Tag Archive: SEK

Riksbank and Norges Bank Policy Meetings

Six major central banks meeting over the next six sessions. Sweden's Riksbank is the most likely ease policy of these central banks, but it is not particularly likely. Norway is decisively on hold, as fiscal policy does some of the heavy lifting.

Read More »

Read More »

FX Daily, October 28: Dollar Sidelined, Krona Stabilizes, Rates Firm

The main development here in the last full week of October is the sharp rise in bond yields. US 10-year yields rose nine bp this week coming into today's session, which features the first look at Q3 GDP. The two-year yield is up four bp. European 10-year benchmark yields mostly rose 11-17 bp. UK Gilts were are the upper end of that range. Two-year yields are 3-5 bp higher.

Read More »

Read More »

Divergence: Norway and Sweden

Sweden has one of the weakest of the major currencies this year. Norway has one of the strongest of the major currencies this year. The key driver is divergence of monetary policy and that divergence is likely continue into next year.

Read More »

Read More »

(13.1) Is the Swedish Krona a Safe-Haven?

Arguments in favor of and against the Swedish Krona,as safe-haven during the euros crisis. Extracts from tradingfloor.com

Read More »

Read More »

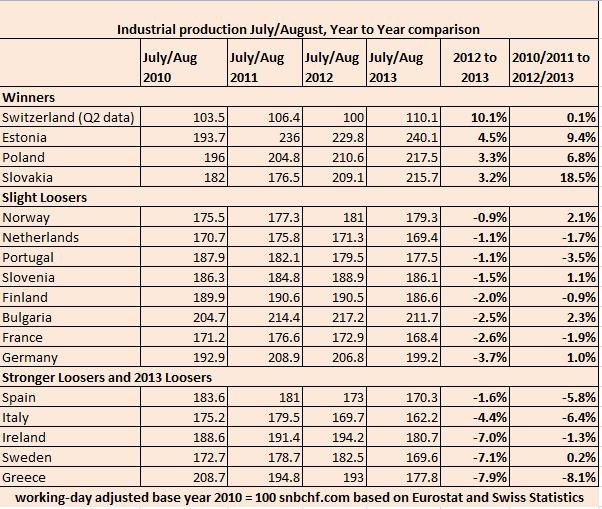

European Industrial Production Still Contracting, Switzerland Expanding Again

Swiss industrial production is rather insensitive to price changes and to the recent slowing of global demand thanks to the concentration on pharmaceuticals and luxury products. Based on Eurostat’s industrial production for July and August , we compared the values from 2010 to 2013 for these two summer months. This aggregated two-months comparison is …

Read More »

Read More »

SNB meeting on March 15th, 2012: Pure Speculation that SNB raises floor, How to Trade it ?

Between November 2011 and January 2012 mostly left-wing politicians and trade unions wanted the EUR/CHF floor to be risen to 1.30 or 1.40 and uttered their wishes regularly in the Swiss newspapers, triggering many FX traders to speculate on this hike. Recently these demands have become more silent even if some UBS analysts still see the floor to …

Read More »

Read More »

The new European Save-Havens: Trade SEK/CHF and NOK/CHF

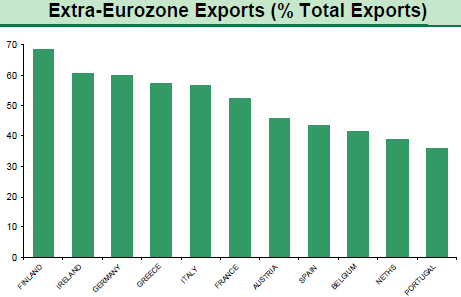

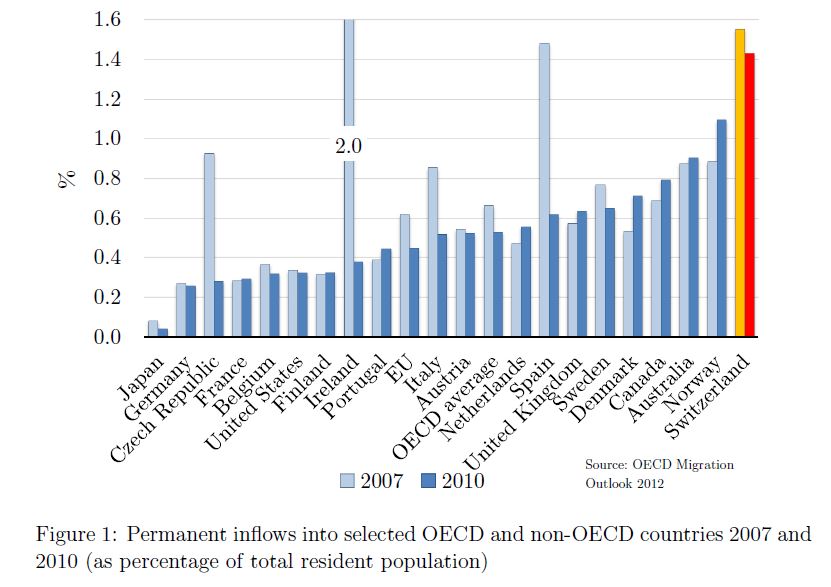

After the announcement of the floor in the EUR/CHF pair, many predicted the Swedish and the Norwegian Krone to take the place of the Swiss Franc as European save-haven against the Euro turmoil (http://on.ft.com/pKSJ1V). Both countries possess a low level of debt, positive trade balance and very competitive economies.

Read More »

Read More »