Tag Archive: Swiss National Bank

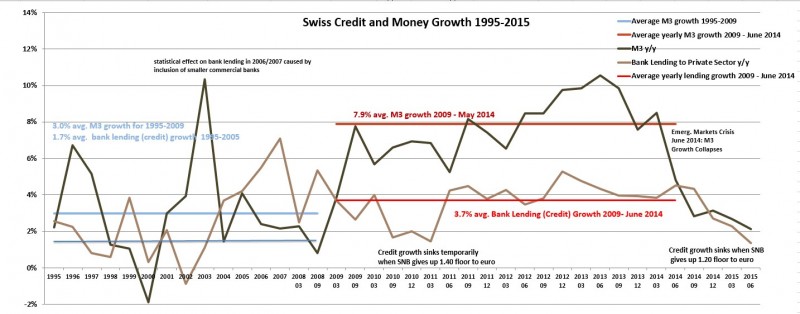

The 2015 Update: Risks on the Rising SNB Money Supply

We explain the risks on the rising money supply in Switzerland. We distinguish between broad money supply (M1-M3) and narrow money supply (M0). Both are rising quickly.

Read More »

Read More »

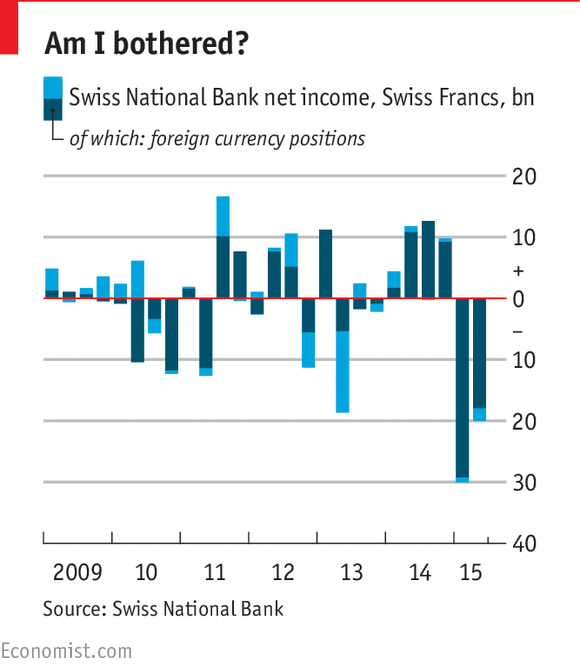

The Swiss National Bank: Switzerland’s central bank makes a massive loss

ON FRIDAY, the Swiss National Bank (SNB), Switzerland’s central bank, reported second quarter losses of SFr20 billion ($20 billion). Following an equally bad first three months of the year, the SNB’s losses so far for 2015 now amount to a whopping SFr50.1 billion, equivalent to 7.5% of Switzerland's GDP.

Read More »

Read More »

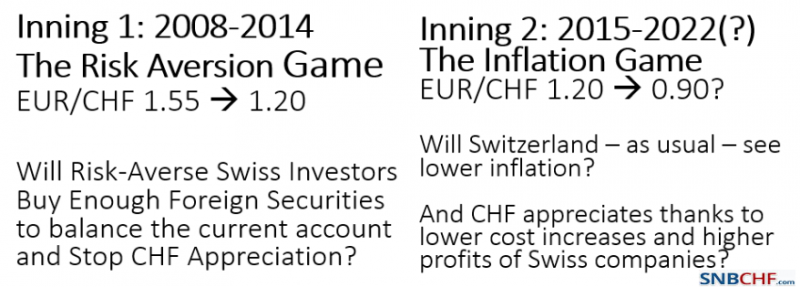

The two phases of CHF appreciation… and what is in between

We show the two phases or "two innings" of Swiss franc appreciation: The risk aversion phase and the high inflation phase.

With the weakening of emerging markets and the strengthening of the United States in 2013/2014, the Swiss National Bank (SNB) had won the first battle in the war against financial market, the "risk aversion game", the first inning in two-part match. Risk aversion is lower because the United States recovered with weaker oil...

Read More »

Read More »

Rising Sight Deposits at SNB Means Rising SNB Debt

Money creation and sight deposits may have two points of view:

1. The central bank creates money - i.e. the SNB decides to increase sight deposits when it does currency interventions

2. Commercial banks create money - inflows in CHF on Swiss bank accounts make those banks increase their "sight deposits at the SNB. If inflows in CHF are higher than outflows then CHF must rise, unless the central bank does currency interventions.

We will present...

Read More »

Read More »

SNB’s IMF data

This IMF data on the SNB website shows SNB Forex and gold reserves in the last month. It is so-called "IMF Special Data Dissemination Standard (SNB Data)"

Read More »

Read More »

Das Gold-Gschichtli der SNB

Dem Jahresbericht 2014 der SNB entnehmen wir ab Seite 63: Lagerung der Goldreserven Gemäss Art. 99 Abs. 3 der Bundesverfassung hält die Nationalbank einen Teil ihrer Währungsreserven in Gold. Die Nationalbank gab im Frühling 2013 bekannt, dass sie 30...

Read More »

Read More »

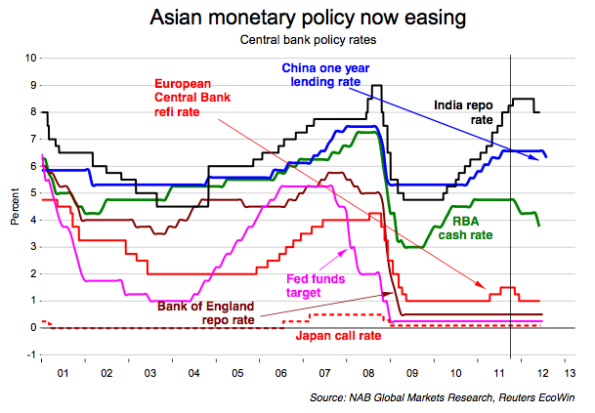

(3) Inflation, Central Banks and Interest Rates

In this chapter we connect three related concepts: inflation, central banks and interest rates.

Read More »

Read More »

(8) Currency Wars: How to Push and Talk Down Your Currency?

Direct or indirect intervention is credible only in countries where domestic asset prices are undervalued and CPI/asset price inflation are no issues. Otherwise they create medium-term risks.

Read More »

Read More »

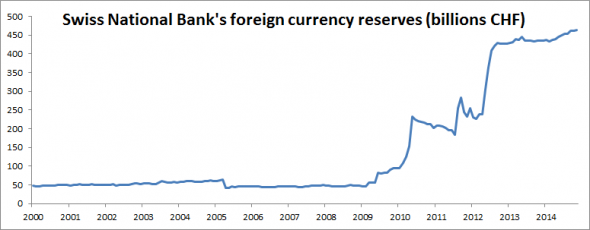

Why did the Swiss franc spike? Lack of Capital Outflows

There is a straightforward answer to the question in the headline: more money has been trying to get into Switzerland than get out, which didn’t affect the exchange rate as long as the Swiss National Bank bought foreign currency. As soon as they stop...

Read More »

Read More »

End of Peg Buiter Critique

In a Citi research note, Willem Buiter discusses the SNB’s decision to discontinue the exchange rate floor of the Swiss Franc vis-a-vis the Euro. His main points are: Buiter refers to his earlier work on removing the lower bound on nominal interest r...

Read More »

Read More »

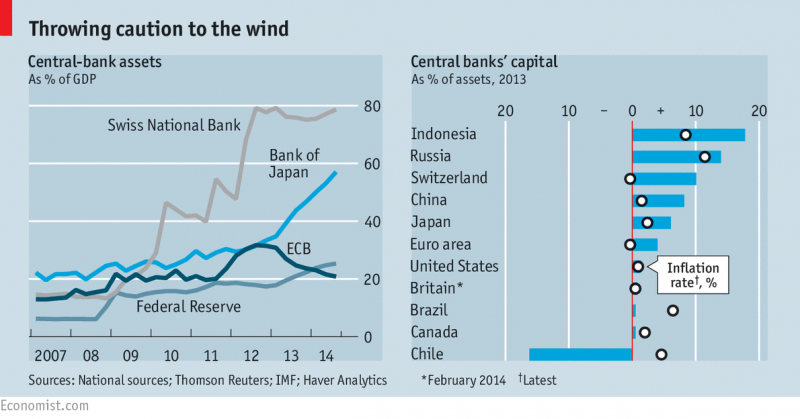

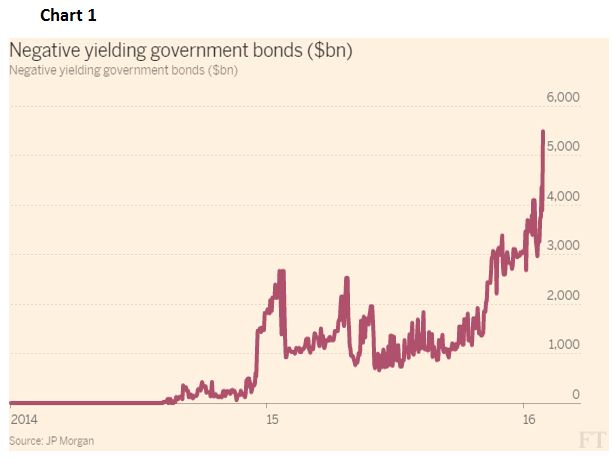

Free exchange: Broke but never bust

CONTEMPORARY central banking is a strongbox of oddities. Deposits, which normally pay interest, can now incur a charge. Investments in government debt, which normally offer a return, give a negative yield. Faced with this weirdness central banks are trying to respect some cardinal rules of finance, with the Swiss National Bank (SNB) and the European Central Bank (ECB) taking steps to protect themselves from losses and ensure that their...

Read More »

Read More »

Switzerland’s currency: Shaken, not stirred

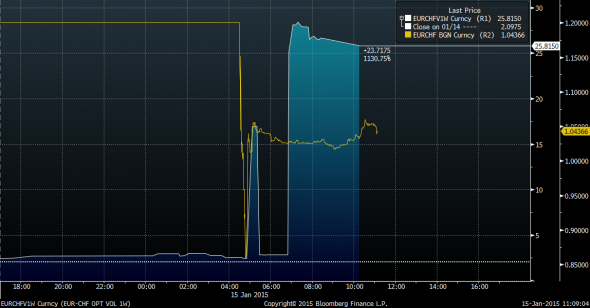

SWISS voters used to hold their central bank in high esteem: one survey in 2013 found the Swiss National Bank (SNB) to be their most respected national institution. That may change after its shock decision on January 15th to abandon the Swiss franc’s cap against the euro. The franc instantly shot up by 30%, provoking howls of anguish from Swiss firms.

Read More »

Read More »

Foreign exchange: Swiss miss

WHEN the Swiss National Bank (SNB) intervened to weaken its currency in 2011, analysts called the subsequent abrupt drop in the franc’s value a “20-standard-deviation move”. Assuming the franc’s ups and downs follow a normal distribution, such a big shift should not have occurred again for many squillions of years.

Read More »

Read More »

Switzerland’s monetary policy: The three big misconceptions about the Swiss franc

ON THURSDAY January 15th Switzerland’s central bank, the Swiss National Bank (SNB), removed the cap on its currency, which it had imposed over three years ago and reaffirmed only three days before its repeal. The doffing of the cap surprised and upset the foreign-exchange markets, hobbling several currency brokers, including Alpari (which happens to sponsor the London football team I support).

Read More »

Read More »

The Economist explains: Why the Swiss unpegged the franc

IN THE world of central banking, slow and predictable decisions are the aim. So on January 15th, when the Swiss National Bank (SNB) suddenly announced that it would no longer hold the Swiss franc at a fixed exchange rate with the euro, there was panic. The franc soared. On Wednesday one euro was worth 1.2 Swiss francs; at one point on Thursday its value had fallen to just 0.85 francs.

Read More »

Read More »

The liquidity monster and FXCM

As we have already pointed out about Thursday’s unprecedented Swiss franc move following the SNB’s announcement about removing its 1.20 euro level floor and introducing a -0.75 per cent interest rate regime, the real story to pay attention to is what...

Read More »

Read More »

What did the SNB do to EURCHF options markets?

The Swiss National Bank made G10 FX a lot more fun to watch today. One interesting thing is how the options markets responded. Via Jared Woodard of BGC, here’s a chart comparing the move in one-week implied volatility in the exchange rate between the...

Read More »

Read More »

Central Europe and the Swiss franc: Currency risk

ANXIETY at the Swiss National Bank’s surprise decision today to drop its peg against the euro was nowhere more evident than in central Europe. The Swiss franc soared against all the region's currencies, including the euro, the Hungarian forint and especially the Polish zloty, and stock exchanges in Poland (pictured) and Hungary dropped sharply.

Read More »

Read More »

The SNB and the Russia/oil connection

A quick post to collate a few side theories on the reasons, justifications and consequences of the SNB move. Simon Derrick at BNY Mellon is first to point out that the euro floor/chf celing was leaving an open door to safe haven flows from Russia by ...

Read More »

Read More »