Tag Archive: Precious Metals

Gold boosted by dovish central banks

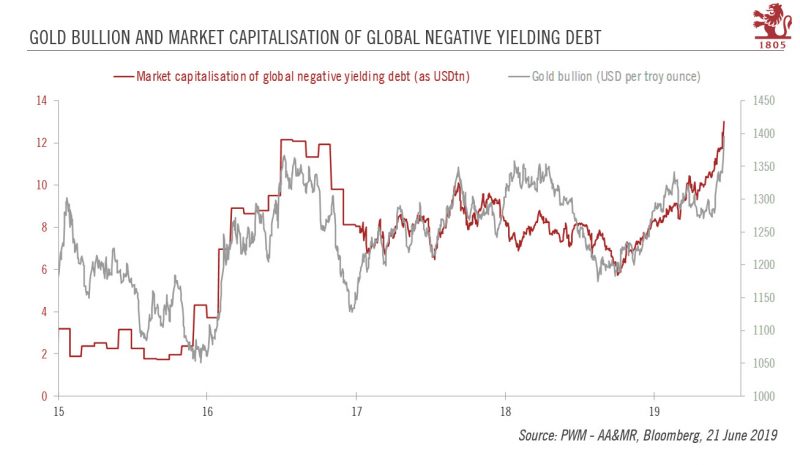

Bar a further major escalation in trade tensions, it is hard to see much more upside for gold in the short term. We remain more upbeat over the medium term.The gold price soared to a fresh five-year high on 20 June following a dovish Fed monetary policy meeting. Indeed, the dovish shift among major central banks (with the sole exception of the Norges Bank) and high global uncertainty have pushed global yields lower recently, reducing the...

Read More »

Read More »

Paul Tudor Jones Likes Gold

Gold is Paul Tudor Jones’ Favorite Trade Over the Coming 12-24 Months. In a recent Bloomberg interview, legendary trader and hedge fund manager Paul Tudor Jones was asked what areas of the markets currently offer the best opportunities in his opinion. His reply: “As a macro trader I think the best trade is going to be gold”.

Read More »

Read More »

A Surprise Move in Gold

Traders and Analysts Caught Wrong-Footed. Over the past week gold and gold stocks have been on a tear. It is probably fair to say that most market participants were surprised by this development. Although sentiment on gold was not extremely bearish and several observers expected a bounce, to our knowledge no-one expected this.

Read More »

Read More »

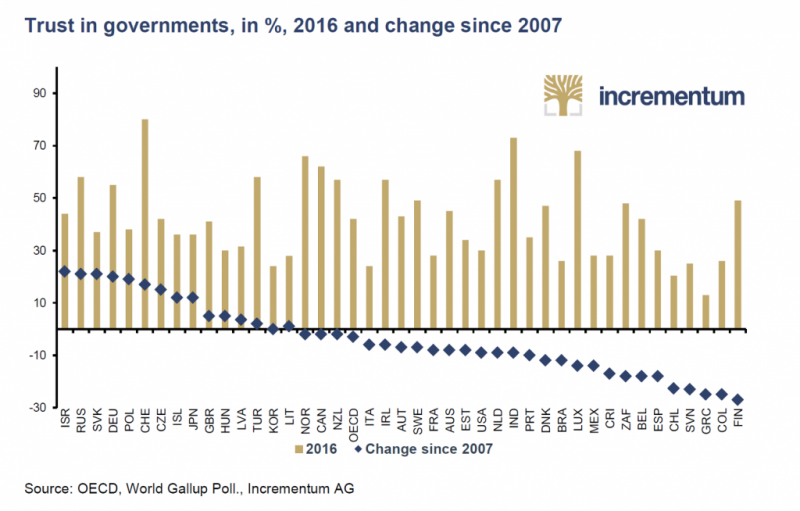

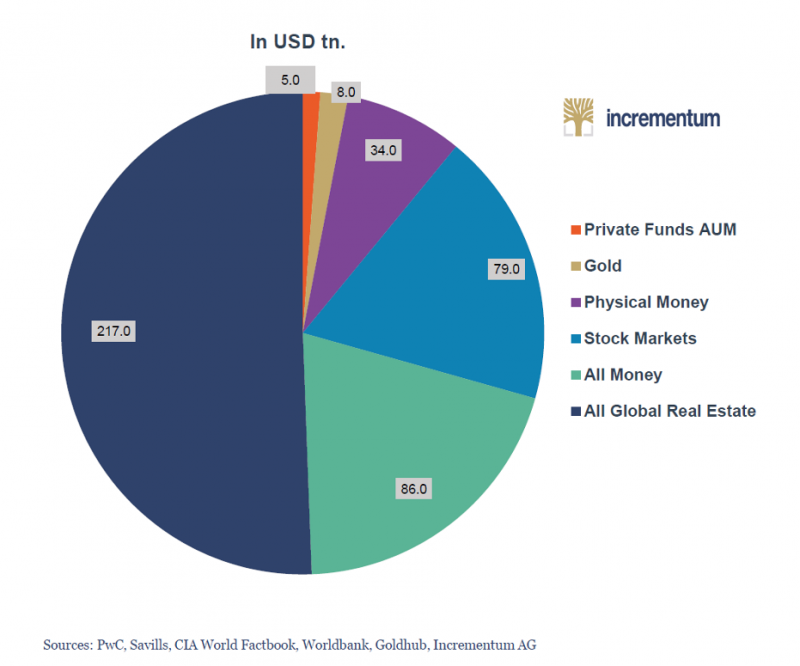

In Gold We Trust 2019

The New Annual Gold Report from Incrementum is Here. We are happy to report that the new In Gold We Trust Report for 2019 has been released today (the download link can be found at the end of this post). Ronnie Stoeferle and Mark Valek of Incrementum and numerous guest authors once again bring you what has become the reference work for anyone interested in the gold market.

Read More »

Read More »

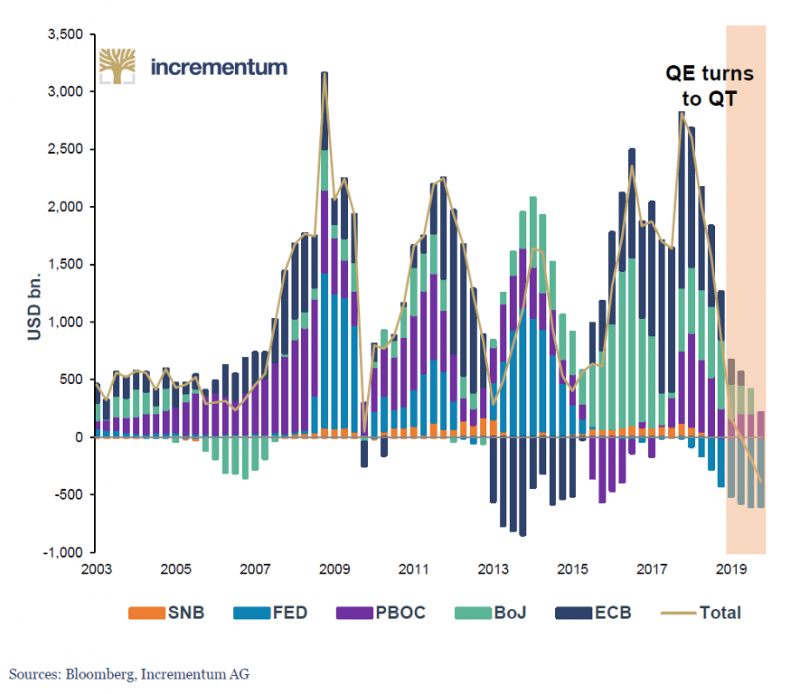

In Gold We Trust 2019 – The Preview Chart Book

The new IGWT report for 2019 will be published at the end of May… …and for the first time a Mandarin version will be released as well. In the meantime, our friends at Incrementum have decided to release a comprehensive chart book in advance of the report. The chart book contains updates of the most important charts from the 2018 IGWT report, as well as a preview of charts that will appear in the 2019 report.

Read More »

Read More »

Monetary U-Turn: When Will the Fed Start Easing Again? Incrementum Advisory Board Meeting Q1 2019

On occasion of its Q1 meeting in late January, the Incrementum Advisory Board was joined by special guest Trey Reik, the lead portfolio manager of the Sprott Institutional Gold & Precious Metal Strategy at Sprott USA since 2015

Read More »

Read More »

The Gold Debate – Where Do Things Stand in the Gold Market?

A Recurring Pattern. When the gold price recently spiked up to approach the resistance area even Aunt Hilda, Freddy the town drunk, and his blind dog know about by now, a recurring pattern played out. The move toward resistance fanned excitement among gold bugs (which was conspicuously lacking previously).

Read More »

Read More »

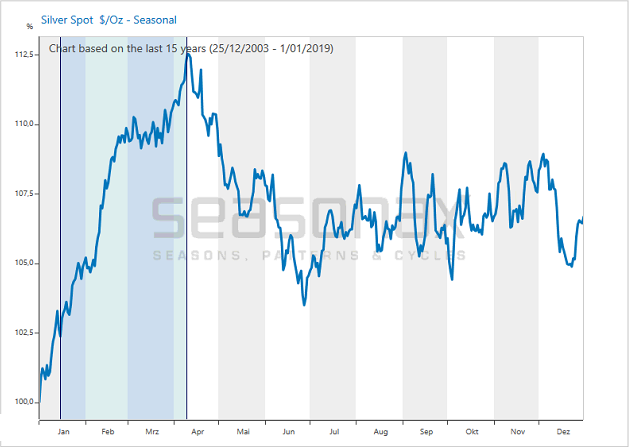

The Strongest Season for Silver Has Only Just Begun

Commodities as an Alternative. Our readers are presumably following commodity prices. Commodities often provide an alternative to investing in stocks – and they have clearly discernible seasonal characteristics. Thus heating oil tends to be cheaper in the summer than during the heating season in winter, and wheat is typically more expensive before the harvest then thereafter.

Read More »

Read More »

Change is in the Air – Precious Metals Supply and Demand

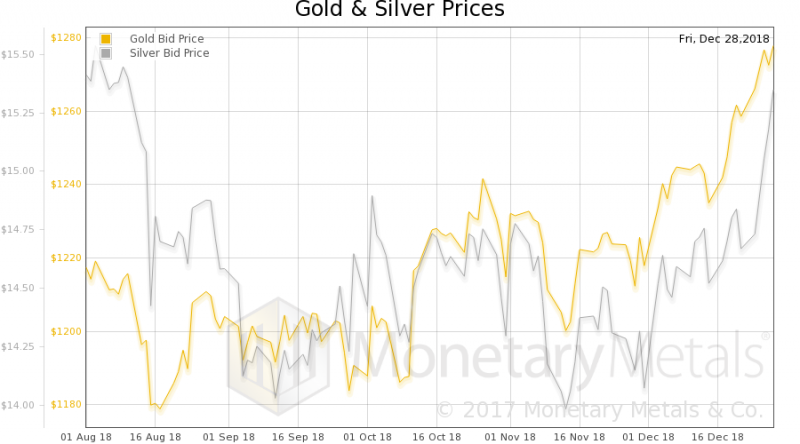

Last week, the price of gold rose $25, and that of silver $0.60. Is it our turn? Is now when gold begins to go up? To outperform stocks? Something has changed in the supply and demand picture. Let’s look at that picture. But, first, here is the chart of the prices of gold and silver.

Read More »

Read More »

The Big Picture: Paper Money vs. Gold

Numbers from Bizarro-World. The past few months have been really challenging for anyone invested in gold or silver; for me personally as well. Despite serious warning signs in the economy, staggering debt levels and a multitude of significant geopolitical threats at play, the rally in risk assets seemed to continue unabated.

Read More »

Read More »

The Interesting Seasonal Trends of Precious Metals

Prices in financial and commodity markets exhibit seasonal trends. We have for example shown you how stocks of pharmaceutical companies tend to rise in winter due to higher demand, or the end-of-year rally phenomenon (last issue), which can be observed almost every year. Gold, silver, platinum and palladium are subject to seasonal trends as well.

Read More »

Read More »

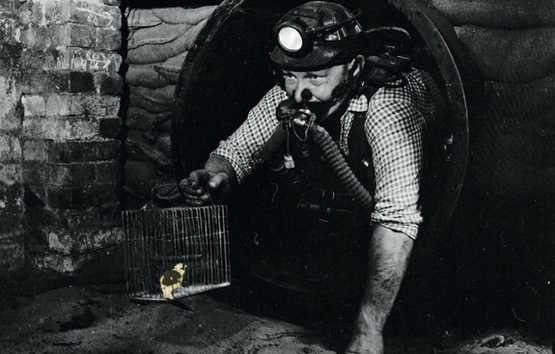

Is the Canary in the Gold Mine Coming to Life Again?

Back in late 2015 and early 2016, we wrote about a leading indicator for gold stocks, namely the sub-sector of marginal – and hence highly leveraged to the gold price – South African gold stocks. Our example du jour at the time was Harmony Gold (HMY) (see “Marginal Producer Takes Off” and “The Canary in the Gold Mine” for the details).

Read More »

Read More »

You Can’t Eat Gold – Precious Metals Supply and Demand

You Actually Can Eat Gold, But Its Nutritional Value is Dubious. “You can’t eat gold.” The enemies of gold often unleash this little zinger, as if it dismisses the idea of owning gold and indeed the whole gold standard. It is a fact, you cannot eat gold. However, it dismisses nothing.

Read More »

Read More »

The Gold Standard: Protector of Individual Liberty and Economic Prosperity

A Piece of Paper Alone Cannot Secure Liberty. The idea of a constitution and/or written legislation to secure individual rights so beloved by conservatives and among many libertarians has proven to be a myth. The US Constitution and all those that have been written and ratified in its wake throughout the world have done little to protect individual liberties or keep a check on State largesse.

Read More »

Read More »

In Gold We Trust – Incrementum Chart Book 2018

Our friends from Incrementum (a European asset management company) have just released the annual “In Gold We Trust” chart book, which collects a wealth of statistics and charts relevant to gold, with extensive annotations. Many of these charts cannot be found anywhere else.

Read More »

Read More »

Yield Curve Compression – Precious Metals Supply and Demand

The price of gold fell nine bucks last week. However, the price of silver shot up 33 cents. Our central planners of credit (i.e., the Fed) raised short-term interest rates, and threatened to do it again in December. Meanwhile, the stock market continues to act as if investors do not understand the concepts of marginal debtor, zombie corporation, and net present value.

Read More »

Read More »

Submerged Lighthouse Syndrome – Precious Metals Supply and Demand

Last week, the lighthouse went down 24 meters (gold went down $24), or 50 inches (if you prefer, silver went down 50 cents). However, let’s take a look at the only true picture of supply and demand. Are the fundamentals dropping with the market price?

Read More »

Read More »

Fundamental Price of Gold Decouples Slightly – Precious Metals Supply and Demand

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Wall Street – Island of the Blessed

Which Disturbance in the Farce can be Profitably Ignored Today? There has been some talk about submerging market turmoil recently and the term “contagion” has seen an unexpected revival in popularity – on Friday that is, which is an eternity ago. As we have pointed out previously, the action is no longer in line with the “synchronized global expansion” narrative, which means with respect to Wall Street that it is best ignored.

Read More »

Read More »

Gold Sector – An Obscure Indicator Provides a Signal

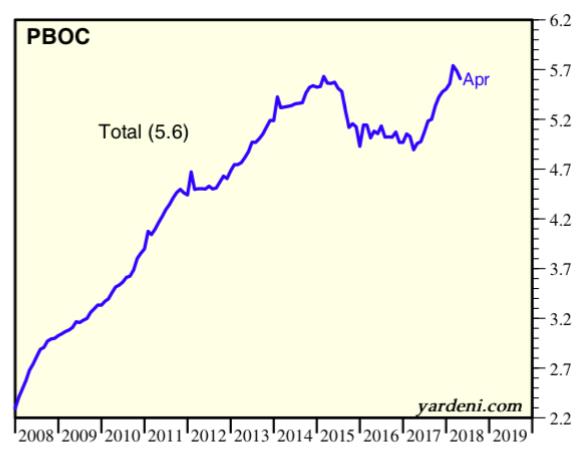

The Goldminbi. In recent weeks gold apparently decided it would be a good time to masquerade as an emerging market currency and it started mirroring the Chinese yuan of all things. Since the latter is non-convertible this almost feels like an insult of sorts. As an aside to this, bitcoin seems to be frantically searching for a new position somewhere between the South African rand the Turkish lira.

Read More »

Read More »

Donate to SNBCHF.com

Donate to SNBCHF.com Via Paypal or Bitcoin To Help Keep the Site Running

Please consider making a small donation to Snbchf.com. Thanks

Bitcoin wallet: bc1qa2h6hgd0xkuh7xh02jm5x25k6x8g7548ffaj3j

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

USD/CHF stays above 0.9100 nearing the highs since October

3 days ago -

SNB Sight Deposits: increased by 17.0 billion francs compared to the previous week

3 days ago -

Pound Sterling falls back as upbeat US Retail Sales strengthen US Dollar

4 days ago -

Canadian Dollar remains vulnerable after strong US Retail Sales

4 days ago -

2024-04-09 – Martin Schlegel: Interest rates and foreign exchange interventions: Achieving price stability in challenging times

10 days ago

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: increased by 17.0 billion francs compared to the previous week

3 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Navigating Market Bubbles and Lessons on Shorts – Andy Tanner

Navigating Market Bubbles and Lessons on Shorts – Andy Tanner -

Is The Gold Price Too High To Buy? The Train Hasn’t Left The Station!

Is The Gold Price Too High To Buy? The Train Hasn’t Left The Station! -

Understanding the Recent Inflation Spike and the Federal Reserve’s Reaction

Understanding the Recent Inflation Spike and the Federal Reserve’s Reaction -

Mit dem Flugzeug pendeln, um Miete zu sparen? ️ #pendeln

Mit dem Flugzeug pendeln, um Miete zu sparen? ️ #pendeln -

Mein YouTube Einnahmen: Totale Transparenz

Mein YouTube Einnahmen: Totale Transparenz -

Renato Moicano Cares About His Country More Than Sohrab Ahmari

-

4-18-24 Are We On Japan’s Path to Stagnation?

4-18-24 Are We On Japan’s Path to Stagnation? -

The Tiny Island That Serves As a Tripwire for War between the US and China

-

Eilt: dramatische Wende im Ukraine-Konflikt!

Eilt: dramatische Wende im Ukraine-Konflikt! -

Widerstand zwecklos (?): DJE-plusNews April 2024 mit Mario Künzel und Moritz Rehmann

Widerstand zwecklos (?): DJE-plusNews April 2024 mit Mario Künzel und Moritz Rehmann

More from this category

A perfect storm in the making

A perfect storm in the making 15 Feb 2024

Gold Hits New All Time Highs

Gold Hits New All Time Highs2 Nov 2023

This Will Be The Biggest Theft of This Century

This Will Be The Biggest Theft of This Century10 Feb 2023

[Video] Gold in 2023 Will Be Driven by Real Rates – Mike Singleton

[Video] Gold in 2023 Will Be Driven by Real Rates – Mike Singleton27 Oct 2022

Ben Bernanke Wins Nobel Prize for Kicking Can Down the Road!

Ben Bernanke Wins Nobel Prize for Kicking Can Down the Road!16 Oct 2022

Rick Rule – Gold Helps Me Sleep at Night

Rick Rule – Gold Helps Me Sleep at Night14 Oct 2022

Were the UK pension funds just the canary in the gold mine?

Were the UK pension funds just the canary in the gold mine?9 Oct 2022

Ed Steer Gold And Silver – We Ain’t Seen Nothing Yet!

Ed Steer Gold And Silver – We Ain’t Seen Nothing Yet!5 Oct 2022

Episode 5 of The M3 Report with Steve St. Angelo

Episode 5 of The M3 Report with Steve St. Angelo28 Sep 2022

US CPI Data Release Update

US CPI Data Release Update17 Sep 2022

What Problem Does Gold Solve?

What Problem Does Gold Solve?14 Sep 2022

We Didn’t Print Money… Honest We Didn’t And More Baseless ClapTrap from Central Banks

We Didn’t Print Money… Honest We Didn’t And More Baseless ClapTrap from Central Banks10 Sep 2022

When markets forget that Central Banks cannot fix the world with interest rates

When markets forget that Central Banks cannot fix the world with interest rates4 Sep 2022

The Russian Gold Standard

The Russian Gold Standard28 Aug 2022

History Of Money and Evolution Suggests a Crash is Coming

History Of Money and Evolution Suggests a Crash is Coming27 Aug 2022

Why we couldn’t be happier that gold is boring

Why we couldn’t be happier that gold is boring23 Aug 2022

More energy blows are dealt to Europe, causing a cold chill to be even colder

More energy blows are dealt to Europe, causing a cold chill to be even colder13 Aug 2022

Will Silver Prices Go Up to $300?

Will Silver Prices Go Up to $300?11 Aug 2022

A muddled message from The Fed

A muddled message from The Fed29 Jul 2022

When Rock begins to beat Paper

When Rock begins to beat Paper24 Jul 2022