Tag Archive: yuan

FX Daily, January 17: Trump’s Comments Send the Dollar Reeling

The Pound has been subjected to a heavy amount of pressure as we progress further into 2017, with GBP/CHF rates being one of the heaviest losers. The pairing is now trading at a similar level to GBP/USD levels below the 1.22 mark. Their is an enjoyable symmetry between the two from an analysts point of view. Both are well regarded as safe-haven currencies, and in this time of increased uncertainty, both have almost the exact same value in the...

Read More »

Read More »

FX Weekly Preview: Five Events that Will Drive the Capital Markets in the Week Ahead

Bank of Canada may be more upbeat following strong jobs and trade figures. China's President Xi will speak at Davos and likely defend globalization and free trade, which some think the US is abandoning. UK PM May's speech on Brexit may be blunted by few surprises, collapse of the government in Northern Ireland, and the pending Supreme Court ruling. ECB will leave rates on hold and look for Draghi to push back against ideas that rise in CPI means QE...

Read More »

Read More »

FX Daily, January 12: Dollar and Yields Ease Further, but Look for Recovery

After a choppy North American session yesterday, the dollar and US yields remain under pressure. The dollar is lower against all the major currencies and most emerging market currencies, including the recently shellacked Turkish lira and Mexican peso.

Read More »

Read More »

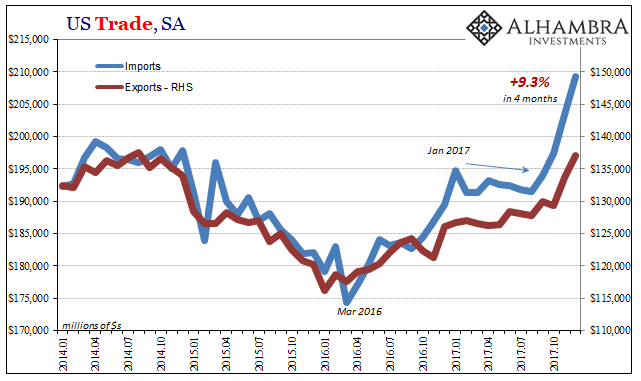

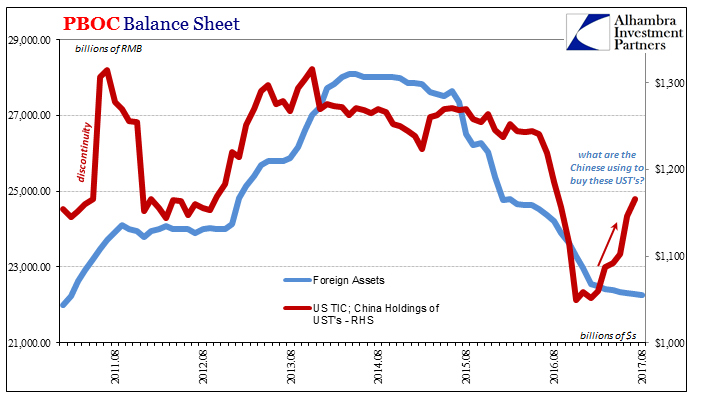

China Capital Flight: When $4 trillion is Too Much and $3 trillion is not Enough

All of China's capital outflows are not capital flight fleeing. Capital controls limiting outflows can be tightened. Paying down dollar loans, a major source of capital outflows, is not an infinite process.

Read More »

Read More »

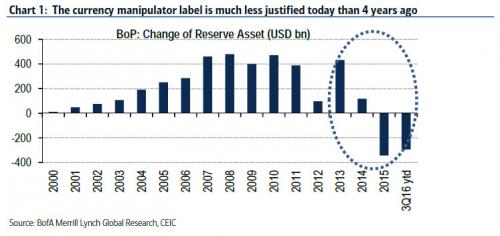

Trump Is Set To Label China A “Currency Manipulator”: What Happens Then?

While China has been banging the nationalist drums in its government-owned tabloids, warning daily of the adverse consequences to the US from either a trade war, or from Trump's violating the "One China" policy, a more tangible concern for deteriorating relations between China and the US is that Trump could, and most likely will, brand China a currency manipulator shortly after taking over the the Oval Office.

Read More »

Read More »

FX Daily, January 09: Sterling Pounded by May’s Hard Brexit

Sterling has stolen the US dollar's spotlight. The issue facing market participants was if the rise in hourly earnings reported as part of the pre-weekend release of US December jobs data was sufficient to end the dollar's downside correction. Instead, May's comments over the weekend indicating not just a desire but strategic thrust to abandon the single market in exchange for regaining control over immigration and not being subject to the...

Read More »

Read More »

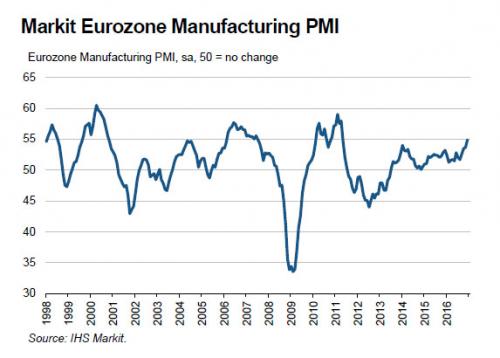

European Stocks Greet The New Year By Rising To One Year Highs; Euro Slides

While most of the world is enjoying it last day off from the 2017 holiday transition, with Asia's major markets closed for the New Year holiday, along with Britain and Switzerland in Europe and the US and Canada across the Atlantic, European stocks climbed to their highest levels in over a year on Monday after the Markit PMI survey showed manufacturing production in the Eurozone rose to the highest level since April 2011.

Read More »

Read More »

China Update

The evolving political situation in China is worth monitoring. China's trade surplus with the US has fallen this year. It has been roughly 20 years since China was formally labeled a currency manipulator. Trump has indicated he would do so.

Read More »

Read More »

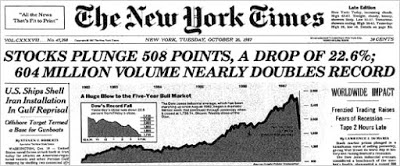

Risk Happens Fast

As a teenager brimming with testosterone my reptilian brain loved action movies. Top of my list were Steven Seagal movies. Clearly it wasn't for his acting skills, which are only marginally better than Barney the dinosaur. What I loved about Seagal was that he was both deadly and terribly fast.

Read More »

Read More »

Yuan Not

There were two dogs that did not bark this year. There are the Japanese yen, which despite negative interest rates and an unprecedented expansion of the central bank's balance sheet, the yen has strengthened 15% against the dollar. The yen has been the strongest major currency, and the third strongest currency in the world behind the high-yielding Brazilian real, recovering from last year's drop, and the Russian rouble, aided by a rebound in oil.

Read More »

Read More »

IMF’s Reserve Data: Dollar Share Little Changed, Yen Share Jumps, Helped By Valuation

The increase in the yen's share of reserves was flattered by the yen's 9% appreciation. The dollar and euro's share of reserves were stable. Chinese integration has seen the share of unallocated reserves fall. Starting with Q3 data, (available end of March 2017) will break out the yuan's share of reserves.

Read More »

Read More »

Is The US Dollar Set To Soar?

Hating the U.S. dollar offers the same rewards as hating a dominant sports team: it feels righteous to root for the underdogs, but it's generally unwise to let that enthusiasm become the basis of one's bets. Personally, I favor the emergence of non-state reserve currencies, for example, blockchain crypto-currencies or precious-metal-backed private currencies--currencies which can't be devalued by self-serving central banks or the private elites...

Read More »

Read More »

Yuan and Why

It is as if Hamlet, the confused prince of Denmark, has taken up residence in Beijing. The famed-prince wrestled with "seeming" and "being". So are Chinese officials. They seem to be relaxing their control over financial markets but are they really? Are they tolerating market forces because they approve what they are doing, such as driving interest rates down or weakening the yuan? If so what happens when the markets do something which they...

Read More »

Read More »

Bretton Woods: RIP

Some romanticists want to have another Bretton Woods fixed exchange rate regime. Bretton Woods had difficulty from nearly the day it went operational. It is misguided to think a new rigid regime is needed or is appropriate.

Read More »

Read More »

Cool Video: CNBC Asia–Mostly about the Redback and Greenback

I was invited to appear on CNBC Asia Rundown show with Pauline Chiou. We discuss the Chinese yuan on the anniversary of last summer's unexpected devaluation. I suggest that most of the things that get observers excited, like the internationalization of the yuan, or the Hong Kong-Shanghai link or, perhaps by the end of the year,a Hong Kong-Shenzhen link are really Chinese machinations that are the result of its contradictions.

Read More »

Read More »

Gorilla or Elephant, Chinese Surplus Capacity is the Challenge

China's excess capacity is one of the most formidable challenges the China and the world face. Unexpectedly, China's steel industry reported a profit in H1 16. M&A for industry rationalization and foreign markets seem to be the main ways China is trying to address the excess capacity.

Read More »

Read More »

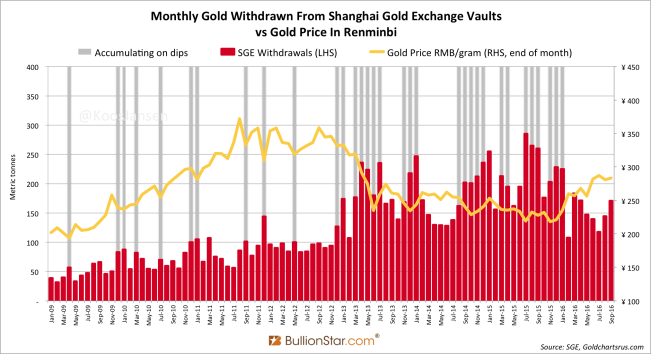

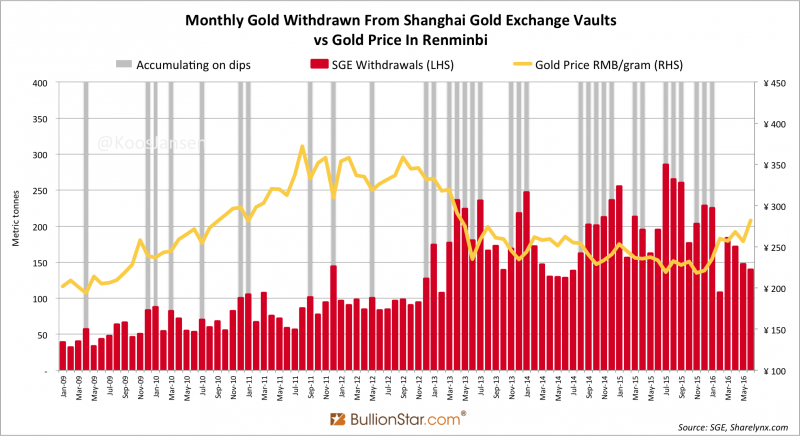

Chinese Gold Demand 973 tonnes in H1 2016, Nomura SGE Withdrawals Chart False

Chinese wholesale gold demand, as measured by withdrawals from the vaults of the Shanghai Gold Exchange (SGE), reached a sizable 973 metric tonnes in the first half of 2016, down 7 % compared to last year.

Read More »

Read More »