Tag Archive: U.S. Treasuries

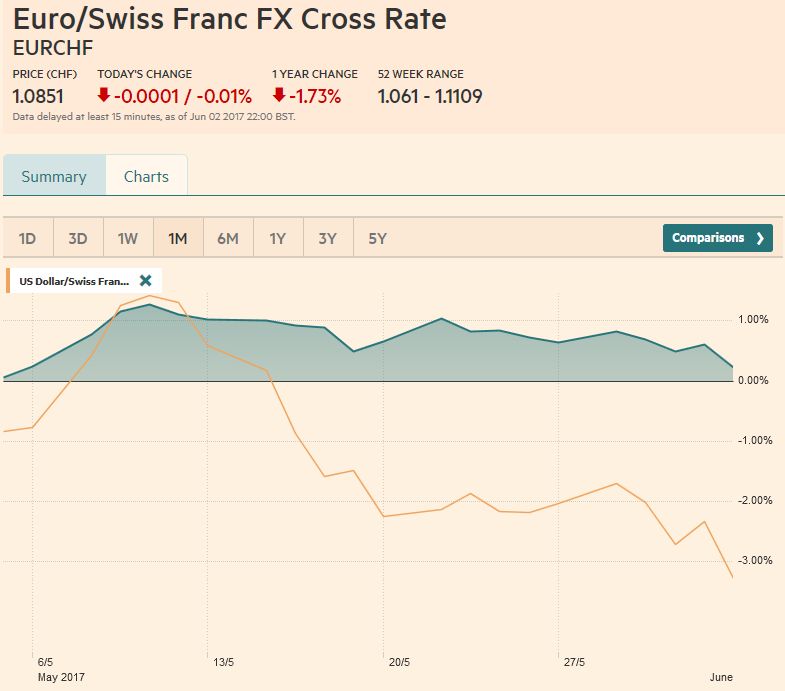

FX Weekly Review, May 29 – June 03: Dollar Dogged by Disappointing Data

While the Euro traded in the range between 1.08 and 1.09, the dollar declined by nearly 3%. The technical indicators warn that the US dollar is stretched, but the combination of disappointing auto sales and jobs report may deny it the interest rate support needed to facilitate a resumption of the bull market.

Read More »

Read More »

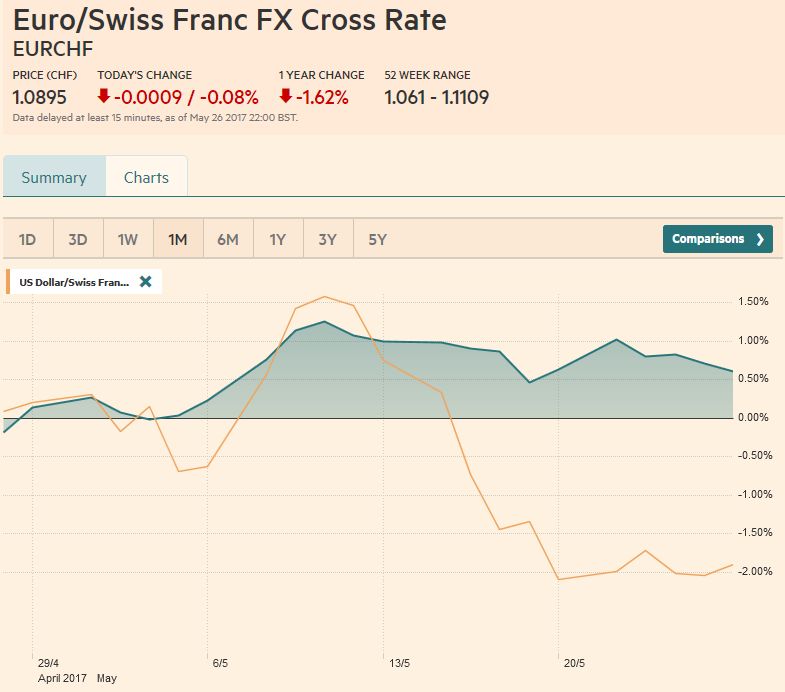

FX Weekly Review, May 22 – 27: Is the Dollar Going To Turn?

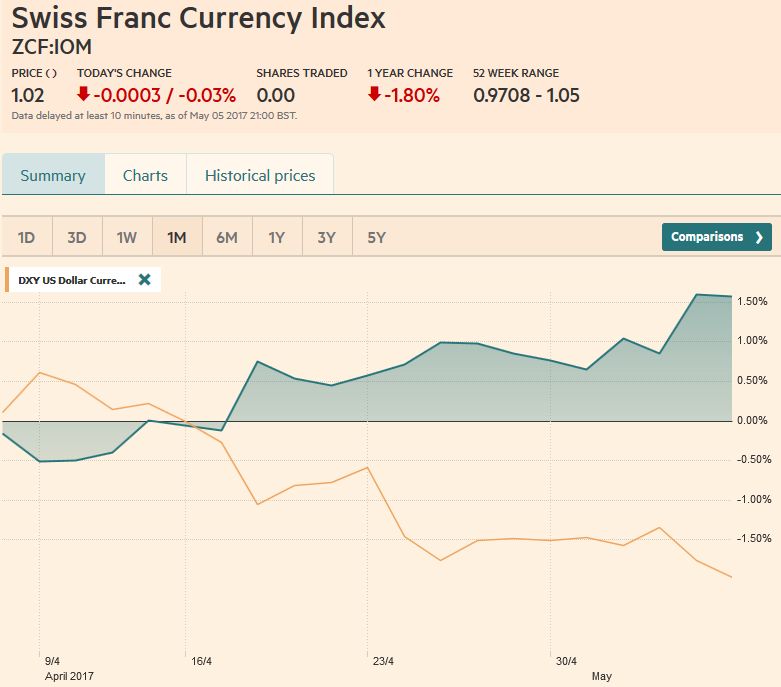

The Swiss Franc recovered a lot of the losses that came with the French elections. That political event was mostly driven by speculators that will close their positions. We expected the EUR to trade around 1.07 to 1.0750 CHF in some time.

Read More »

Read More »

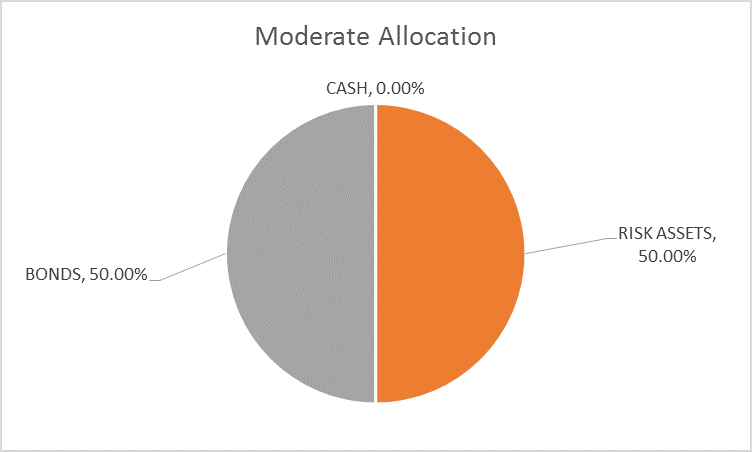

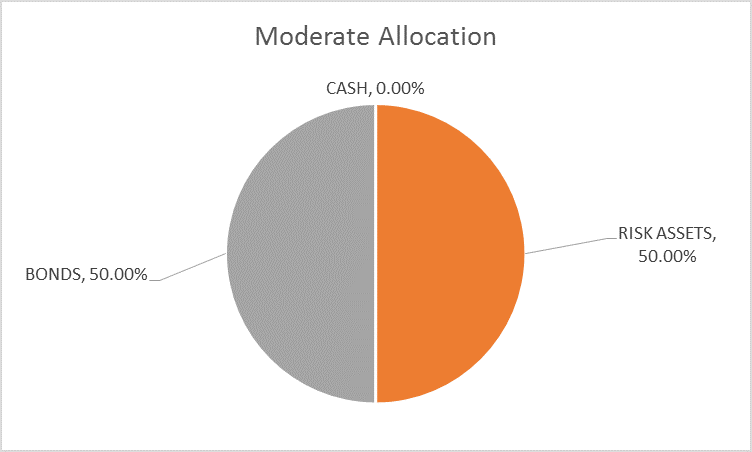

Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are, however, changes within the asset classes. We are reducing the equity allocation and raising the allocation to REITs.

Read More »

Read More »

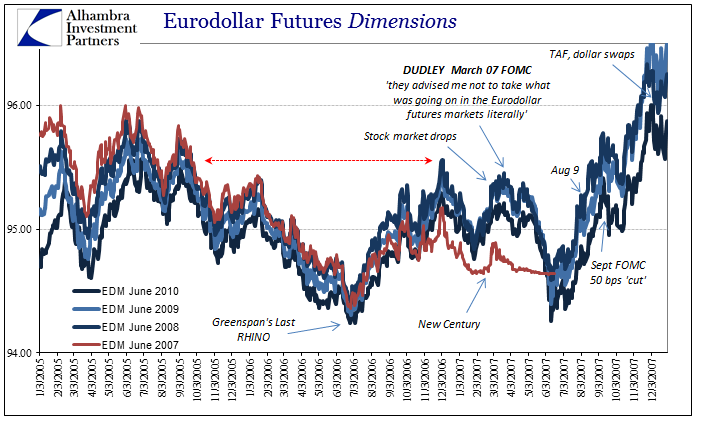

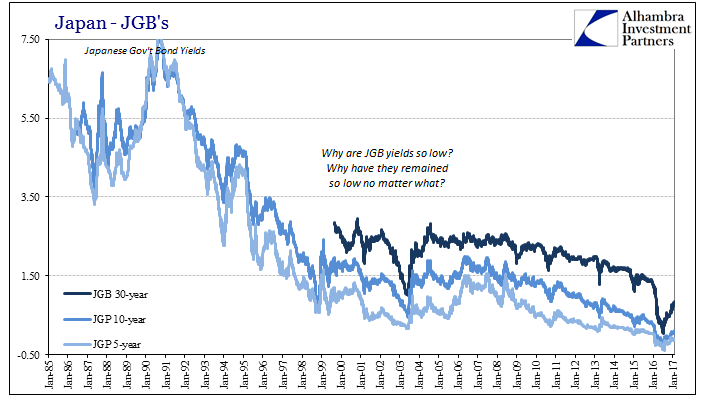

Less Than Nothing

As I so often write, we still talk about 2008 because we aren’t yet done with 2008. It doesn’t seem possible to be stuck in a time warp of such immense proportions, but such are the mistakes of the last decade carrying with them just these kinds of enormous costs.

Read More »

Read More »

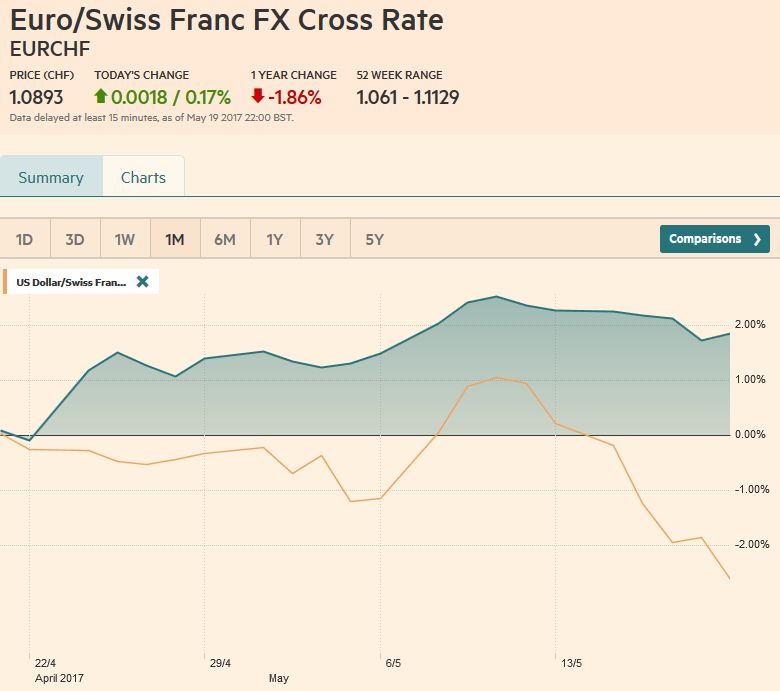

FX Weekly Review, May 15-20: Swiss Franc recovering against EUR

The Swiss Franc recovered a lot of the losses that came with the French elections. That political event was mostly driven by speculators that will close their positions. We expected the EUR to trade around 1.07 to 1.0750 CHF in some time.

Read More »

Read More »

Yen is the Weakest Currency in the World over the Past Month

Yen was the strongest currency in the world from mid-March to mid-April. Yen has been the weakest currency over the past month. US rates have risen relative to Japan. Japan has shifted away from QE and toward targeting interest rate.

Read More »

Read More »

FX Weekly Review, May 08-13: Euro rises far above 1.09 CHF, for how long?

The euro rose up to 1.0980. How long this momentum will last is still the question, given that it is driven by this political event and sustained by SNB interventions.

Read More »

Read More »

The Wrong People Have An Innate Tendency To Stand Out

I don’t think Milton Friedman would have made much of chess player. For all I know he might have been a grand master or something close to that rank, but as much as his work is admirable it invites too the whole range of opposite emotion. He was the champion libertarian of the free market who rescued economics from the ravages of New Deal socialism, but in doing so he simply created the avenue for where Economics of that kind could be transposed...

Read More »

Read More »

Noose Or Ratchet

losing the book on Q4 2016 balance sheet capacity is to review essentially forex volumes. The eurodollar system over the last ten years has turned far more in this direction in addition to it becoming more Asian/Japanese. In fact, the two really go hand in hand given the native situation of Japanese banks.

Read More »

Read More »

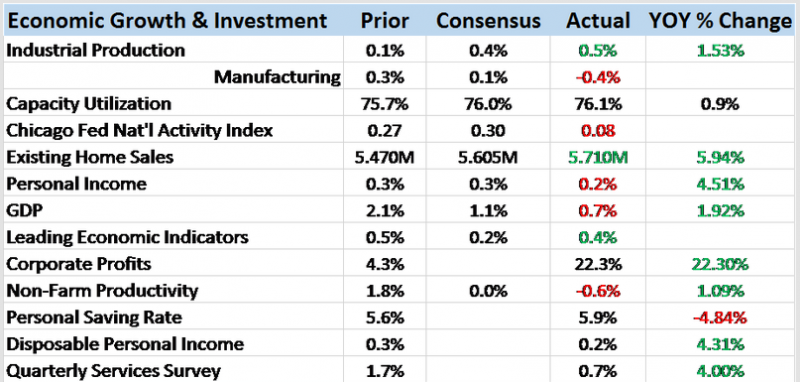

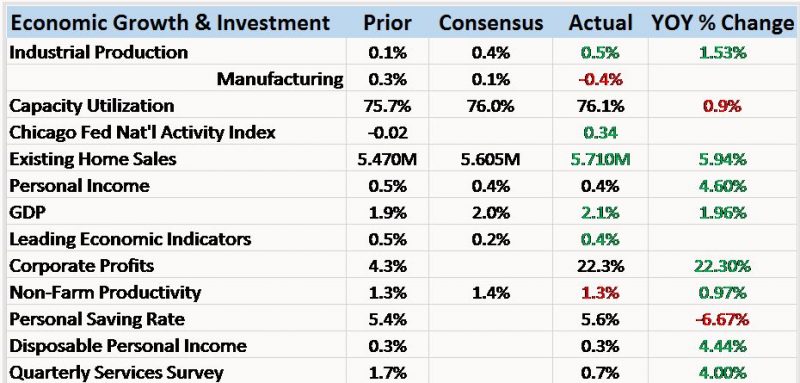

Bi-Weekly Economic Review

The economic reports since the last economic update were generally less than expected and disappointing. The weak growth of the last few years had been supported by autos and housing while energy has been a wildcard. When oil prices fell, starting in mid-2014 and bottoming in early 2016, economic growth suffered as the shale industry retrenched.

Read More »

Read More »

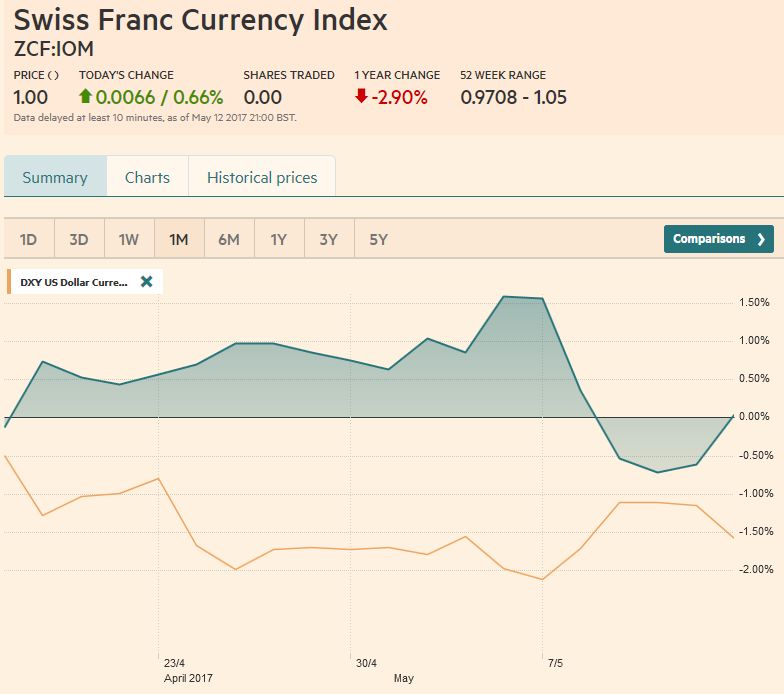

FX Weekly Review, May 01 – 06: Seasonal Patterns and Yen Crosses

The Swiss Franc index gained 1.5% in the last month, the biggest part of it is from the last week. The trade-weighted indices the Fed tracks are updated monthly. The Bank of England calculates the effective exchange rate on a daily basis. It has not fallen since April 24.

Read More »

Read More »

Clickbait: Bernanke Terrifies Stock Investors, Again

If you are a stock investor, you should be terrified. The most disconcerting words have been uttered by the one person capable of changing the whole dynamic. After spending so many years trying to recreate the magic of the “maestro”, Ben Bernanke in retirement is still at it.

Read More »

Read More »

FX Daily, May 01: May Day Calm

Many financial centers are closed for May. Japanese markets were open today, but will be closed for three sessions beginning Wednesday for the Golden Week celebrations. The US dollar is narrowly mixed.

Read More »

Read More »

FX Weekly Review, April 24 – 29: Dollar Remains the Fulcrum

Often the US dollar, as the numeraire, seems to be the main actor in the foreign exchange market. Other times, the dollar appears to be at the fulcrum between European currencies on one hand, and the dollar-bloc currencies on the other hand. Another way expressing this is whether there is a dollar-move underway or is it really more about the crosses.

Read More »

Read More »

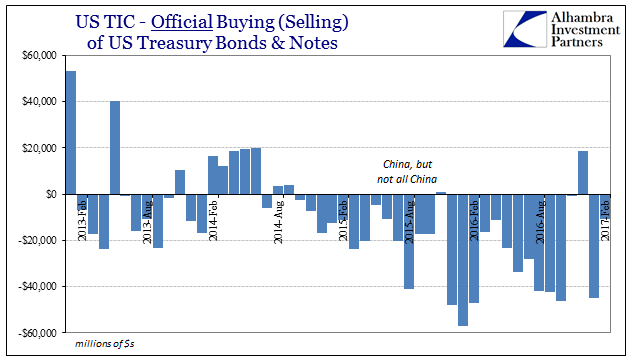

‘Dollar’ ‘Improvement’

According to the headline TIC statistics, foreign central banks have in the past six months sold the fewest UST’s since the 6-month period ended November 2015. That may indicate an easing of “dollar” pressure in the private markets due to “reflation” sentiment.

Read More »

Read More »

Bi-Weekly Economic Review

It wasn’t a very good two weeks for economic data with the majority of reports disappointing. Most notable I think is that the so called “soft data” is starting to reflect reality rather than some fantasy land where President Trump enacts his entire agenda in the first 100 days of being in office. Politics is about the art of the possible and that is proving a short list for now.

Read More »

Read More »

FX Weekly Review, April 17 – 22: Dollar Technicals Trying to Turn, but…

While the dollar index had another bad week with a 0.75% less, the Swiss Franc currency index could accumulate the corresponding gains. Main reason is that the EUR/CHF rose over 1.07.

Read More »

Read More »

Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50.

The performance of markets in the first quarter of the year was a bit schizophrenic. Stocks performed well which one might interpret as a reflection of improving economic growth prospects. Certainly President Trump and his proxies were quick to take credit but unfortunately for the new...

Read More »

Read More »

FX Daily, April 18: US Dollar Consolidates Yesterday’s Gains

The US dollar is consolidating the gains scored late in the US session yesterday in response to a Financial Times interview with US Treasury Secretary Munchin who seemed to play down the strategic importance of Trump's recent complaint about the greenback's strength.

Read More »

Read More »

Monetary Policy is Important, but US Fiscal Stance Moving Center Stage

Monetary policy is off the table for at least the next two months. Several fiscal issues are coming to a head. Despite the GOP majority in Congress and White House, brinkmanship cannot be ruled out.

Read More »

Read More »