Tag Archive: U.S. Treasuries

FX Weekly Review, April 10-14: Swiss Franc loses against the Yen, but wins against Dollar

Last week the Swiss Franc improved against both euro and dollar, but - compared to its safe-haven counterpart Japanese Yen - it had a bad performance. We expect strong SNB interventions.

Read More »

Read More »

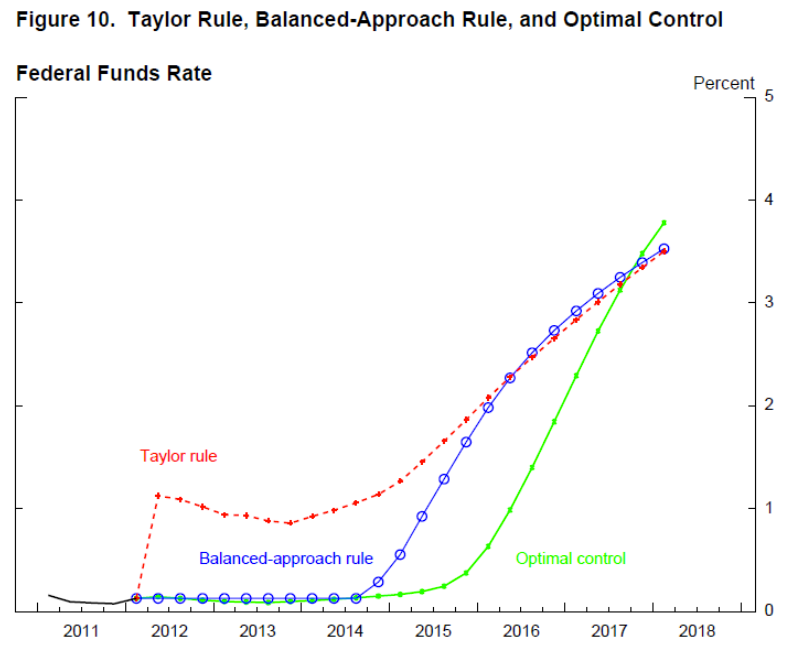

Optimal Lunacy

In June 2012, Janet Yellen, then the Vice Chairman of the Federal Reserve, addressed an audience in Boston with what for the time seemed like a radical departure. It was the latest in a string of them, for conditions throughout the “recovery” period never did quite seem to hit the recovery stride. Because of that, there was constant stream of trial balloons suggesting how the Federal Reserve might try to overcome this economic inertia.

At that...

Read More »

Read More »

Trade Notes: China and Prospects for a New Executive Order

China's trade concessions seem modest, but little discussion of US concessions. Reports suggest Trump is set to sign a new executive order to investigate trade practices in steel, aluminum, and maybe household appliances. Trade imbalances and floating currencies are not mutually exclusive.

Read More »

Read More »

Bi-Weekly Economic Review

It is hard not to notice that the chart above has a lot less red in it than it has in some time. That is true of the month to month data as well as the year over year changes. There has been a widely reported gap between so called soft data – surveys and polls – and the hard data – actual economic activity reports. Bulls say the gap is there because the soft data always leads the hard data.

Read More »

Read More »

FX Weekly Review, April 03-08: Dollar Recovery Can Continue, 10-year Yield Set to Rise

The US dollar appreciated against most of the major currencies last week. The Japanese yen was the chief exception. It rose about 0.5% as US yields remained heavy and equities were mostly softer. The Dollar Index did not fall in any session last week. It has had one losing session over the past nine, and that was the last day in March when the Dollar Index slipped less than 0.1%. It finished the week a bit above thee 61.8% retracement objective of...

Read More »

Read More »

US Jobs: Who Carries The Burden of Proof?

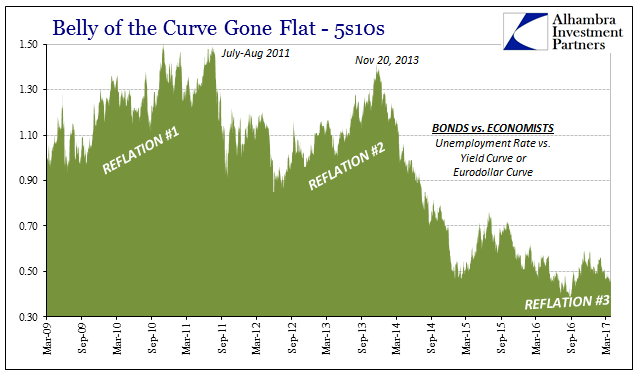

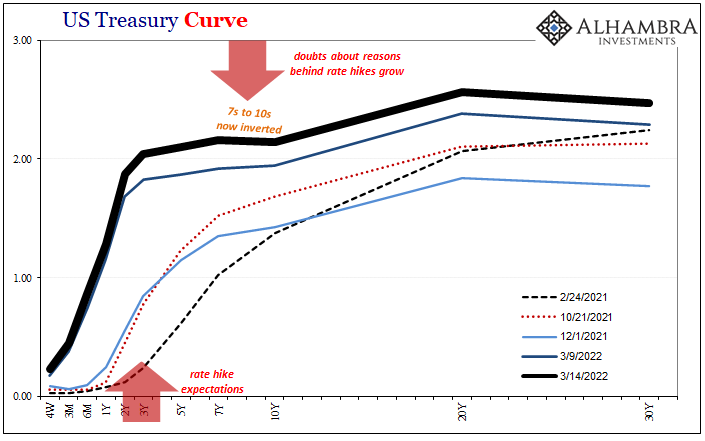

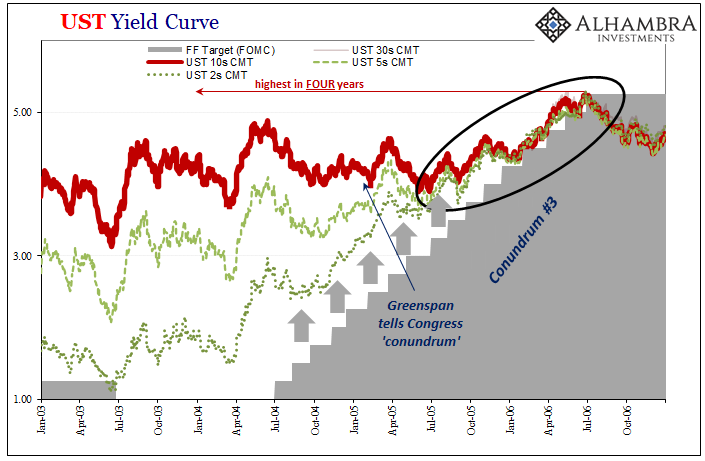

The idea that interest rates have nowhere to go but up is very much like saying the bond market has it all wrong. That is one reason why the rhetoric has been ratcheted that much higher of late, particularly since the Fed “raised rates” for a third time in March. Such “hawkishness” by convention should not go so unnoticed, and yet yields and curves are once more paying little attention to Janet Yellen.

Read More »

Read More »

FX Weekly Review, March 27 – 31: Euro breaks down against USD and CHF

Weak inflation figures in the euro zone let the common currency fall against both the dollar and the Swiss franc. Still last week, the Swiss Franc index had some losses against the US dollar index.

Read More »

Read More »

FX Daily, March 28: Prospects for Turnaround Tuesday?

The slide in the US dollar and US interest rates faded in the North American session on Monday. US participants also had a fairly relaxed initial response to news that after years of complaining, the Republicans could not agree on an alternative to the Affordable Care Act.

Read More »

Read More »

FX Weekly Review, March 20 – March 25: Dollar Bottom Near?

In the last week, the Swiss Franc index recovered and gained about 2%. The dollar index lost 1.5%. Position adjustments: The dollar tended to trade heaviest against those currencies that speculators were short, like the euro, yen, and sterling.

Read More »

Read More »

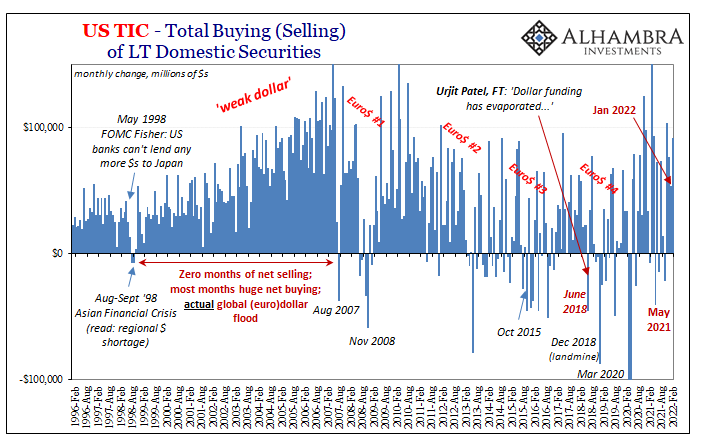

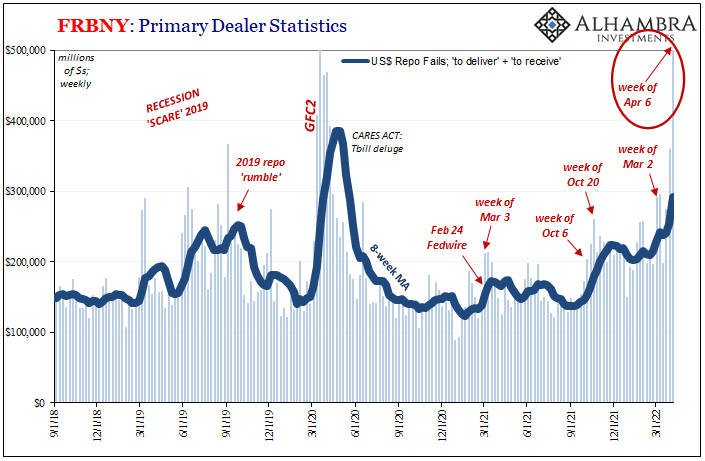

All In The Curves

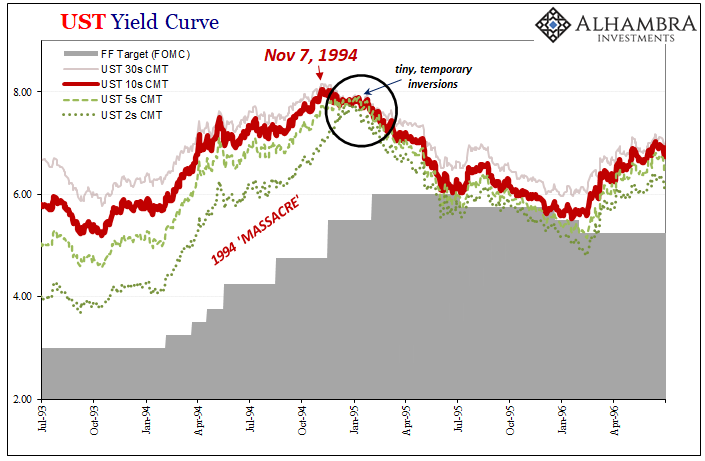

If the mainstream is confused about exactly what rate hikes mean, then they are not alone. We know very well what they are supposed to, but the theoretical standards and assumptions of orthodox understanding haven’t worked out too well and for a very long time now. The benchmark 10-year US Treasury is today yielding less than it did when the FOMC announced their second rate hike in December.

Read More »

Read More »

FX Weekly Review, March 13 – March 18: Fed Disappoints, Dollar Losses

The failure of the Fed to signal an increased pace of normalization and the prospects of other central banks raising rates spurred dollar losses, which deteriorated its technical outlook.

Read More »

Read More »

FX Weekly Review, March 06 – March 11: CHF loses against the euro

The Swiss Franc lost this week in particular against the euro, given that Mario Draghi was less dovish than expected. If the stronger euro is driven only by speculators, or also by "real money" (investments in cash, bonds, stocks) will be visible in Monday's sight deposits release.

Read More »

Read More »

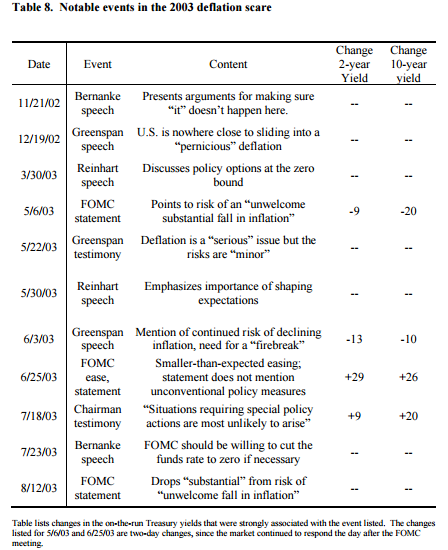

FX Weekly Review, February 27 – March 04: Dramatic Shift in Fed Expectations Spurs Dollar Gains, but Now What?

The pendulum of market sentiment swung hard and fast toward a Fed rate hike in the middle of March. The signals from Fed officials, including Governor Brainard and Powell, spurred the move. According to Bloomberg, the market had discounted a 90% chance of a hike before Yellen and Fischer spoke. A week ago, Bloomberg calculations showed a 40% chance of a move.

Read More »

Read More »

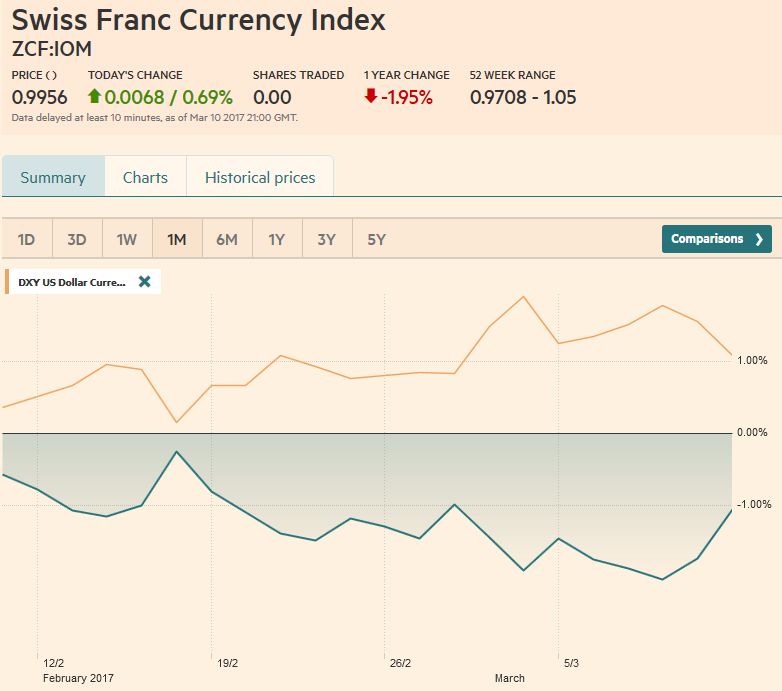

FX Weekly Review, February 20 – 25: Ranges in FX: Respect the Price Action

It is difficult right now to talk about the foreign exchange market using the dollar as the numeraire. The dollar was stronger against most of the major currencies last week, but not the yen or sterling. The Dollar Index itself was little changed, rising less than 0.15%.

Read More »

Read More »

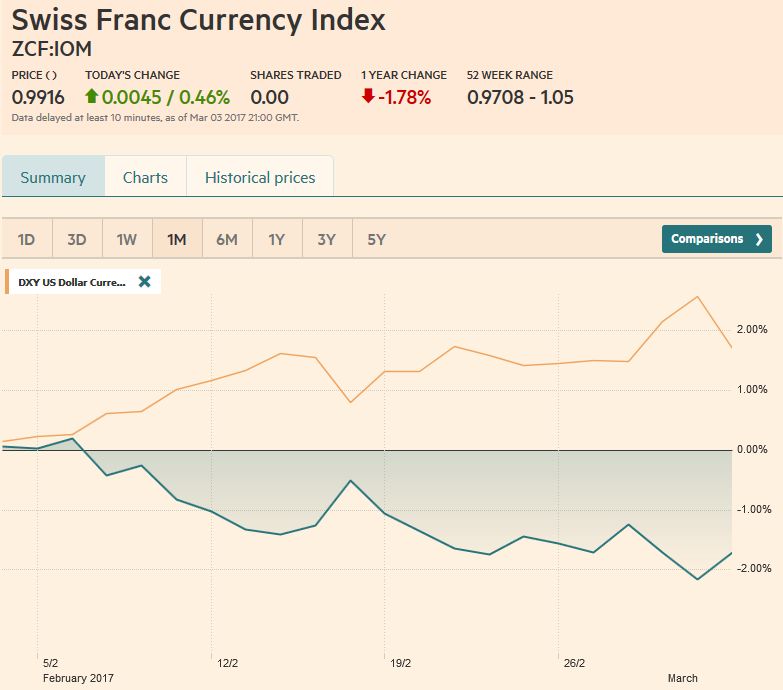

FX Weekly Review, February 13 – 18: Why still long the dollar?

Arguments for being long the dollar: FX investors because of the difference in monetary policy (e.g. higher US rates), Bond investors long US Bonds because higher bond yields, On the other side, European and Swiss equities are not so much overvalued as U.S. stocks are.

Read More »

Read More »

FX Daily, February 14: Markets Showing Little Love on Valentines

Corrective pressures are gripping the major capital markets today.The Dollar Index's nine-day advancing streak is being threatened by the position adjustment ahead of Yellen's testimony later today. Despite record high closes in the main US equity markets yesterday, Asia could not follow suit. It tried to initially, and recorded new highs since July 2015, but sellers emerged and the MSCI Asia Pacific Index closed marginally lower on the lows of the...

Read More »

Read More »

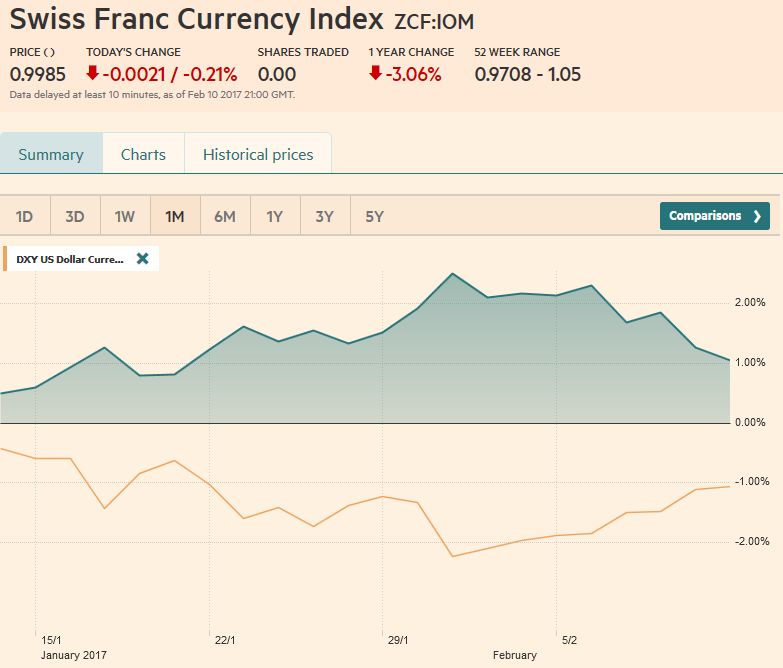

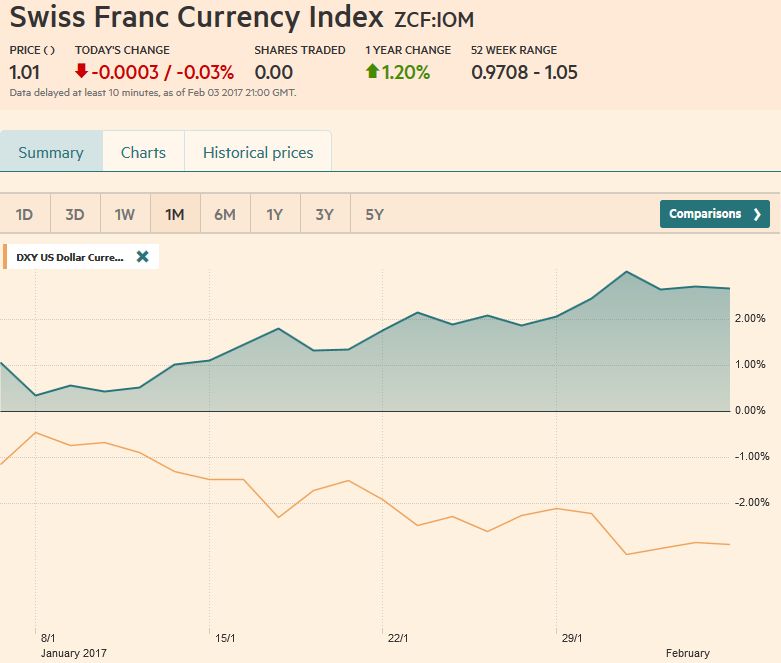

FX Weekly Review, February 06 – 11: Further Dollar and CHF Strength versus Euro weakness ahead?

We are expecting a further strengthening of both dollar and Swiss Franc against the euro over the next 3 months. Reason is the rising Swiss demand the continued dovishness of the ECB, despite rising inflation.

Read More »

Read More »

FX Daily, February 08: EUR/CHF down to 1.630, Swiss Boom Starting?

The reader might have seen the latest Swiss Consumer Sentiment and the UBS consumption indicator. They suggest that the Swiss boom phase should finally come.

I anticipated the boom already in my slides for the CFA Society. The Swiss boom was postponed when the SNB decided to remove the euro peg in early 2015.

Read More »

Read More »

Gold Prices Rising As “World Has Never Been More Uncertain”

Gold prices rising & up 6.6% YTD. Signal “impending market volatility”. World has never been more uncertain (see chart). Fear in Wall Street versus Fear in Washington. Price of ‘plunge protection’ rising even as VIX remains low. Smart money diversifying into gold. Important to watch rising gold and rising bond yields. Gold may prove the “tell”.

Read More »

Read More »

FX Weekly Review, January 30 – February 04: Reversal of Trump Reflation Trade Continues

The Swiss Franc index remained around the 2% gain that for the last month, the recovery from the Trump reflation trade. In this trade, investors preferred U.S. against European stocks. This tendency, however, is reversing now - and with it the franc recovered.

Read More »

Read More »