Just some simple words about the vicious cycle of the US economy and the consequences on the US dollar:

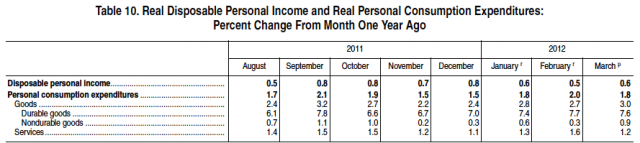

A stronger USD will not rescue the US economy, quite the contrary. US companies will not hire in the US, but outsource or hire overseas. If they hire in the US, due to the high number of unemployed people, real wages do barely increase (see BEA data below). Wage increases need domestic growth or growth via exports.

But US companies cannot compete internationally with a strong dollar and with declining productivity; therefore the growth via exports is blocked.

Domestic growth is not possible, because the main domestic factor, the housing market remains depressed. Tax increases are looming next year.

If wages do not rise, only deficit spending (see table above) or strongly cheaper gas prices may boost US consumer spending (like in November/December 2011). Spending, however, but will boost gas prices upwards (like seen in February/March 2012) and increases the US trade deficit, pushing upwards the foreign incomes of the trading partners and as ultimate consequence the USD down again.

If it is not the markets and bad US economic data, that push the US Dollar down, at the end it will be the Fed, because prices will have declined so much, that they are able to do Quantitative Easing. With a continued rise of the dollar, wages nearly down, shelter taking 32% of the CPI basket and imports about 15%, only some months are missing to see QE3. *

Surprisingly it was the normally hawkish Minneapolis Fed President Narayana Kocherlakota that emphasized that easing was looming.

The currencies that take profit of the bad US trade balance, are

- the Japanese Yen (JPY), where in April exports to the US increased by 42.9%, but imports only by 4.4%.

- the Singapore Dollar (SGD), a country with an ever strong trade surplus and where inflation is tamed via currency appreciation.

- the Norwegian Krona (NOK), where huge oil and natural gas exports guarantee a trade surplus every month

- the Euro (EUR) with investments into the German economy via the DAX (see trade balance differences among euro zone countries). The export-leaning MDAX, however, is for us currently overvalued. German banks partially hedged PIIGS exposure and have strong incomes from German HNWI’s. Energy providers like EON and RWE, that lost a lot in 2011, are also contained in the DAX, have upwards potential when a future bad German finance situation will need a rethink of the German nuclear exit strategy. In the case of complete break-up of the euro zone the DAX investment will revalue thanks to the re-introduced Geman Mark.

- the Swiss franc (CHF) through investments into their exporters and bank stocks, because the Swiss National Bank (SNB) artificially supports these companies via a cap on the franc. Swiss banks UBS and Credit Suisse are also a buy for us because their wealth management have big risk-off private-banking inflows from the continued property selling in the Emerging Markets (e.g. Brazil or China).

- the maybe most important argument if favor of EUR and JPY is the diversification strategy for the Chinese currency reserves from the USD and the Yen-yuan direct trading. Apart from these two SDR currencies also the SGD and the CHF (as euro without risk) might be subject to the Chinese diversification strategy.

- We do not recommend neither commodity currencies (especially AUD, NZD) nor gold, because those investments are sliding with the Chinese slow-down, even if they could take profit of US Quantitative Easing speculations.

- We are short the S&P 500 till QE3 takes more shape.

The composition of this currency portfolio (JPY, SGD, NOK, CHF and EUR, all of them long against USD) depends on the market expectations of the investor. The JPY is by far the most risk-averse, we believe that one should overweight JPY in current market conditions and slowly increase the part of the other currencies.

*There is only one argument against QE3, this is recent rises in rents despite falling house prices. This could push the shelter CPI component (containing both owner-occupied house and rents) upwards.

QE3 expectations can be found here.

Are you the author? Previous post See more for Next postTags: China,consumer spending,Credit Suisse,deficit,Federal Reserve,Gold,Japan,Japanese yen,Kocherlakota,Krona,Norwegian Krone,Oil & Commodities,QE3,Quantitative Easing,Swiss National Bank,trade deficit,U.S. Consumer Spending,U.S. Trade Balance,United States