Tag Archive: yuan

Great Graphic: The Yuan’s Weakness

Don't be fooled, the yuan has fallen more against its basket that against the dollar this year. It is not clear what China means by stable. Market forces appear to be moving in the same direction as officials wish.

Read More »

Read More »

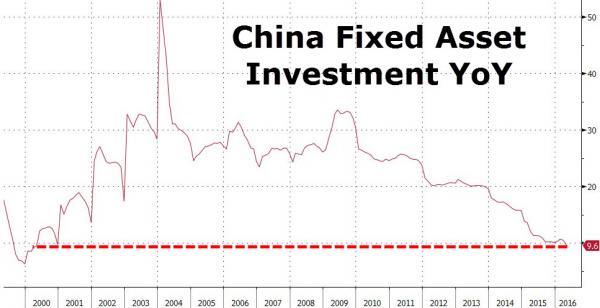

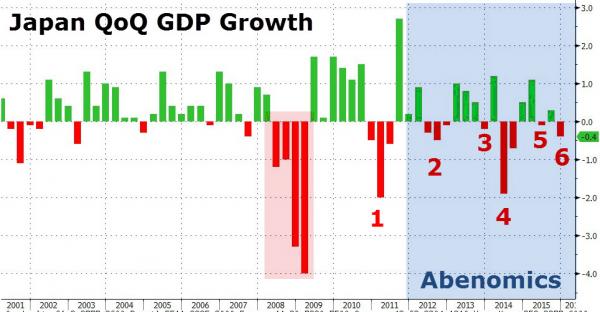

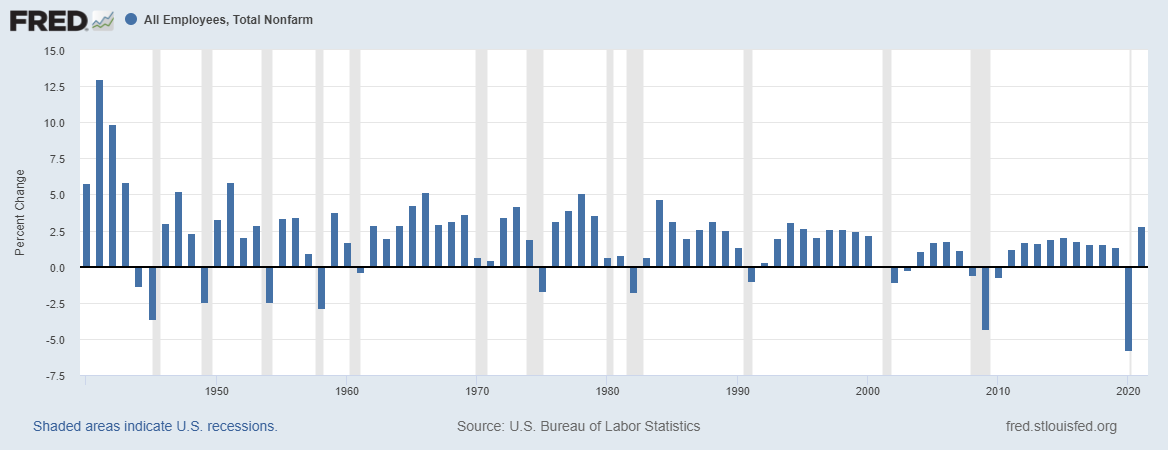

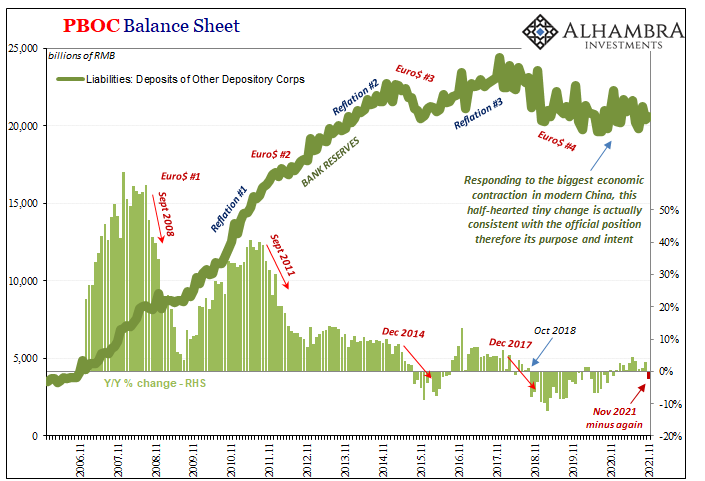

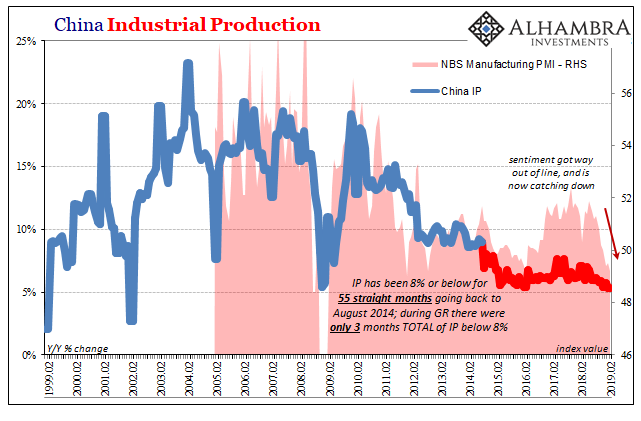

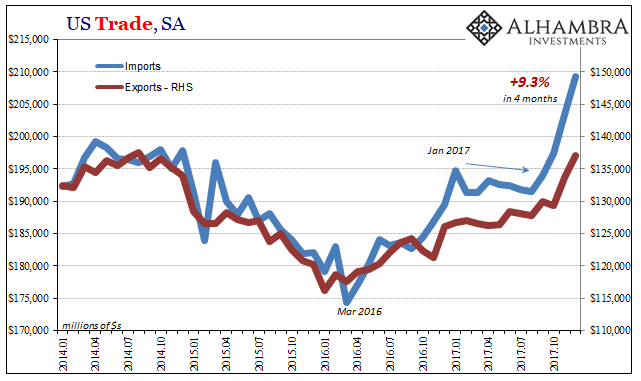

China and Japan Chart Update

A chart-up from China and Japan. Growth of Chinese industrial production, retail sales, fixed asset investment is at lows not seen since the Asian financial crisis. The Yuan is falling. Economic data from Japan is not a lot better.

Read More »

Read More »

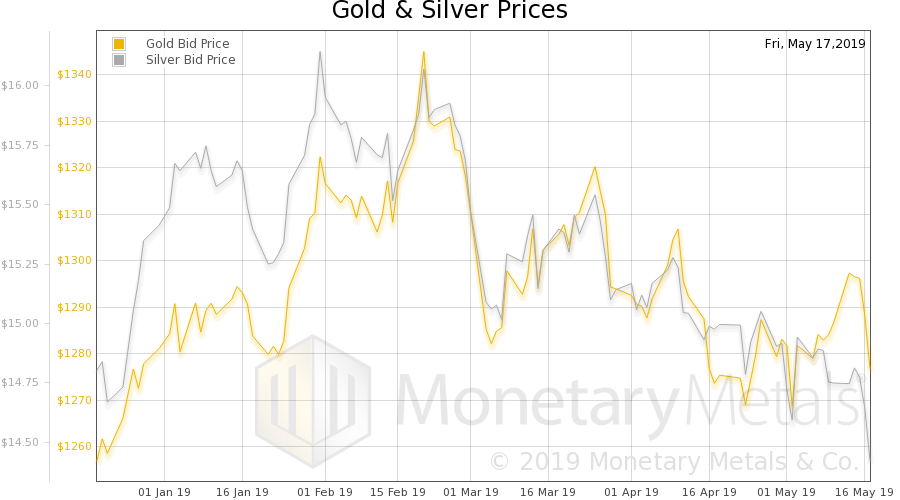

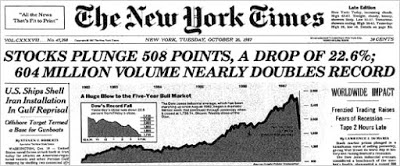

Chart up-date: Stocks, Bonds, Copper, Gold

Well that escalated quickly...All-time highs within reach... everything is awesome...wait what...

Quite a week:

Gold +5.25% in last 2 weeks - best run in 4 months

Silver +5.65% this week - best week since May 2015

Copper -4% this week to lowest week...

Read More »

Read More »

FX Weekly Preview: Macro Developments Will Not Stand in Way of Dollar Move Lower

Through the first part of the year, the swinging pendulum of expectations for the trajectory of Fed policy has been a major driver in the foreign exchange market. This is true even though the ECB and BOJ continue to ease monetary policy aggressively. The Australian and New Zealand dollars appear to influenced more by the … Continue...

Read More »

Read More »

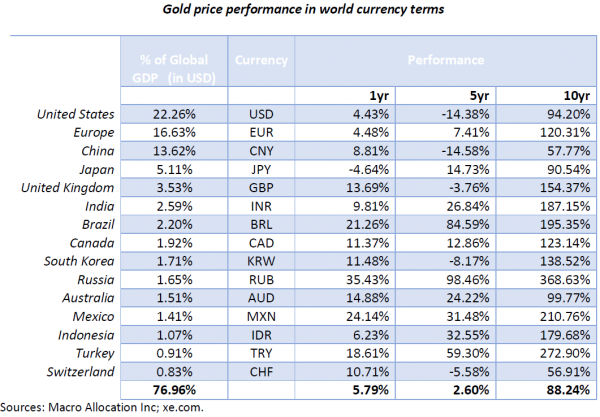

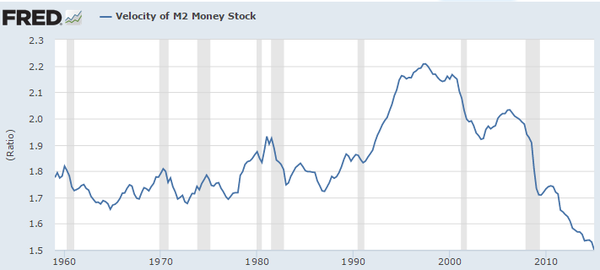

The Global Monetary System Has Devalued 47 percent Over The Last 10 Years

Authored by Paul Brodsky via Macro-Allocation.com,

We have argued the inevitability of Fed-administered hyperinflation, prompted by a global slowdown and its negative impact on the ability to service and repay systemic debt. One of the most political...

Read More »

Read More »

The Yuan and Market Forces: Declaratory and Operational Policy

The Wall Street Journal is reporting that minutes of a meeting in China two months ago reveal that officials there have abandoned their commitment to give market forces greater sway in setting the yuan’s exchange rate. Reportedly, in response to economists and banks request that officials stop resisting market pressure, one PBOC official explained that …

Read More »

Read More »

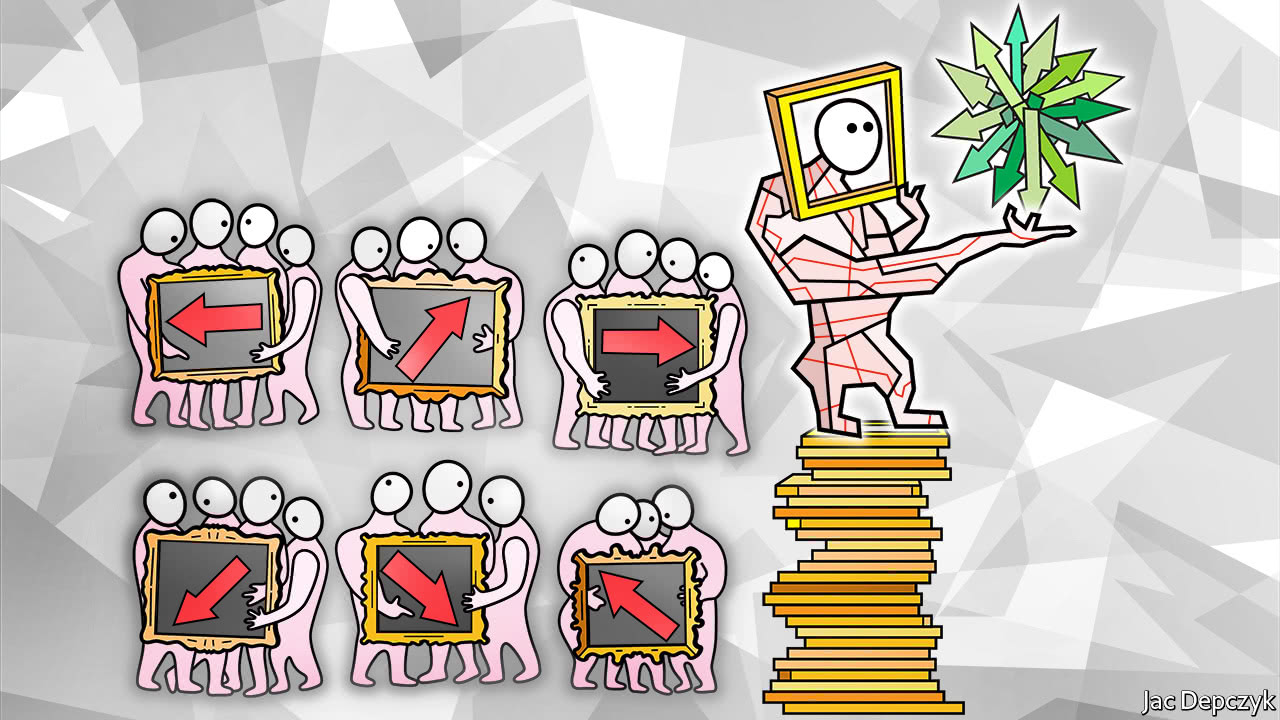

The Twilight Of The Gods (aka Central Bankers)

The current financial market volatility increasingly reflects loss of faith in policy makers. Celebrity central bankers are learning that they must constantly produce new miracles for their followers.

Read More »

Read More »

Are Central Banks Setting Each Other Up?

Authored by Mark St.Cyr,

There are times you try to connect the dots. There are others where those connections warrant adorning your trusted tin-foiled cap of choice; for you just can’t get there unless you do. This I believe is one of those time...

Read More »

Read More »

Global Stocks Soar On Stimulus Hopes After Miserable Chinese, Japanese Data; Short Squeeze

Bad news is once again good news... for stocks that is.

After a month and a half of markets unable to decide if they should buy or sell on ugly data, over the weekend, People’s Bank of China Governor Zhou Xiaochuan expressed faith in the economy, ...

Read More »

Read More »

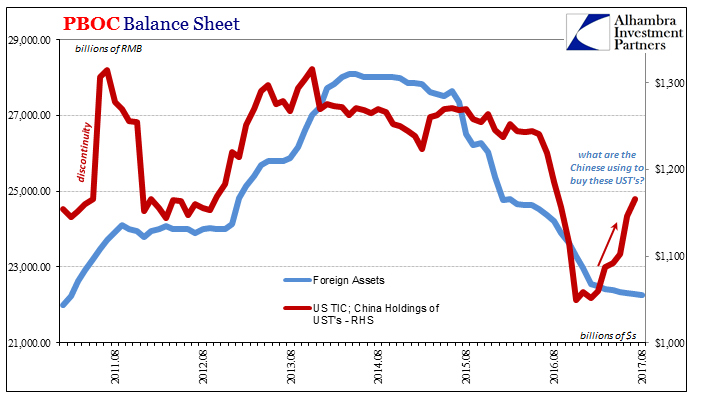

The Chinese Yuan Countdown Is On

Submitted by SaxoBank's Dembik Christopher via TradingFloor.com,

Currency stability is a prerequisite for China's economic transition

Defending the yuan is prohibitively expensive – China cannot beat the market

Progressive devaluation managed by PBoC...

Read More »

Read More »

Square Holes And Currency Pegs

Submitted by Raul Ilargi Meijer via The Automatic Earth blog,

When David Bowie died, everybody, in what they wrote and said, seemed to feel they owned him, and owned his death, even if they hadn’t thought about him, or listened to him, for years....

Read More »

Read More »

Global Risk Off: China Reenters Bear Market, Oil Tumbles Under $30; Global Stocks, US Futures Gutted

"We're gonna need a bigger Bullard"

- overheard on a trading desk this morning.

Yesterday, when looking at the market's "Bullard 2.0" moment, which was a carbon copy of the market's kneejerk surge higher response to Bullard's "QE4" comments fr...

Read More »

Read More »

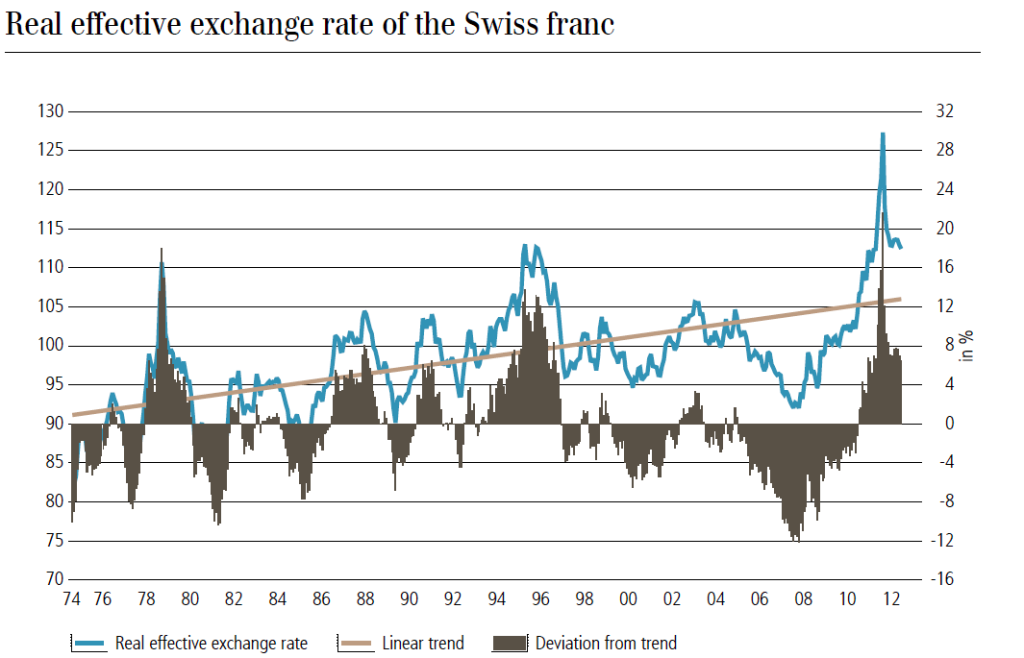

(2.5) Real Effective Exchange Rate, Swiss Franc, Yen and Renminbi

The weighted average of country's currency relative to index or basket of other major currencies adjusted for inflation. We explain the Real Effective Exchange Rate for the Franc, the Yen and Renmimbi

Read More »

Read More »

When Will the Renminbi Become a Reserve Currency?

We recently explained that China will overtake the United States not only for GDP but also for wealth. In this post we explain what is still missing to become a world reserve currency and how quickly this could happen.

Read More »

Read More »

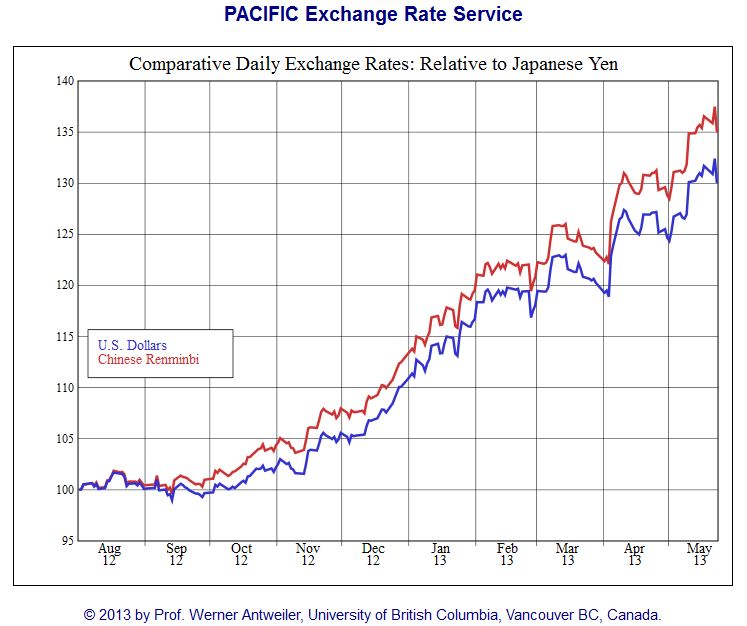

How 40% Renmimbi appreciation vs Yen Caused a Deflationary Commodity Price Shock for World Economy

Everybody is wondering why China is currently so weak, with a HSBC manufacturing in contractionary territory. No wonder, the main competitor in electronics and many more products,the Japanese yen has appreciated by nearly 40%. While China has to fight years-long appreciation of wages, the Japanese profit on years-long deflation and cheaper costs. At the …

Read More »

Read More »