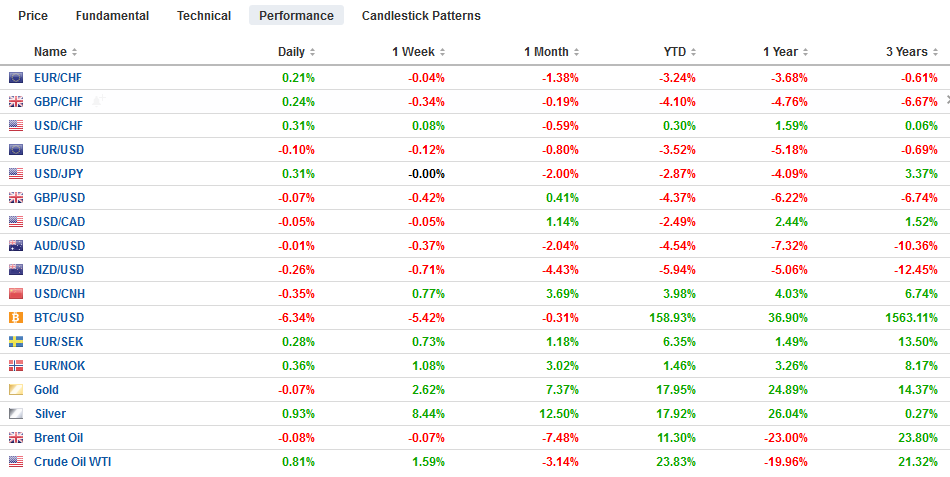

Swiss FrancThe Euro has risen by 0.14% to 1.0887 |

EUR/CHF and USD/CHF, August 29(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The capital markets are calm today, though there does seem to be some optimism creeping back into the market. The Chinese yuan strengthened, snapping a ten-day slide and Italian bank shares index has risen by more than 1% for the fourth consecutive session. The safe-haven yen and Swiss franc are softer. In fact, the dollar is rising against the Swiss franc for the fourth straight session, which if sustained, would be the longest streak in several months. Asia Pacific equities were mixed, but several large ones, like Japan, China, South Korea, and India slipped. European markets are rising, led by Italy, and the Dow Jones Stoxx 600 is making new highs for the week. The S&P 500, which closed firmly yesterday after holding support near 2850, is poised to gap higher. Benchmark 10-year yields are a little firmer in Europe, but Italy and Greece are exceptions as yields plumb new lows. US 10-year yield continues to consolidate below 1.5%. The foreign exchange market is becalmed. The dollar is mostly flat to firmer against nearly all of the major currencies. Emerging markets are mixed, with the Mexican peso the worst performer, off around 0.3%, following the GDP forecast downgrade by the central bank. Oil prices are firm for the third day following news that government estimate shows oil inventories falling a little more than 10 mln barrels last week. August is the third month that saw a week that a saw a drawdown of 10 mln or more barrels. Gold is steady, a little below $1550. |

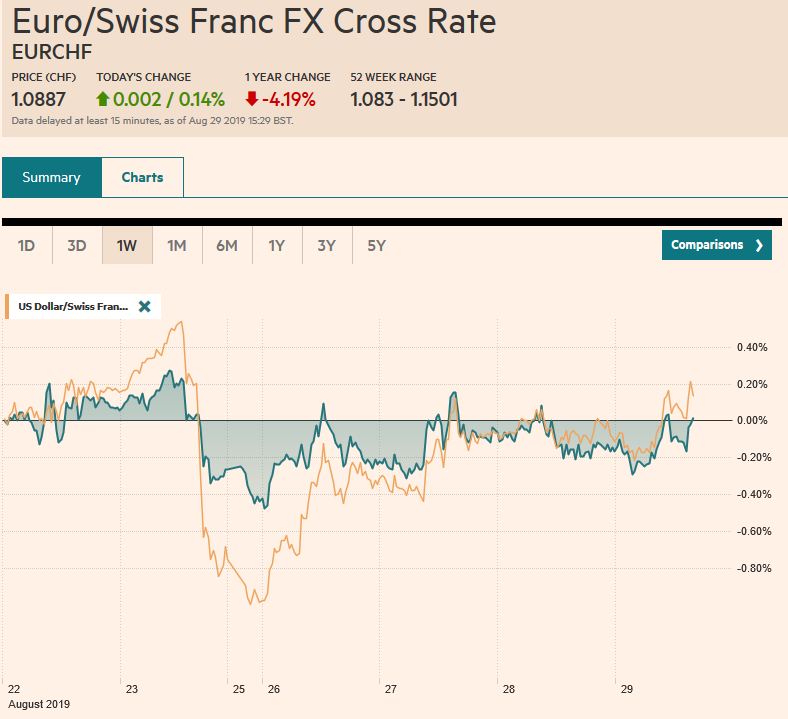

FX Performance, August 29 |

Asia Pacific

The Chinese yuan is snapping a ten-day tailspin. The PBOC set the dollar’s reference rate at CNY7.0856, up marginally from yesterday’s CNY7.0825 fix, but well below the CNY7.1085 median forecast by the Bloomberg survey. Recall the dollar approached CNH7.20 on Monday and has been consolidating slightly lower since. The dollar made the high of the week against the onshore yuan today near CNY7.1705 and then reversed to trade below yesterday’s low near CNY7.1555.

China confirmed that it will not retaliate against the US increase in its new tariff schedule by 5% starting with the new levies on September 1 (to 10% from the initial 5%) while previous tariffs of 25% will be raised to 30%. US Treasury Secretary Mnuchin indicated that a Chinese trade delegation may still come to the US for the next round of talks, but declined to say when. Separately, reports indicate that last month Japan took a shipment of liquified natural gas (LNG) from China (~70.5k tons), which would be the first such shipment in 30 years.

Disappointing data from Down Under are having little impact. New Zealand reported its weakest business confidence since 2008, while Australia reported an unexpected decline in Q2 private capital expenditures (-0.5% vs. median forecasts for a 0.4% increase). The Australian dollar is a little firmer, and the New Zealand dollar is slightly heavier. The Aussie slipped to a three-day low (~$0.6715) but has recovered. It remains below the 20-day moving average (~$0.6770), which it has not closed above for over a month. The Reserve Bank of Australia meets next week but is expected to stand pat, with the next cut expected at the Oct 1 meeting. The dollar is at a three-day high against the yen near JPY106.30, where a $450 mln option will expire today. The 20-day moving average is near JPY106.15, and the dollar has not closed above this average this month. The top end of this month’s range is around JPY107.

Eurozone

Brexit was supposed to be about taking back what was Parliament’s prerogative from the EU. In order to overcome Parliament’s objections, Prime Minister Johnson, with the Queen’s approval, suspended parliament from September 12 to October 14. It will be legally challenged. Previously, the UK’s Supreme Court ruled that Parliament has a right to a say in how the UK leaves the EU. There will be other challenges at well. Johnson’s move has a steep price tag too. Davidson, the leader of the Scottish Tories, quit. With many observers focused on the Democrat Unionist Party (DUP) from Northern Ireland, Davidson also played a vital role in delivering Scotland 13 seats to the Tories. Meanwhile, the DUP said they want to re-negotiate their 2017 deal with the Tories, and this is likely to entail more concessions and funds.

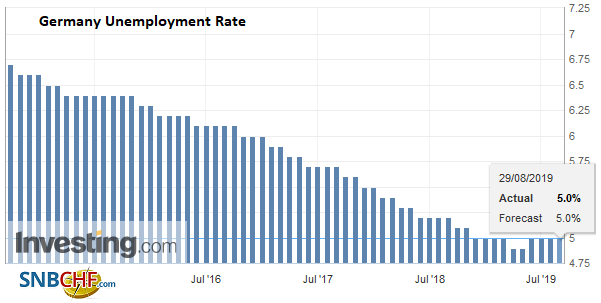

GermanyGerman data disappoints. Job-creation is going into reverse and August was the fourth month without net gains, though the unemployment rate remained steady at 5%. The states reported August inflation figures and all saw a decline in the year-over-year rate. Although the methodology is a little different than the EU-harmonized calculation, there seems to be downside risk to the median (Bloomberg survey) forecast for the pace to tick up to 1.2% from 1.1% in July. Last August, the harmonized measure was flat and stood at 2.1% over the previous year. This weekend’s two state elections could have significant knock-on effects on the national CDU/SPD coalition if the AfD does as well as the polls suggest. |

Germany Unemployment Rate, August 2019(see more posts on Germany Unemployment Rate, ) Source: Investing.com - Click to enlarge |

If pessimism is deepening over Germany, hope springs eternal in Italian politics. Prime Minister Conte will be able to lead a new coalition. The markets are nearly euphoric that a budget-busting confrontation with the EU may be avoided. The League’s Salvini overplayed his hand, it appears. A few weeks ago, he likely had dreams of being Prime Minister, and if now it is clear that if that dream does come to pass it is not imminent. He can be expected to play the role of obstructionist in the new configuration. Today investors are hopeful of this new window of opportunity for a virtuous cycle of lower interest rates, better growth, smaller deficits, and better conditions for the troubled bank loans. Italy sold 10-year bonds today at a record low yield of less than 100 bp.

The euro is spending its second session below $1.11, which it has not done since 2017. It has dripped lower since the initial follow-through buying from last week fizzled on Monday. Last week’s low was near $1.1050 and the month’s low was set on August 1 just above $1.1025. The intraday technical readings suggest a test on these maybe for another day. Sterling set the high for the month on Tuesday a little above $1.23. Today it is in a roughy 20-tick range on either side of $1.22. There is a nearly GBP260 mln expiring option struck at $1.2245 that looks to be out of play. Support is around $1.2150, yesterday’s low and the 20-day moving average.

United States

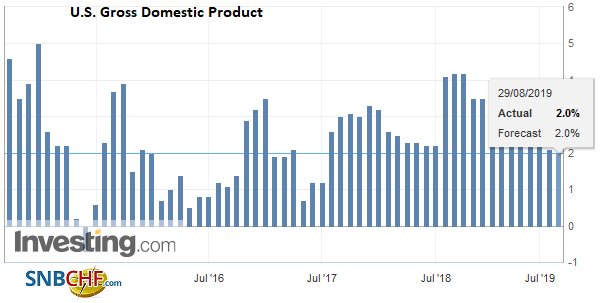

|

U.S. Gross Domestic Product (GDP), Q2 2019(see more posts on U.S. Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

A poor bill auction (Letes) yesterday appears to have triggered a dramatic response by Argentina. It seeks to “reprofile” its debt. It insists on using the term instead of restructuring, which sounds more ominous because it is negotiating to extend maturities rather than interest rates. It is seeking a voluntary extension of maturities of $50 bln of long-term debt and wants to defer payment on $7 bln of short-term debt. President Macri also intends to extend the terms of $44 bln of obligations to the IMF. Institutions may be on the hook, but individual investors may be exempted. Opposition leader Fernandez is expected to address the government’s proposal today. The dollar rose about 3.2% against the peso yesterday. It was the sixth consecutive advance and the most in about two weeks.

We would not read much in the fact that the US dollar is posting an outside day against the Canadian dollar. Its performance in North America today will be important for the near-term technical outlook. A close below CAD1.3280 could signal a test on the lower end of the greenback’s recent range, which comes in around CAD1.3220. The key to the medium-term outlook may be CAD1.3180-CAD1.3200. The markets may be cautious ahead of next week’s central bank meeting on ideas that it would likely have to soften its language if it’s going to cut rates in October, which is about 2/3 discounted. Mexico’s central bank cut this year’s growth forecast to 0.2%-0.7% from 0.8%-1.8%. Private-sector forecasts are for 2019 year-over-year growth of 0.7%. The dollar jumped above MXN20.25 in late Asian turnover, but sellers emerged and pushed the greenback to MXN20.15, where it is straddling pending the North American session. The dollar has risen about 5.25% against the peso this month, its best performance since last October (8.6%). We expect levered participants to be attracted to the carry play again soon.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,ARS,Brexit,EUR/CHF and USD/CHF,Germany,Germany Unemployment Rate,Italy,newsletter,SPX,U.S. Gross Domestic Product