Tag Archive: Swiss National Bank

Private markets, public investors: The march of the sovereigns

SOVEREIGN wealth funds, typically set up by oil-exporting nations, have been around for decades, in the case of Kuwait since 1953. But their influence has increased in recent years, as China has adopted a similar strategy for investing some of its vast foreign-exchange reserves while existing funds have been fuelled by gains from high oil prices.

Read More »

Read More »

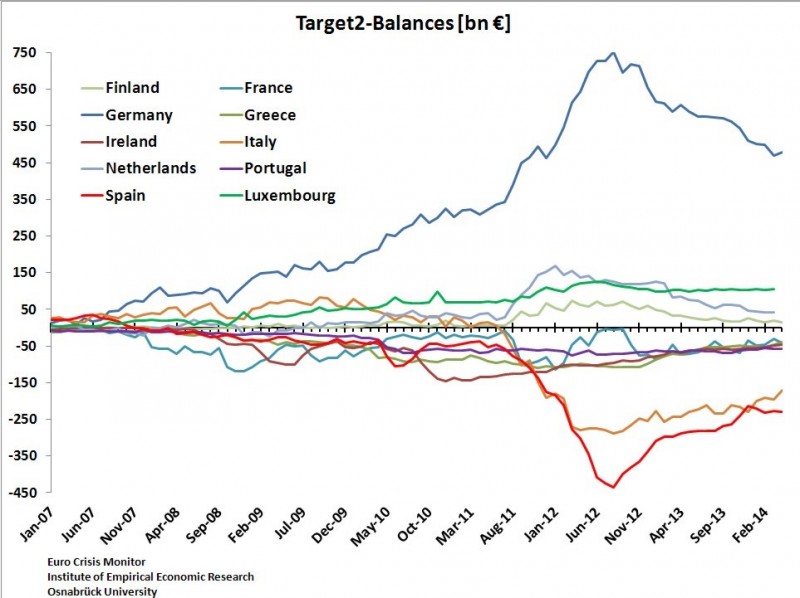

Negative Rates for Bundesbank TARGET2 Surplus?

The ECB surprised with negative rates on excess reserves, on the deposit facility and even on TARGET2. We clarify whether the Bundesbank, as a member of the euro system, must pay negative interest rates on its huge TARGET2 surplus.

Read More »

Read More »

SNB verlängert Goldabkommen, aber wozu?

Die SNB schreibt heute in einer Medienmitteilung: Um ihre Absichten in Bezug auf ihre Bestände an Gold darzulegen, geben die Beteiligten am Goldabkommen folgende Erklärung ab: Gold bleibt ein wichtiges Element der globalen Währungsreserven.

Read More »

Read More »

Is the SNB Intervening Again?

Update March 21, 2014: Total SNB sight deposits increased to 367.8 bln. CHF, but flows reverted a bit. Foreign banks and “non-banks” reduced their CHF exposure at the SNB to 50.8 bln, possibly converting a part of the difference into USD. Dollars are more useful when sanctions will hurt both Russian and German firms. On … Continue...

Read More »

Read More »

The IMF Assessment for Switzerland 2014 and our critique

In the 2014 assessment for Switzerland by the International Monetary Fund, several sentences sparked in our eyes; we will contrast them with our recent critique.

Read More »

Read More »

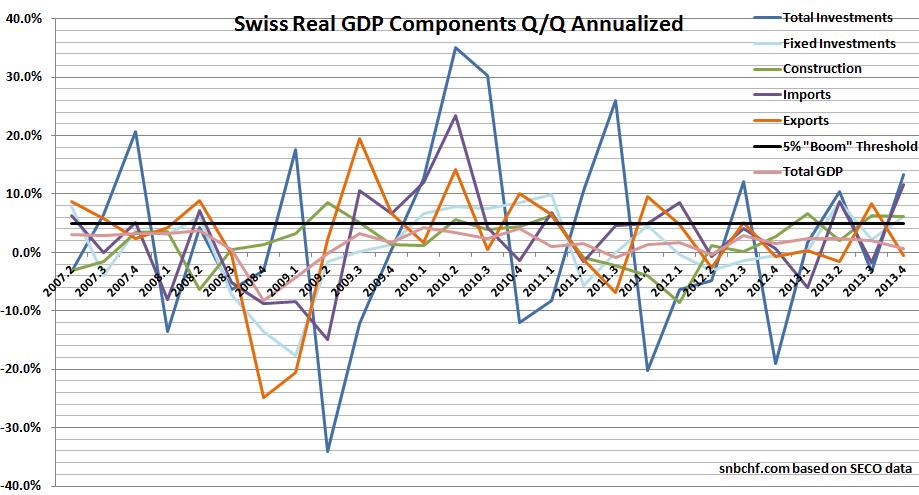

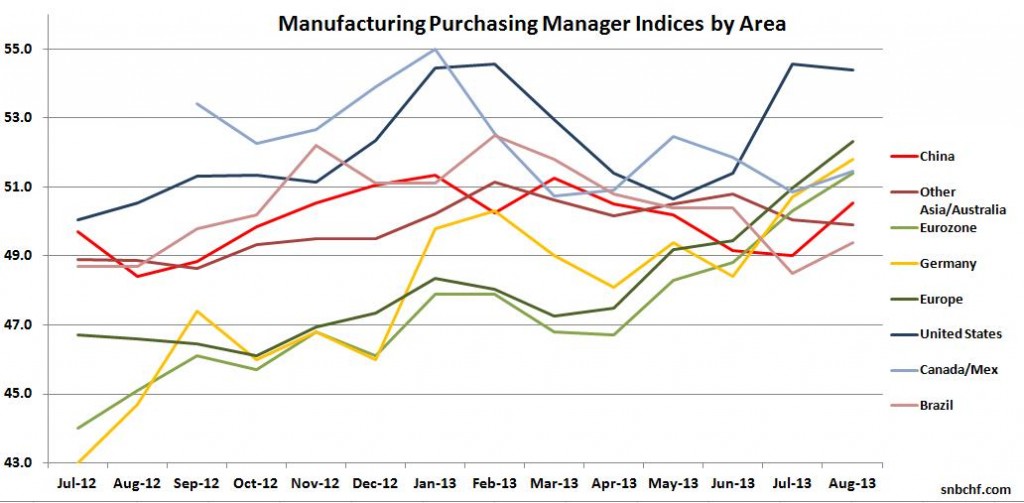

GDP: Switzerland Enters Boom and.. incredibly.. SNB is Still Printing Money

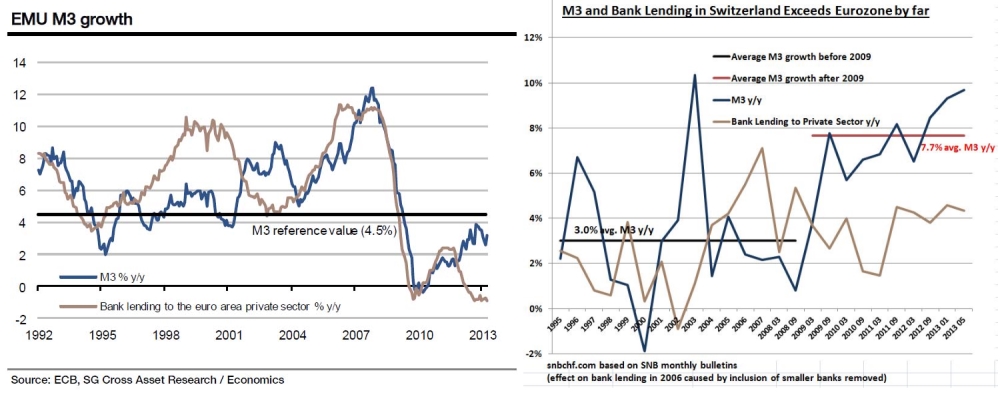

According to the latest data from the SECO,Swiss GDP rose by 0.2% in Q4/2013. Despite the relatively weak headline, the detailed data showed a couple of characteristics that speak for an upcoming boom. At the same time, the Swiss National Bank is printing money again: both the monetary base and money supply are increasing.

Read More »

Read More »

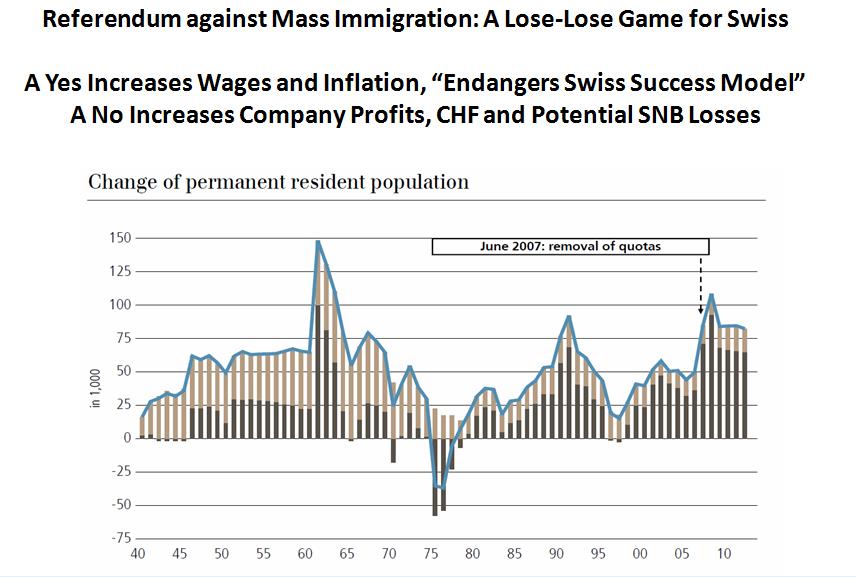

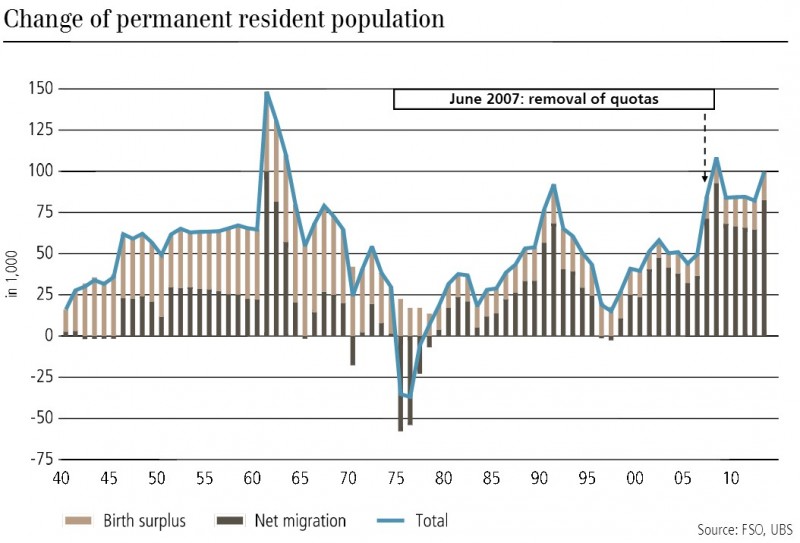

Swiss Yes To Referendum Against Mass Immigration Is A Yes To Higher Salaries And Higher Inflation

In the referendum on Mass Immigration on Sunday, the Swiss opted for less competition, which implies that with the upcoming Swiss boom, salaries and inflation will rise.

Read More »

Read More »

Pros and Cons of the Swiss Countercyclical Capital Buffer

Switzerland is currently living in a big real estate boom. The bubble bursting would imply that banks' collateral in the form of real estate falls in value. Therefore the banks' assets might fall because many home buyers might not be able to repay their mortgage. If a real estate bubble pops, then banks should be better capitalized to absorb such a shock. Therefore the Swiss National Bank introduced macro-prudential measures, like the so-called...

Read More »

Read More »

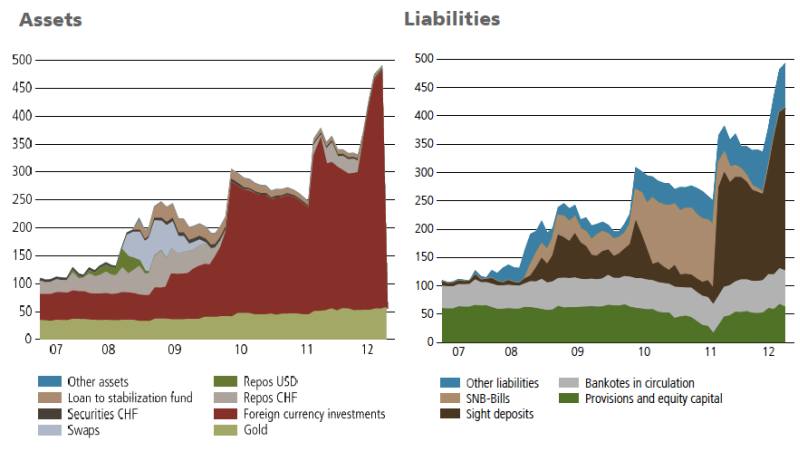

SNB Balance Sheet Expansion

Since 2008 the balance sheet of the Swiss National Bank is 280% higher, this is the equivalent of 60% of Swiss GDP. So did most other central banks, too. But there is one big difference: The risk for the SNB is far higher, the SNB nearly exclusively possesses assets denominated in volatile foreign currency.

Read More »

Read More »

Swiss National Bank Monetary Policy Mandate – 2007 version vs. today

The mandate of the Swiss National Bank is concentrated on price stability, i.e. less than 2% inflation and to avoid deflation.

Read More »

Read More »

ECB rate cut creates complex situation for SNB

Says Thomas Jordan.

Need to wait to assess impact of ECB rate cut

Wasn’t totally surprised by the cut

Interest rates will remain low in Switzerland

Low rates may lead to property bubble risk which SNB will respond to if necessary

SNB monitoring property market which is already in difficult situation

I did wonder about the lack of movement in EUR/CHF yesterday considering that nearly every other euro pair took a hit. It’s either become the...

Read More »

Read More »

Weekly Newspaper on Swiss National Bank and Swiss Franc

Feel free to click into the other categories “politics”, “business”, #chf, #snb in order to see more articles.

Read More »

Read More »

In Which Positions Does the SNB Win and Where Does it Lose Money: Details on the Q3 Results

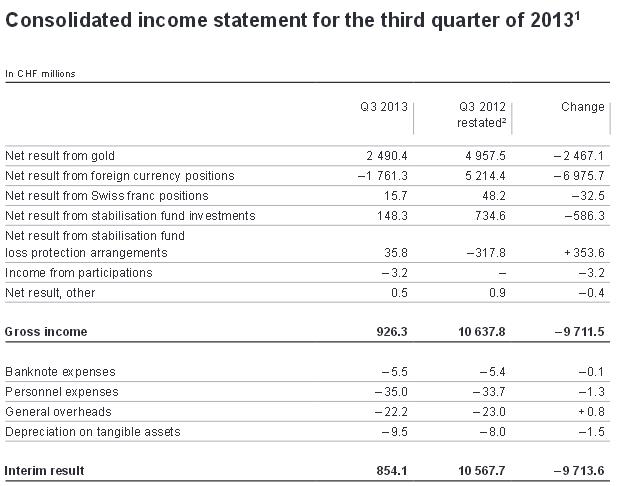

UPDATE October 31, The official press release focused on the results for Q1 to Q3. The loss was 6.4 billion after a 7.3 bln. CHF loss in the first two quarters. Over all three quarters especially gold and the yen weakened the central bank’s positions. For the third quarter, it means that income was positive … Continue reading »

Read More »

Read More »

Weekly Newspaper on Swiss National Bank, Edition October 28

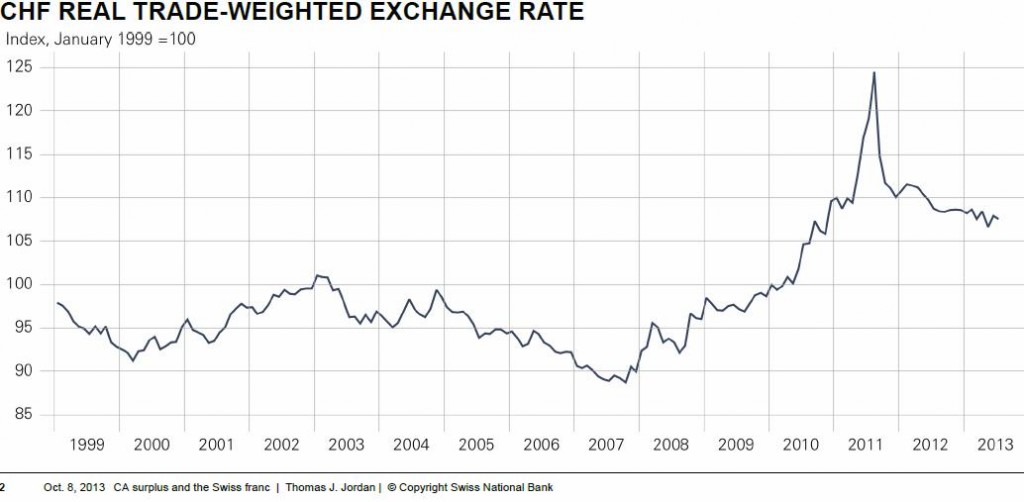

The SNB recently published the latest real effective exchange rate (REER). According to that the franc was only 7% overvalued against the base year 1999. Credit Suisse (CS) has taken some more factors than the REER under consideration: for them the fair value of the EUR/CHF is now 1.22, while the dollar was still undervalued. …

Read More »

Read More »

Danthine: SNB would end franc cap once it raises interest rates

It was obvious already at the latest SNB Monetary Policy Assessment, the SNB is becoming more and more hawkish. At the forefront is its ueber-hawk Jean-Pierre Danthine, the person responsible for the overheating Swiss housing market. He has now announced: SNB would end franc limit once it raises interest rates The Swiss National Bank will …

Read More »

Read More »