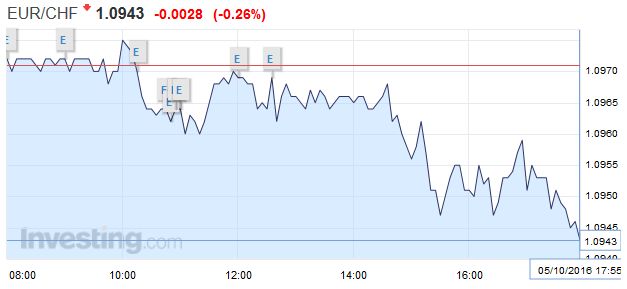

Swiss FrancAfter the sudden rise to 1.0973 the EUR/CHF is falling again. The volatiliy is related to the CHF speculative postion, that suddenly was Short CHF. |

EUR/CHF - Euro Swiss Franc, October 05 2016 |

Federal ReserveWhile the markets can be an incredibly efficient discounting mechanism, it sometimes is also an echo chamber. What began off as a Bloomberg report indicated that there was an agreement at the ECB that when it decided to end its asset purchases, it would gradually taper back rather than come to a fast stop, by the end of the day, it had become the as Market Watch put it “… ECB could end quantitative easing efforts sooner than it had planned.” Today the echo reverberates back to Bloomberg, where one report explains the weakness in equities saying that “Bloomberg reported that an informal consensus was building in the ECB to rein in quantitative easing…” Moreover, the report leaves out the denial by the ECB spokesperson. |

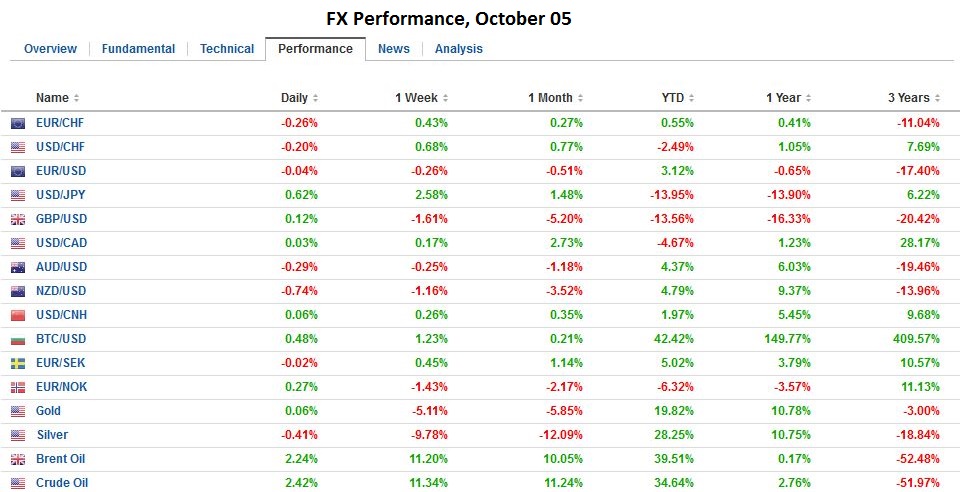

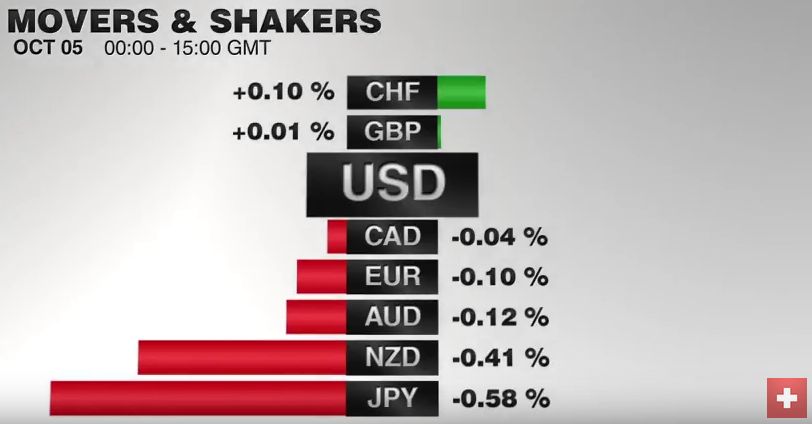

FX Performance, October 05 2016 Movers and Shakers Source Dukascopy - Click to enlarge |

| By itself, the Bloomberg story itself told us little new. ECB President Draghi had already indicated that there would not be an abrupt end to the purchases when that day arrives. The original Bloomberg story explicitly noted that before tapering, that the current asset program could be extended. The Bloomberg story essentially confirmed that there was a consensus behind Draghi’s remark and that the quantum of 10 bln euros means that it will take most of a year to wind down the purchases. | |

| At the last press conference, Draghi was specifically asked about issues about extending the purchases beyond March 2017, or the decision-making process, as the capital key, was not discussed. Some may be more cynical, but there is good reason to accept Draghi at face value. The decision on asset purchases need not be made until December. If this is true, then there is no point in talking about it as the full set of information is not available.

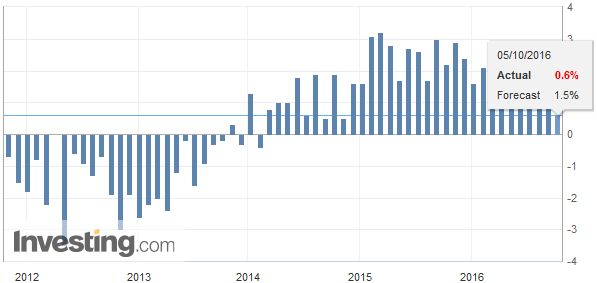

The dollar marginally extended yesterday’s gains against the yen, which we note, violated a downtrend line going back to late-May. The greenback is toying with JPY103.00. The next immediate target we suggested was the mid-September high near JPY103.35. The high from earlier in September was a little above JPY104.30. The Swedish krona is the strongest of the major currencies with a 0.4% gain against the dollar and 0.2% against the euro. These gains come despite the dramatic plunge in August industrial production and orders. Industrial output collapsed 4.1%. It is the fifth drop in six months and the largest since July 2015. Industrial orders fell 9.8% in August, offsetting the 1.1% rise in June and 5.1% gain in July. |

|

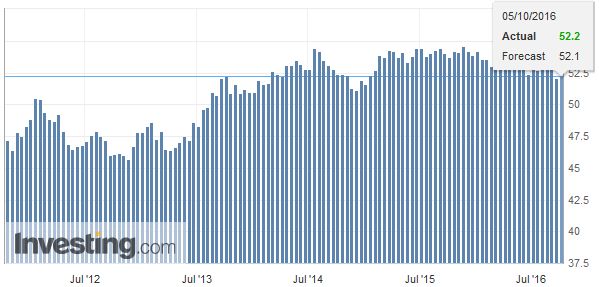

EurozoneThe euro is consolidating yesterday’s recovery. It is trading in about a quarter cent range above $1.12. The focus is not on today’s service and composite PMI, which in aggregate was in line with the flash readings. The service PMI ticked up to 52.2 from 52.1 in the flash, but the composite reading was steady at 52.6. Recall that 52.6 matches the lowest level since January 2015. Not only has the euro remained firm, but bond yields are extended yesterday’s losses. Benchmark 10-year yields are 2-5 bp higher. The backing up of yields is also corresponding to a widening of premiums over German bunds. Over the past five sessions, Italy has replaced Portugal for the biggest increase in yields. The 16.5 bp increase compares with 10.5 in Germany, 11 in Spain and 10 in Portugal.

|

Eurozone Services PMI, September 2016(see more posts on Eurozone Services PMI, ) Source Investing.com - Click to enlarge |

| Equity markets in Europe are lower, with the Dow Jones Stoxx 600 snapping a six-day advance. Here Italy is bucking the trend, with the FTSE Milan Index up 0.5% near midday. Although Deutsche Bank shares are flat, Italian bank shares are up over 2% to break a two-day 1.7% fall. In Asia, Japanese shares moved higher (~0.5%), but most other bourses were heavier, and the MSCI Asia-Pacific Index was flat. |

Eurozone Retail Sales, September 2016(see more posts on Eurozone Retail Sales, ) Source Investing.com - Click to enlarge |

Japan

Japan’s service PMI fell for the second consecutive month to stand at 48.2. It is the second month below the 50 boom/bust, and it is the lowest reading since April 2014. The composite was also below 50 for the second consecutive month. After February, there has been only one month that the service PMI was above 50 (July 50.1).

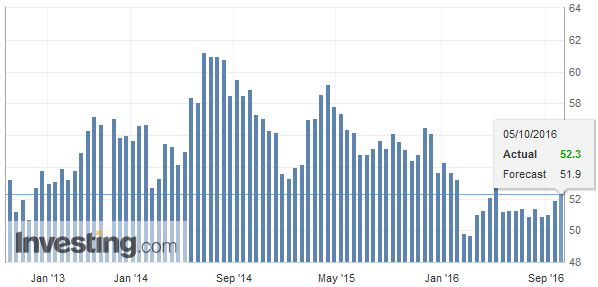

United KingdomIdeas that the May government’s priorities will produce “hard” Brexit continued to weigh on sterling. Sterling was pushed below $1.27 in late-Asian activity, but it has recovered back toward session highs (almost $1.2750) with the help of another firm PMI reading. The service PMI was 52.6 in September, down slightly from the 52.9 August report, which it will be recalled was a dramatic recovery from the 47.4 July reading. The median forecast was for a larger pullback. The BOE meets in early-November. The recent string of data has made a follow-up rate cut less likely. However, in any event, given the signals from the BOE, negative rates or even zero base rate was not being considered. This means that a rate cut would not have been 25 bp but probably something closer to 10-15 bp. The failure to ease further in November is clearly not a game changer. Surveys by a couple of the large accounting/consulting firms found a high number of companies consider moving some operations out of the UK. |

U.S. Services PMI, September 2016(see more posts on U.S. Services PMI, ) Source Investing.com - Click to enlarge |

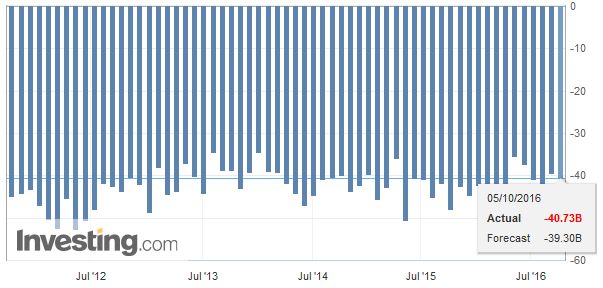

United StatesThe North American session features the ADP employment estimate, the August trade balance, and the PMI/ISM services report and factory orders. The ADP report is the most important. Investors will also pay close attention to the DOE energy report. Yesterday’s industry (API) estimate showed inventories falling 7.6 mln barrels. Despite what some partisans may suggest, the fact of the matter is that how to deal with ‘too big to fail” banks remains not only controversial but cuts across party lines. When US Representative Waters suggests breaking up the large banks, or Senator Warren comes down hard on banks that have betrayed the public’s trust as well as the law, many investors cringed. |

U.S. Services PMI, September 2016(see more posts on U.S. Services PMI, ) Source Investing.com - Click to enlarge |

| However, Minneapolis Federal Reserve President Kashkari, a Republican who ran TARP under President Bush, has advocated the breakup of large banks. He also believes that Dodd-Frank did not go far enough. Kashkari laid out his views in his first speech as Fed President eight months ago. Kashkari speaks later today.

Meanwhile, Chicago Fed President Evans, a noted dove, said yesterday that he envisions one hike this year, probably in December. One implication of this is that it means that he was likely not one of the three officials whose dots that did not see a hike this year. Given Dudley’s cautiousness expressed earlier this week, the third dot may have been his. If so, and the other two being Brainard and Tarullo, it may explain Yellen’s hesitancy last month. |

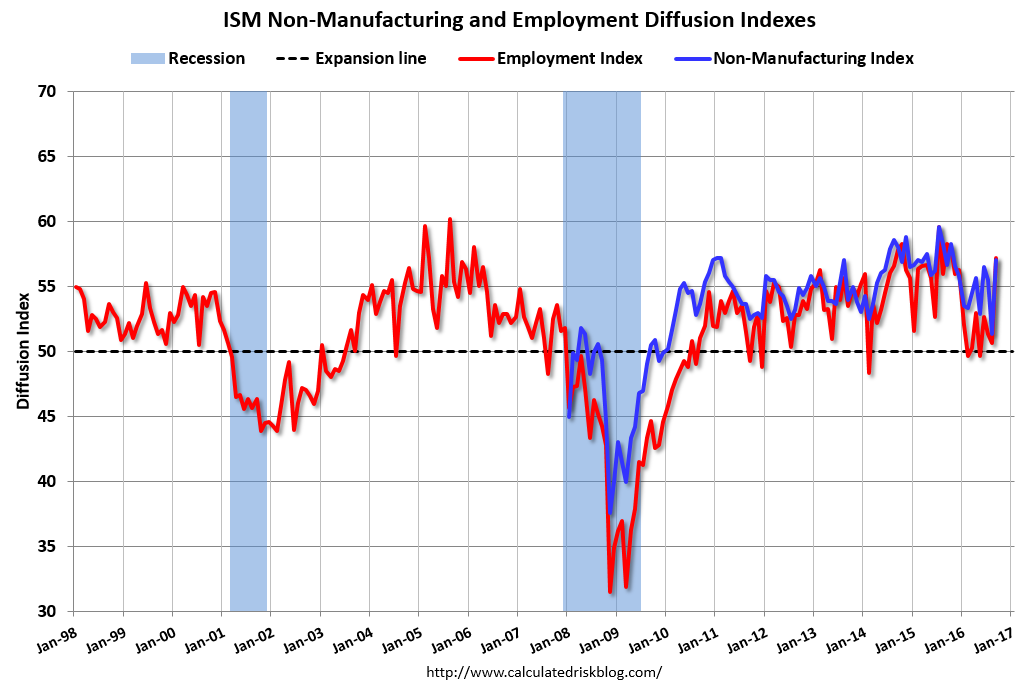

U.S. ISM Non-Manufacturing PMI, September 2016(see more posts on U.S. ISM Non-Manufacturing PMI, ) |

| We also note that Evans, like Mester, did not rule out a November hike. As we have argued, there simply is not a precedent for a rate hike a week before national elections. To break such a tradition, there must be a great sense of urgency, which does not seem present. We suspect that such comments are meant to underscore the idea that all meeting are live. We are skeptical. |

U.S. Trade Balance, September 2016(see more posts on U.S. Trade Balance, ) Source Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$EUR,$JPY,Bank of England,ECB,Eurozone Retail Sales,Eurozone Services PMI,FX Daily,Germany Services PMI,Italy Services PMI,newslettersent,Spain Services PMI,U.K. Services PMI,U.S. ISM Non-Manufacturing PMI,U.S. Services PMI,U.S. Trade Balance