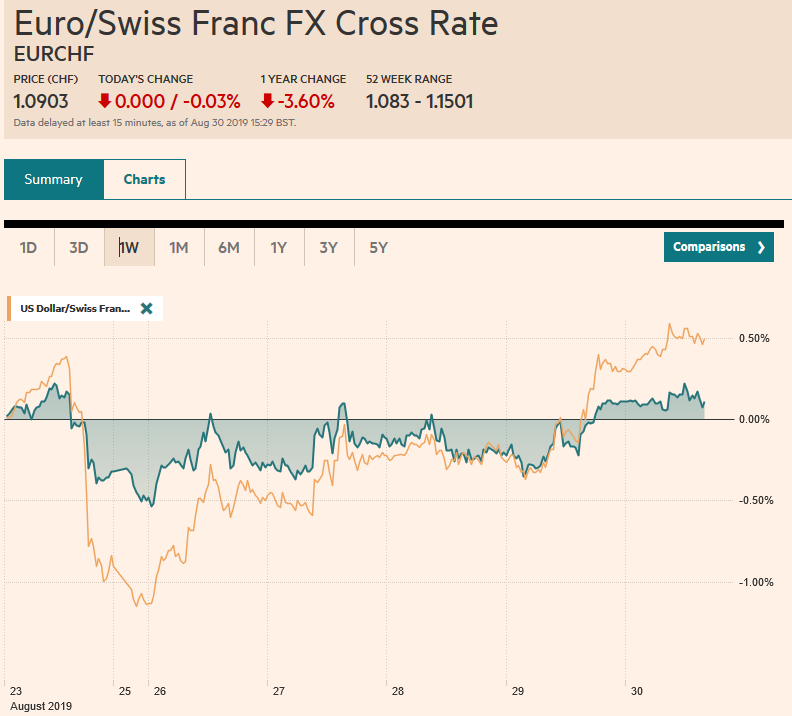

Swiss FrancThe Euro has fallen by 0.03% to 1.0903 |

EUR/CHF and USD/CHF, August 30(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Global equities are advancing at least in part on ideas that trade tensions are easing. China announced it would not take immediate action on the five percentage point increase in levies that the US announced strictly in response to China’s retaliatory tariffs. A lull between blows is not the same thing as de-escalation or truce. The next round of tariff increases is set for September 1. Nevertheless, equities are higher following the 1.25% rise in the S&P 500 yesterday. China and Indian markets were the notable laggards in the Asia Pacific. The Dow Jones Stoxx 600 is up about 0.7% and near its best levels since August 2. US shares are trading firmer and the S&P 500, which gapped higher yesterday is approaching the upper end of the month’s range near 2950. Rising equities has removed a bid from bonds, and most yields are edging higher today. Italian bonds are a notable exception with new record lows as a crisis appears to have been avoided. The dollar is firm against the major currencies. Central and Eastern European currencies remain under pressures, but emerging currencies in Asia, led by the Korean won are firmer. South Korea reported a 2.6% jump in July (month-over-month) industrial output compared with expectations for a 0.5% increase. Oil is snapping a three-day advance and gold is soft for a third day. End of month activity ahead of a three-day weekend for the US and Canada is also a consideration today. |

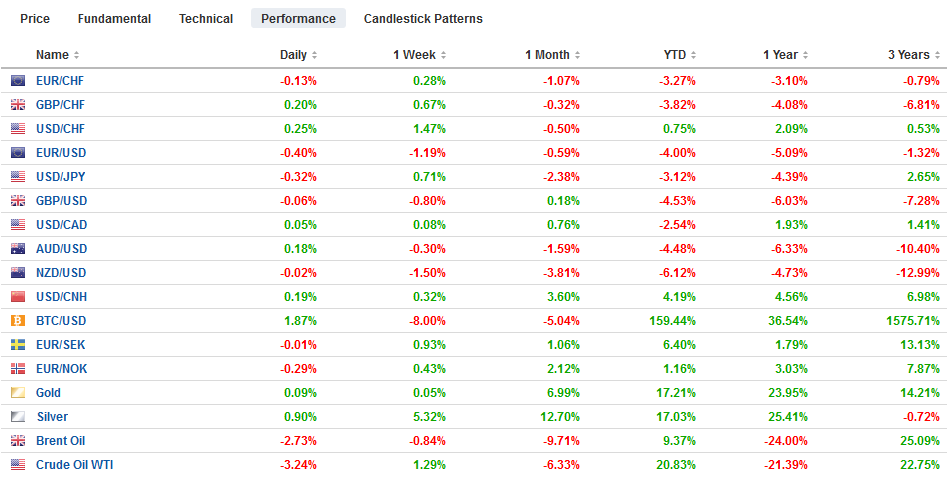

FX Performance, August 30 |

Asia Pacific

The yuan was stronger in the Asian session but has given back those gains in Europe. The PBOC again (eighth session) set the dollar’s reference rate lower than the models the banks use suggested. We do not read much into China’s restraint in not retaliating against the hike in previously announced tariffs. The US has now admitted that Chinese officials did not call Trump to restart talks that were already underway. That was simply used to support the markets comes as no surprise to many. New tariffs will go into effect on September 1. The real signal seems to be not a de-escalation in the tensions but that a trade agreement between the two is unlikely any time soon.

The US dollar is holding a little below HKD7.85, the top end of the band. Reports indicated that China rotated its People Liberation Army garrison in Hong Kong, but some suspect that was just cover for bringing in more force. Hong Kong has banned demonstrations this weekend and arrests of some activists have been reported.

Most of the data that Japan reported today was unexpectedly good. This includes July unemployment, which ticked down to 2.2% and industrial production, which rose 1.3% (compared with 0.3% expected by the median forecast in the Bloomberg survey). Construction orders surged nearly 27%. After stronger than expected growth in Q1 and Q2, Japan’s economy appears off to a good start in Q3. The one important disappointment today was retail sales. The median forecast called for a 0.9% decline (after a flat reading in June). Instead, Japan reported a 2.3% decline on the month. It matches the biggest drop in five years. Separately, the BOJ announced a JPY50 bln reduction in the 5-10 year JGBs it buys. The 10-year yield, which the “yield curve control” policy was to keep between +/- 20 bp has not been in the range since August 8.

The dollar is quietly trading mostly in the quarter yen below JPY106.50 today. There is an option for $380 mln struck there that expires today. Resistance is seen near JPY106.75 and then JPY107.00. Initial support may be seen by JPY106.20. Australia reported that building approvals in July tumbled 9.7% (unchanged was expected) and spurred losses in the Australian dollar toward $0.6700. The Aussie has traded below there this month, but yesterday’s close was (~$0.6728) was a new 10-year closing low. The New Zealand dollar is also at fresh four-year lows.

Europe

With the Queen taking the Privy Council advice to allow the Prime Minister to suspend Parliament, those opposed have taken their case to the courts. A Scottish judge refused to grant an emergency injunction against Johnson, but it is too early to call this a victory for the government. It was not a ruling on the merits of the case, but rather it was not an emergency in the sense that a fuller hearing can be held next week. There is a similar case pending in Northern Ireland that may also be decided today.

We find much value in the concept of affirmation through negation. Shakespeare had Queen Gertrude express this in Hamlet: “The lady doth protest too much methinks.” The protests by the Dutch and German central bank heads (Knot and Weidmann), as well as Germany’s ECB executive board member Lautenschlaeger against quantitative easing, seem to suggest an aggressive package of stimulus will be announced by the ECB next month (September 12). The initial estimate of August CPI came in at 1.0% headline rate, down from 1.1% in July and well below the “near but less than 2%” target. The core rate was unchanged at 0.9%, defying expectations of a 1.0% rate. Recall that the core rate bottomed in 2015 at 0.6%.

The euro recorded a two-year low a little above $1.1025 on August 1. It reached a low today just below $1.1035, and the intraday technicals warn of the risk of additional declines ahead of the weekend. There are two sets of options to note that are set to expire today. The first set is really two strikes; one at $1.10 for about 682 mln euros and the other is just below there at $1.0997 for almost 690 mln euros. On the upside, there is chart resistance now at $1.1050, where a 1.9 bln euro option is struck. Sterling is little changed after testing the week’s low a little below $1.2160 and the 20-day moving average (~$1.2155). Several expiring options are near the money now. There are GBP472 mln pounds in an option at $1.2150 and another GBP820 mln at $1.2170-$1.2175. There is also an option at $1.2195 for GBP620 mln.

United States

The US reports July personal income and consumption figures. These are not the sources of weakness and concern in the US economy. However, the inflation gauge is a different story. The headline rate, which is what the formally targets at 2%, is expected to be unchanged at 1.4%, while the core rate that Fed officials often emphasize is expected to be stuck at 1.6%. We suspect there is a little downside risk. The University of Michigan’s final reading of August consumer confidence will also be reported. Canada reports Q2 GDP. It is expected to have accelerated to around 3.0% from 0.4% in Q1. The data is a bit dated, and the market has already taken on board that Canada emerged from the soft patch. Indeed, many are looking at next week’s Bank of Canada meeting to soften its neutral stance to lay the groundwork for a possible cut at the October 30 meeting.

S&P cut Argentina’s rating to selective default following President Macri’s proposals to delay the servicing of $101 bln of debt. The peso is off about 5% on the week coming into today’s session. The yield on its two-year dollar bond rose from 44% at the end of last week to over 63% yesterday. The price of insuring against default (five-year CDS) has risen from about 26.4% a week ago to 36.5% yesterday.

Against the Canadian dollar, the US dollar has mostly traded between the 20-day moving average (~CAD1.3275) and the 200-day moving average (~CAD1.3315). The intraday technicals seem to favor a stronger greenback ahead of the weekend. The US dollar is closing in on its seventh consecutive weekly gain against the Canadian dollar. On a monthly basis, the US dollar has only fallen against the Canadian dollar in January and June this year. The dollar may snap a six-day advance against the Mexican peso, but it will most likely close higher for the seventh consecutive week also. On a monthly basis, the peso and dollar have both gained in four of the first eight months. Initial support for the dollar is seen near MN20.05 today.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$CAD. $EUR,$CNY,ARS,Brexit,Currency Movement,EUR/CHF and USD/CHF,newsletter