Tag Archive: SPY

Lies, Damn Lies, and Taxes

President Trump hinted at the end of last week that the Administration's tax proposals would be aired in the next two or three weeks. This seems to be a signal of its inclusion in his address to both houses of Congress on February 28. This is not quite a State of the Union speech, but similar and precisely what Obama did in February 2009.

Read More »

Read More »

FX Daily, February 14: Markets Showing Little Love on Valentines

Corrective pressures are gripping the major capital markets today.The Dollar Index's nine-day advancing streak is being threatened by the position adjustment ahead of Yellen's testimony later today. Despite record high closes in the main US equity markets yesterday, Asia could not follow suit. It tried to initially, and recorded new highs since July 2015, but sellers emerged and the MSCI Asia Pacific Index closed marginally lower on the lows of the...

Read More »

Read More »

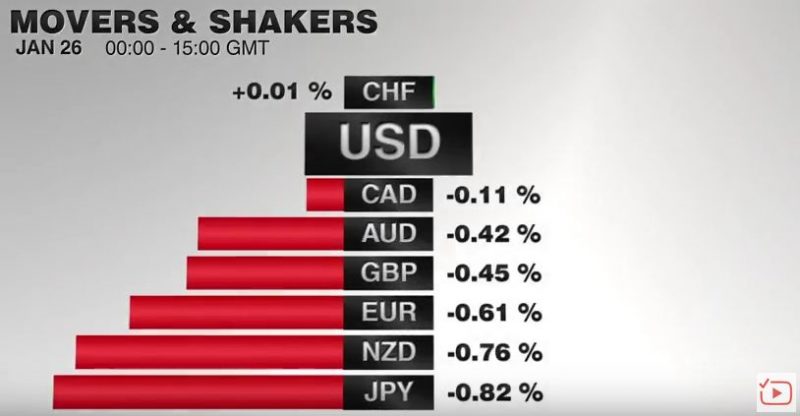

FX Daily, January 26: EUR/CHF collapses to 1.670

The US dollar is mostly firmer against the major currencies but is confined to narrow ranges, and well-worn ranges at that, but the focus has shifted to the strong advance in equities. Yesterday, the Dow Jones Industrials finally rose through the psychologically-important 20k level, and the S&P 500 gapped higher to new record levels.

Read More »

Read More »

FX Daily, January 17: Trump’s Comments Send the Dollar Reeling

The Pound has been subjected to a heavy amount of pressure as we progress further into 2017, with GBP/CHF rates being one of the heaviest losers. The pairing is now trading at a similar level to GBP/USD levels below the 1.22 mark. Their is an enjoyable symmetry between the two from an analysts point of view. Both are well regarded as safe-haven currencies, and in this time of increased uncertainty, both have almost the exact same value in the...

Read More »

Read More »

FX Weekly Preview: What You Should Know to Start the First Week of 2017

Data has already been reported. Trends reversed in the last two weeks. US jobs data may disappoint. It will take a few more weeks to lift some of the uncertainty hanging over the markets.

Read More »

Read More »

FX Daily, December 29: Dollar, Equities and Yields Fall

In thin holiday markets, a correction to the trends seen in Q4 has materialized. The US dollar is heavy. Japanese and European equities are lower. Bonds are firmer.

Read More »

Read More »

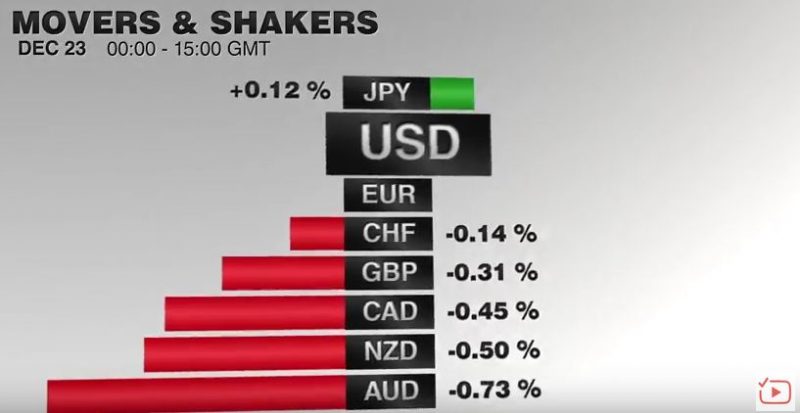

FX Daily, December 23: Markets Edge into Holiday Weekend

Asian shares trade heavily. The MSCI Asia-Pacific Index ex-Japan fell 0.4%. It is the fourth lower close this week and brings the loss to 1.75% for the week. It is fallen in seven of the past nine weeks. The Dow Jones Stoxx 600 is little changed on the session and is nursing a minor loss on the week and could snap a two-week advance.

Read More »

Read More »

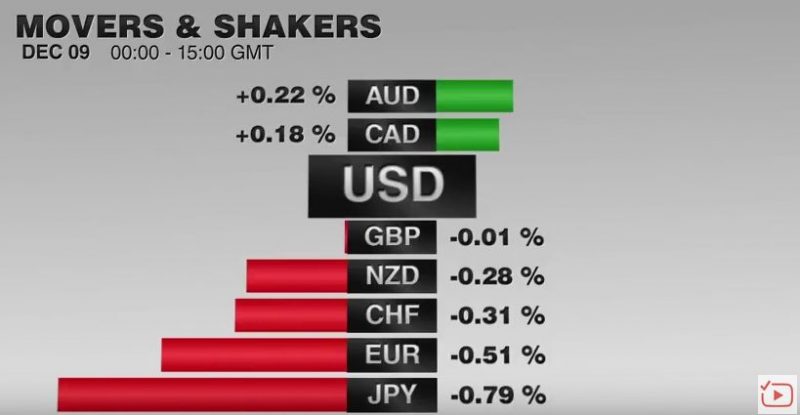

FX Daily, December 09: Euro Chopped Lower before Stabilizing

The euro has stabilized after extending yesterday's ECB-driven losses. The euro's drop yesterday was the largest since the UK referendum to leave the EU. Ahead of the weekend, there may be some room for additional corrective upticks, but they will likely be limited, with the $1.0650 area offering initial resistance. In the larger picture, this week's range, roughly $1.05 to $1.0850 likely will confine the price action for the remainder of the...

Read More »

Read More »

FX Weekly Preview: Shifting Portfolio Preferences Continue to Drive Capital Markets

Forces emanating from the US and Europe are driving the capital markets. The moves may be stretched technically, but the market adjustment has further to run as not even two Fed hikes are discounted for next year. European political concerns and an ECB expected to continue its asset purchases have driven German 2-year yields to new record lows.

Read More »

Read More »

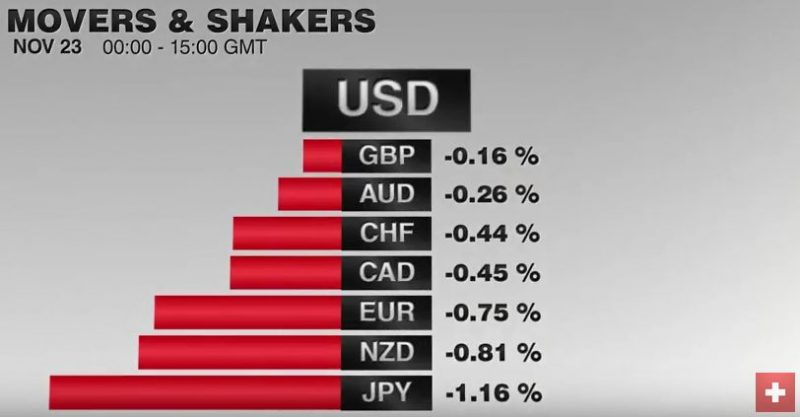

FX Daily, November 23: Dollar Sees Flat Consolidation while the Equity Advance Fizzles in Europe

The US dollar is trading inside yesterday's ranges against the euro and yen. The dollar's tone matches the consolidation in the debt market ahead of today's slew of US data and tomorrow's holiday. Tokyo markets were on holiday.

Read More »

Read More »

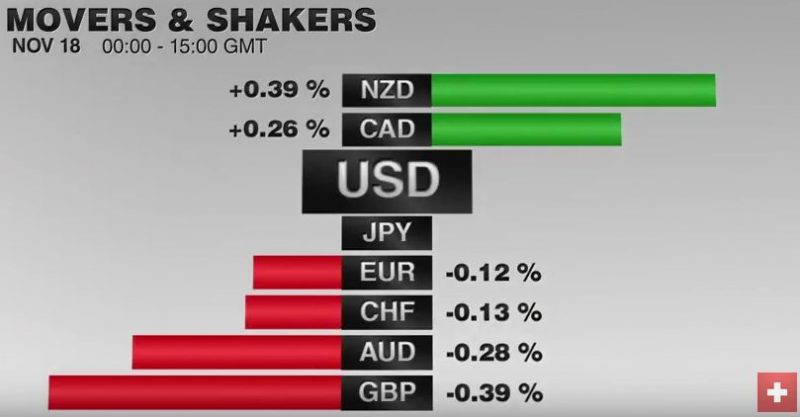

FX Daily, November 18: Revaluation of the Dollar Continues

Since the US election, the dollar has been on a tear. Pullbacks have been brief and shallow. There are powerful trends in place. The euro has fallen nearly five percent over the past ten sessions, during which it is not closed higher once. The dollar rose four days this week against the yen and four days last week.

Read More »

Read More »

Cool Video: Bloomberg Interview – Peso, Equities, Yuan

Even before the my polling station opened today, I had the privilege of being on Bloomberg Surveillance today with Gina Cervetti and Tom Keene. We talk about a wide range of issues directly and tangentially related to the US election. We discuss the outcome the market appears to be discounting.

Read More »

Read More »

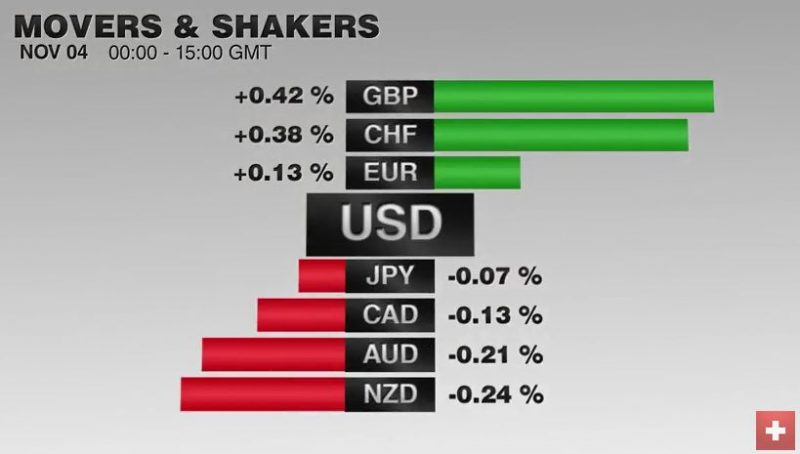

FX Daily, November 04: US Jobs Figures: Another Time the Swiss Franc Strengthens

With the not convincing U.S. jobs number, both the EUR and, in particular, the Swiss Franc could improve. With continuing political uncertainty in the U.S., more speculators closed their short CHF positions

Read More »

Read More »

The Yen in Three Charts

The dollar is taking out a several month downtrend against the yen. The correlation between the yen and the S&P 500 has broken down. The US 2-year premium over Japan has steadily risen.

Read More »

Read More »

Great Graphic: Stocks and Bonds

The relationship between the change in Us 10-year yields and the change in the S&P 500 has broken down. The 60-day correlation is negative for the first time since late Q2 2015. It is only the third such period of inverse correlation since the start of 2015.

Read More »

Read More »

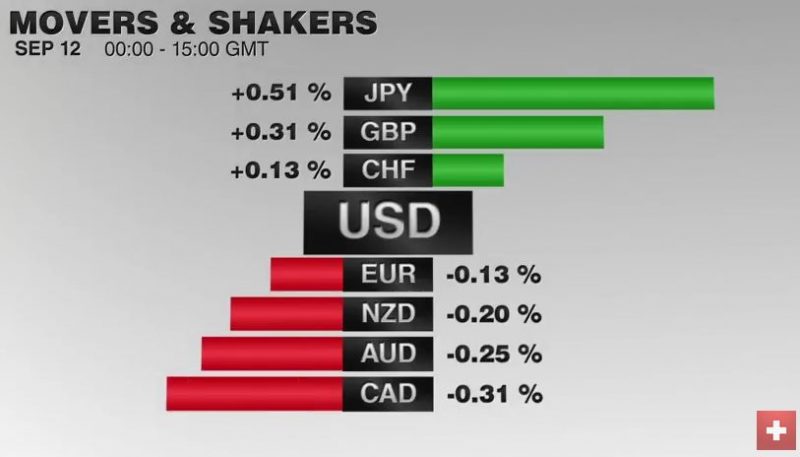

FX Daily, September 12: Markets Off to a Wobbly Start

The EUR/CHF retreated today together with falling stock prices. When investors sell their stocks and move into cash, then the Swiss Franc very often appreciates. This is the safe haven effect: cash in Swiss Franc is perceived as more secure.

Read More »

Read More »

Negative and the War On Cash, Part 2: “Closing The Escape Routes”

History teaches us that central authorities dislike escape routes, at least for the majority, and are therefore prone to closing them, so that control of a limited money supply can remain in the hands of the very few. In the 1930s, gold was the escape route, so gold was confiscated. As Alan Greenspan wrote in 1966:

Read More »

Read More »

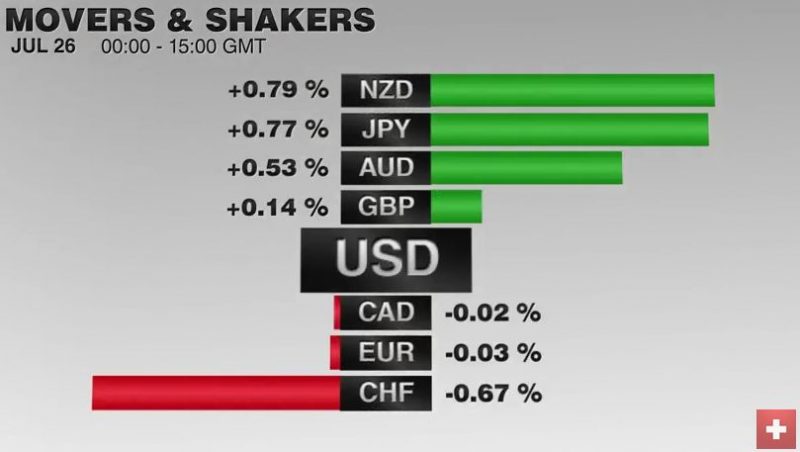

FX Daily, July 26: Strange Day: Yen Soars , Swissie Falls

The Swiss Franc strangely depreciated on a day, when the other safe-haven, the yen strongly improved. The euro went up to 1.0899 by 0.54%. The reason seems to be technical.

Read More »

Read More »

FX Daily, July 06: Dollar and Yen Advance Amid Growing Investor Angst

What a difference a few days make. Many saw last week's equity market advance a sign that Brexit anxiety was overdone. However, quarter-end position adjustments appear to have been misread. Equity markets are falling now. Bond yields in the US, Japan, and Germany, are at new record low. Japan's 20-year bond yield briefly dipped below zero for the first time.

Read More »

Read More »