Swiss Franc |

EUR/CHF - Euro Swiss Franc, March 28(see more posts on EUR/CHF, ) |

GBP/CHFThe Swiss Franc continues to hold the higher ground as global uncertainty continues to dominate the markets. UBS Consumption Indicator is released tomorrow morning which should give some further clues to as the health of the Swiss economy. The numbers are important as the consumption is the most important component of Swiss Gross Domestic Product (GDP). A strong number this morning that signals a buoyant economy could help support the Swiss Franc further. Meanwhile as far as GBP CHF is concerned, Article 50 will be invoked tomorrow by UK Prime Minister Theresa May which will officially start the two year process for Britain to leave the European Union. There has been considerable uncertainty over these last 9 months as to whether Brexit will actually happen or not so there is a chance there could be considerable volatility for the Swiss Franc tomorrow. The platform by which Theresa May accomplishes this will be on a very publicised level for the world to see and there is likely to be a substantial reaction. Those clients looking to buy or sell Swiss Francs would be wise to get touch to look at the options of maximising on the rates of exchange when there is market movement. My view is that that the pound is likely to strengthen against the Swiss Franc after the announcement. Another indicator for Switzerland is released on Thursday which measure future economic trends and is linked to GDP growth. The KOF leading indicator is yet another data release which can signal future growth in the Swiss economy and could help support the Swiss Franc. |

GBP/CHF - British Pound Swiss Franc, March 28(see more posts on GBP/CHF, ) |

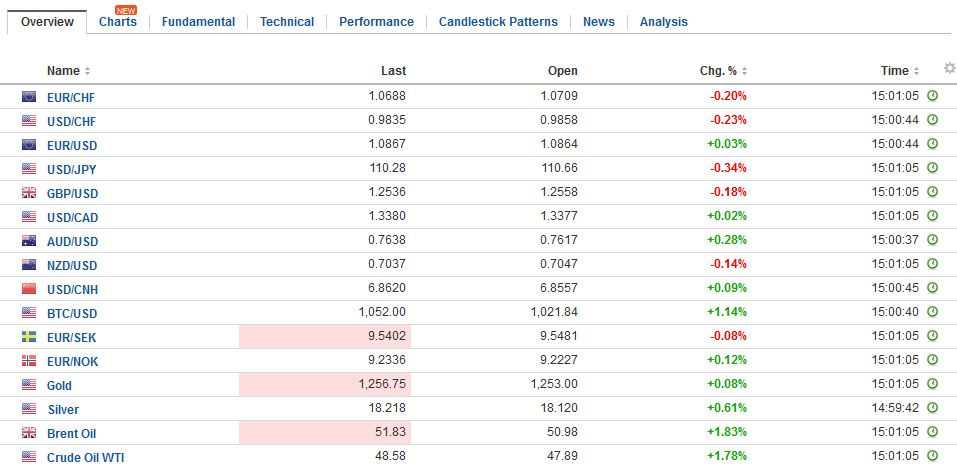

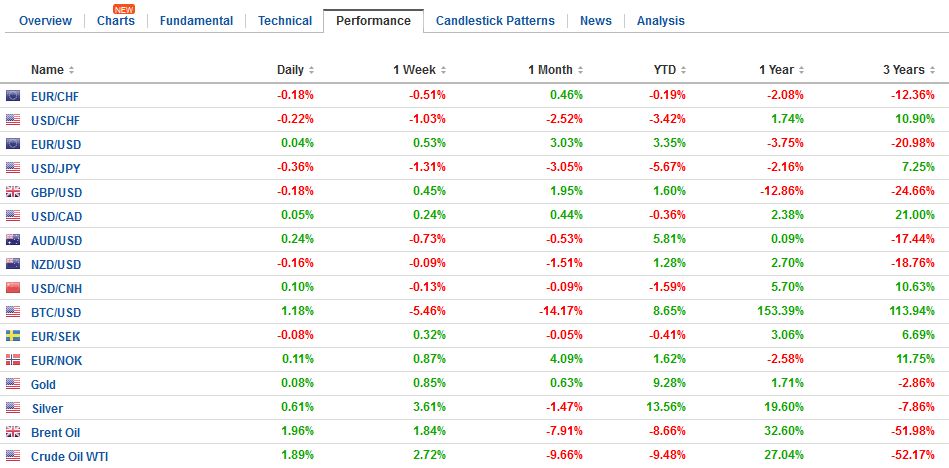

FX RatesThe slide in the US dollar and US interest rates faded in the North American session on Monday. US participants also had a fairly relaxed initial response to news that after years of complaining, the Republicans could not agree on an alternative to the Affordable Care Act. Many observers experience the currency market to be buffeted by many different forces. Perhaps, because, unlike other assets, currencies in their pure form do not generate a yield stream that can be modeled, they seem to be more subject to market fads. However, our work continues to show the strong relationship between the dollar and interest rate differentials. This remains our anchor. The chances of Turnaround Tuesday materializing for the dollar will be bolstered if US interest rates stabilize. The US 2-year yield approached 1.22% yesterday before recovering. The link between the rate the Federal Reserve targets (Fed funds) and the two-year note is stronger than at the long-end of the coupon curve. The two-year yield seems unreasonably low at 1.25% with a Fed funds target range of 75-100 bp unless one does not expect more than one hike over the next seven quarters. During this period, the median view of Fed officials is for five hikes over this period. Under Occam’s Razor, one can explain the recent price action in the foreign exchange market without discussing US fiscal policy. The Fed hiked on March 15 and is often the case, buy the rumor sell the fact activity, the dollar and US interest rates fell. The two-year note yieldfell17 basis points after the Fed hiked rates in December. The yield has declined 18 bp since the March cut. |

FX Daily Rates, March 28 |

| The day before the Fed hiked, Bloomberg’s calculation showed a nearly 54% chance of a June hike to 1.00-1.25%. A week after the Fed hiked, the odds had fallen to almost 47%. The odds have slipped a little more to 45%.

The Dollar Index fell from about 103.55 to near 99.25 in the weeks following last December’s rate hike. It made a high of around 101.70 on March 15. We saw that the two-year yield had declined now as much as it did in December. If the Dollar Index did this, it would bring it toward 97.40. However, the Dollar Index has fallen for three consecutive weeks coming into this week’s activity. Technical indicators are stretched, and the Slow Stochastics and RSI appear poised to turn higher. The euro has advanced for four consecutive weeks. It extended that rally yesterday, briefly poking through $1.09. It stopped just shy of the 61.8% retracement of the losses suffered since the US election (~$1.0925). It traded above the 200-day moving average (~$1.0880) for the first time since that election, though failed to finish the North American session above it. Technical indicators are stretched. Given the technical and psychological damage, we suspect that a period of consolidation, with the $1.0800-$1.0820 offering support. The dollar approached but held above JPY110. This is an important area for technical and psychological reasons. We note that it corresponds to the 50% retracement objective of the dollar’s rally since the US election. The 61.8% retracement is found a little below JPY108.00. Ahead of that is the 200-day moving average (~JPY108.30). |

FX Performance, March 28 |

United StatesThe US 10-year yield peaked when Fed hiked in December near 2.64%. It fell to almost 2.30%. The 10-year yield peaked the day before the Fed hiked earlier this month near 2.63%. At the low point yesterday, before the bounce, the yield was briefly pushed below 2.35%. |

Yield US Treasuries 10 years, Apr 2016 - Mar 2017(see more posts on U.S. Treasuries, ) Source: Bloomberg.com - Click to enlarge |

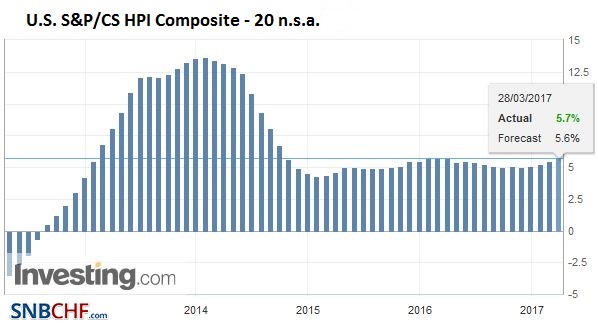

U.S. S&P-CS HPI Composite - 20 n.s.a. YoY, January 2017(see more posts on U.S. Case Shiller Home Price Index, ) Source: Investing.com - Click to enlarge |

Sterling has fallen only three times in the past 12 sessions coming into Tuesday’s session. It has moved from the lower end of the year’s range to the upper end. It faltered yesterday after it moved above $1.26. Sterling has not traded above $1.28 since early last October. Initial support is seen near $1.2550 and then $1.2520. Wednesday’s notification that Article 50 of the Lisbon Treaty is a formality and widely anticipated, which is not to take away from its historic importance.

In the North American session, four Fed officials speak, including Yellen. On balance, we suspect that Fed officials cannot be particularly pleased with the market response. A seemingly simple statement noting that the Fed had recognized the uncertainty surrounding the outlook for fiscal policy and recent developments do not change that, could help steer investor attention back to mostly healthy even if not spectacular US growth dynamics.

Oil prices also recovered in North America yesterday, which supported the recovery in yields and the dollar. The $48.00-$48.50 area (basis the May light sweet futures contract) may be key to the near-term outlook.

Asian equities have begun off the session on a firm note, and this also supports the Turn Around Tuesday scenario. We had noted that the 2317 area was the next target in the S&P 500, which corresponded to the 50% retracement of this year’s gain. It seemed like a reasonable target as the position adjusting ahead of the quarter-end became a more important consideration. The S&P 500 recovered after approaching it (~2322) yesterday. A move above 2350-2357 would lift the tone considerably.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$EUR,$JPY,$TLT,EUR/CHF,gbp-chf,newslettersent,SPY,U.S. Case Shiller Home Price Index,U.S. Treasuries