Tag Archive: Swiss National Bank

BoJ Adopts Negative Interest Rates, Fails To Increase QE

Well that did not last long. After initial exuberance over The BoJ's wishy-washy decision to adopt a 3-tiered rate policy including NIRP, markets have realized that without further asset purchases (which were maintained at the current pace), there is...

Read More »

Read More »

Swiss Franc Plunges To One-Year Lows Amid SNB Intervention Chatter

With the biggest drop in 3 months, EURCHF has broken above last September's highs, plunging below 1.06. Amid chatter of SNB intervention, this is the weakest Swissy has been since the removakl of the ceiling a year ago.

EURCHF reached 1.10592...

...

Read More »

Read More »

Global Risk Off: China Reenters Bear Market, Oil Tumbles Under $30; Global Stocks, US Futures Gutted

"We're gonna need a bigger Bullard"

- overheard on a trading desk this morning.

Yesterday, when looking at the market's "Bullard 2.0" moment, which was a carbon copy of the market's kneejerk surge higher response to Bullard's "QE4" comments fr...

Read More »

Read More »

Nigerian Currency Collapses After Central Bank Halts Dollar Sales To Stall “Hyperinflation Monster”

Having told banks and investors "don't panic" in September, amid spiking interbank lending rates and surging default/devaluation risks, it appears the massive shortage of dollars that we warned about in December has washed tsunami-like ashore in oil-...

Read More »

Read More »

Why The Powerball Jackpot Is Nothing But Another Tax On America’s Poor

Now that the Powerball Jackpot has just hit a record $1.4 billion, people, mostly those in the lower and middle classes, are coming out in droves and buying lottery tickets with hopes of striking it rich.

After all, with $1.4 billion one can ...

Read More »

Read More »

Monetary assessment meeting Swiss National Bank

Monetary assessment meeting Swiss National Bank: My real-time tweets contain the main important points of the SNB meeting from the view of investors or FX traders.

Read More »

Read More »

Will The Franc Follow In The Euro’s Footsteps?

The SNB's expected December 10 rate cuts have already been priced in to the Swiss Franc.

The central bank's failure to do more than the market expected resulted in a stronger CHF.

Growing uncertainty over the Fed's 2016 monetary policy is a bullish factor for the franc.

Read More »

Read More »

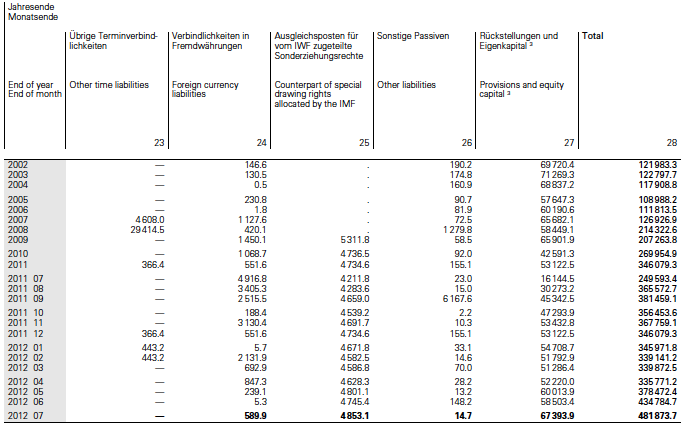

SNB’s history of balance sheet and Monthly bulletin

The SNB monthly bulletins contain all important data of the SNB and the Swiss economy as of the latest quarter.

Read More »

Read More »

SNB & CHF, the blog on a beleaguered central bank, its currency, on gold and astute investments

SNBCHF.com tracks Swiss macro-economic news and the Swiss National Bank. The SNB finally gave up the euro peg and agreed with the authors of this blog. Over years this blog expressed opposition against the EUR/CHF peg in about 900 different pages. They track the strong Swiss economic performance over these years. They explain all logical and fundamental Forex background why this peg did not have any reason to exist or, at least, why it was doomed...

Read More »

Read More »

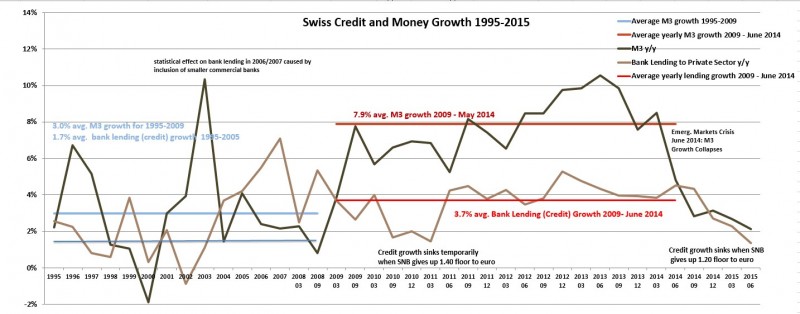

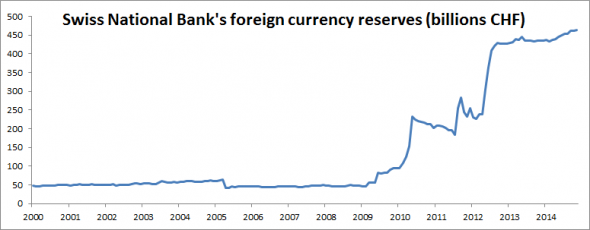

The 2015 Update: Risks on the Rising SNB Money Supply

We explain the risks on the rising money supply in Switzerland. We distinguish between broad money supply (M1-M3) and narrow money supply (M0). Both are rising quickly.

Read More »

Read More »

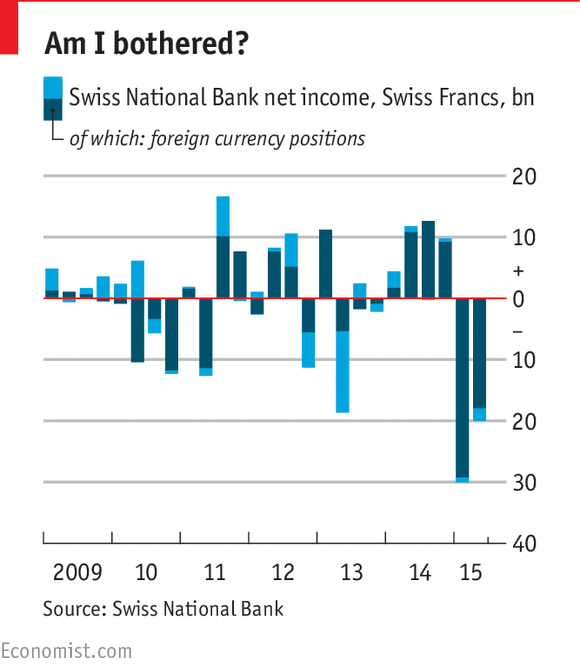

The Swiss National Bank: Switzerland’s central bank makes a massive loss

ON FRIDAY, the Swiss National Bank (SNB), Switzerland’s central bank, reported second quarter losses of SFr20 billion ($20 billion). Following an equally bad first three months of the year, the SNB’s losses so far for 2015 now amount to a whopping SFr50.1 billion, equivalent to 7.5% of Switzerland's GDP.

Read More »

Read More »

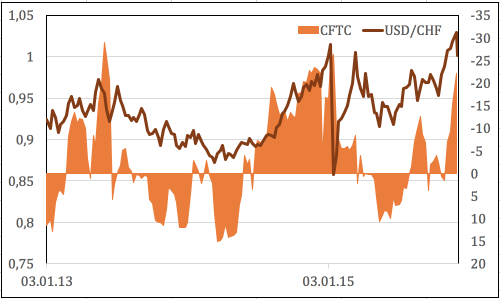

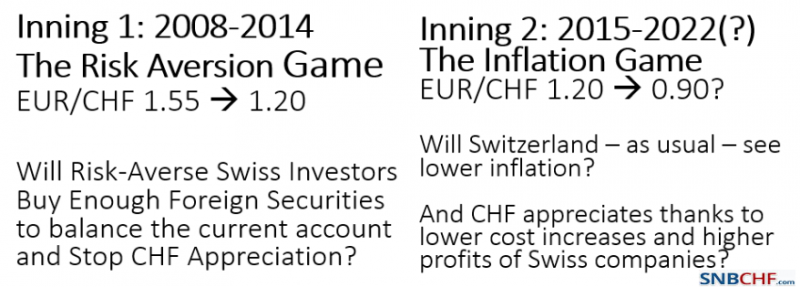

The two phases of CHF appreciation… and what is in between

We show the two phases or "two innings" of Swiss franc appreciation: The risk aversion phase and the high inflation phase.

With the weakening of emerging markets and the strengthening of the United States in 2013/2014, the Swiss National Bank (SNB) had won the first battle in the war against financial market, the "risk aversion game", the first inning in two-part match. Risk aversion is lower because the United States recovered with weaker oil...

Read More »

Read More »

Rising Sight Deposits at SNB Means Rising SNB Debt

Money creation and sight deposits may have two points of view:

1. The central bank creates money - i.e. the SNB decides to increase sight deposits when it does currency interventions

2. Commercial banks create money - inflows in CHF on Swiss bank accounts make those banks increase their "sight deposits at the SNB. If inflows in CHF are higher than outflows then CHF must rise, unless the central bank does currency interventions.

We will present...

Read More »

Read More »

SNB’s IMF data

This IMF data on the SNB website shows SNB Forex and gold reserves in the last month. It is so-called "IMF Special Data Dissemination Standard (SNB Data)"

Read More »

Read More »

Das Gold-Gschichtli der SNB

Dem Jahresbericht 2014 der SNB entnehmen wir ab Seite 63: Lagerung der Goldreserven Gemäss Art. 99 Abs. 3 der Bundesverfassung hält die Nationalbank einen Teil ihrer Währungsreserven in Gold. Die Nationalbank gab im Frühling 2013 bekannt, dass sie 30...

Read More »

Read More »

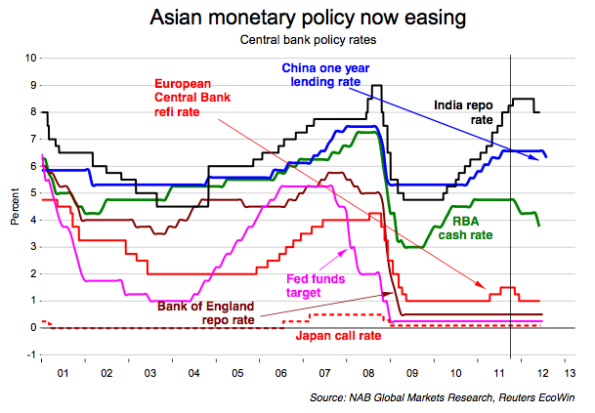

(3) Inflation, Central Banks and Interest Rates

In this chapter we connect three related concepts: inflation, central banks and interest rates.

Read More »

Read More »

(8) Currency Wars: How to Push and Talk Down Your Currency?

Direct or indirect intervention is credible only in countries where domestic asset prices are undervalued and CPI/asset price inflation are no issues. Otherwise they create medium-term risks.

Read More »

Read More »

Why did the Swiss franc spike? Lack of Capital Outflows

There is a straightforward answer to the question in the headline: more money has been trying to get into Switzerland than get out, which didn’t affect the exchange rate as long as the Swiss National Bank bought foreign currency. As soon as they stop...

Read More »

Read More »