Tag Archive: U.S. Consumer Spending

Consumer Spending measures the inflation adjusted amount of money spent by households in the US economy.

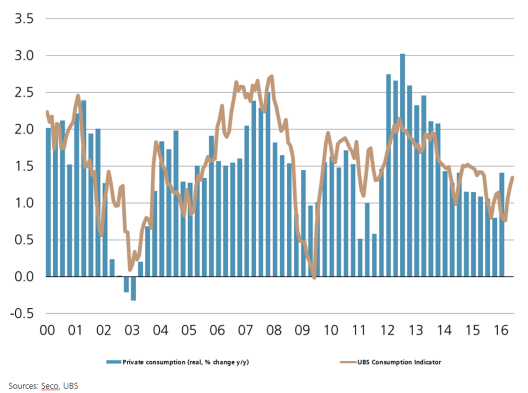

Switzerland UBS consumption indicator December: pleasing end to the year

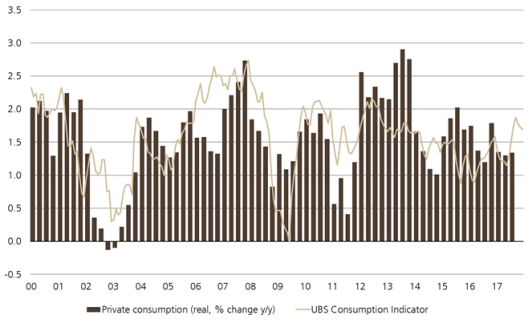

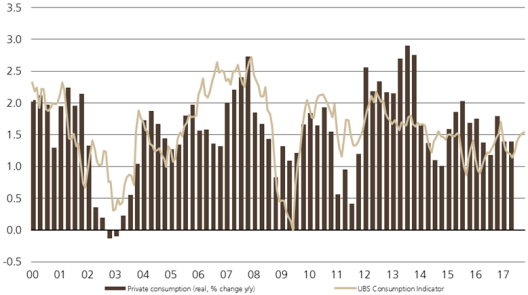

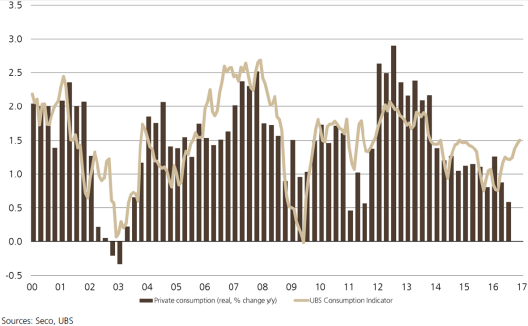

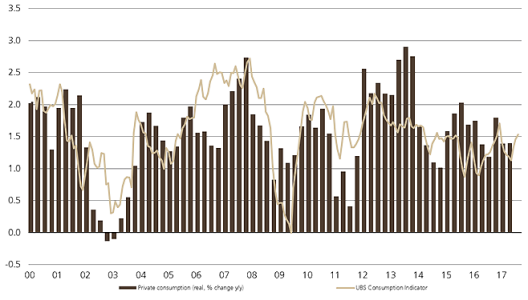

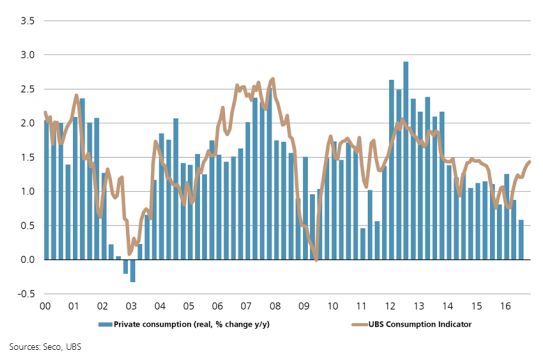

At 1.69 points, the consumption indicator lay well above the long-term average in December 2017, conveying an optimistic snapshot of Swiss private consumption. Weaker figures for new car registrations prevented an even higher value. The consumption indicator fell slightly in December 2017 to 1.69 points from 1.73. However, values had been revised upward in the past few months.

Read More »

Read More »

Switzerland UBS consumption indicator November: Solid private consumption in 2018

At 1.67 points, the UBS consumption indicator was above its long-term average in November, indicating solid consumption growth in 2018. Thanks to solid economic growth, private consumption will likely continue expanding despite rising inflation.

Read More »

Read More »

Switzerland UBS Consumption Indicator October: UBS consumption indicator trends sideways

The UBS consumption indicator was quoted at 1.54 points in October, suggesting that private consumption is growing at a solid pace in the fourth quarter. A weaker Swiss franc and a drop in unemployment provide support for it, but rising inflation and the accompanying stagnation of real wages are likely to cap any growth in it.

Read More »

Read More »

Switzerland UBS Consumption Indicator September: Higher expectations in the retail industry

The UBS consumption indicator rose to 1.56 points in September, signalling consumption growth slightly above the long-term average. The indicator was supported by significantly higher expectations in the retail industry, but UBS still projects consumer spending to grow 1.3 percent for the year overall.

Read More »

Read More »

Switzerland UBS Consumption Indicator August: A pleasant end to summer

The UBS consumption indicator increased to 1.53 points in August thanks to robust new car registrations and encouraging numbers of hotel stays by Swiss residents, indicating consumption growth slightly above the long-term average of 1.5%. However, the UBS economists still project 1.3% consumer spending growth for the year overall.

Read More »

Read More »

FX Daily, May 30: Mixed Dollar as Market Awaits Preliminary EMU CPI and US Jobs

With the backdrop of US interest rates unable to get much traction, despite the strong probability of another Fed rate hike in a couple of weeks, the third since last November election, the US dollar mixed today. The chief story today, though, is not the greenback but the euro. The euro is trading heavily for the fourth session.

Read More »

Read More »

FX Daily, March 31: Greenback Finishing Weak Quarter in Mixed Fashion

The US dollar fell against all the major currencies in the first three months of 2017. The weakness initially seemed to be a correction to the rally, which began before the US election last year. The dollar recovered in February, in anticipation of a hawkish Fed in March.

Read More »

Read More »

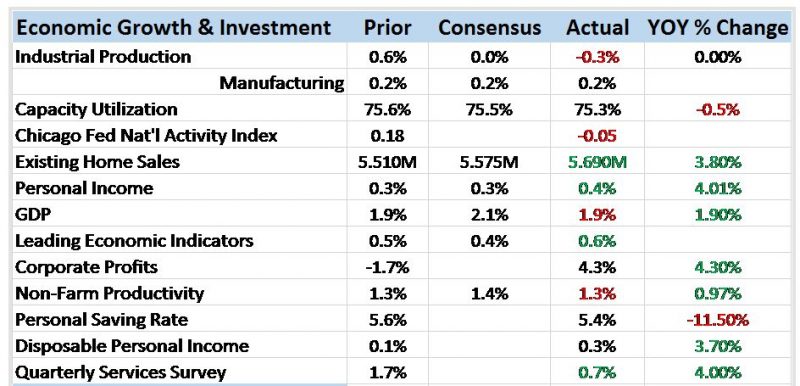

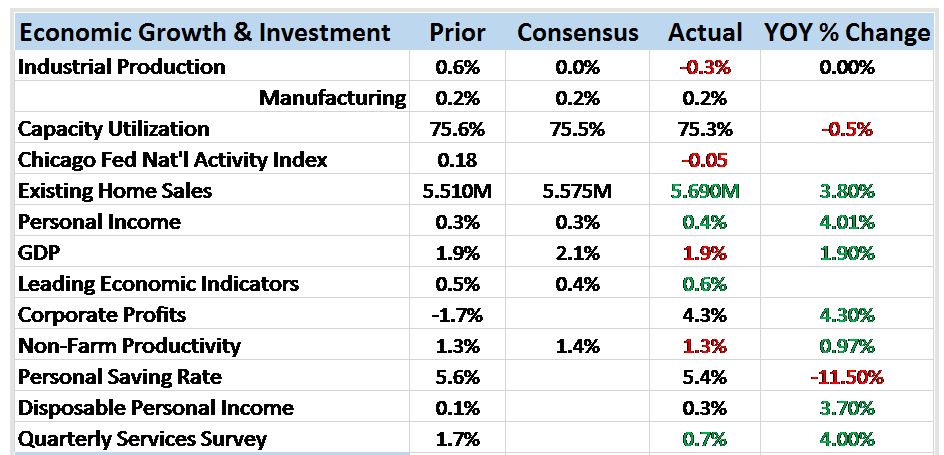

Bi-Weekly Economic Review

The Federal Reserve is widely expected to raise interest rates again at their meeting next week. They obviously view the recent cyclical upturn as being durable and the inflation data as pointing to the need for higher rates. Our market based indicators agree somewhat but nominal and real interest rates are still below their mid-December peaks so I don’t think a lot has changed.

Read More »

Read More »

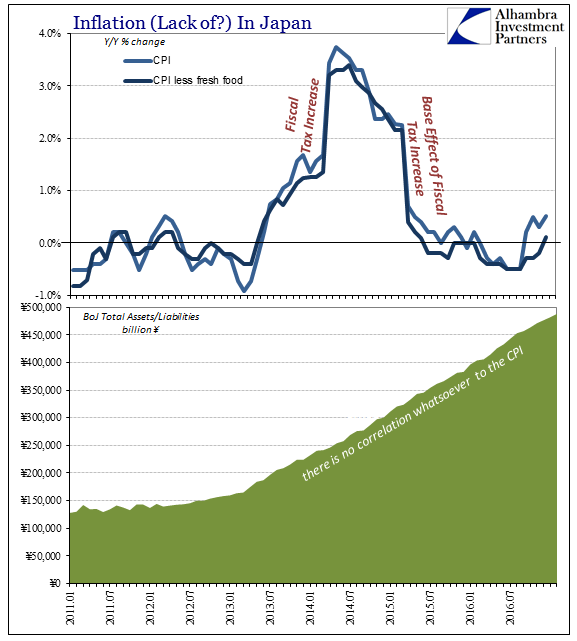

True Cognitive Dissonance

There is gold in Asia, at least gold of the intellectual variety for anyone who wishes to see it. The Chinese offer us perhaps the purest view of monetary conditions globally, where RMB money markets are by design tied directly to “dollar” behavior. It is, in my view, enormously helpful to obsess over China’s monetary system so as to be able to infer a great deal about the global monetary system deep down beyond the “event horizon.”

Read More »

Read More »

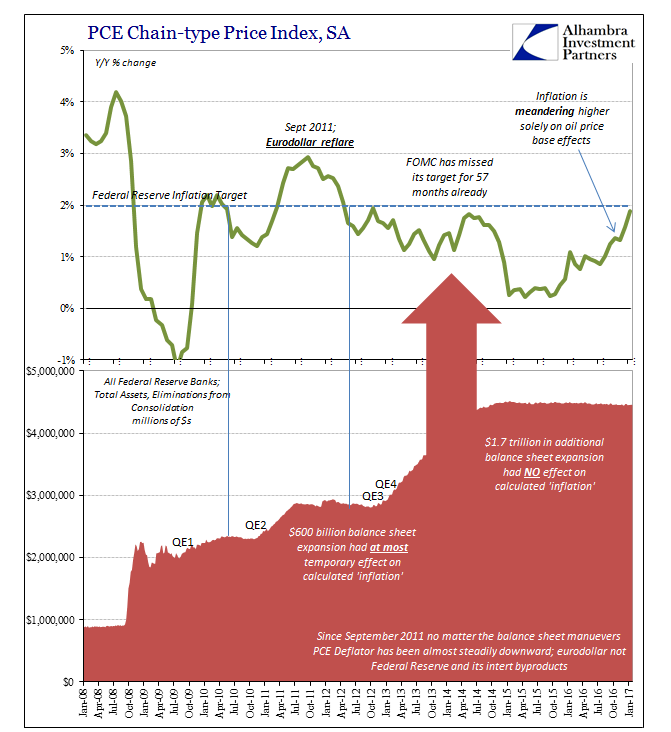

Real Disposable Income: Headwinds of the Negative

The PCE Deflator for January 2017 rose just 1.89% year-over-year. It was the 57th consecutive month less than the 2% mandate (given by the Fed itself when in early 2012 it made the 2% target for this metric its official definition of price stability).

Read More »

Read More »

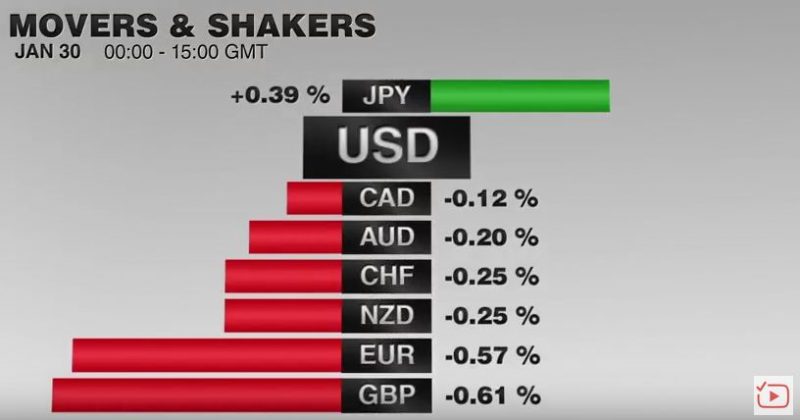

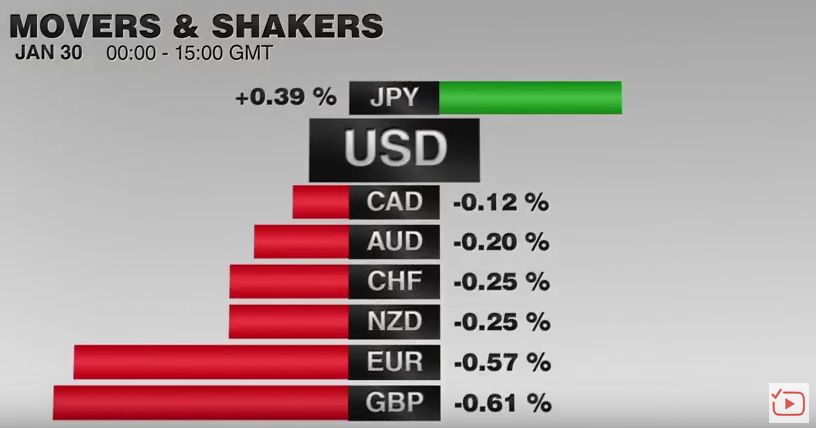

FX Daily, January 30: EUR/CHF falls further to 1.650

The EUR/CHF collapsed once again to 1.0650. This rate broke the 1.0680 - 1.0700 that constituted the previous intervention area.

Reasons can be found in the weak U.S. GDP weak, in Trump's foreign trade policy and in the strong Swiss trade balance.

Read More »

Read More »

US GDP Misses, but Final Domestic Sales Accelerate

Net exports was a large drag on growth. Inventories flattered growth. Underlying signal, final domestic demand, increased 2.5% after 2.1% in Q3.

Read More »

Read More »

Switzerland UBS Consumption Indicator December: Automobile market with record year-end results

The UBS consumption indicator rose from 1.45 to 1.50 points in December. The positive trend of last fall continued and signalizes solid growth prospects for private consumption this year. New car registrations in the automobile sector, which are at an all-time high, are at the root of this positive outlook.

Read More »

Read More »

Switzerland UBS Consumption Indicator November: Subdued private consumption in 2017 despite solid November figures

The UBS Consumption Indicator climbed to 1.43 points in November from 1.39. Another strong month in domestic tourism and the positive trend on the automobile market made the rise possible. Initially a solid start is to be expected for 2017, but momentum is expected to subside.

Read More »

Read More »

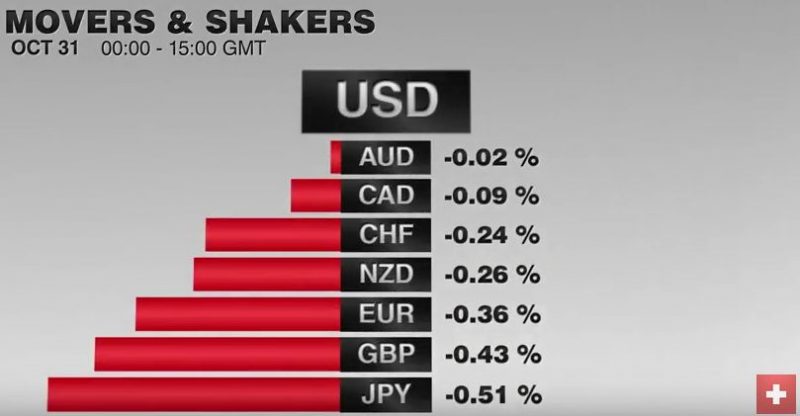

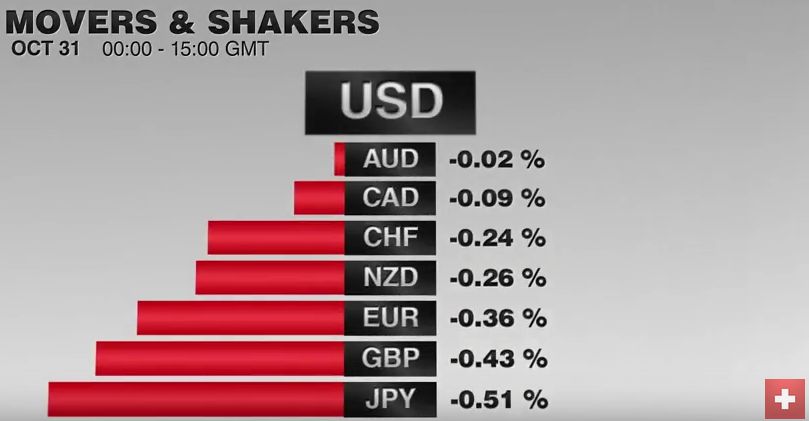

FX Daily, October 31: Respite for Market Nerves Lifts Peso, Rand, and US Dollar

he latest US political news before roiled thin pre-weekend markets, but cooler heads and more of them are prevailing today. Trump's fortune in the polls had bottomed prior to the re-opening of the investigation into Clinton's emails and the national polls have narrowed.

Read More »

Read More »

Switzerland, UBS Consumption Indicator August

The UBS Consumption Indicator rose to 1.53 points in August from 1.45. This development was fueled by resurging tourism and above-average car sales for the month. However, the situation on the labor market casts a shadow on this rise.

Read More »

Read More »

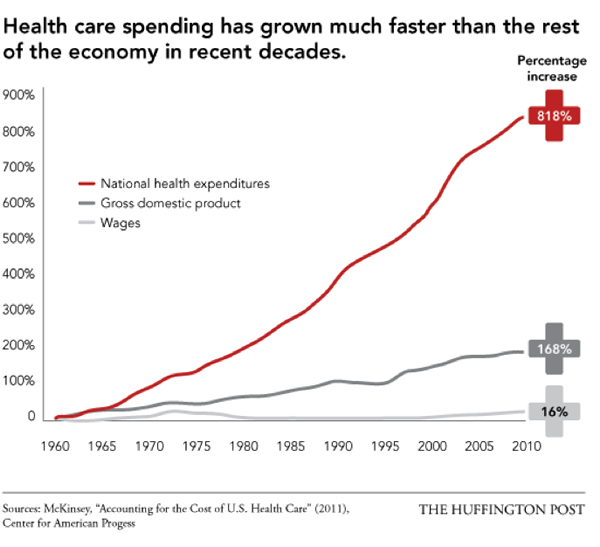

If Everything Is So Great, How Come I’m Not Doing So Great?

While the view might be great from the top of the wealth/income pyramid, it takes a special kind of self-serving myopia to ignore the reality that the bottom 95% are not doing so well. We're ceaselessly told/sold that the U.S. economy is doing phenomenally well in our current slow-growth world -- generating record corporate profits, record highs in the S&P 500 stock index, and historically low unemployment (4.9% in July 2016).

Read More »

Read More »

Shrewd Financial Analysis in the Year 2016

“Markets make opinions,” says the old Wall Street adage. Perhaps what this means is that when stocks are going up, many consider the economy to be going great. Conversely, when stocks tank it must be because the economic sky is falling.

Read More »

Read More »

Switzerland UBS Consumption Indicator July: Car buyers turn on cruise control

In July, the UBS consumption indicator rose to 1.32 points from 1.21. A slight downward adjustment of the June figure and above-average car sales generated the increase. However, the disappointing June figures for tourism and sluggish consumer sentiment slightly curbed this upward trend.

Read More »

Read More »