Swiss Franc |

EUR/CHF - Euro Swiss Franc, May 23(see more posts on EUR/CHF, ) |

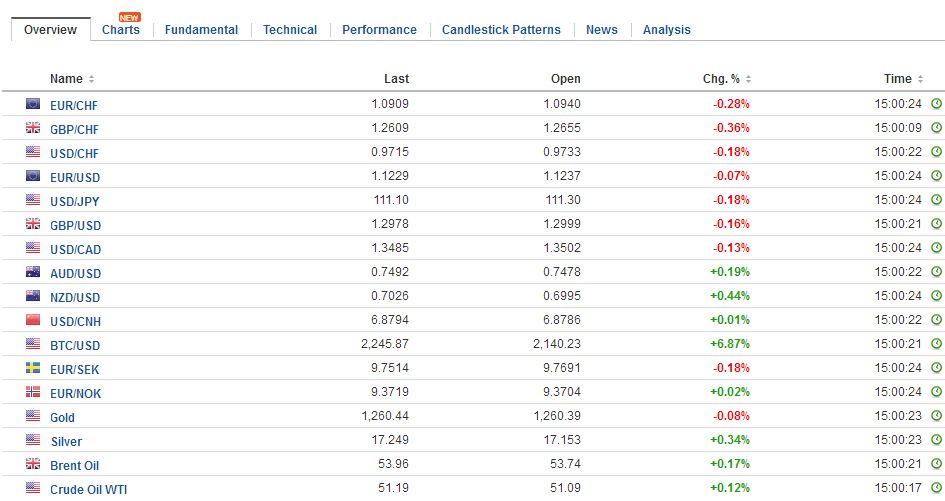

FX RatesThe US dollar cannot get out of its own way, it seems. With a light economic schedule, there is little to offset the continued drumbeat of troubling political developments. The latest turn, as reported first in the Washington Post, that President Trump asked heads of intelligence groups to also publicly deny collusion with Russia. We are again struck by the pattern in American politics where the cover-up is often worse than the actual malfeasance. We are also concerned that the opposition is leaning ahead of its skis to the extent that it insist on impeachment talk before the investigations by the Senate and House have fully gotten underway. |

FX Daily Rates, May 23 |

| There are some chunky options expiring today. The $1.1250 strike in the euro (780 mln euros) will be cut today. A $1.13 strike (302 mln euros) also rolls over. In the yen, the JPY112 strike ($633 mln today and $2.4 bln tomorrow) may help cap the dollar’s upside. Sterling strike at $1.2975 (GBP636 mln) will be cut today.

The proposal, which needs to be approved by Congress in order to beg implemented, calls for selling the reserves starting October 2018 to raise around $16.5 bln. The strategic reserves currently hold almost 690 mln barrels. A sale of half over a ten-year period entails the sale of about 95k barrels a day. This is equivalent to about 1% of the US current output. It is also a little more than the amount that Iraq is producing in excess of its OPEC quota. On the eve of the OPEC meeting that looks set to extend the six-month output cuts for nine more months, oil is threatening to break the recent advance. The July light sweet oil futures contract has advanced in four sessions coming into today and is up 10 of the past 14 sessions. It is currently trading off nearly 1%, as is Brent. |

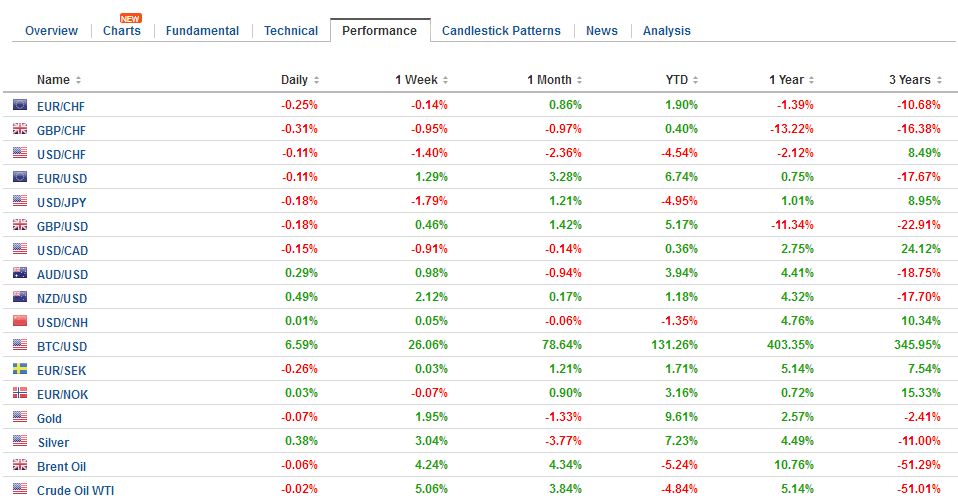

FX Performance, May 23 |

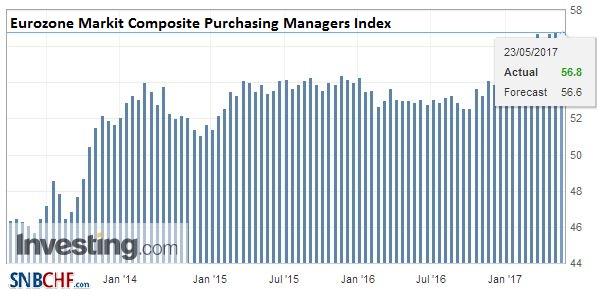

EurozoneMeanwhile, the drumbeat of favorable eurozone data continued. The May flash PMIs suggest another strong quarter of growth. The composite for the region was unchanged at 56.8, matching the multi-year high. |

Eurozone Markit Composite Purchasing Managers Index (PMI), May (flash) 2017(see more posts on Eurozone Markit Composite PMI, ) Source: Investing.com - Click to enlarge |

| Manufacturing was a bit stronger than expected at 57.0 (vs. 56.7 in April), |

Eurozone Manufacturing Purchasing Managers Index (PMI), May (flash) 2017(see more posts on Eurozone Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

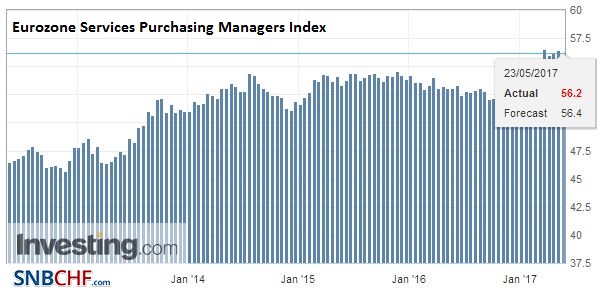

| while services were a little softer at 56.2 (from 56.4). |

Eurozone Services Purchasing Managers Index (PMI), May (flash) 2017(see more posts on Eurozone Services PMI, ) Source: Investing.com - Click to enlarge |

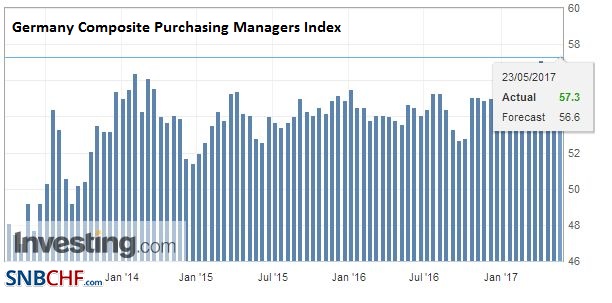

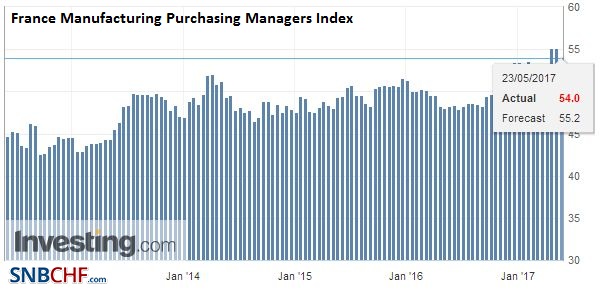

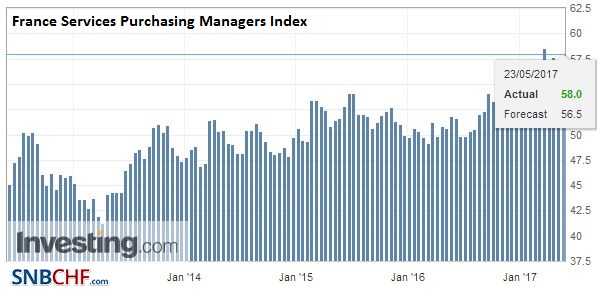

GermanyWhile the composite readings of both Germany and France rose, the details were different. |

Germany Composite Purchasing Managers Index (PMI), May (flash) 2017(see more posts on Germany Composite PMI, ) Source: Investing.com - Click to enlarge |

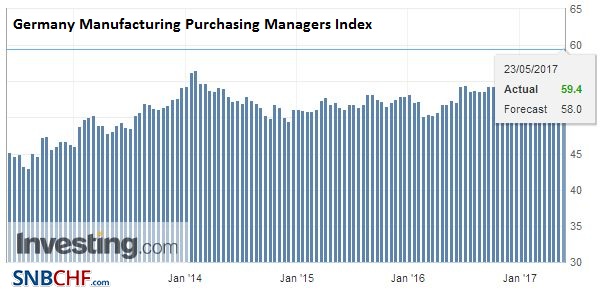

| In Germany, manufacturing improved (59.4 vs. 58.2), |

Germany Manufacturing Purchasing Managers Index (PMI), May (flash) 2017(see more posts on Germany Manufacturing PMI, ) Source: Invesing.com - Click to enlarge |

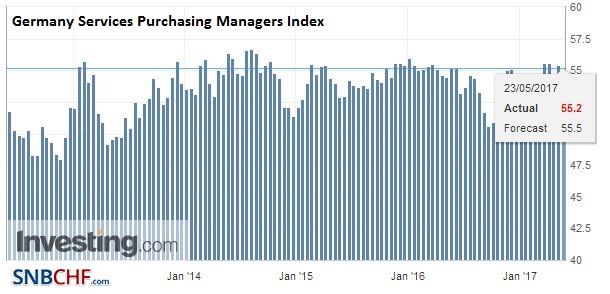

| while service activity eased (55.2 vs. 55.4). |

Germany Services Purchasing Managers Index (PMI), May (flash) 2017(see more posts on Germany Services PMI, ) Source: Investing.com - Click to enlarge |

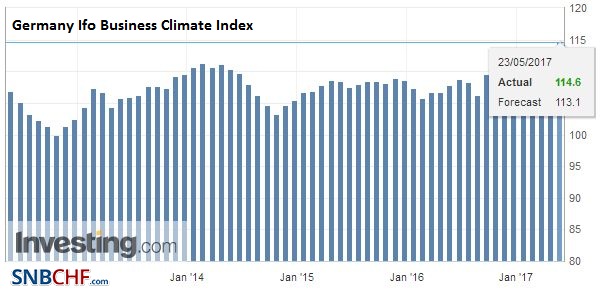

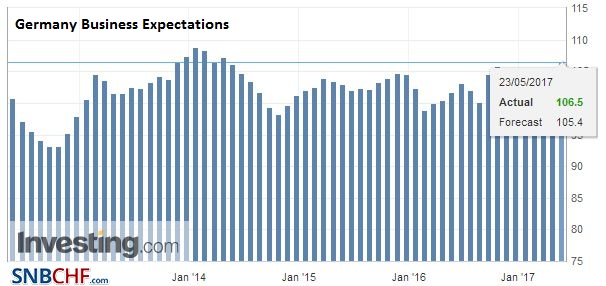

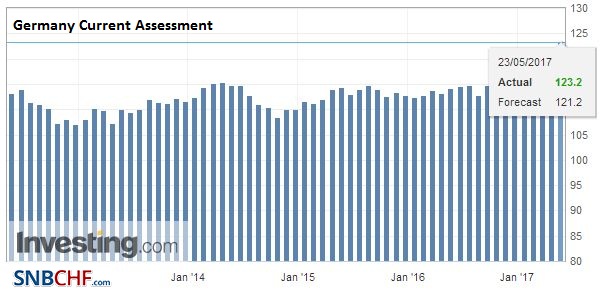

| Separately, German reported IFO survey results which also firmed. |

Germany Ifo Business Climate Index, May 2017(see more posts on Germany IFO Business Climate Index, ) Source: Investing.com - Click to enlarge |

| Business confidence is at its highest level since 1991. |

Germany Business Expectations, May 2017(see more posts on Germany Business Expectations, ) Source: Investing.com - Click to enlarge |

Germany Current Assessment, May 2017(see more posts on Germany Current Assessment, ) Source: Investing.com - Click to enlarge |

|

Germany Gross Domestic Product (GDP) YoY, Q1 2017(see more posts on Germany Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

|

FranceIn France manufacturing slipped (54.0 vs. 55.1), |

France Manufacturing Purchasing Managers Index (PMI), May (flash) 2017(see more posts on France Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

| while services improved (58.0 vs. 56.7). |

France Services Purchasing Managers Index (PMI), May (flash) 2017(see more posts on France Services PMI, ) Source: Investing.com - Click to enlarge |

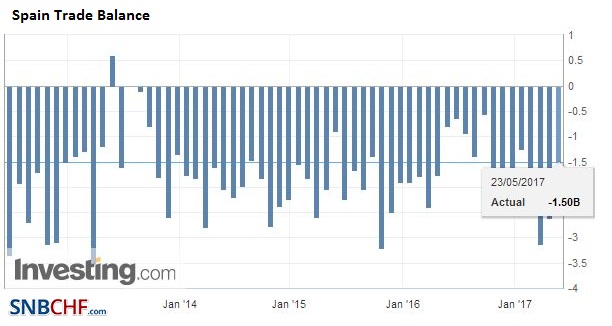

Spain |

Spain Trade Balance, May 2017(see more posts on Spain Trade Balance, ) Source: Investing.com - Click to enlarge |

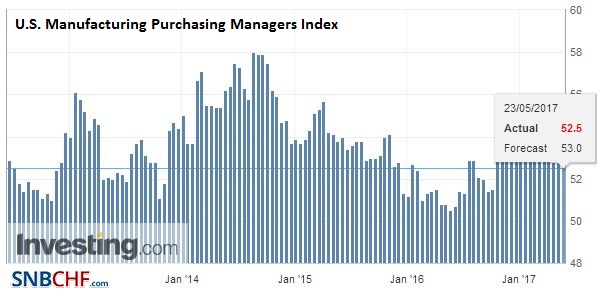

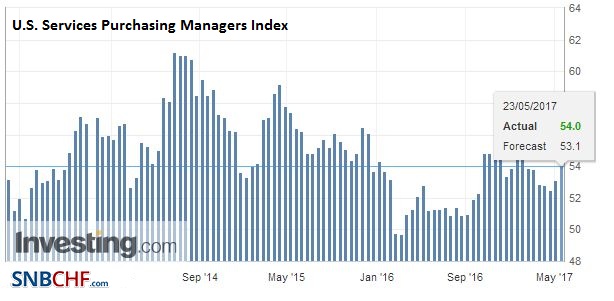

United StatesUS economic data today includes the flash Markit PMI readings, where small increases are expected and new home sales, which are expected to ease in April after rising 5.8% in March. Canada reports wholesale trade. The API oil inventory data will be released after the markets close. Tomorrow the US CBO will publish its deficit scoring of the health care reform that the House of Representative passed recently. If it projects a larger deficit in 10 years time, the chamber may have to vote on the bill again before it is sent to the Senate. The FOMC minutes will also be reported tomorrow. Some apparently are hoping for more insight into the balance sheet strategy, but it more likely to be seen in next month’s minutes. At the same time, in terms of sequencing, news about tax cuts, deregulation, and infrastructure spending is taking a backseat to Trump’s budget for FY18, formally submitted yesterday. It calls for $3.6 trillion in spending cuts over the next decade. There are few additional details from the earlier draft. One of the features that took some by surprise was the proposal to sell half of the US strategic oil reserves. |

U.S. Manufacturing Purchasing Managers Index (PMI), May (flash) 2017(see more posts on U.S. Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

U.S. Services Purchasing Managers Index (PMI), May (flash) 2017(see more posts on U.S. Services PMI, ) Source: Investing.com - Click to enlarge |

|

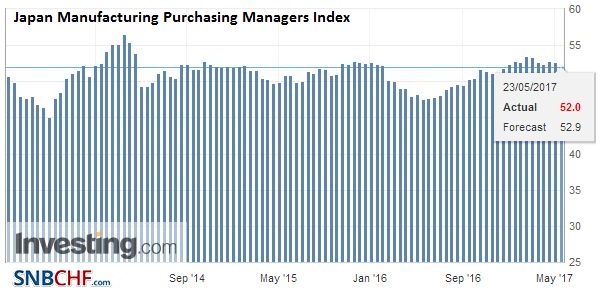

JapanJapan’s flash manufacturing PMI disappointed. It slipped to 52.0 from 52.7. Output fell to 52.9 from 53.4. Both of theses readings are the lowest since last November. New orders also fell. However, with softer US yields and weaker Japanese shares (Nikkei -0.3%), the dollar was able to make little headway against the yen. It has been largely confined to a JPY110.90 to JPY111.30 range. |

Japan Manufacturing Purchasing Managers Index (PMI), May (flash) 2017(see more posts on Japan Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

United Kingdom

The tragic suicide bombing in Manchester failed to have much market impact, though the campaigns ahead of the June 8 election have been postponed. The election has long been regarded as an easy victory for the Tories, but Prime Minister May seems to be intent on turning it into a contest. Her seeming reversal on elderly care has unsettled some ministers, according to reports, and comes on the heels of polls suggesting the contest has tightened. Some observers raise questions, not so much about the substance of the issue, but the leadership style of secrecy and taking significant decisions without a cabinet discussion. In March, the government had to reverse itself too on taxing small businesses.

Adding to the poor news stream, the UK reported a larger than expected deficit in the first month of the new fiscal year. Government spending increased, while the pullback by consumers limited the VAT receipts. Net borrowing was 10% above the year ago pace and 20% more than expected. Government revenue increased 3.9%. Spending increased 5.9%.

Brazil

We note that S&P warned that it might cut Brazil’s credit rating (BB) due to political uncertainty. Brazil says it will stick with its reforms, but many are skeptical that this will be possible if the situation continues to deteriorate. The Mexican peso initially came under pressure “in sympathy” but has since stabilized.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,$EUR,$JPY,EUR/CHF,Eurozone Manufacturing PMI,Eurozone Markit Composite PMI,Eurozone Services PMI,France Manufacturing PMI,France Services PMI,FX Daily,Germany Business Expectations,Germany Composite PMI,Germany Current Assessment,Germany Gross Domestic Product,Germany IFO Business Climate Index,Germany Manufacturing PMI,Germany Services PMI,Japan Manufacturing PMI,MXN,newslettersent,Spain Trade Balance,U.S. Manufacturing PMI,U.S. Services PMI