Tag Archive: U.S. Services PMI

The Service PMI release is published monthly by Markit Economics. The data are based on surveys of over 400 executives in private sector service companies. The surveys cover transport and communication, financial intermediaries, business and personal services, computing & IT, hotels and restaurants.

FX Daily, August 03: Dollar-Bloc Currencies Turning, but Euro Downticks Limited

The high-flying dollar-bloc currencies may be a preliminary sign market change. The US dollar is gaining on the Canadian dollar for the fourth consecutive session. It is probing resistance we identified in the $1.2620 area. The US dollar has not traded above its 20-day moving average since the Fed hiked rates on June 14. It is found today near CAD1.2625.

Read More »

Read More »

FX Daily, July 24: Euro Recovers from Softer Flash PMI

The euro made a marginal new high in early Asia, but participants rightly drew cautious ahead of the flash eurozone PMI. The flash PMI was softer than expected, and although the composite fell to six monthly lows, it is more a reflection of how steady it has been at elevated levels.

Read More »

Read More »

FX Daily, July 06: Stocks and Bonds Mostly Heavier, while Dollar Hovers Little Changed

The US dollar is narrowly mixed against the major currencies after being confined to tight ranges through the Asian session and European morning. Equities are nursing small losses, and interest rates are pushing higher. The yield on the 10-year German Bund reached 50 bp for the first time since early 2016. Oil prices have steadied after yesterday's slide.

Read More »

Read More »

FX Daily, June 23: Dollar Pares Gains Ahead of the Weekend

The US dollar is trading lower against all the major currencies today, which pares its earlier gains. The greenback is holding on to small gains for the week against most of them, except the New Zealand dollar, Swiss franc and Norwegian krone.

Read More »

Read More »

FX Daily, June 05: US Dollar Starts Important Week Mostly Stable to Higher

The US dollar is beginning what promises to be an important week on a steady to firmer note against most of the major currencies. It is a holiday in parts of Europe (e.g.,m Germany and Switzerland). Although excitement is not until Thursday's ECB meeting, UK election, and the testimony of former US FBI Director Comey, there are several developments today to note.

Read More »

Read More »

FX Daily, May 23: Greenback Remains Soft

The US dollar cannot get out of its own way, it seems. With a light economic schedule, there is little to offset the continued drumbeat of troubling political developments. The latest turn, as reported first in the Washington Post, that President Trump asked heads of intelligence groups to also publicly deny collusion with Russia.

Read More »

Read More »

FX Daily, May 03: Marking Time

The global capital markets are relatively calm. Japan, South Korea, and Hong Kong markets are closed for national holidays. Investors await the FOMC statement, though expectations could not be much lower. The disappointing US auto sales, and poor Apple sales figures reported yesterday have had little impact on the broader investment climate.

Read More »

Read More »

FX Daily, April 05: Dialing it Up on Hump Day

he dollar is practically unchanged against the euro and yen in the first two sessions of the week. The pace can be expected to pick up starting Wednesday. Although the euro slipped through $1.0650, it was not sustained, and on Monday and Tuesday, the euro finished near its highs.

Read More »

Read More »

FX Daily, March 24: Dollar Trying to Stabilize Ahead of the Weekend

The US dollar has been stabilizing over the past couple of sessions. This broad stability of the dollar is impressive because of the questions of the prospects of US President Trump's economic agenda. Expectations for tax reform and infrastructure spending have bolstered investor confidence and helped boost equity prices despite what appears to be stretched valuation.

Read More »

Read More »

FX Daily, March 03: Yellen and Jobs Report Last Two Hurdles to US Hike

The US dollar is narrowly mixed as Yellen's speech in Chicago is awaited. The greenback's three-day advance against the euro and four-day advance against the yen is at risk. The dollar-bloc currencies, where speculators in the futures market had gone net long, continue to underperform.

Read More »

Read More »

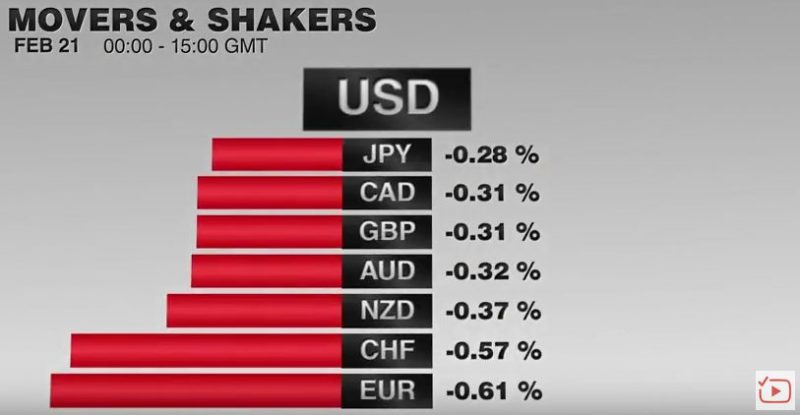

FX Daily, February 21: Dollar Bounces Back

Some profit-taking in the middle of last week pushed the dollar lower and gave rise in some quarters that the run was over. However, the greenback has come back the bid. It is gaining against all the major currencies today and most of the emerging market currencies.

Read More »

Read More »

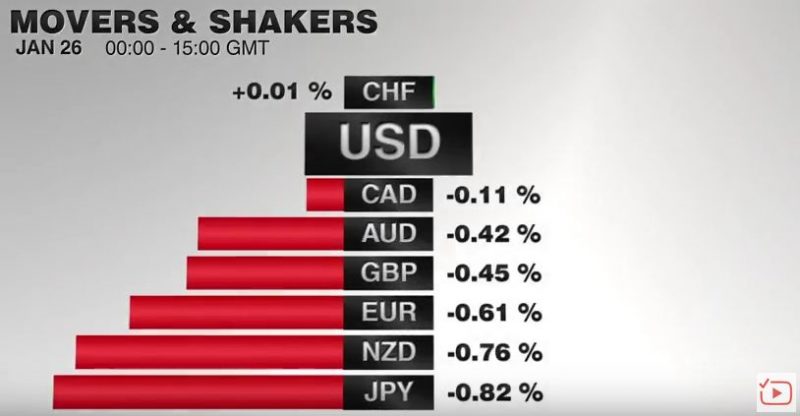

FX Daily, January 26: EUR/CHF collapses to 1.670

The US dollar is mostly firmer against the major currencies but is confined to narrow ranges, and well-worn ranges at that, but the focus has shifted to the strong advance in equities. Yesterday, the Dow Jones Industrials finally rose through the psychologically-important 20k level, and the S&P 500 gapped higher to new record levels.

Read More »

Read More »

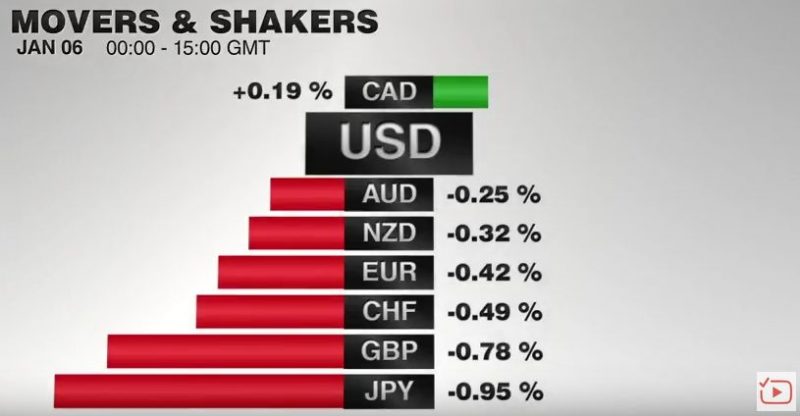

FX Daily, January 06: Dollar Consolidates Losses, Peso Firms while Yuan Reverses

I am reading a lot about the pound in 2017 which is likely to be as volatile as in 2016. But the Franc is a harder beast to predict. Loosely tracking the euro but subject to its own rules and trends GBPCHF could be an interesting pair to watch in 2017. There are numerous global events which can shape the direction on the Franc and clients looking to exchange pounds into Francs or move Francs back to the UK should be considering the path ahead.

Read More »

Read More »

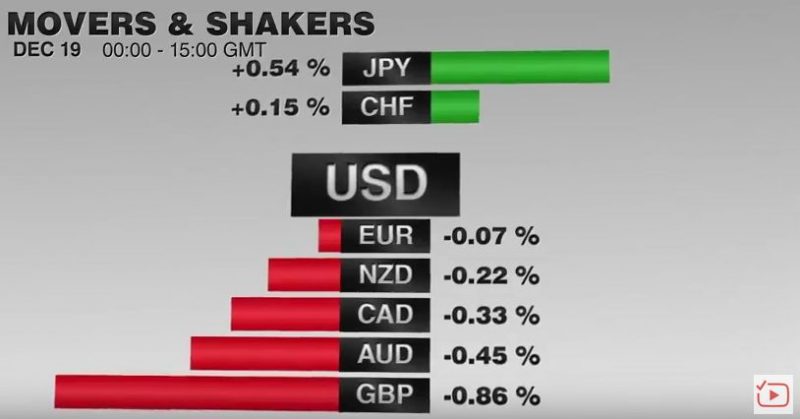

FX Daily, December 19: EUR/CHF Dives under 1.07

Once again a line in sand for the Swiss National Bank is broken. The EUR/CHF falls under 1.07. But trading algorithms are like this: When the EUR/USD is falling, then the EUR/CHF must follow. The SNB decided not to intervene any more at 1.07.

Read More »

Read More »

FX Daily, December 05: Dollar Comes Back Bid, but Still Vulnerable to Corrective Pressures

After softening ahead of the weekend, the US dollar has begun the new week on a firm note. It is gaining against most major and emerging market currencies. Outside of what appears to be a staged call between US President Elect Trump and the Taiwanese President, the developments in Europe grabbed the markets' attention. Austria turned back the populist right Freedom Party's bid for the presidency. The Freedom Party does not appear to have carried...

Read More »

Read More »

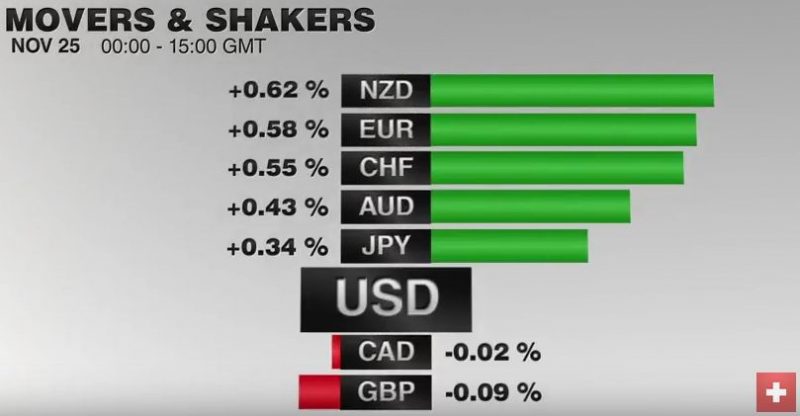

FX Daily, November 25: Corrective Forces Emerge, but Underlying Trend is Evident

The US dollar's recent gains are being trimmed today, and it is down against all the major currencies. Many emerging market currencies, including the Turkish lira, Indian rupee, and Hungarian forint are firmer today.

Read More »

Read More »

FX Daily, November 03: Political Angst Drives Markets

GBP/CHF rates are trading below 1.20 on the exchange, providing those clients holding CHF with some of the best rates they’ve seen in the past six years. The Pounds woes have been well documented but with a key day of economic data releases ahead, is it all about to change?

Read More »

Read More »

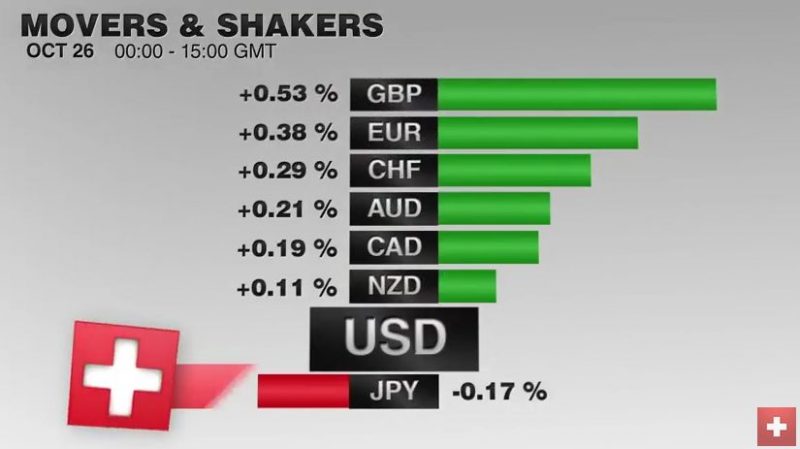

FX Daily, October 26: Euro and Yen Extend Recovery

After touching 1.08, which apparently the "new floor", the SNB moved the EUR/CHF upwards yesterday and Monday. Today's EUR recovery against USD, let also the EUR/CHF rise. The US dollar's upside momentum reversed in North America yesterday and has been sold in Asia and Europe. This seems like mostly position adjustments ahead of next week's FOMC, BOE and RBA meetings, in an otherwise subdued news period. The euro has at three-day highs. It has...

Read More »

Read More »

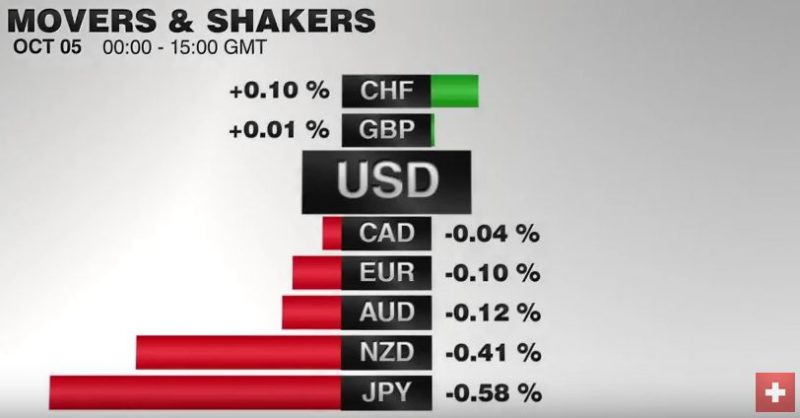

FX Daily, October 05: Euro Remains Firm Despite Dubious Tapering Story

After the sudden rise to 1.0973 the EUR/CHF is falling again. The volatiliy is related to the CHF speculative postion, that suddenly was Short CHF. Traders that moved with the SNB Window Dressing for Q3 are closing their shorts again.

Read More »

Read More »

FX Daily, August 25: Narrow Ranges Prevail as Breakouts Fail

The US dollar remains mostly within the ranges seen yesterday against the major currencies.The market awaits fresh trading incentives and the end of the summer lull, which is expected next week. The Jackson Hole Fed gathering at which Yellen speaks tomorrow is seen as the highlight of this quiet week.

Read More »

Read More »