A history

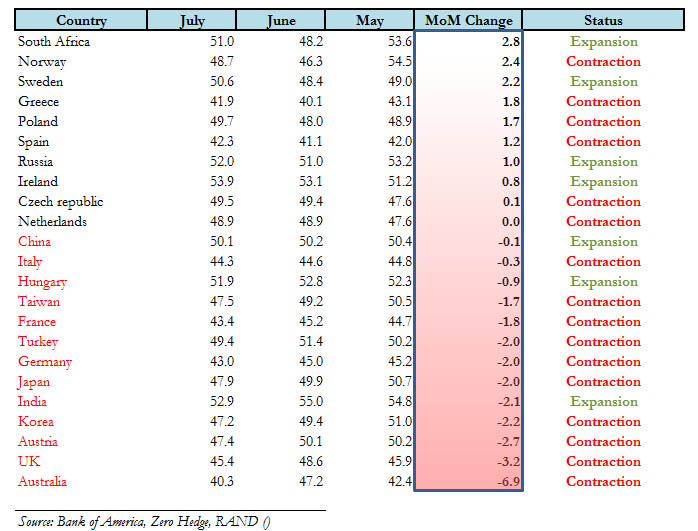

July:Global Manufacturing PMIs July 2012

PMI positive/negative change ratio: 12:15

Expansion/Contraction ratio: 7:20

Risk Indicators

August 2:

S&P500 1361

Copper 3307

Brent 106

AUDUSD 1.0465

EURUSD 1.2179

DAX 6606

SMI 6407

Switzerland: 48.6 (June 48.1, May 45.4)

Brazil: 48.7 (June 48.5)

Poland: 49.7 (June 48.0)

United States/ISM: 49.8 (June 52.5, May 54.0) (ISM is listed in June/May below)

additionally: United States/Markit: 51.4 (June 51.9, May 52.5)

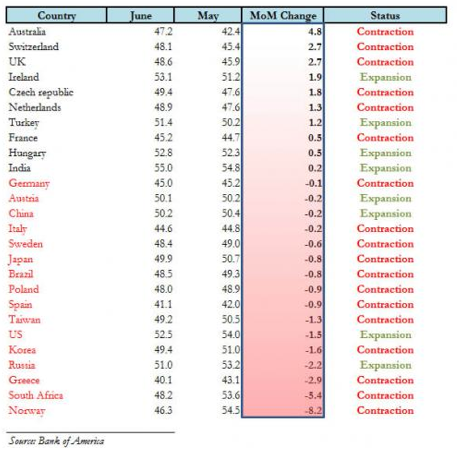

June: Global Manufacturing PMIs June 2012

PMI positive/negative change ratio: 10:17

Expansion/Contraction ratio: 8:19

Risk indicators per July 2:

S&P500 1357

Copper 3466

Brent 97

AUDUSD 1.023

EURUSD 1.2580

DAX 6578

SMI 6109

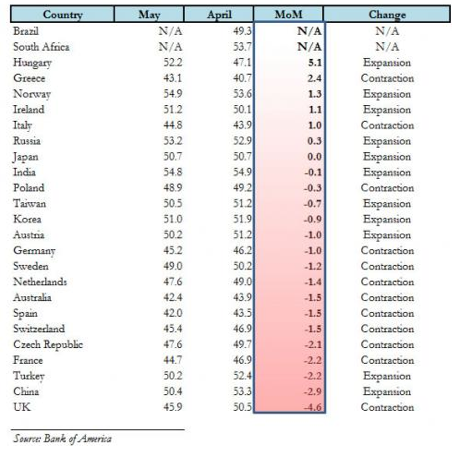

May: Global Manufacturing PMIs May 2012

PMI positive/negative change ratio: 6:16

Expansion/Contraction ratio: 12:13

Risk indicators per June 3:

S&P500 1263

Copper 3289

Brent 98

AUDUSD 0.964

EURUSD 1.2398

DAX 5978

SMI 5713

History JPM global composite PMI

History JPM global services PMI

History JPM global manufacturing PMI

The July update appeared in Seeking Alpha.

Are you the author? Previous post See more for Next postTags: Australia,Brazil,Brent Oil,China,Composite PMI,Copper,Eurozone,France,Germany Exports,Greece,India,Ireland,Italy,Japan,Markit,Mexico,Netherlands,PMI,Poland,Purchasing Manager,Russia,Saudi-Arabia,SMI Swiss Market Index,Spain,Surprise Index,Sweden,Switzerland,Taiwan,Turkey,U.K.,U.S. Chicago PMI,U.S. ISM Manufacturing PMI,U.S. ISM Non-Manufacturing PMI,United States