UPDATE November 2013:

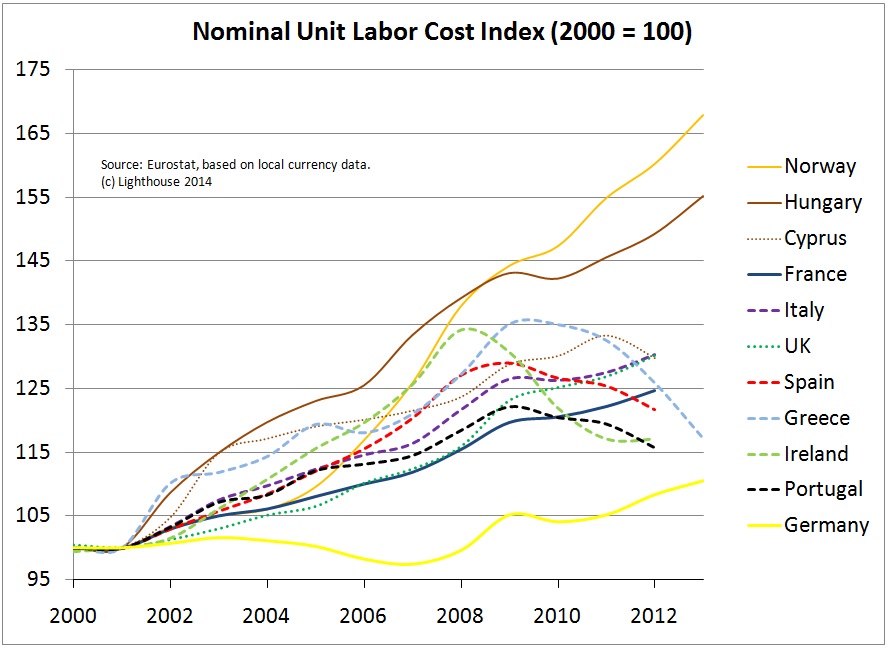

The Norwegian Krone has strongly devalued again. The reason is that demand from Europe has further weakened, Brent oil has fallen in price, Norwegian inflation and wage increases at levels of 2-2.5% are far higher than in the Euro zone. The central bank is focused on growth instead of fighting inflation, i.e. exercising financial repression.

German GDP, however, continues to expand thanks to consumer spending, and finally in Q3/2013 investment has increased more than previously. For the first time for years, imports rose more than exports.

More about Currencies in Northern Europe

While inflation, higher wages and capital outflows in emerging markets might hamper their competitiveness, and US wage inflation is reduced by high unemployment and a weak participation rate, we judge that the upcoming inflationary cycle in developed nations has already started in Germany and Finland. These nations might be joined later by some other Northern European countries like Norway, Sweden and Switzerland. They are all countries with low unemployment and strong current account surpluses.

By early 2013, the European “risk-on currencies”, the Norwegian krone and even more the Swedish krona have strongly revalued against the euro thanks to trader’s risk appetite and talks about another ECB rate cut. These FX rate price moves have countered wage inflation in the two Scandinavian countries. They have even led Sweden into deflation, that could intensify and change the Riksbank’s relaxed stance on the exchange rate.

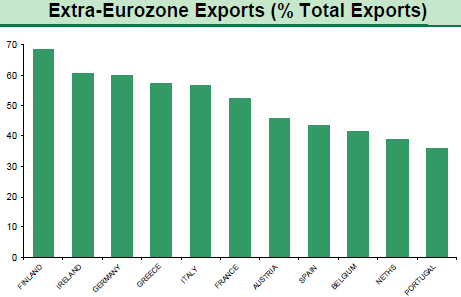

On the other side, finally rising German consumer demand apparent in recent retail sales increases, helped to confirm the upwards trend for the Swedish economy that mostly depends on exports to Germany and Europe (total 73%) – some key companies are H&M and Ikea; sales for these companies are very price-sensitive and therefore negative correlated to oil prices. But Sweden is also associated with technology firms: its currency is hence a proxy of stock markets.

Norway is well-known for surpluses thanks to oil exports. What people know less about Norway is the high private indebtedness and a huge real estate boom that is still sustained by long-lasting current account surpluses, as opposed to Spain’s or Denmark’s housing busts and current account deficits until 2007.

Finland was the first Western nation to show stronger wage inflation with yearly salary hikes between 3% and 4% since 2009. The country has seen an extreme success story since the year 2000: it has increased its GDP per person at constant prices by 30% thanks to the boom in the traditional Finnish (machinery) export markets in Russia and CES. High wages, lower demand from Russia and Asia and eroded margins for exporters contributed to a Finnish GDP contraction in 2012.

Switzerland, however, has a very global export structure, as opposed to Germany, Sweden (73% exports to Europe) and Finland, the Swiss have a share of 20% exports to the Americas and the UK and 30% to emerging markets. Additionally, Switzerland concentrates on the rather price-inelastic pharmaceutical, watches and luxury products sectors. Together with strong local demand, Switzerland managed to outpace Germany, Sweden and Finland with an around 1% higher GDP increase in 2012.

The more risk-averse Swiss franc, has remained mostly stable against the euro recently despite the risk-friendly environment. We judge that Switzerland will see slowly rising inflation and a further narrowing of the inflation gap with the euro zone.

See more for