If one knows the composition of the Fed’s Federal Open Market Committee (FOMC), then it is far easier to guess if the Fed is opting for quantitative easing or not, how long the tapering will continue, or when they hike rates. In the following we will examine who in the Federal Open Market Committee (“FOMC” or often commonly used “Fed”) is a dove, who is a hawk or who is a centrist.

2015 compared to 2014: Swing to the doves

Here already the 2015 update, via Deutsche Bank:

In 2015 the doves Evans, Lockhart, Williams and the centrist Lacker will replace the hawks Fisher, Plosser and Mester and the dove Kocherlakota.

The FOMC composition

The FOMC consists of the seven members of the Board of Governors of the Federal Reserve and 10 members coming from the 12 different regional Federal Reserves. The Fed governors are determined by the U.S. president and the U.S. senate, they have a permanent voting right for FOMC decisions.

Five regional Fed presidents out of the 12 regional Federal Reserve Banks have a voting right, of which the New York Fed president a permanent one. Five other regional Fed presidents are “alternate voting” members, which effectively means that inside the FOMC they may only express their opinion but not vote. With the yearly rotation three regional Fed presidents move completely out of the FOMC. Hence, the voting majority of the FOMC consists of the seven votes of the Fed’s board of governors, one permanent member, namely the president of the New York Fed and the four (rotating) votes coming from the other Reserve Bank presidents.

The following table gives an overview over all board member and regional Fed presidents and their position (hawk/dove), quotes on a strong dollar and low inflation. It also indicates their voting rights in 2014, for the five groups see below.

| Position | Name |

Dove/Hawk |

Hike rates? |

Voting 2015 |

Public Statement (via WSJ and other)…………………………………………………. |

|---|---|---|---|---|---|

| Chair | Janet L. Yellen |

strong dove, group 5 (decider) |

data dependent | voting | If progress in the labor market continues to be more rapid than anticipated by the Committee or if inflation moves up more rapidly than anticipated, resulting in faster convergence toward our dual objectives, then increases in the federal funds rate target could come sooner than the Committee currently expects and could be more rapid thereafter. Of course, if economic performance turns out to be disappointing and progress toward our goals proceeds more slowly than we expect, then the future path of interest rates likely would be more accommodative than we currently anticipate.” |

| Vice chairman | Stanley Fischer

|

centrist | data dependent | voting | Of course Stanley Fischer would be a hawk at the Fed … Oct 11: ““In determining the pace at which our monetary accommodation is removed, we will, as always, be paying close attention to the path of the rest of the global economy and its significant consequences for U.S. economic prospects.” |

| Permanent voting member as NY Fed presidentsss | William C. Dudley |

Strong dove, group 5 (decider) |

hike not before mid 2015 | voting | We would have poorer trade performance, less exports, more imports,” he said. “And if the dollar were to appreciate a lot, it would tend to dampen inflation. So it would make it harder to achieve our two objectives. So obviously we would take that into account.” Source “It still is premature to begin to raise interest rates,” adding the consensus view that the Fed will boost rates in the middle of 2015 “seems like a reasonable view.” October 7, 2014 |

|

Board member

|

centrist, group 1 (inaction), chosen in a 2012 compromise as republican | data dependent | voting |

“Monetary policy in the United States is likely to remain highly accommodative for some time, as our economy fights to overcome the remaining headwinds”,

Speech Aug 2014: “If we continue to see strengthening payroll, [gross domestic product], employment, then we’ll move faster. If it goes the other way and things weaken, it’ll be slower.” |

|

|

Board member

|

dove, group 2 (to be convinced) |

data dependent | voting | The U.S. economy “appears to have some momentum for what is still moderate growth.” October 11,2014 |

|

|

Board member

|

|

dove | no public statement yet | voting | Brainard replaced Jeremy Stein that announced that he would resign his position at the Federal Reserve and return to Harvard by May 28. |

| Fed regional presidents | |||||

|

San Francisco Fed president

|

dove, group 3 (easing proponent) |

mid next year | voting in 2015 | “My baseline forecast implies ending the current asset-purchase program on schedule this month and rate increases in the fed-funds-rate target range starting sometime next year. That hasn’t changed for some time. International developments have not been significant enough to really move that in a really meaningful way.” October 19,2014 |

|

| Chicago Fed president | strong dove, group 3 (easing proponent) |

hike later | voting in 2015 |

History has not looked kindly on attempts to prematurely remove monetary accommodation from economies that are in or near a liquidity trap.…If we were to presume prematurely that the U.S. economy has returned to a more business-as-usual position and reduce monetary accommodation too soon, we could find ourselves in the very uncomfortable position” of having to cut rates after having just raised.

Oct 13, 2014 |

|

|

Atlanta Fed president

|

dove, group 2 (to be convinced) |

mid next year | voting in 2015 |

“I continue to expect conditions for [interest rate] liftoff to ripen by the middle of 2015 or a bit later.”

Sept 25, 2014 |

|

|

Richmond Fed president

|

centrist, group 4 (hawk) |

data dependent | voting in 2015 | Voted against asset purchases in every FOMC meeting in 2012. Oct 9, 2014: “At this point it’s too soon to draw conclusions about when we lift off.”.” |

|

|

St. Louis Fed president

|

centrist, group 4 (hawk) |

hike later | express opinion in 2015 |

“Faced with falling inflation expectations, “a reasonable response of the Fed in this situation would be to invoke the clause on the taper that said that the taper was data dependent. And we could go on pause on the taper at this juncture.”

Oct 16, 2014 |

|

|

Kansas Fed president

|

Esther L. George |

hawk, group4 (hawks), successor of hawk Thomas Hoenig. | hike now | express opinion in 2015 | voted against asset purchases, in every FOMCS meeting in 2013 “Starting this process [of raising interest rates] sooner rather than later is important….if we continue to wait to see full employment, to see inflation running beyond the 2% target–then we risk having to move faster and steeper with interest rates in a way that is destabilizing to the economy in the long term.” Oct 6, 2014 |

|

Boston Fed president

|

strong dove, group 3 (easing proponent) |

data dependent | express opinion in 2015 |

“I think it’s probably well understood that we can change the statement and some things in the statement are going to have to change if we do end the [bond] purchase program.

Oct 9 |

|

|

Cleveland Fed president

|

Loretta J. Mester

|

hawk | data dependent | not in FOMC in 2015 (voting in 2014) |

New since June 2014 replacing Pianalto “Fed’s Mester joins the hawks” With the end of the program nearing, I believe it is again time for the committee to reformulate its forward guidance Aug 2014: “Changes in the stance of policy will be calibrated to the economy’s actual progress and anticipated progress toward our dual-mandate goals, and to the speed with which that progress is being achieved.” |

|

Dallas Fed president

|

strong hawk, Group 4 (hawks) |

Hike soon | not in FOMC in 2015 (voting in 2014) |

The timing of rate hikes “really depends on how the economy evolves….The spring may be the right time to raise rates rather than the summer.

Sept 29, 2014 |

|

|

Philadelphia Fed president

|

Patrick T. Harker |

not in FOMC in 2015 (voting in 2014) |

Replaced Charles I. Plosser in July 2015 | ||

|

Minneapolis Fed president

|

Narayana Kocherlakota |

Shift from hawk to strong dove | hike later | not in FOMC in 2015 (voting in 2014) |

“Just because unemployment is falling that’s not a reason to raise rates.…There is no harm in having low unemployment in the country except insofar as that generates wage pressures and that shows up in inflation. But I don’t see that in my inflation outlook.”

Oct 7, 2014 |

|

Permanent alternate FOMC member as NY Fed vice

|

no public statement | Only express opinionxxxx | Replaced Christine Cumming in June 2015. |

Federal Reserve Bank Rotation in the FOMC and the Hawks

As explained above, four FOMC voting members change each year. In 2014, hawks Fisher (Dallas Fed) and Plosser (Philadelphia Fed) are new voting members. This implies two more voters in favor of tapering. The new voting member Kocherlakota (Minneapolis) was previously quite hawkish, but has become a dove.

The following table gives an overview when which regional Fed president obtains voting rights.

(source Fed).

2013 2014 2015

Members New York (dove)

Boston (dove)

Chicago (dove)

St. Louis (middle)

Kansas City (hawk?)New York (dove)

Cleveland (middle)

Philadelphia (hawk)

Dallas (hawk)

Minneapolis (hawk)New York (dove)

Chicago (dove)

Richmond (hawk)

Atlanta (middle)

San Francisco (dove)

Alternate Members New York VP (?)

Cleveland (middle)

Philadelphia (hawk)

Dallas (hawk)

Minneapolis (hawk)New York VP (?)

Chicago (dove)

Richmond (hawk)

Atlanta (middle)

San Francisco (dove)New York VP (?)

Cleveland (middle)

Boston (dove)

St. Louis (middle)

Kansas City (hawk?)

Sources

This division into groups above comes from Berkeley’s Prof DeLong’s type pad.

Dividing the FOMC into groups

Daedalos: I would start by dividing the potential voting members of the Federal Open Market Committee into several groups. The first group is made up of Elizabeth Duke, Jerome Powell, and Esther George. The second group is made up of Dan Tarullo, Sarah Bloom Raskin, Sandra Pianalto, and Dennis Lockhart. The third group is made up of Eric Rosengren, Charles Evans, and John Williams. The fourth group is made up of Jeffrey Lacker, Charles Plosser, James Bullard, Narayana Kocherlakota, and Richard Fisher. And the fifth group is made up of Ben Bernanke, Janet Yellen, Jeremy Stein, and William Dudley.

The first group are financial-sector worthies with a bias toward inaction and not rocking boats, but willing to go along with strong views from elsewhere on the committee. The second group are those without strong monetary policy opinions of their own who are distressed by the current situation and willing to engage in boat-rocking if they can be convinced it would be constructive.

The third group–Rosengren, Evans, and Williams–think like we do.

The fourth group–it is not at all clear to me right now that the fourth group “think” at all. …

Kurush: OK. I get it. The fifth group?

Daedalos: The fifth group–Bernanke, Yellen, Stein, and Dudley–are, or ought to be, the deciders here. They have deep knowledge of and strong substantive views about monetary policy. They are not reputationally bankrupt and thus gambling for reputational resurrection.

Hence we obtain 5 groups.

- Bias towards inaction

- Group that needs to be convinced by others in order to implement easing

- Strong proponents of easing

- Hawks

- The deciders…

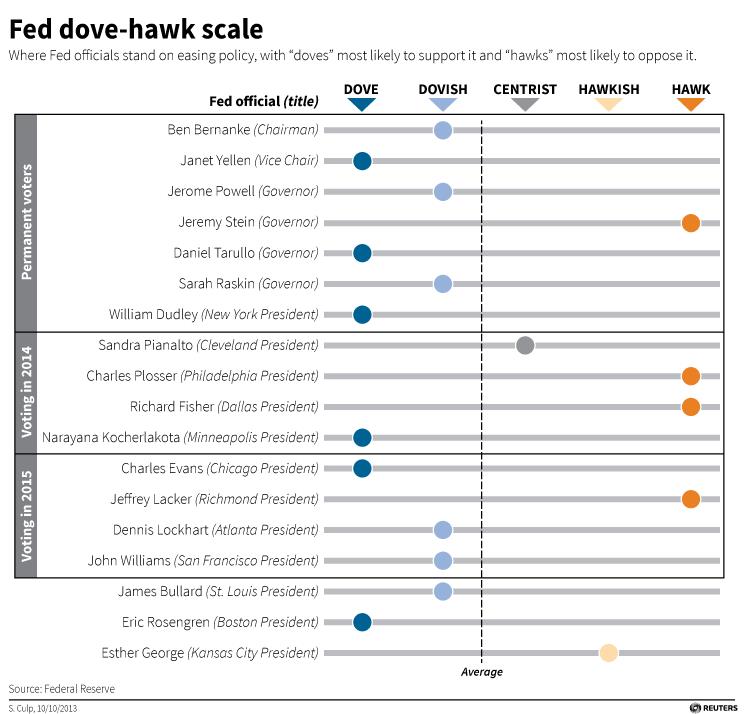

Fed Dove-Hawk Scale 2014 by Reuters

Details on Quantitative Easing and the indicators the Fed uses are given here.

See more for

5 pings

Tri Star Investment » Education Research Professors

2014-08-24 at 23:11 (UTC 2) Link to this comment

[…] and initial conditions fixed, we can know exactly its evolution over time. (Not to be confused with Federal Reserve Bank!). But in the case of chaotic systems, a small difference in these conditions makes the system […]

What Is The Fed? | ZombieMarkets

2015-04-15 at 16:36 (UTC 2) Link to this comment

[…] source: https://snbchf.com/monetary-fiscal-policy/fed-its-fomc-composition/ […]

What Is The Federal Reserve? All You Ever Wanted To Know - Commodity Trade Mantra

2015-04-16 at 13:21 (UTC 2) Link to this comment

[…] source: https://snbchf.com/monetary-fiscal-policy/fed-its-fomc-composition/ […]

Kofax Global Partner Program » Magis Global

2015-04-21 at 16:42 (UTC 2) Link to this comment

[…] is a leading provider of solutions for automating document-based business processes. Learn more at: Dennis P. Lockhart. For more than 20 years, Kofax offers award-winning solutions that automate document-based business […]

Fed Dove-Hawk Scale | 研究ノート

2015-05-18 at 15:35 (UTC 2) Link to this comment

[…] The Fed’s FOMC Composition: Who is Hawk, Who is Dove? 2015 Update […]