It is a bizarre turn of events. Just like the Game of Throne's Westeros is a map of the UK put on top of an inverted Ireland, so too do UK events seem to be a strange permutation of the pre-referendum views. Although sterling and interest rates have not fully recovered from the Brexit decision, equity markets have, and fear of contagion has died down.

Read More »

Tag Archive: Dudley

FX Daily, July 11: Dollar Extends Gains

The combination of the rebounding US job growth and gains in the S&P 500 to near record levels before the weekend is helping boost the US dollar against the major currencies, while the emerging market currencies are mixed. In addition, indications that Japan will put together another fiscal stimulus package and the Bank of England may cut rates late this week are helping global equities.

Read More »

Read More »

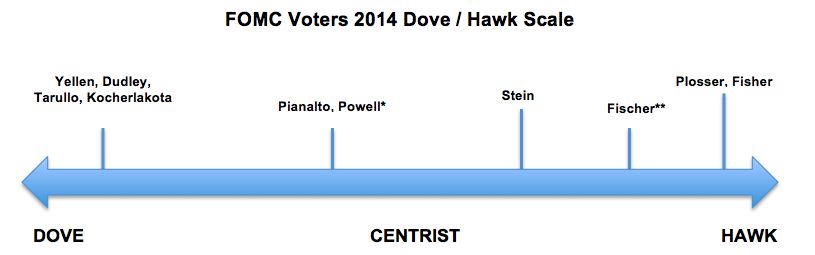

Fed FOMC: Who is Hawk, Who is Dove? 2015 Update

Composition of the Fed's Federal Open Market Committee (FOMC composition), needed to know if the Fed is opting for quantitative easing or not.

Read More »

Read More »

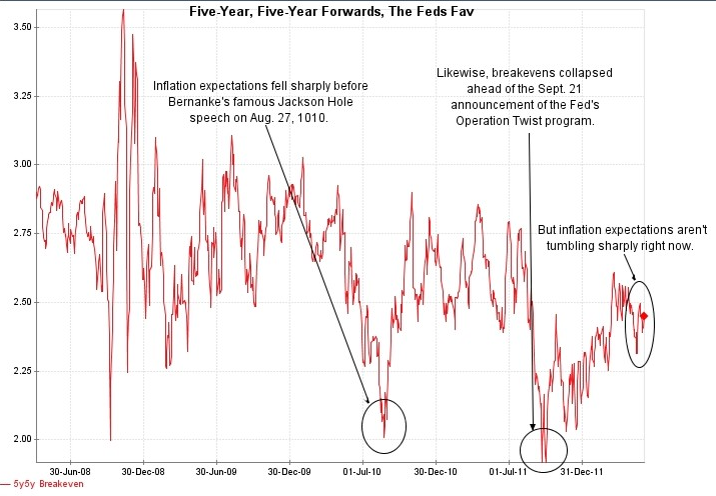

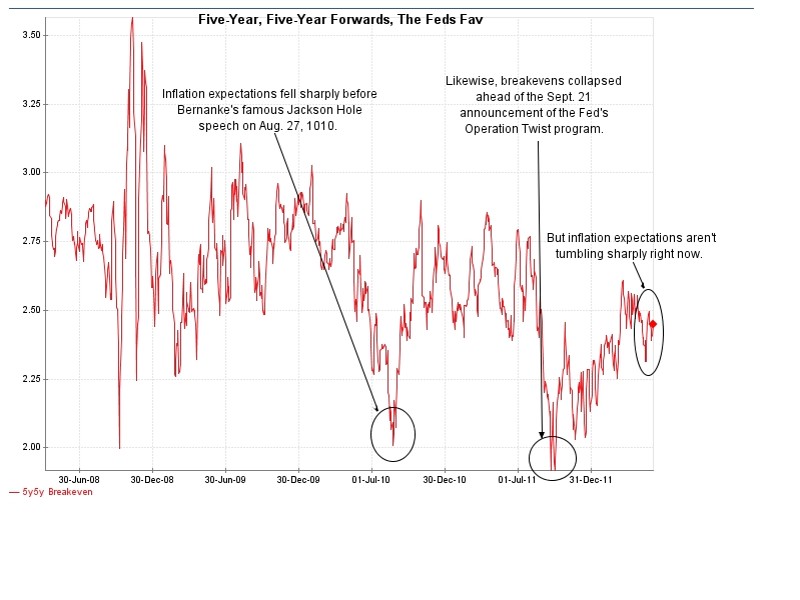

Brad DeLong on Jackson Hole and Quantitative Easing

Berkeley Professor Brad DeLong has delivered a nice allegorical entry in his type pad on a quick Quantitative Easing. Letting speak old greek mythological figures he hides his personal opinion. A half now completely written platonic dialogue on what the Federal Reserve is Doing — or not Doing — Right Now DeLong explains the …

Read More »

Read More »

Fed Violates its Own Inflation Targets. Should QE3 Be Postponed?

At this year’s Jackson Hole symposium, Ben Bernanke promised to help the economy via further easing if needed. We doubt his promises because because the Fed might contradict their inflation targets. Current levels of around 2 % for the consumer price inflation excluding food and energy (“core CPI“) and the deflator of the GDP …

Read More »

Read More »

Quantitative Easing Indicators, June 2012

The main drivers for demand for Swiss francs are the Euro crisis, but even more the behavior of American investors, who go out of the dollar in the fear of further bad US economic data and in the fear of Quantitative Easing. This will push down the dollar and safe-havens like the CHF, gold or the … Continue reading »

Read More »

Read More »