The main drivers for demand for Swiss francs are the Euro crisis, but even more the behavior of American investors, who go out of the dollar in the fear of further bad US economic data and in the fear of Quantitative Easing. This will push down the dollar and safe-havens like the CHF, gold or the Japanese Yen up.

The following slide show from last year shows who in the Fed is a dove and who is a hawk.

The seven governors of the board comprise the voting majority of the FOMC with the other five votes coming from Reserve Bank presidents.

The current voting members and their opinions

- Ben Bernanke, Chairman of the board: Moderate dove, bio.

- William Dudley, New York: Moderate dove, Easing ?, Reference, bio

- Elizabeth Duke, board of governors: Dove, bio

- Jeffrey Lacker, Richmond: Easing no, Reference, bio

- Dennis Lockhart, Atlanta: Easing yes, Reference, bio

- Sanda Pianalto, Cleveland: Easing no, Reference, bio

- Jerome Powell, board of governors, bio

- Sarah Bloom Raskin, board of governors: Dove, bio

- Jeremy C. Stein: board of governors, bio

- Daniel Tarullo, board of governors : Strong dove, Easing probably yes, bio

- John Williams, San Francisco: Easing yes, Reference, bio

- Janet Yellen, Vice Chair of the board: strong dove, Easing yes, Reference, bio

Alternate Members (not voting this year)

- James Bullard, St. Louis, hawk

- Charles L. Evans, Chicago, strong dove

- Esther George, Kansas City

- Eric S. Rosengren, Boston

- Christine M. Cumming, First Vice President, New York

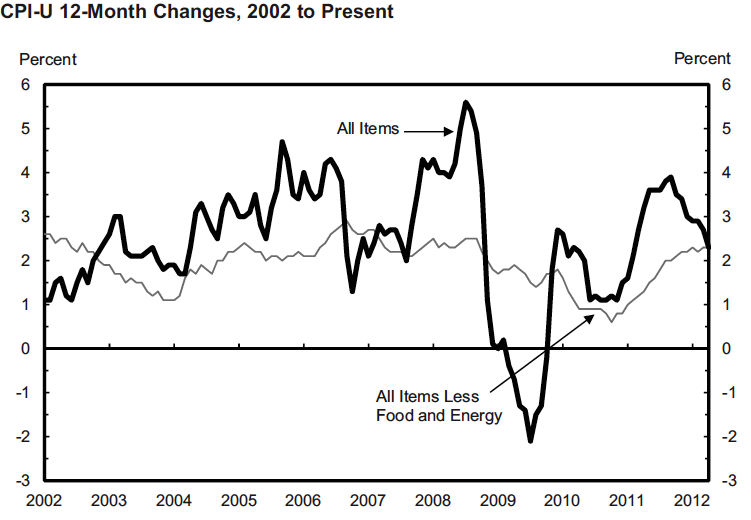

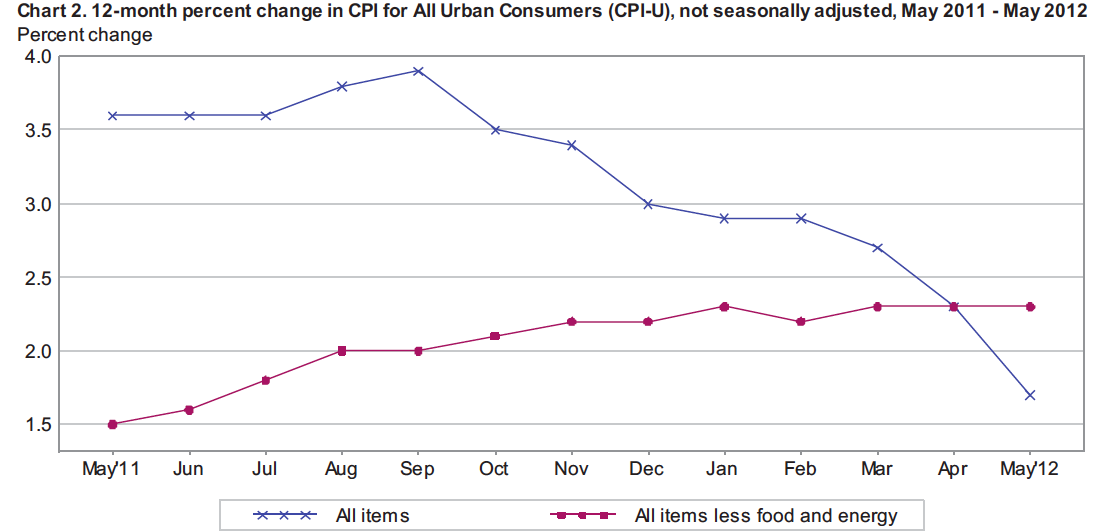

Inflation is no obstacle for more easing

Hawks like Kocherlakota, Fisher, Plosser are not voting members.

According to the latest Fed meeting, QE3 is not certain yet.

The Quantitative Easing Indicators

A rising gold-crude ratio (MA50) is an indicator for weak global and US growth, disinflation and eventually a coming Quantitative Easing. Since May 7 this ratio is increasing. May 7 also coincides with the start of strong inflows into the Swiss franc.

Inflation indicators for Quantitative Easing

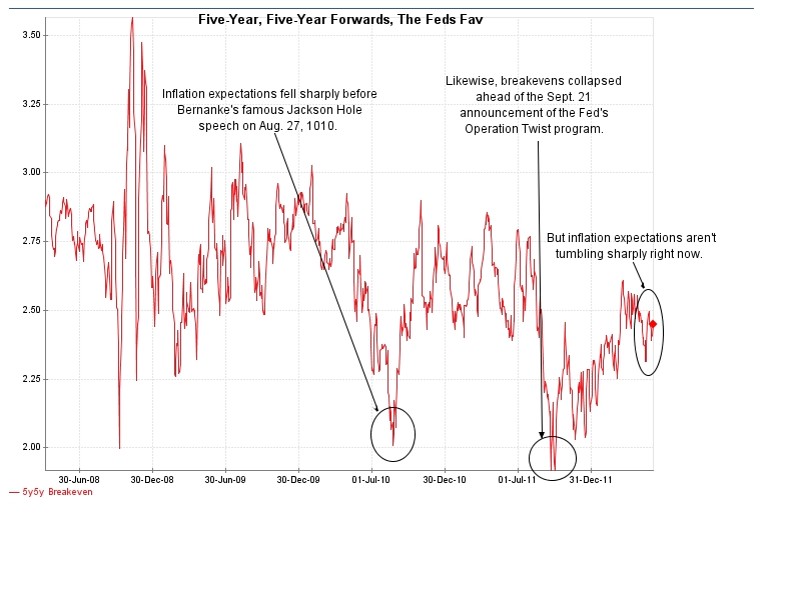

The current Five year, Five year forward, Fed’s Fav from CreditSuisse appeared in the WSJ.

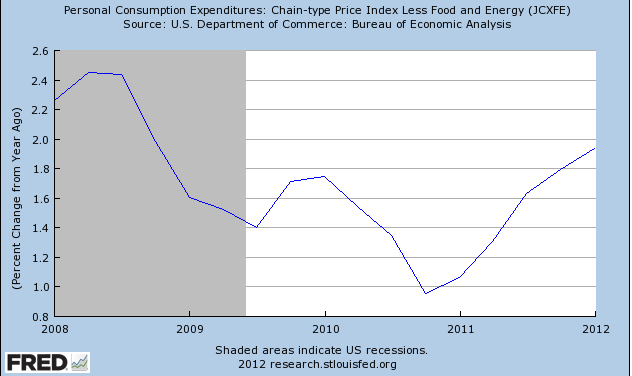

And the for the FED most important indicator, the Core PCE, is now with 1.9% a lot higher than at QE2 time, in September 2010 with 1.3%. A clear indication that QE3 is not imminent.

Are you the author? Previous post See more for Next post

Tags: Ben Bernanke,Dudley,Eric Rosengren,Federal Reserve,Fisher,FOMC,Gold,Hawk,Janet Yellen,Japanese yen,Jerome Powell,Kocherlakota,M1,Monetary Policy,QE2,QE3,Quantitative Easing