Tag Archive: SEK

FX Daily,April 16: Market Struggles for Direction

The Syrian strike over the weekend, and the official indication that "mission accomplished" and that was a limited one-off strike has spurred little market reaction. There is one more loose end, as it were, and that is that the US has indicated it will announce additional sanctions on Russia for its involvement in Syria's chemical weapon use. The ruble is volatile but slightly firmer to start the week, and while dollar-bond yields are firmer, the...

Read More »

Read More »

FX Daily, April 12: Geopolitics Overshadow the Fed, Greenback Steadies

The US dollar steadied at lower levels, while equities eased as investors remain focused on the preparations to strike Syria and still tense rhetoric on trade. Reports indicate that the US and France have moved warships into the area and the UK has moved submarines within striking distance as well.

Read More »

Read More »

FX Daily, March 07: Renewed Threat of Trade War Makes Investors Angry

In response to the resignation of one of the few "globalist" advisers in the US Administration, the resignation Cohn has sent ripples through the capital markets. Stocks have been marked down across the world. The prospects of a trade war are also not good for growth and it may be adding to the pressure on yields.

Read More »

Read More »

FX Daily, March 06: Resiliency Demonstrated

The resiliency of the status quo is again on display. After much chin wagging and finger pointing after the Italian elections and the modest decline in Italian assets, they have bounced back today. Italian bonds and stocks are participating in today's advance. Italian equities were off 0.5% yesterday and are up a 1.1% near midday in Milan. Italy's 10-year yield rose three basis points yesterday is off five today.

Read More »

Read More »

FX Daily, February 28: It Takes Powell to Convince the Market that Yellen was Right

Many market participants think they heard Fed Chair Powell give a fairly strong signal that he favored a more aggressive course. The implied yield on the December Eurodollar futures rose five basis points to 1.535%. The December Fed funds futures contract rose three basis points.

Read More »

Read More »

FX Weekly Preview: Policy Mix Underlines Positive Fundamental Backdrop for the Dollar

The prospects that the Republican-controlled legislative branch would find a compromise to tax cuts were enhanced when a few senators appeared to capitulate without much to show for it may have helped lift US stocks and dollar ahead of the weekend.

Read More »

Read More »

FX Daily, December 12: UK Front and Center, but Sterling is Laggard in Today’s Move Against the Dollar

The US dollar is trading with a lower bias against most of the major and emerging market currencies. The upside surprise in Sweden's inflation is helped the krona recover from its recent slide. It is the strongest of the majors, gaining 1.1% against the dollar and nearly as much against the euro, which is in a third of a cent range below $1.18.

Read More »

Read More »

FX Daily, December 11: Dollar Mixed to Start the Week, While Equities Firm

The US dollar is narrowly mixed in relatively quiet activity. Year-end adjustment is well underway, and the news stream is light to start the week that sees more than a dozen central bank meetings. There is little doubt in the market that the Federal Reserve will hike rates for the third time this year at mid-week.

Read More »

Read More »

FX Daily, November 21: Dollar Marks Time

The US dollar has largely been confined to yesterday's trading ranges against the major currencies amid light news. The North American session does not hold much hope for fresh impetus. The US reports October existing home sales, which are not typically market moving in the best of times. Yellen does not speak until after the markets close, and even then is unlikely to sway expectations, which have priced in a rate hike next month.

Read More »

Read More »

FX Daily, November 16: Euro Extends Pullback

After rising to its best level since October 20, the euro reversed direction yesterday and has extended its pullback today. The unexpected tick up in US core CPI and better than expected retail sales may have helped spur the euro losses after three cent run-up over the past several sessions. There bearish candlestick (shooting star) leaves the late euro longs in weak hands.

Read More »

Read More »

FX Daily, September 07: ECB Focus for Sure, but not Only Game in Town

The US dollar is trading broadly lower. The ECB meeting looms large. Many, like ourselves, expected that when Draghi said in July that the asset purchases would be revisited in the fall, it to meant after the summer recess, not a legalistic definition of when fall begins. Still, there have been some reports, citing unnamed sources close to the ECB, that have played down such expectations, and warn a decision on next year’s intentions may not be...

Read More »

Read More »

FX Daily, August 15: Greenback Firms, Encouraged by Dudley and Ebbing of Tensions

NY Fed President Dudley appears to have stolen any potential thunder in the July FOMC minutes that will be released tomorrow. While we put more emphasis on today's US retail sales data and the August Fed surveys, many others argued that the minutes were the key report this week.

Read More »

Read More »

FX Daily, July 28: Dollar and Equities Closing Week on Heavy Note

The US dollar is mostly lower, though one of the features of recent days has been the dramatic slide of the Swiss franc, and that is continuing today. The franc is off another 0.5% today, to bring its weekly loss to a sharp 2.5%. The euro finished last week near CHF1.1030 and is now near CHF1.1370; its highest level since the cap was lifted in mid-January 2015.

Read More »

Read More »

FX Daily, July 03: Dollar Bounces to Start H2

The beleaguered US dollar is enjoying a respite from the selling pressure that pushed it lower against all the major currencies in the first six months of 2017. A measure of the dollar on a trade-weighted basis fell about 5% in the first half after appreciating nearly 8% in Q4 16.

Read More »

Read More »

FX Weekly Preview: Official Coordination or Is the Market Getting Ahead of Itself?

The consensus narrative sees a coordinated attempt by officials to prepare investors for less accommodative monetary policy. Data from the eurozone and UK may suggest the respective economies are not accelerating. Before getting to the jobs report, the US economic data, like auto sales, may be soft, while the prices paid in the manufacturing ISM may ease.

Read More »

Read More »

FX Daily, June 13: Dollar Softens Ahead of Start of FOMC Meeting

The US dollar is trading with a heavier bias against all the major currencies save the Japanese yen. The Scandis and Canadian dollar are leading the move. Sweden reported a 0.1% rise in the headline and underlying inflation while the median expected a decline of the same magnitude. The year-over-year pace slowed but not as much as expected.

Read More »

Read More »

FX Weekly Preview: Politics and Economics in the Week Ahead

FOMC, BoE, and BOJ meet next week; only the Fed is expected to change policy. High frequency data may be less important than the central bank meetings and politics in the week ahead. UK political situation is far from resolved, and US drama continues, while several hot spots in the EMU are emerging.

Read More »

Read More »

FX Daily, February 15: Yellen Helps the Dollar Extend Streak

The Dollar Index's ten-day rally was at risk yesterday, but Yellen's reiteration of the commitment to continue to lift rates gradually helped extend the streak to eleven sessions.This surpassed the streak around the election (November 7-November 18). With today's gains, it may draw closer to what appears to be the long streak, 14 sessions between April 30, 2012 and May 17.

Read More »

Read More »

FX Weekly Preview: Yellen’s Path Cleared by Trump’s Moderation

Trump has moderated in several areas, he is being checked in others, and less impactful in others. This will underscore the focus on Yellen's testimony this week. At same time, many will be reluctant to short the dollar ahead of the tax reform plans that may be unveiled in Trump's upcoming speech to Congress.

Read More »

Read More »

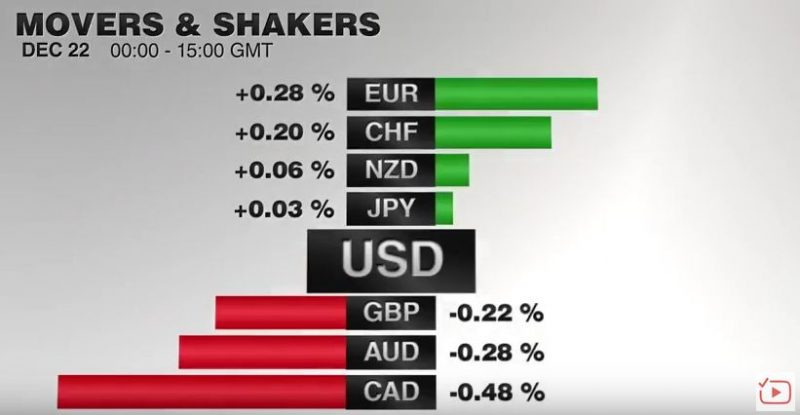

FX Daily, December 22: Mixed Dollar amid Light News as Investors Move to Sidelines

GBP/CHF rates have dipped over the past week, as the markets start to slowdown ahead of the Christmas period. Market trends become harder to predict at this time of year, due to the fact there is less capital injected by investors. Less liquidity ultimately equals less stability and the Pound may be suffering due to investors pulling their funds away from it and into safer haven currencies such as the CHF.

Read More »

Read More »