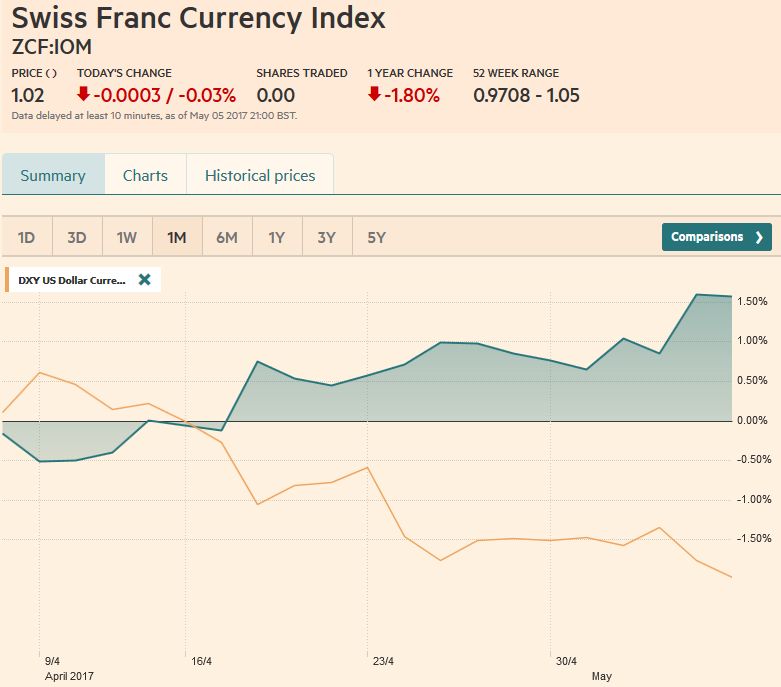

Swiss Franc Currency IndexThe Swiss Franc index gained 1.5% in the last month, the biggest part of it is from the last week. |

Trade-weighted index Swiss Franc, May 06(see more posts on Swiss Franc Index, ) Source: markets.ft.com - Click to enlarge |

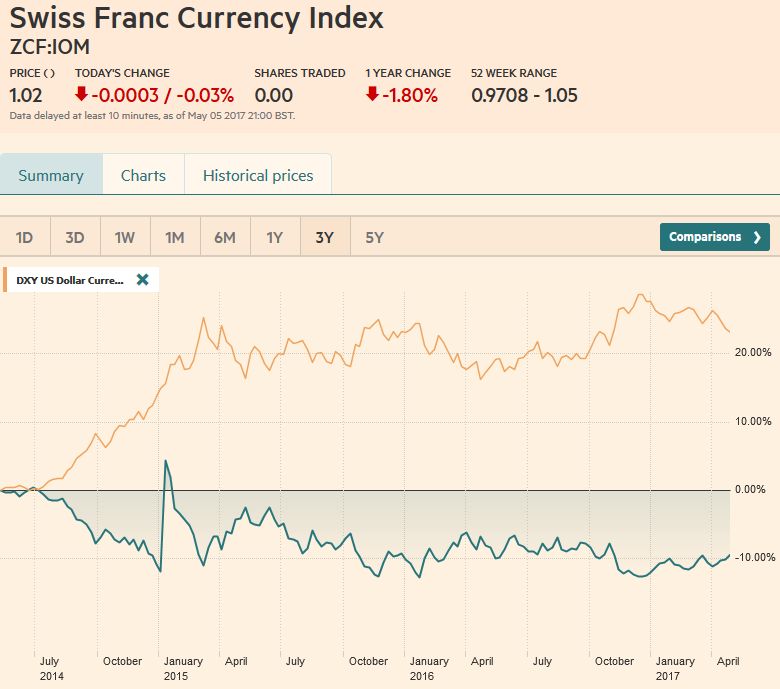

Swiss Franc Currency Index (3 years)The Swiss Franc index is the trade-weighted currency performance (see the currency basket)On a three years interval, the Swiss Franc had a weak performance. The dollar index was far stronger. The dollar makes up 33% of the SNB portfolio and 25% of Swiss exports (incl. countries like China or Arab countries that use the dollar for exchanges). Contrary to popular believe, the CHF index gained only 1.73% in 2015. It lost 9.52% in 2014, when the dollar (and yuan) strongly improved. |

Swiss Franc Currency Index (3 years), May 06(see more posts on Swiss Franc Index, ) Source: Markets.ft.com - Click to enlarge |

USD/CHFIt is difficult to talk about a weak US dollar when in recent days it has made new six-week highs against the yen, 14 month highs against the Canadian dollar, four-month highs against the Australian dollar, and five-month highs against the New Zealand dollar. It is at three-week highs against the Chinese yuan and near the upper end of its two-month range against the Mexican peso. But the dollar lost against both Swiss Franc and Euro that were the major outformers. Seasonal pattern indicate that the months of May and June are good for the European currencies during the initial “Sell in May” months, when investors often sell US stocks. The dollar is typically strong in the winter months together with rising stock markets. While the yen (and also the franc) are strong in weakest months of the stock market in August and September.

|

US Dollar/Swiss Franc FX Spot Rate, May 06(see more posts on USD/CHF, ) Source: markets.ft.com - Click to enlarge |

US Dollar IndexThe trade-weighted indices the Fed tracks are updated monthly. The Bank of England calculates the effective exchange rate on a daily basis. It has not fallen since April 24. Last week was the third consecutive weekly gain and fifth in the past six weeks. What appears to be happening is an adjustment From around the middle of March through the middle of April the euro sheds 6.6% against the yen. Since April 15, the euro has rallied 7.6% back. The euro fell to five-month lows in the middle of April and now is near its best levels of the year, which itself was the highest since last May-June. The Dollar Index is not a trade-weighted measure of the dollar. It is, as we have noted, heavily weighted toward Europe, and two of the US largest trading partners, Mexico and China, are not even included. The gap created by the sharply lower opening on April 24 remains unfilled. The gap was entered, but not closed, and the Dollar Index retreated to the lower end of its two-week range. The MACDs and Slow Stochastics are about to turn higher. Still, the near-term risk may extend toward 9785, which is the 50% retracement of the rally since last May’s low 91.90. A move back above 99.30 may be constructive (~ 200-day moving average, and 38.2% retracement), but the top of the gap is 99.65.

|

US Dollar Currency Index, May 06(see more posts on U.S. Dollar Index, ) Source: markets.ft.com - Click to enlarge |

EUR/USDThe euro has risen for four consecutive weeks to approach an important technical area. The $1.0980 area is the 50% retracement of the decline from last year’s high, which was set in early May a little above $1.16. For the record, the 61.8% retracement is found near $1.1130. Second, downtrend line is drawn off that May 2106 high and the spike from the US election. It comes into near $1.1010 early next week, falling about two ticks (one-hundredths of a penny). If it is a measuring gap, which takes place half way through a move, then the price objective would also be near $1.10. The technical indicators are stretched, but only the Slow Stochastic is set to move lower. The MACDs are consistent with additional gains. The RSI is firm but below the high from the end of last month.

|

EUR/USD with Technical Indicators, May 06(see more posts on Bollinger Bands, EUR/USD, MACDs Moving Average, RSI Relative Strength, Stochastics, ) |

USD/JPYThe dollar has advanced against the yen for three consecutive weeks. Since April 14 low near JPY108, the greenback rallied 4.6% to test JPY 113.00. The JPY112.70 area corresponds with the 61.8% retracement of this year’s decline. The measuring objective of the bottom pattern that the dollar carved would be back toward the mid-March high near JPY115.50. Still, the RSI is getting stretched; the Slow Stochastic is poised to cross down, while the MACDs are trending higher. Former resistance, near JPY112, should now offer support. |

USD/JPY with Technical Indicators, May 06(see more posts on Bollinger Bands, MACDs Moving Average, RSI Relative Strength, Stochastics, USD/JPY, ) |

GBP/USDSterling has gained against the dollar for four weeks and seven of the past eight weeks. The Slow Stochastics and MACDs are about to turn lower, though the price action still looks constructive. The $1.30 area remains within spitting distance, and the $1.3055 is the 38.2% Of note, the 50-day average is poised to move above the 200-day average. Technicians refer to this as the “Golden Cross” or “Dead Man’s Cross ( I suppose depending which side you are on).

|

GBP/USD with Technical Indicators, May 06(see more posts on Bollinger Bands, GBP/USD, MACDs Moving Average, RSI Relative Strength, Stochastics, ) |

AUD/USDWeak metal prices and slowing of China’s PMIs may have encouraged the push down in the Australia dollar through $0.7400 to its lowest level since mid-January. This area also corresponds to the 61.8% retracement of the Australian dollar’s gains since the start of the year. Still, with a recovery in copper prices and oil in the North American session, the Aussie managed to claw back above $0.7400. Resistance is pegged in the $0.7440-$0.7460 area. |

AUD/USD with Technical Indicators, May 06(see more posts on Australian Dollar, Bollinger Bands, MACDs Moving Average, RSI Relative Strength, Stochastics, ) |

USD/CADThe US dollar posted a key reversal against the Canadian dollar. The greenback made new highs since February 2016 after the employment data, but then was sold off and closed below the previous day’s lows. The first target is near CAD1.3650 and then CAD1.3575. The RSI has turned lower. The Slow Stochastics are set to do so, while the MACD’s are leveling out. On the upside the dollar stalled in front of CAD1.38, while the CAD1.3840 is a 61.8% retracement of the greenback’s slide since February 2016 high near CAD1.47. |

USD/CAD with Technical Indicators, May 06(see more posts on Bollinger Bands, Canadian Dollar, MACDs Moving Average, RSI Relative Strength, Stochastics, ) |

Crude Oil

Selling pressure on the June light sweet oil futures contract reached a crescendo before the weekend when prices slumped to the lowest level since April 2016 near $43.75. The contract rebounded smartly reaching almost $46.70. This essentially fulfilled a 50% retracement objective of the last leg down in oil prices that began on April 28 just shy of the $50 a barrel level. Above there, $47.50 is the 61.8% retracement, and the $47.75 is a 38.2% retracement of the decline since the April 12 high above $54. The $49-$50 area may offer a more formidable hurdle. The speed of the recovery before the weekend warns of potential bullish divergences with the technical indicators, which did not confirm the new lows. The RSI turned up, and the Slow Stochastics are set to turn. MACDs are lagging. |

Crude Oil, May 2016 - May 2017(see more posts on Crude Oil, ) Source: bloomberg.com - Click to enlarge |

U.S. TreasuriesThe US 10-year yield rose for the third consecutive week. The yield has risen from 2.16% on April 18 to almost 2.38% after the April jobs data. The 2.40% area is the next threshold. It is the halfway point of the decline since the March 14 peak (~2.63%). Better retail sales and an increase in CPI could help underpin yields. The June note futures pushed through the 38.2% retracement of its rally since the day before the March FOMC meeting (~125-03) and stopped shy of the 50% retracement (seen near 124-20). The technical indicators are mixed. The MACDs are headed lower, but the Slow Stochastics appear to be |

Yield US Treasuries 10 years, May 2016 - May 2017(see more posts on U.S. Treasuries, ) Source: bloomberg.com - Click to enlarge |

S&P 500 IndexThe S&P 500 eked out a small gain on the week, which was sufficient to extend the advancing streak for the third week, and set a marginal new record high. A break of 2380 would be significant and would point to a near-term top being in place. On the downside, the gaps left from higher opening on April 24 and April 25 may draw prices. The gaps are found roughly between 2356.2 and 2369.20 and 2377 and 2381. The Slow Stochastics and MACDs are rolling over. The VIX briefly fell below 10.0% on May 1 to record its lowest level since before the Great Financial Crisis. |

S&P 500 Index, May 06(see more posts on S&P 500 Index, ) Source: markets.ft.com - Click to enlarge |

Are you the author? Previous post See more for Next post

Tags: Australian Dollar,Bollinger Bands,British Pound,Canadian Dollar,Crude Oil,EUR/CHF,EUR/USD,Euro,Euro Dollar,GBP/USD,Japanese yen,MACDs Moving Average,newslettersent,RSI Relative Strength,S&P 500 Index,Stochastics,Swiss Franc Index,U.S. Dollar Index,U.S. Treasuries,usd-jpy,USD/CHF,USD/JPY