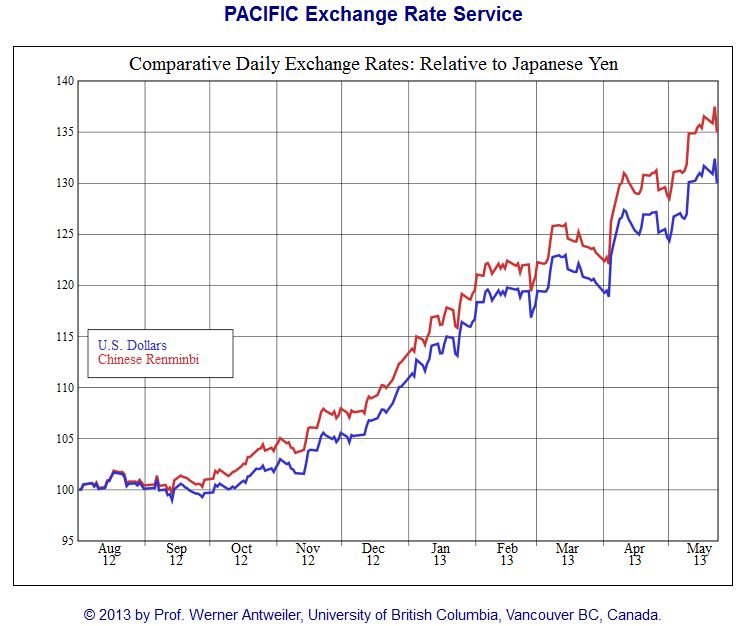

Everybody is wondering why China is currently so weak, with a HSBC manufacturing in contractionary territory. No wonder, the main competitor in electronics and many more products,the Japanese yen has appreciated by nearly 40%. While China has to fight years-long appreciation of wages, the Japanese profit on years-long deflation and cheaper costs. At the same time the major customer, the euro zone implemented strong austerity and consequently demand for Chinese goods has come down.

Everybody is wondering why China is currently so weak, with a HSBC manufacturing in contractionary territory. No wonder, the main competitor in electronics and many more products,the Japanese yen has appreciated by nearly 40%. While China has to fight years-long appreciation of wages, the Japanese profit on years-long deflation and cheaper costs. At the same time the major customer, the euro zone implemented strong austerity and consequently demand for Chinese goods has come down.

Problems on demand side and competition on supply side, an export-oriented economy like China can stand this only with difficulties.

Yen devaluation created world-wide commodity-price deflation

Chinese products are at the beginning of the world-wide supply chain, Chinese is the world’s work-bench.

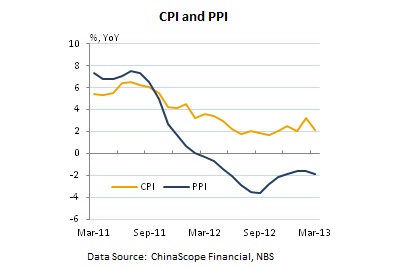

Their production costs are mostly based on wages and prime materials, while the production of other countries is often based on preliminary products and ingredients from China. We explained that commodity prices mostly depend on the expected expansion of China and the Chinese need of prime materials for production. The weakening of Chinese production costs thanks to a stronger Renmimbi (even against the US dollar) and cheaper commodity prices could only partially offset the Japanese competition, 2-3 % lower PPI versus 40% weaker yen.

Their production costs are mostly based on wages and prime materials, while the production of other countries is often based on preliminary products and ingredients from China. We explained that commodity prices mostly depend on the expected expansion of China and the Chinese need of prime materials for production. The weakening of Chinese production costs thanks to a stronger Renmimbi (even against the US dollar) and cheaper commodity prices could only partially offset the Japanese competition, 2-3 % lower PPI versus 40% weaker yen.

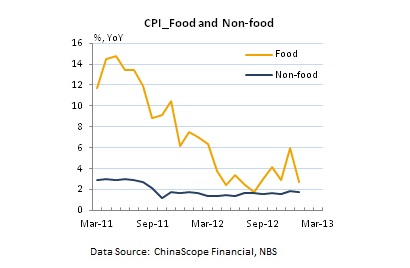

On the other side a stronger Renmimbi improves Chinese purchasing power. Rising wages and weaker food prices have strengthened considerably purchasing power.

The biggest external risk concerns China. Its real exchange rate has become overvalued. It is heavily exposed to developed world countries ratcheting down their real exchange rates. Since abandoning the fixed 8.28 yuan/dollar rate in 2005, China’s unit labour costs have been rising at 7 per cent a year, and its currency by 4 per cent, for a combined annual 11 per cent in dollars.

Overvaluation became a serious problem in 2011. Producer price inflation (PPI) of 7 per cent then matched unit labour costs (in yuan), but crumpled into 2-3 per cent producer price deflation over the past couple of years. April’s 2.6 per cent deflation has intensified from 1.6 per cent in February. Chinese businesses have to slash prices to keep a grip on their export markets. But unit labour costs are still rising at a 5 per cent rate, squeezing profit margins, and are up 20 per cent relative to the export competition since 2011.

Adding to this problem is the sudden, related, swing into high real interest rates. In mid-2011, the one-year lending rate from state-owned banks was 6.6 per cent, which combined with 7 per cent PPI to give a slightly negative real rate. But a flight of depositors from China’s banks has kept nominal interest rates high. The nominal interest rate is only down to 6 per cent now, but combined with PPI deflation, the real interest rate is close to 9 per cent. Such high real interest rates combined with squeezed profit margins have pushed China into a prolonged “investment-led” slowdown. (source FT)

Apart from commodities themselves, commodity currencies like AUD, NZD, CAD, NOK but also the Swiss franc have weakened.

But still, commodity prices are cyclical, next year they could rise again, when Chinese consumer demand rises. Logically producer prices will edge up and real interest rates down again. A simple cyclical movement.

Are you the author? Previous post See more for Next postTags: China,Japan,renminbi,yuan