Swiss Franc Currency IndexThe Franc index lost considerably in the last week, in particularly in comparison to the dollar index. Reason was the exceptionally strong U.S. ISM Non-Manufacturing Index. Marc Chandler speaks about the jobs report that is rather a lagging indicator, but I like to focus on the leading index., the ISM.

|

Trade-weighted index Swiss Franc 1 Month(see more posts on Swiss Franc Index, ) |

|

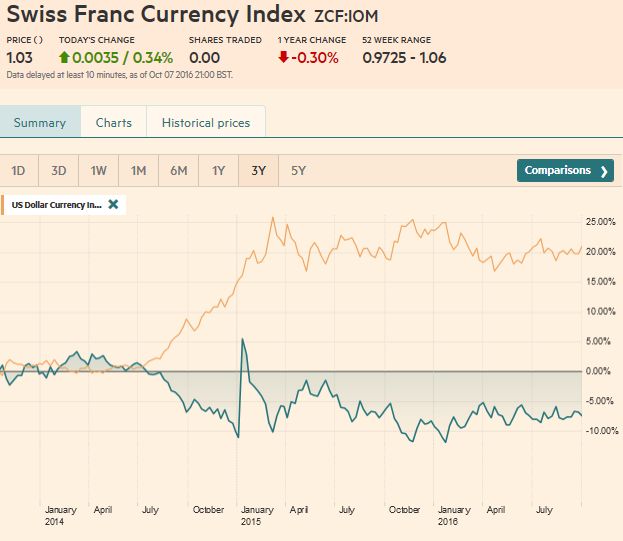

Swiss Franc Currency Index (3 years)The Swiss Franc index is the trade-weighted currency performance (see the currency basket)On a three years interval, the Swiss Franc had a weak performance. The dollar index was far stronger. The dollar makes up 33% of the SNB portfolio and 25% of Swiss exports (incl. countries like China or Arab countries that use the dollar for exchanges). Contrary to popular believe, the CHF index gained only 1.73% in 2015. It lost 9.52% in 2014, when the dollar (and yuan) strongly improved.

|

Swiss Franc Currency Index(see more posts on Swiss Franc Index, ) |

USD/CHF

|

US Dollar - Swiss Franc FX Spot Rate(see more posts on USD/CHF, ) |

US Dollar IndexBefore the jobs report, the Dollar Index

rose to almost 97.20, the highest since late-July. Note that the top of the Bollinger Band was near 96.55. The jobs data sent the Dollar Index to 96.40. That met the 38.2% retracement objective (~96.50) of the rally from the September 30 low near 95.35. The 50% retracement is at 96.25 (which corresponds to the five-day moving average). The 61.8% retracement is 96.05.

|

US Dollar Currency Index(see more posts on Dollar Index, ) |

EUR/USDThe euro had fallen to two-month lows near Those extremes, $1.11 on the downside and $1.1250 may denote the range for period ahead. We expect policy for the ECB and the Federal Reserve are on hold until December. |

Euro/US Dollar FX Spot Rate(see more posts on EUR/USD, ) |

USD/JPYThe dollar’s eight-session advance against the yen ended

|

US Dollar Japanese Yen FX Spot Rate(see more posts on USD/JPY, ) |

GBP/USDSterling collapsed before the weekend but managed to recover toward $1.25. After losing 1.25% in the month of September, sterling depreciated by 4% last week, The risks of a hard exit from the EU, which has come to mean the lack of free access to the single market in exchange for more controls over immigration, have risen, but that does not explain what was as much as a 10% move in few minutes. The drop was not as large as the one that took place in the immediate response to the referendum, but there are few precedents of such a large move without a clear precipitating factor. Our usual technical tools may be of little help, but we suspect

|

UK Pound Sterling / US Dollar FX Spot Rate(see more posts on British Pound, ) |

AUD/USDThe Australian dollar’s technical tone has softened, with the RSI and MACDs moving lower. The five-day moving average could slip below the 20-day average next week. The $0.7700 area has proved to be a formidable cap. The third test in three months failed to break the ceiling. A retracement objective near $0.7570 has been frayed but not convincingly violated. Even then, a break of $0.7540 may be needed to signal a retest on the early-September lows a cent lower.

|

AUD/USD FX Rate Chart(see more posts on Australian Dollar, ) |

USD/CADThe Canadian jobs report was better than the US, but the rate differential story still is operative, and that, arguably, helped keep the US dollar well supported. The US dollar closed the week recording four consecutive sessions of higher lows and higher highs. The greenback is testing the CAD1.33 level. It marks a 38.2% retracement of the dollar’s sell-off since approaching CAD1.47 at the end of January. It has not been above there since early-March. A move above there would bring the next objective (~CAD1.3575) into view. A shelf appears carved near CAD1.30.

|

USD/CAD FX Rate Chart(see more posts on Canadian Dollar, ) |

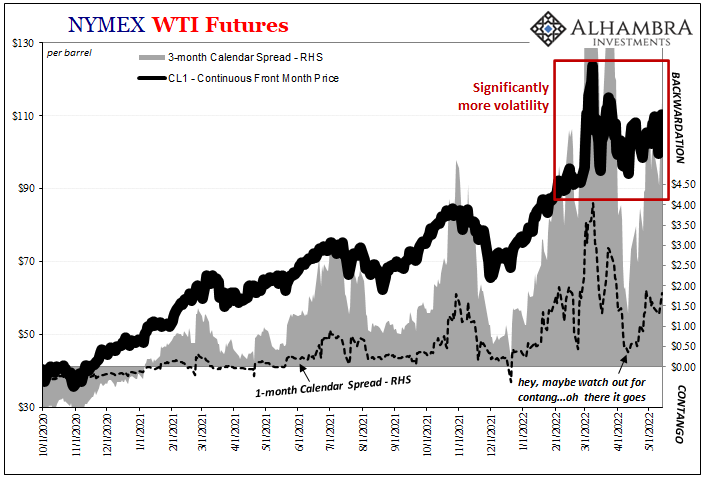

Crude Oil

|

Crude Oil Chart(see more posts on Crude Oil, ) |

U.S. TreasuriesOur fundamental work has shown that the foreign exchange market appears to have become more sensitive to interest rate developments. US interest rates had risen ahead of the jobs report, and whatever disappointment there was with the data, interest rates did not pullback. The US 10-year yield is near a four-month high 1.75%, having risen for six consecutive sessions. The 2-year yield has a We expect a consolidative period. |

Yield US Treasuries 10 years(see more posts on U.S. Treasuries, ) |

S&P 500 Index

|

S&P 500 Index(see more posts on S&P 500 Index, ) |

Are you the author? Previous post See more for Next post

Tags: Australian Dollar,British Pound,Canadian Dollar,Crude Oil,Dollar Index,EUR/CHF,EUR/USD,Euro,Japanese yen,MACDs Moving Average,newslettersent,S&P 500 Index,Swiss Franc Index,U.S. Treasuries,usd-jpy,USD/CHF,USD/JPY