months and the German yield is up 21 bp. The two-year JGB yield is up almost three basis points.

Markets may be like a radio. Sometimes there is noise. Sometimes there is a signal-music. Reasonable people may differ what is the signal or music and what is noise. The idea that the US, the ECB or Japan announced a change in policy last week strikes us as noise and more a function of investor psychology and angst, and uncertainty surrounding the timing of ECB and BOJ exits in the face of among the most robust economic expansions in more than a decade. Market positioning and sentiment seems extremely dollar negative, though according to the OECD’s PPP models, most major currencies are overvalued against the dollar, except the yen (~8.3% undervalued) and euro (~6.9% undervalued). Sterling is nearly fairly valued (~-0.65% undervalued).

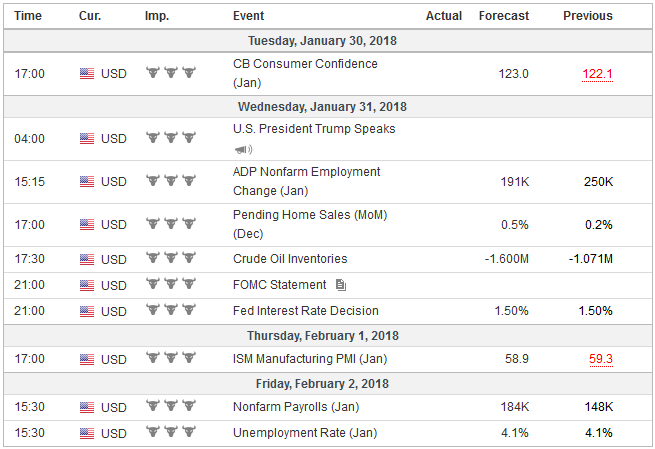

United StatesIn addition to the US jobs data at the end of the week, there are two other events that are important for investors, without discussing Trump’s first State of the Union Address. In fact, Trump will deliver the State of the Union Address a few hours after Yellen chairs her last FOMC meeting. The market understands that there is practically no chance of a rate hike. However, a hawkish hold is the most likely outcome. Growth impulses are stronger, even though Q4 GDP disappointed. The part of the economy that is the most responsive to monetary policy, final domestic purchases rose by a robust 4.8%. Inflation and market-based measures of inflation expectation have risen. In the first look at Q4 GDP, the core PCE deflator rose from 1.3% to 1.9%. The 10-year breakeven rate (the difference between the yield of the conventional 10-year note and the 10-year TIPS) has risen by about 20 bp since the December FOMC meeting and at nearly 2.10%, where it finished last week, it is at three-year highs. The US Treasury will announce the details of the quarterly refunding. This is important because investors have already been put on notice that the size of the coupon offerings will increase. Many participants still not appear to appreciate that the government’s net issuance this year will be around twice last year’s $550 bln. Around a third or so will be T-bills, but this cannot happen until the debt ceiling resolved. Coupon issuance is going to rise as the Federal Reserve increasingly withdraws from buying (at a rate of $60 bln in Q1 18, $90 bln in Q2, $120 bln in Q3, reaching a terminal velocity of $150 bln in Q4 18). The US non-farm payrolls are likely to bounce back from the weather-induced weakness in December. The median estimate is around 180k after December 148k increase. The US averaged 171k net new jobs a month last year, down from 187k average in 2016 and 226k in 2015. The point is US jobs growth is doing fine, but it is well past the cyclical peak. Auto sales, which will be reported also seem to be past their cyclical peak, but were re-energized last year replacements are devastating storms The focus has turned to average hourly earnings growth. Currently, it is seen in the context of the outlook for core inflation, but it is also an important driver or income and consumption. Average hourly earnings have risen at an average monthly pace of 0.2% in every year since 2010. The average for the last three months of 2017 slipped to a 0.1% pace. However, average hourly earnings rose 0.3% in December and are forecast to have matched that in January. The year-over-year pace slowed to 2.5% in December 2017 compared with 2.9% in December 2016. A 0.3% increase in December will lift the pace to 2.6%. |

Economic Events: United States, Week January 29 |

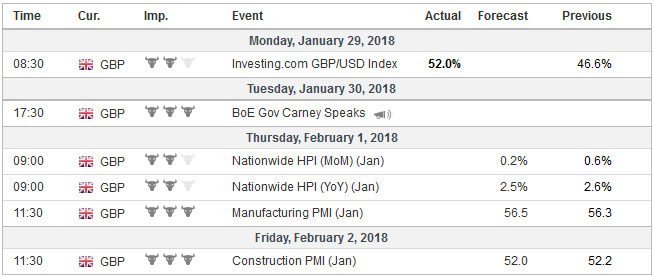

United KingdomThere are two eurozone economic reports that will draw attention. First, following the UK and US, the first estimate of Q4 GDP will be reported. The median in the Bloomberg survey looks for a 0.6% pace, the same as in Q3. The risk lies to the upside, given what appears to have been a broadening of the expansion. |

Economic Events: United Kingdom, Week January 29 |

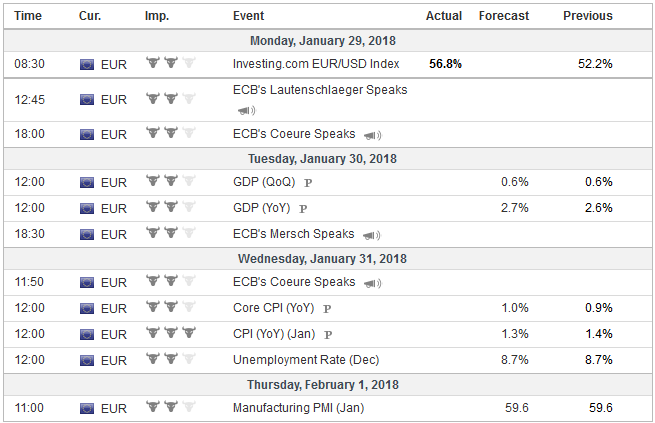

EurozoneSecond, and more important for monetary policy is the preliminary estimate of January CPI. Most economists are looking for the headline rate to slip to 1.3% from 1.4%, while the core rate ticks up to 1.0% from 0.9%. The change is in the opposite direction on what one would expect if the price of oil increase was not fully offset by the euro’s appreciation. Given market positioning and sentiment, disappointment with a core rate miss may spur a greater market reaction than an upside surprise on the headline rate. |

Economic Events: Eurozone, Week January 29 |

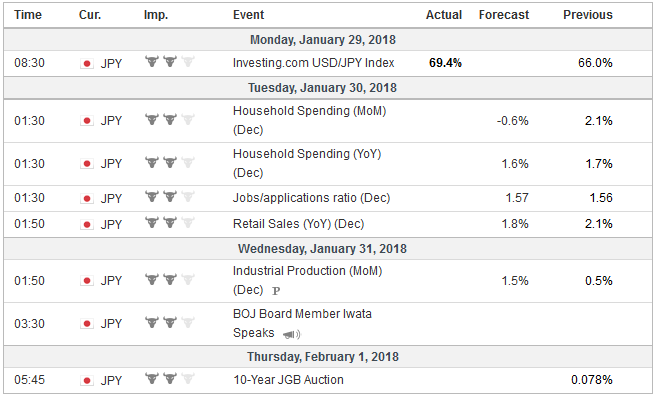

JapanLastly, Japan reports economic data almost every day next week. These include jobs, household spending, retail sales, industrial production, auto production and sales, manufacturing PMI, and construction orders and housing starts. The key takeaway is that the Japanese economy is continuing its expansion. It is, for the time being, a virtuous cycle of stronger exports spurring capex and output, which boosts the demand for labor, and now consumption. A homegrown threat on the horizon is the sales tax increase planned for October 2019. |

Economic Events: Japan, Week January 29 |

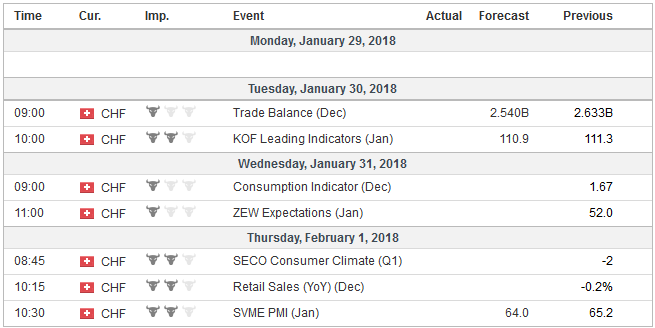

Switzerland |

Economic Events: Switzerland, Week January 29 |

Tags: #USD,$EUR,$JPY,newslettersent