Tag Archive: U.S. Gross Domestic Product

Gross Domestic Product (GDP) measures the annualized change in the inflation-adjusted value of all goods and services produced by the economy. It is the broadest measure of economic activity and the primary indicator of the economy’s health. A stronger than expected number should be taken as positive for the EUR and a lower than expected number as negative to the EUR.

GDP Is Bogus: Here’s Why

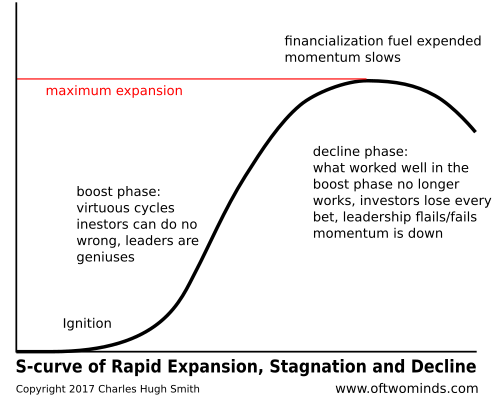

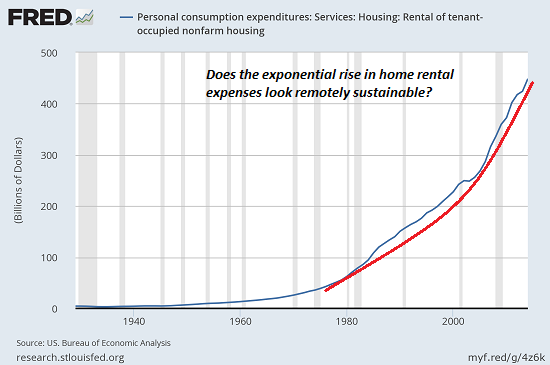

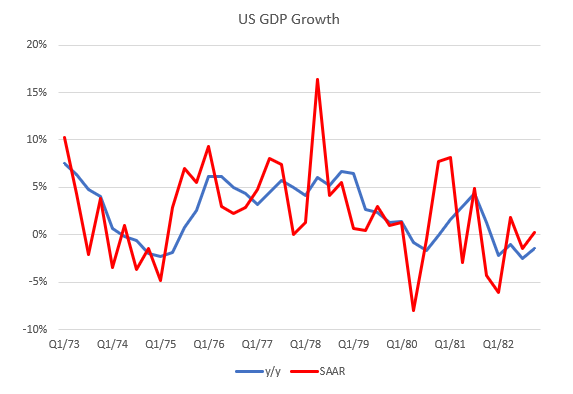

The rot eating away at our society and economy is typically papered over with bogus statistics that "prove" everything's getting better every day in every way. The prime "proof" of rising prosperity is the Gross Domestic Product (GDP), which never fails to loft higher, with the rare excepts being Spots of Bother (recessions) that never last more than a quarter or two.

Read More »

Read More »

Are You Better Off Than You Were 17 Years Ago?

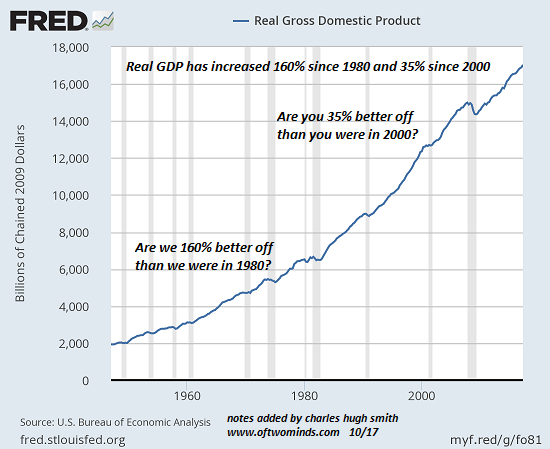

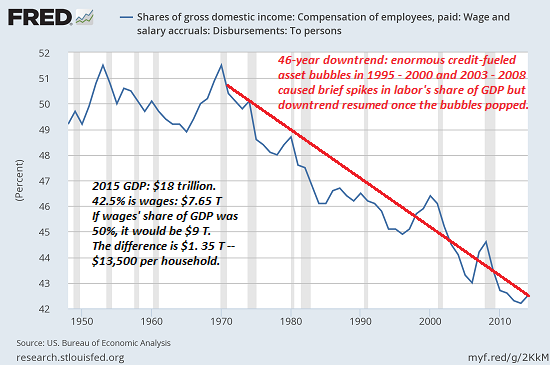

We tend to measure what's easily measured (and supports the status quo) and ignore what isn't easily measured (and calls the status quo into question). If we use gross domestic product (GDP) as a broad measure of prosperity, we are 160% better off than we were in 1980 and 35% better off than we were in 2000. Other common metrics such as per capita (per person) income and total household wealth reflect similarly hefty gains.

Read More »

Read More »

Federal Reserve President Kashkari’s Masterful Distractions

The True Believer.How is it that seemingly intelligent people, of apparent sound mind and rational thought, can stray so far off the beam? How come there are certain professions that reward their practitioners for their failures? The central banking and monetary policy vocation rings the bell on both accounts. Today we offer a brief case study in this regard.

Read More »

Read More »

Fed Quack Treatments are Causing the Stagnation

Bleeding the Patient to Health. There’s something alluring about cure-alls and quick fixes. Who doesn’t want a magic panacea to make every illness or discomfort disappear? Such a yearning once compelled the best and the brightest minds to believe the impossible for over two thousand years.

Read More »

Read More »

FX Daily, September 28: Greenback Consolidates while Yields Continue to March Higher

The US dollar is consolidating inside yesterday's ranges against the euro and yen while extending its gains against sterling and the dollar-bloc currencies. The sell-off in the US debt market continues to drag global yields higher. The 10-year Treasury yield reached 2.01% on September 8 and now, nearly three weeks later, is near 2.35%. It had finished last week at 2.25%.

Read More »

Read More »

Expectations and Acceptance of Potential

The University of Michigan reports that consumer confidence in September slipped a little from August. Their Index of Consumer Sentiment registered 95.3 in the latest month, down from 96.8 in the prior one. Both of those readings are in line with confidence estimates going back to early 2014 when consumer sentiment supposedly surged.

Read More »

Read More »

Why We’re Doomed: Stagnant Wages

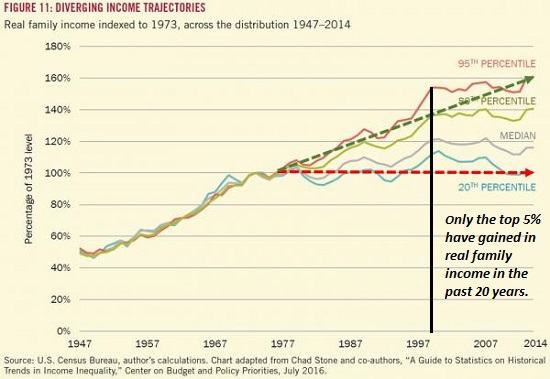

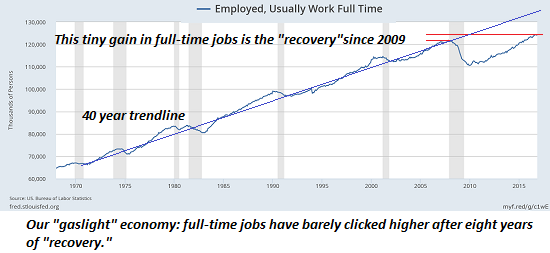

The point is the present system cannot endure. Despite all the happy talk about "recovery" and higher growth, wages have gone nowhere since 2000--and for the bottom 20% of workers, they've gone nowhere since the 1970s. Gross domestic product (GDP) has risen smartly since 2000, but the share of GDP going to wages and salaries has plummeted: this is simply an extension of a 47-year downtrend.

Read More »

Read More »

FX Daily, August 30: US Dollar Recovery Extended

The US dollar recovery that began in North American yesterday continued to in Asia and Europe. The geopolitical anxiety sparked by North Korea's missile over Japan subsided. The US response was seen as measured and tempered.

Read More »

Read More »

Questions

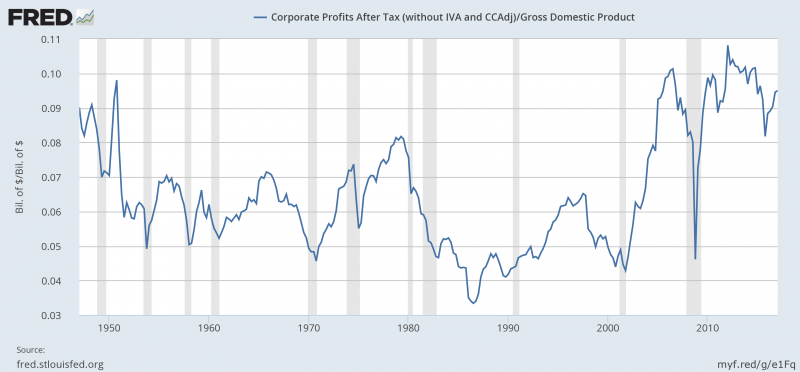

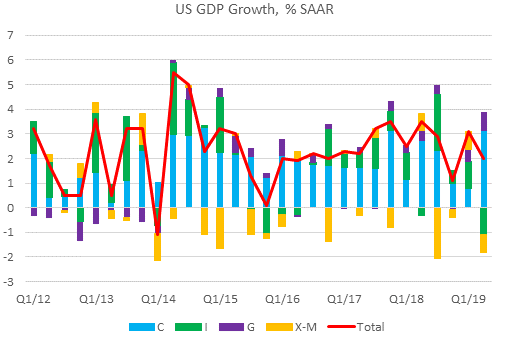

Why are profit margins persistently high? With decent earnings this quarter, corporate profits as a % of GDP will approach (maybe exceed) 10% again. That is abnormally high compared to the period 1960 to 2000. Margins actually started to rise in the mid-80s but really accelerated after 2000 and outside of the 2008 crisis have remained high. Why?

Read More »

Read More »

Are We Already in Recession?

How shocked would you be if it was announced that the U.S. had just entered a recession, that is, a period in which gross domestic product (GDP) declines (when adjusted for inflation) for two or more quarters? Would you really be surprised to discover that the eight-year long "recovery," the weakest on record, had finally rolled over into recession?

Read More »

Read More »

FX Daily, July 28: Dollar and Equities Closing Week on Heavy Note

The US dollar is mostly lower, though one of the features of recent days has been the dramatic slide of the Swiss franc, and that is continuing today. The franc is off another 0.5% today, to bring its weekly loss to a sharp 2.5%. The euro finished last week near CHF1.1030 and is now near CHF1.1370; its highest level since the cap was lifted in mid-January 2015.

Read More »

Read More »

Reports on a Quarterly Survey Conducted: Qualifying Shortage (Labor)

There isn’t a day that goes by in 2017 where some study is released or anecdote is published purporting a sinister labor market development. There is a shortage of workers, we are told, often a very big one. The idea is simple enough; the media has been writing for years that the US economy was recovering, and they would very much like to either see one and be proven right (and that recent revived populism is illegitimate), or find an excuse why...

Read More »

Read More »

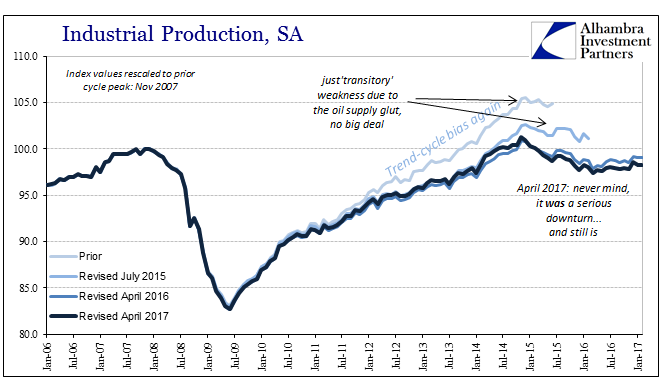

Now You Tell Us

As we move further into 2017, economic statistics will be subject to their annual benchmark revisions. High frequency data such as any accounts published on or about a single month is estimated using incomplete data. It’s just the nature of the process. Over time, more comprehensive survey results as well as upgrades to statistical processes make it necessary for these kinds of revisions.

Read More »

Read More »

Hell To Pay

Economic nonsense comes a dime a dozen. For example, Federal Reserve Chair Janet Yellen “think(s) we have a healthy economy now.” She even told the University of Michigan’s Ford School of Public Policy so earlier this week. Does she know what she’s talking about?

Read More »

Read More »

Who’s Playing The Long Game–and What’s Their Game Plan?

When we speak of The Long Game, we speak of national/alliance policies that continue on regardless of what political party or individual is in office. The Long Game is always about the basics of national survival: control of and access to resources, and jockeying to diminish the power and influence of potential adversaries while strengthening one's own power and influence.

Read More »

Read More »

US Jobs: Who Carries The Burden of Proof?

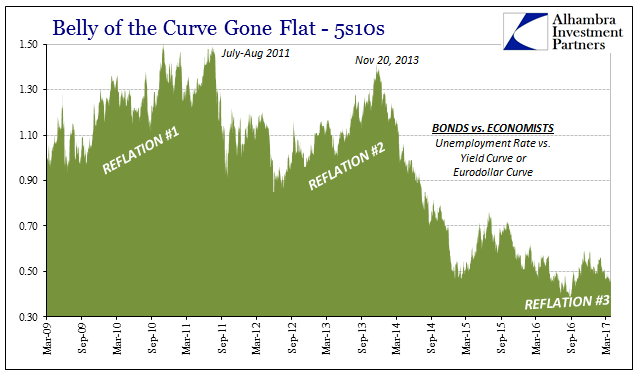

The idea that interest rates have nowhere to go but up is very much like saying the bond market has it all wrong. That is one reason why the rhetoric has been ratcheted that much higher of late, particularly since the Fed “raised rates” for a third time in March. Such “hawkishness” by convention should not go so unnoticed, and yet yields and curves are once more paying little attention to Janet Yellen.

Read More »

Read More »

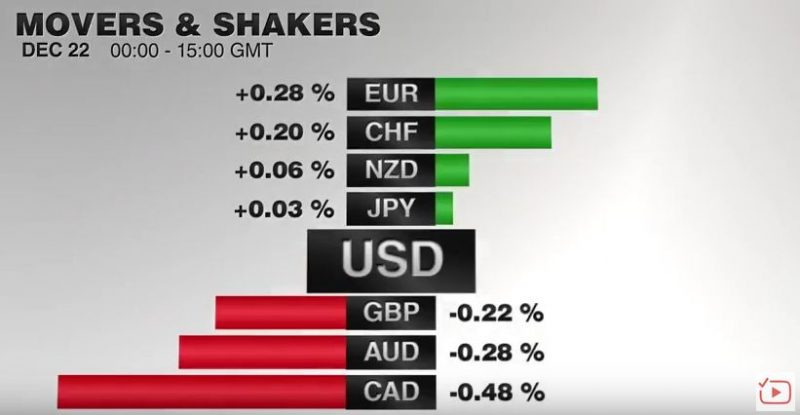

FX Daily, December 22: Mixed Dollar amid Light News as Investors Move to Sidelines

GBP/CHF rates have dipped over the past week, as the markets start to slowdown ahead of the Christmas period. Market trends become harder to predict at this time of year, due to the fact there is less capital injected by investors. Less liquidity ultimately equals less stability and the Pound may be suffering due to investors pulling their funds away from it and into safer haven currencies such as the CHF.

Read More »

Read More »

What Have the “Experts” Gotten Right? In the Real Economy, They’re 0 for 5

If the "experts" were assessed on results, they'd all be fired. The mainstream media continually hypes the authority of "experts," i.e. people with a stack of credentials from top institutions. But does the mainstream media ever check on whether the "experts" got anything right? Let's compare the "experts" (conventional PhD economists) diagnoses and fixes with the results of their policies.

Read More »

Read More »

Populism in America: “Follow the Money”

If you want to understand today's populism, don't look to the mainstream media's comically buffoonish propaganda blaming the Russians: look at the four issues listed below. One of the most disturbing failures of the mainstream media in this election cycle was its complete lack of historical context for Trump's brand of populism.If you consumed the mainstream media's coverage of the campaign and election, you noted their obsession with speech acts...

Read More »

Read More »