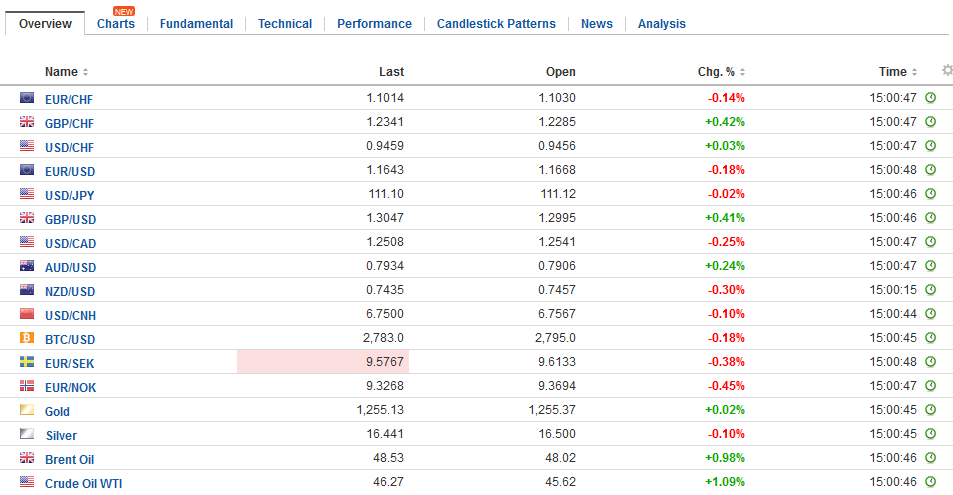

Swiss FrancThe Euro has fallen by 0.17% to 1.1009 CHF. |

EUR/CHF and USD/CHF, July 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

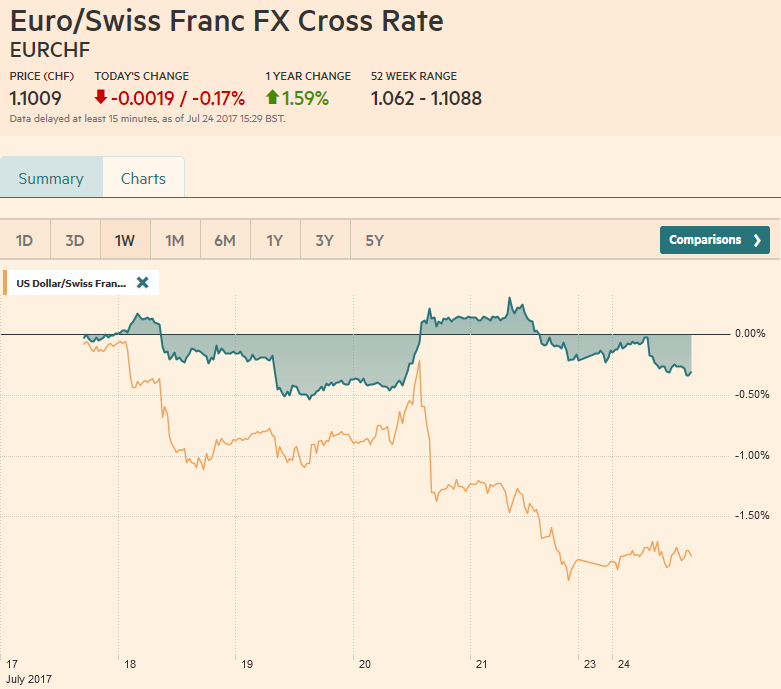

FX RatesThe euro made a marginal new high in early Asia, but participants rightly drew cautious ahead of the flash eurozone PMI. The flash PMI was softer than expected, and although the composite fell to six monthly lows, it is more a reflection of how steady it has been at elevated levels. At the same time, it is consistent with one of our contentions; namely that the economic momentum that was so apparent in the first half is no longer accelerating. The euro was sold for half a cent before finding a solid bid near $1.1630. The pre-weekend low was about $1.1620. Recall that initially in response to the ECB meeting, the euro initially fell to $1.1480 on July 20 before recovering smartly to almost $1.1680. To keep today’s pullback in perspective, note that it managed to simply push the euro back below the upper Bollinger Band (~$1.1650). Softer global bond yields may be helping bolster the yen. European core 10-year yields are off nearly two basis points, while periphery yields are off 2-4 bp, though Spanish bonds are under performing. US 10-year yields are off a single basis point in the European morning. |

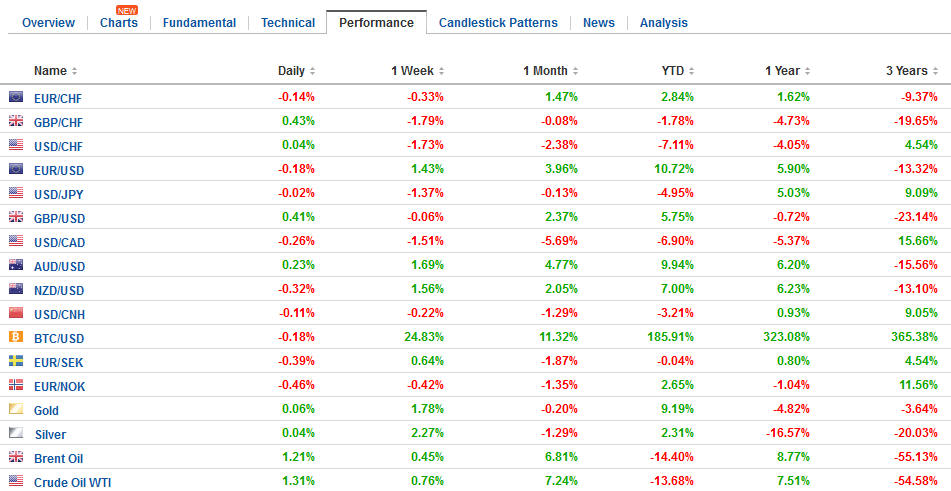

FX Daily Rates, July 24 |

| Asian equities extended their rally, while European shares are heavier for the third consecutive session. The MSCI Asia Pacific Index extended its rally to the 11th session with its minor 0.15% gain. Japan and Australian markets kept the index in check, while Chinese shares advanced. The Shanghai Composite rose 0.4% and has risen in four of the last five sessions, and over the five sessions, it is among the strongest in the region.

European equity markets are being weighed down by consumer discretionary, energy and utilities. All the major sectors are lower, though industrials and financials are faring best. Many asset managers have been attracted to European stocks on valuation grounds, and have also liked the tailwind offered by the euro. However, as we have noted US shares have outperformed since the start of May, and today’s decline has brought the Dow Jones Stoxx 600 to its lowest level since late April. Recall that in response to Macron’s first round victory in France in late April, equity markets gapped higher. The DAX has entered the gap at the end of last week and continued to close it today, but it extends to about 12091, another 50 points or so below. France’s CAC has spent the better part of the past six weeks in the gap, which extends to 5081.6. |

FX Performance, July 24 |

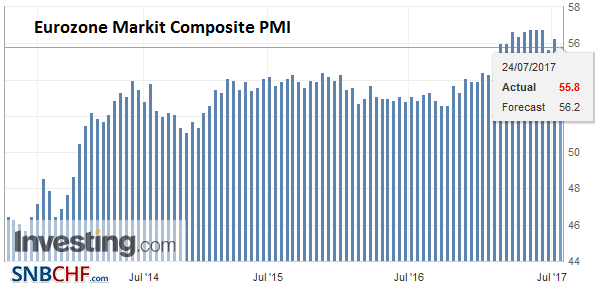

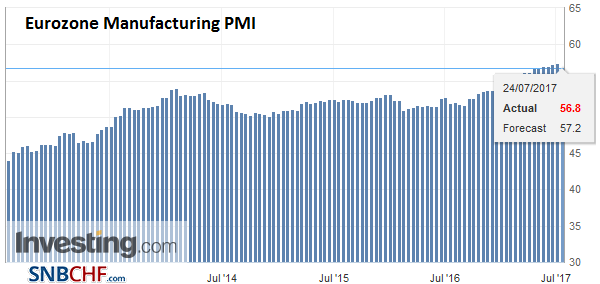

EurozoneThe eurozone composite flash PMI eased to 55.8 from 56.3. Economists expected a softer number, but the slippage was more than expected. It was a function of the manufacturing sector. |

Eurozone Markit Composite PMI, July 2017 (flash)(see more posts on Eurozone Markit Composite PMI, ) Source: Investing.com - Click to enlarge |

| The manufacturing PMI eased to 56.8 from 57.4. |

Eurozone Manufacturing PMI, July 2017 (flash)(see more posts on Eurozone Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

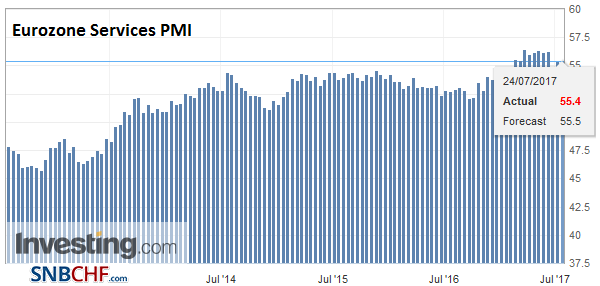

| Services were unchanged at 55.4. Of note on the aggregate level, manufacturing costs appear to have begun slowing, while new orders and employment remains firm. |

Eurozone Services PMI, July 2017 (flash)(see more posts on Eurozone Services PMI, ) Source: Investing.com - Click to enlarge |

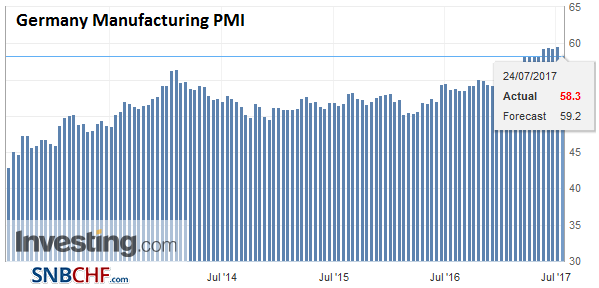

GermanyIn Germany, both service and manufacturing readings fell and by more than expected. The manufacturing PMI slipped to 58.3 from 59.6. |

Germany Manufacturing PMI, July 2017 (flash)(see more posts on Germany Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

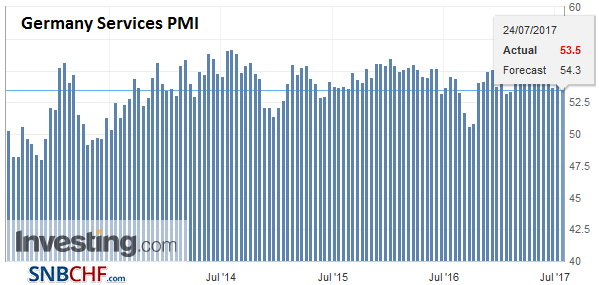

| Services PMI eased to 53.5 from 54.0. |

Germany Services PMI, July 2017 (flash)(see more posts on Germany Services PMI, ) Source: Investing.com - Click to enlarge |

| The composite PMI fell to 55.1 from 56.4, which is the lowest since January. The manufacturing reading is three-month low. |

Germany Composite PMI, July 2017 (flash)(see more posts on Germany Composite PMI, ) Source: Investing.com - Click to enlarge |

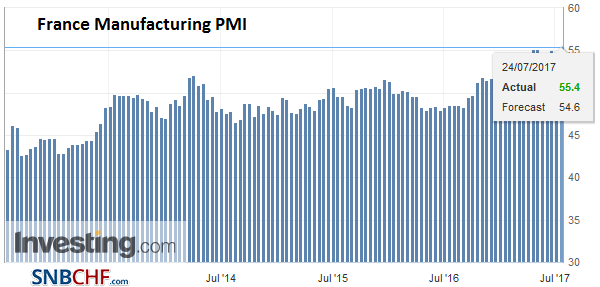

FranceFrench manufacturing fared better than in Germany, rising to 55.4 from 54.8. This is a new six-year high. |

France Manufacturing PMI, July 2017 (flash)(see more posts on France Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

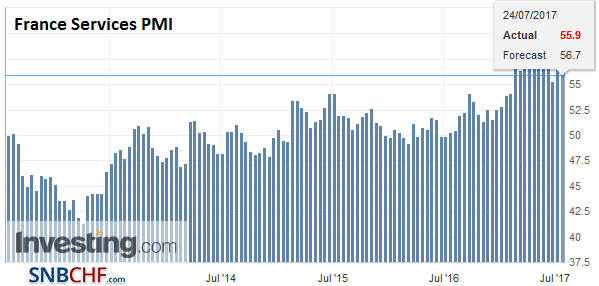

| Services disappointed, at 55.9 from 56.9. That puts the composite at 55.7, which is also a six-month low. The composite in June stood at 56.6. |

France Services PMI, July 2017 (flash)(see more posts on France Services PMI, ) Source: Investing.com - Click to enlarge |

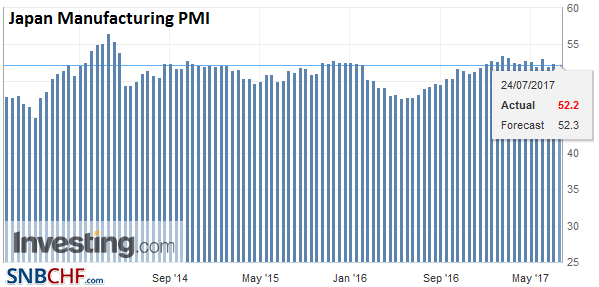

JapanEarlier, Japan reported that its preliminary manufacturing PMI also ticked down in July to 52.2 from 52.4. Nevertheless, the yen remains firm. It is extending its gains against the dollar for the fifth consecutive session. In Asia, the dollar was sold through the JPY111 area, which corresponds to 1 61.8% retrenchment of the dollar’s gains since the Fed hiked last month. European dealers took the dollar to almost JPY110.60. Only a move now above JPY111.20 would deter the market from pushing the dollar closer to JPY110, where a more important psychological test would be in store. |

Japan Manufacturing PMI, July 2017 (flash)(see more posts on Japan Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

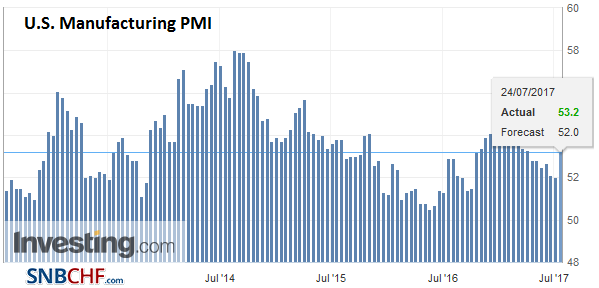

United StatesThis is a big week for the US. The first part of the week may be dominated by political issues. President Trumps’ son-in-law and adviser Kushner is to testify before the Senate Intelligence Committee. Several meetings with Russians apparently were not included in initial declarations. |

U.S. Manufacturing PMI, July 2017 (flash)(see more posts on U.S. Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

| An early campaign manager (Manafort) will testify to the same committee later in the week. Meanwhile, the Senate’s leadership may force a procedural vote on repealing the Affordable Care Act. |

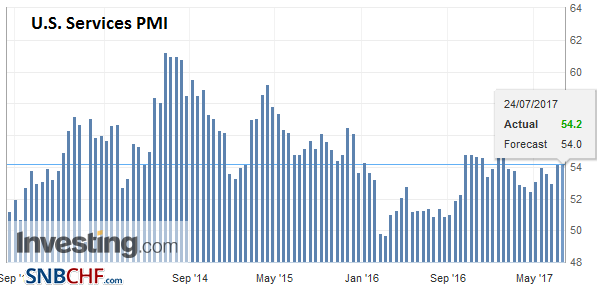

U.S. Services PMI, July 2017 (flash)(see more posts on U.S. Services PMI, ) Source: Investing.com - Click to enlarge |

| Wednesday is the conclusion of the FOMC meeting, and at the end of the week, the US reports its initial estimate of Q2 GDP. Also, the Q2 earnings season begins in earnest with nearly 20% of the S&P 500 companies reporting. |

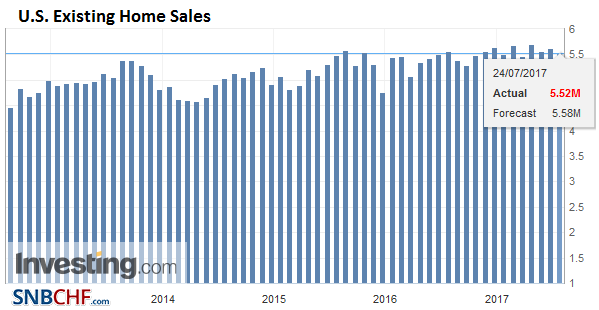

U.S. Existing Home Sales, June 2017(see more posts on U.S. Existing Home Sales, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$EUR,$JPY,EUR/CHF,Eurozone Manufacturing PMI,Eurozone Markit Composite PMI,Eurozone Services PMI,France Manufacturing PMI,France Services PMI,Germany,Germany Composite PMI,Germany Manufacturing PMI,Germany Services PMI,Japan Manufacturing PMI,newslettersent,U.S. Existing Home Sales,U.S. Manufacturing PMI,U.S. Services PMI,USD/CHF